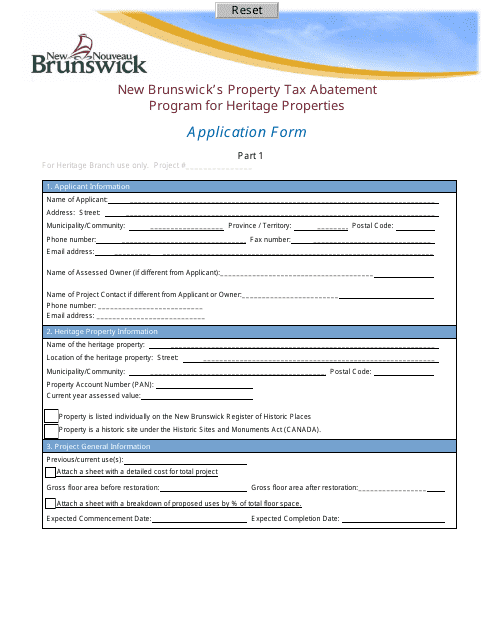

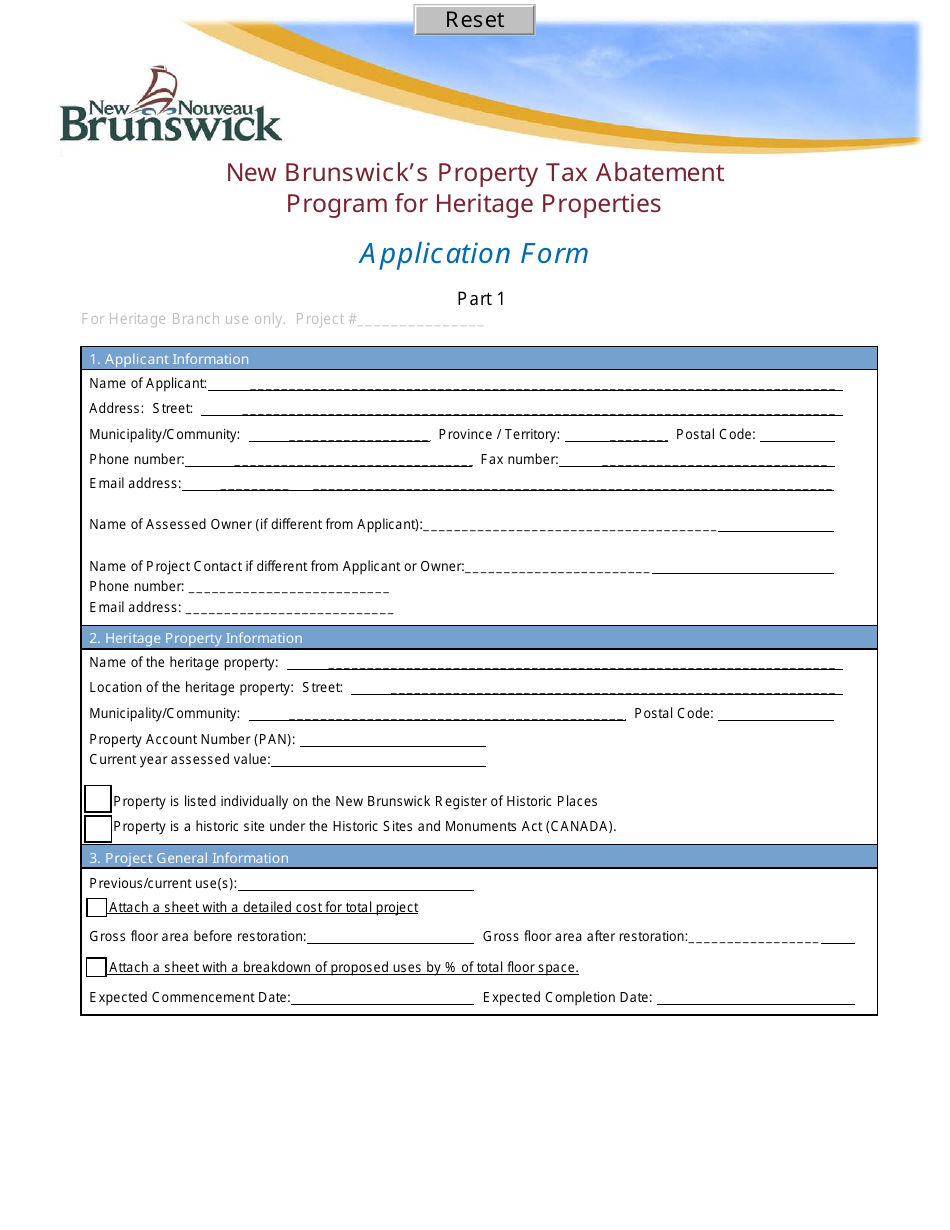

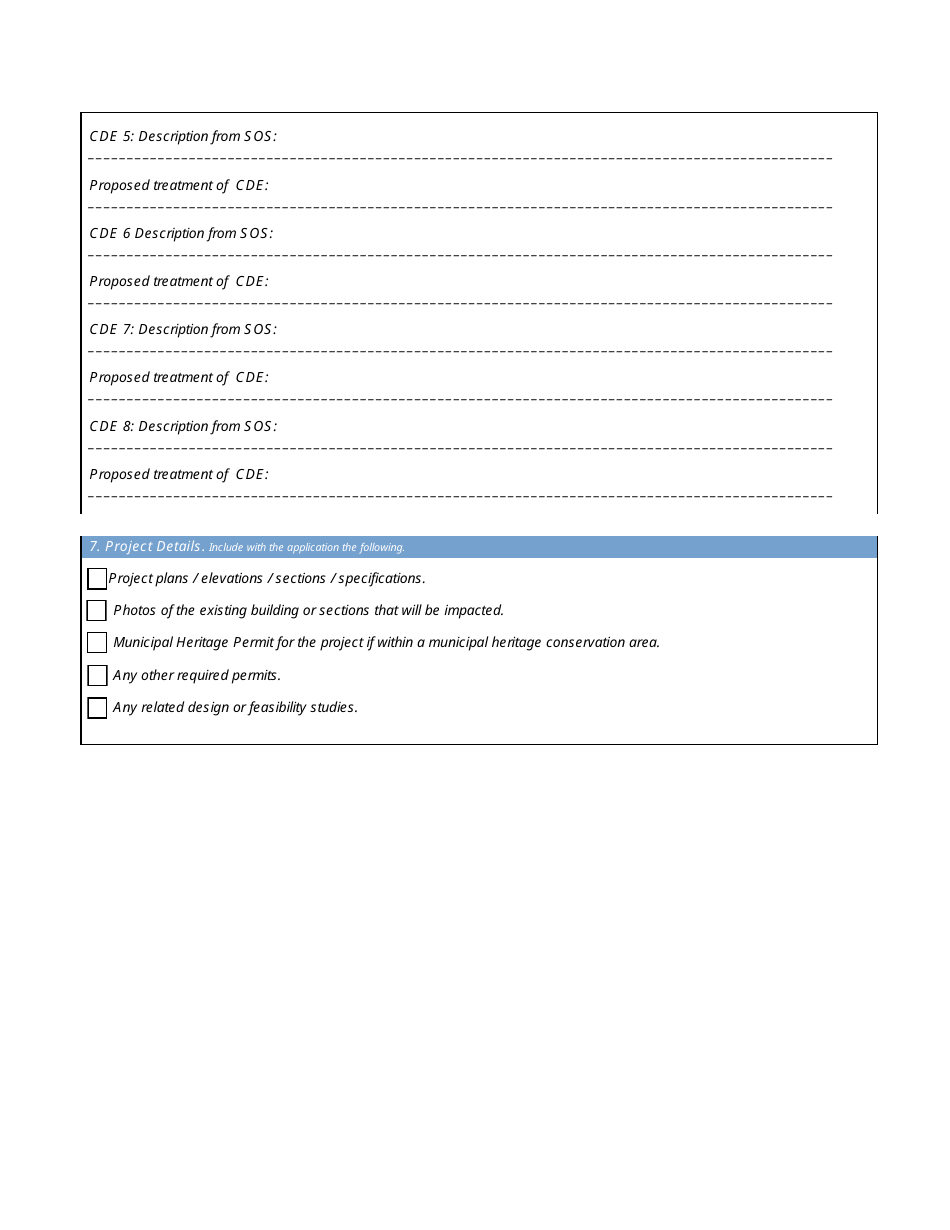

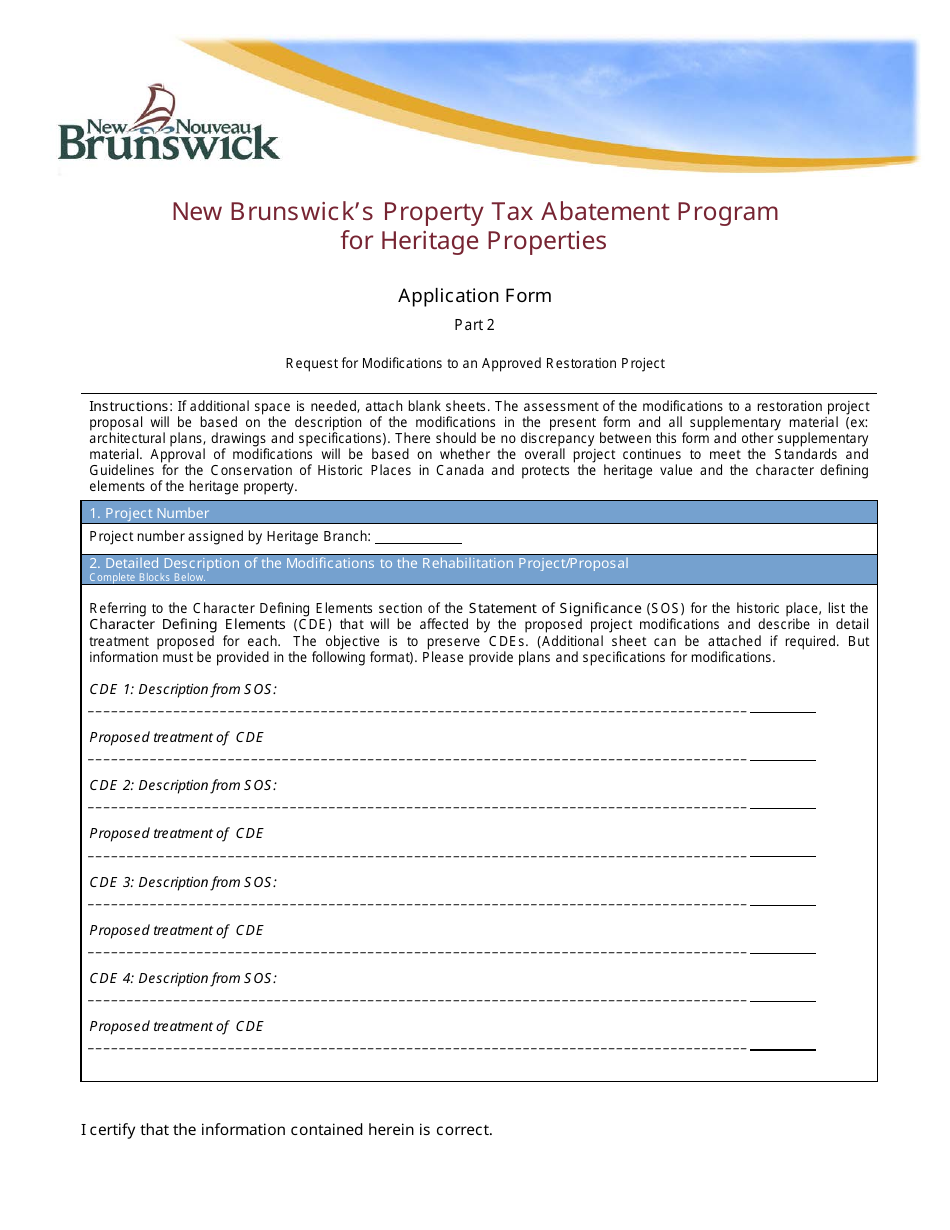

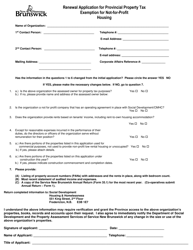

New Brunswick's Property Tax Abatement Program for Heritage Properties Application Form - New Brunswick, Canada

The New Brunswick Property Tax Abatement Program for Heritage Properties Application Form is used for property owners in New Brunswick, Canada to apply for a tax abatement program specifically designed for heritage properties.

The property owner or their authorized representative would typically file the New Brunswick's Property Tax Abatement Program for Heritage Properties application form.

FAQ

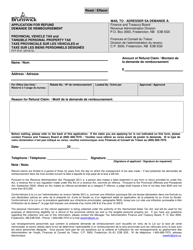

Q: What is New Brunswick's Property Tax Abatement Program for Heritage Properties?

A: The Property Tax Abatement Program for Heritage Properties is a program in New Brunswick, Canada that provides tax relief to owners of designated heritage properties.

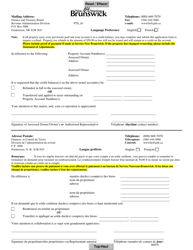

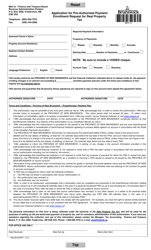

Q: How do I apply for the Property Tax Abatement Program for Heritage Properties?

A: To apply for the program, you need to fill out an application form.

Q: What are the eligibility requirements for the program?

A: The eligibility requirements for the program include owning a designated heritage property and meeting certain criteria set by the province.

Q: What is the purpose of the program?

A: The purpose of the program is to encourage the preservation and maintenance of designated heritage properties by providing tax relief to their owners.

Q: What benefits does the program provide?

A: The program provides tax relief by reducing the amount of property taxes that owners of designated heritage properties have to pay.

Q: Is the program available only in New Brunswick?

A: Yes, the Property Tax Abatement Program for Heritage Properties is only available in New Brunswick, Canada.

Q: Who is eligible to apply for the program?

A: Owners of designated heritage properties in New Brunswick, Canada are eligible to apply for the Property Tax Abatement Program for Heritage Properties.

Q: How can I contact the program administrators for more information?

A: For more information, you can contact the program administrators of the Property Tax Abatement Program for Heritage Properties in New Brunswick, Canada.