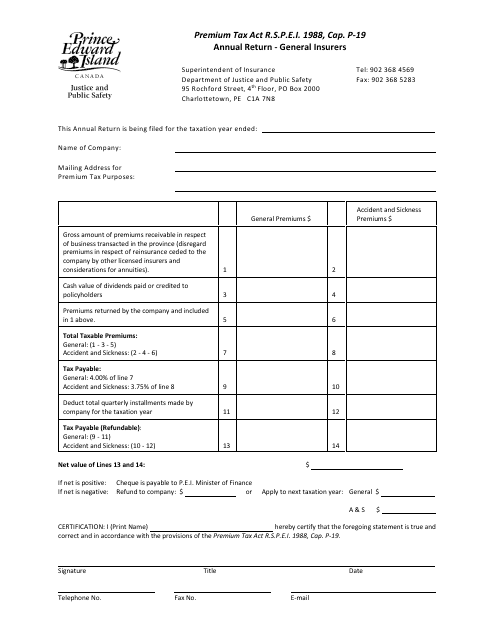

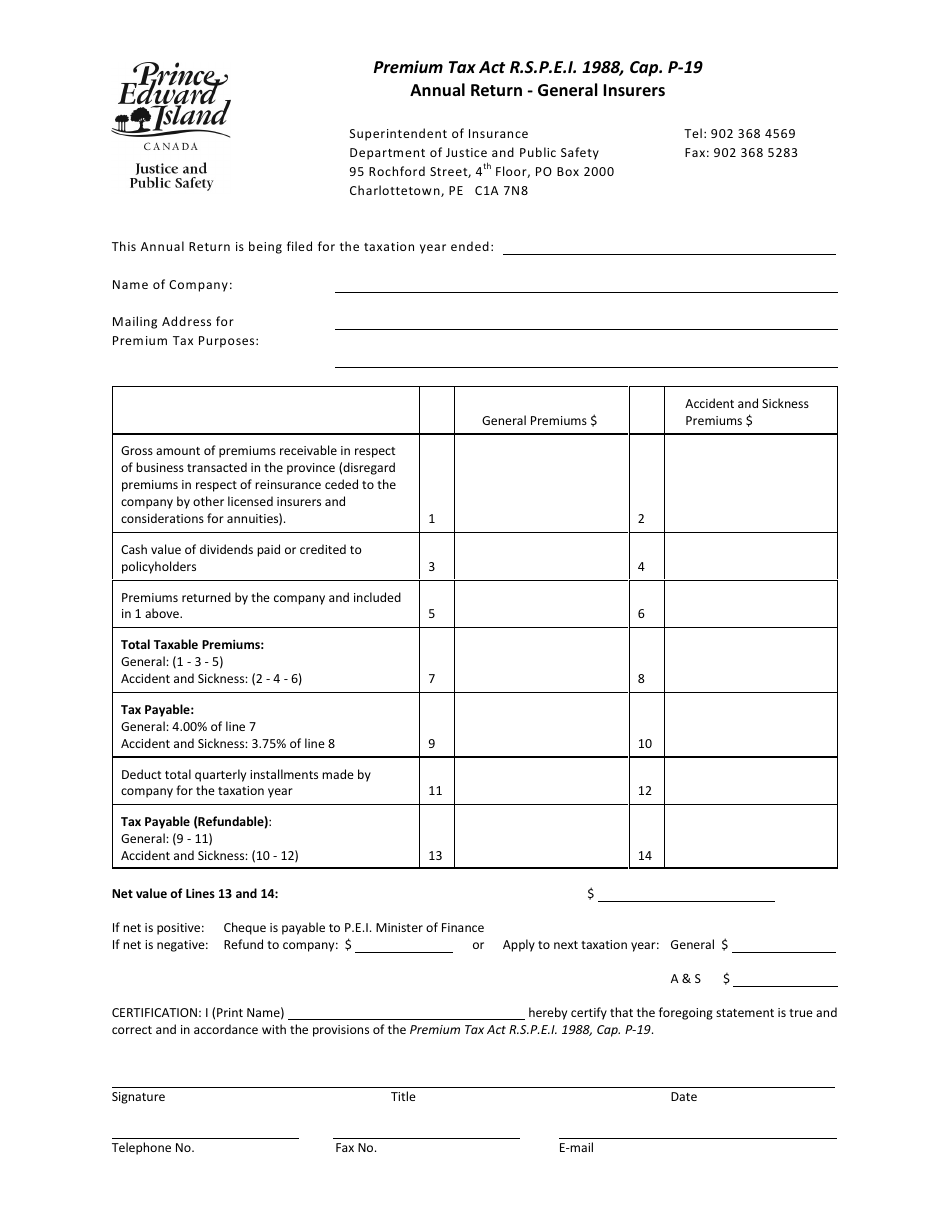

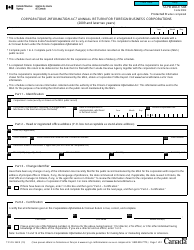

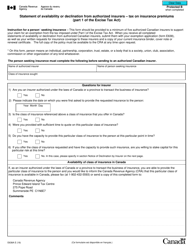

General Premium Tax Annual Return - Prince Edward Island, Canada

The General Premium Tax Annual Return in Prince Edward Island, Canada is a form that businesses use to report and pay their annual premium tax. The premium tax is a tax on insurers that is based on the premiums they collect from policyholders in the province. It is intended to generate revenue for the government of Prince Edward Island.

The insurance company or group insurance administrator files the General Premium Tax Annual Return in Prince Edward Island, Canada.

FAQ

Q: What is the General Premium Tax Annual Return?

A: The General Premium Tax Annual Return is a tax return that must be filed by insurance companies operating in Prince Edward Island, Canada.

Q: Who needs to file the General Premium Tax Annual Return?

A: Insurance companies operating in Prince Edward Island, Canada need to file the General Premium Tax Annual Return.

Q: What is the purpose of the General Premium Tax Annual Return?

A: The purpose of the General Premium Tax Annual Return is to report and pay the general premium tax owed by insurance companies.

Q: When is the deadline to file the General Premium Tax Annual Return?

A: The deadline to file the General Premium Tax Annual Return is usually on or before March 31st of each year.

Q: Are there any penalties for late filing of the General Premium Tax Annual Return?

A: Yes, there may be penalties for late filing of the General Premium Tax Annual Return. It is important to file the return on time to avoid any penalties.

Q: How can I pay the general premium tax owed?

A: The general premium tax owed can be paid by cheque, electronic funds transfer, or other accepted methods specified by the tax authority.