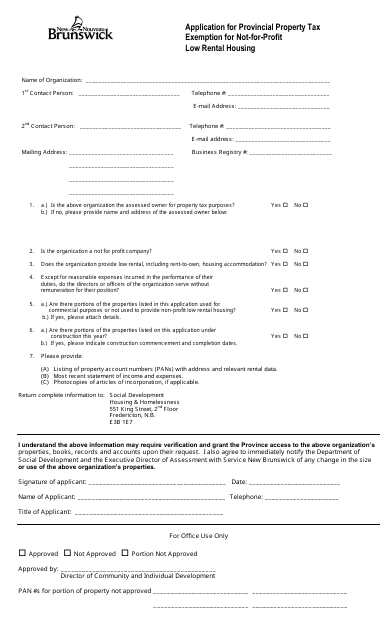

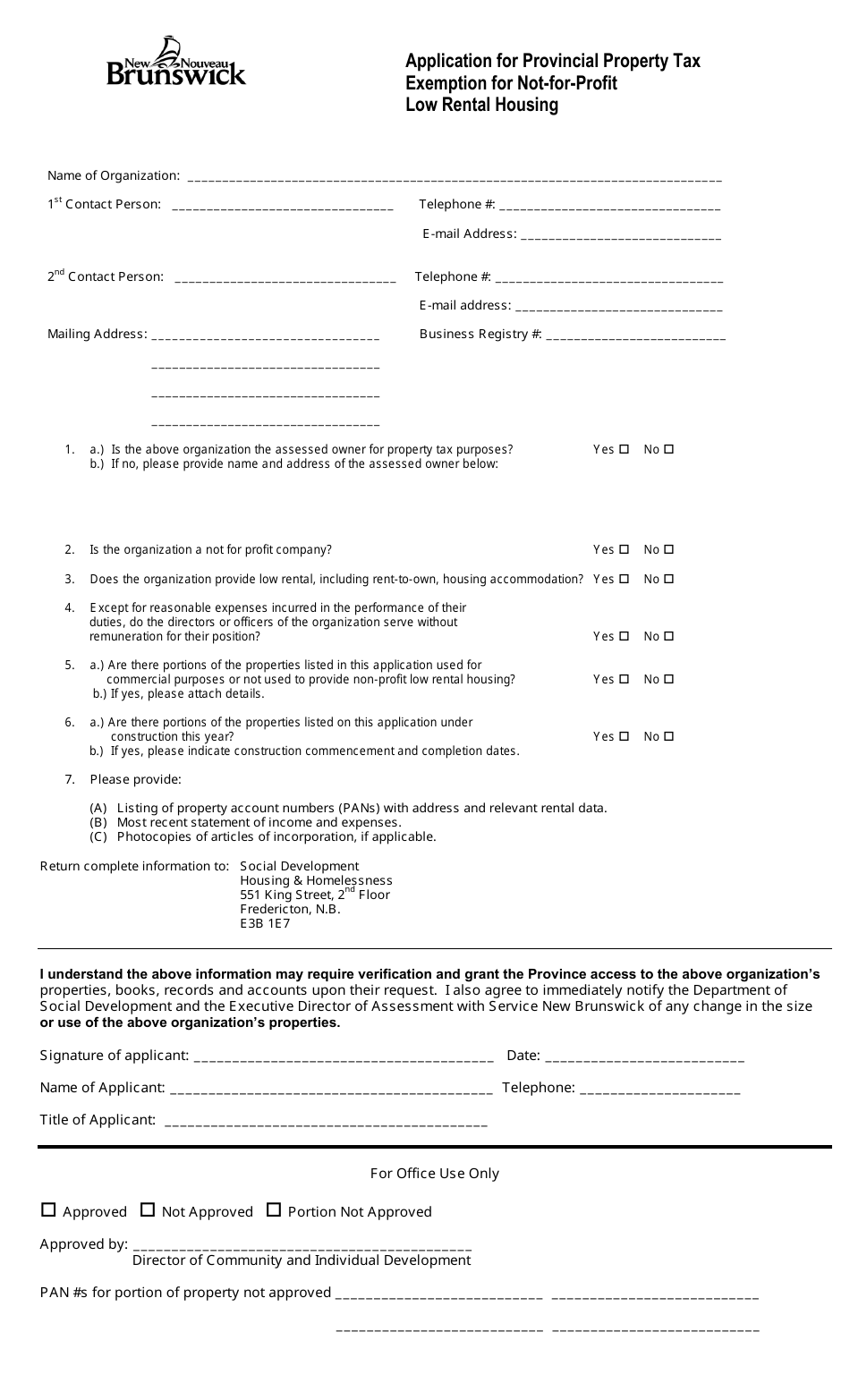

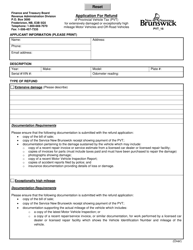

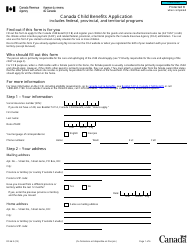

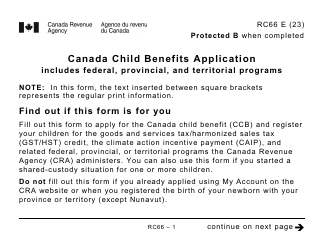

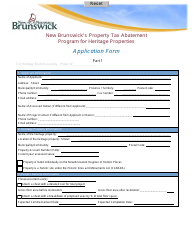

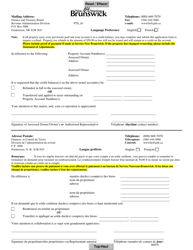

Application for Provincial Property Tax Exemption for Not-For-Profit Low Rental Housing - New Brunswick, Canada

The Application for Provincial Property Tax Exemption for Not-For-Profit Low Rental Housing in New Brunswick, Canada is for organizations that provide low rental housing and are seeking a tax exemption on their properties. This application allows eligible not-for-profit organizations to apply for the exemption in accordance with the provincial tax laws.

The property owner or the organization managing the low rental housing is responsible for filing the application for provincial property tax exemption for not-for-profit low rental housing in New Brunswick, Canada.

FAQ

Q: What is the application for?

A: The application is for a provincial property tax exemption for not-for-profit low rental housing in New Brunswick, Canada.

Q: Who is eligible for this exemption?

A: Not-for-profit organizations that provide low rental housing in New Brunswick are eligible for this exemption.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to support not-for-profit organizations in providing affordable housing to low-income individuals and families.

Q: What does the exemption cover?

A: The exemption covers the provincial property tax for eligible not-for-profit low rental housing properties.

Q: How can one apply for the exemption?

A: To apply for the exemption, organizations need to fill out the application form and submit it to the designated authority in New Brunswick.

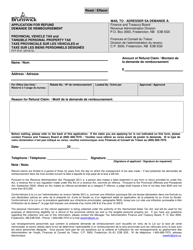

Q: Are there any deadlines for submitting the application?

A: Yes, there are specific deadlines for submitting the application. It is important to check the official guidelines or contact the designated authority for the current deadlines.

Q: Is there any cost associated with the application?

A: There may be a processing fee or other associated costs with the application. It is advisable to review the official guidelines or contact the designated authority for more information.

Q: What happens after submitting the application?

A: After submitting the application, it will be reviewed by the designated authority, and a decision will be communicated to the organization regarding the eligibility of the property for the tax exemption.

Q: Is the exemption permanent?

A: The exemption is subject to periodic review and renewal. Organizations should ensure compliance with any requirements or conditions for maintaining the tax exemption.