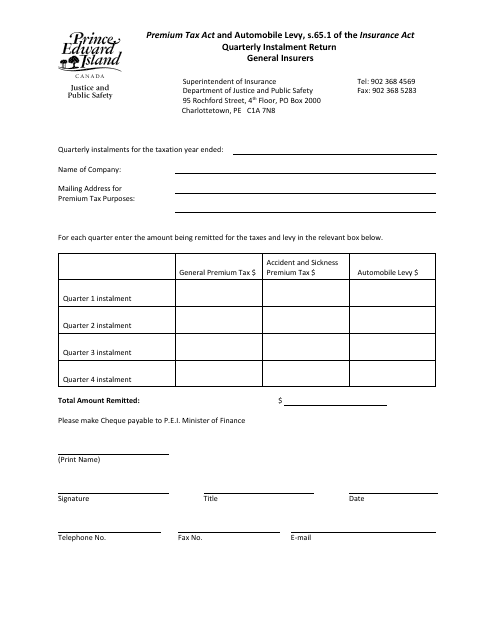

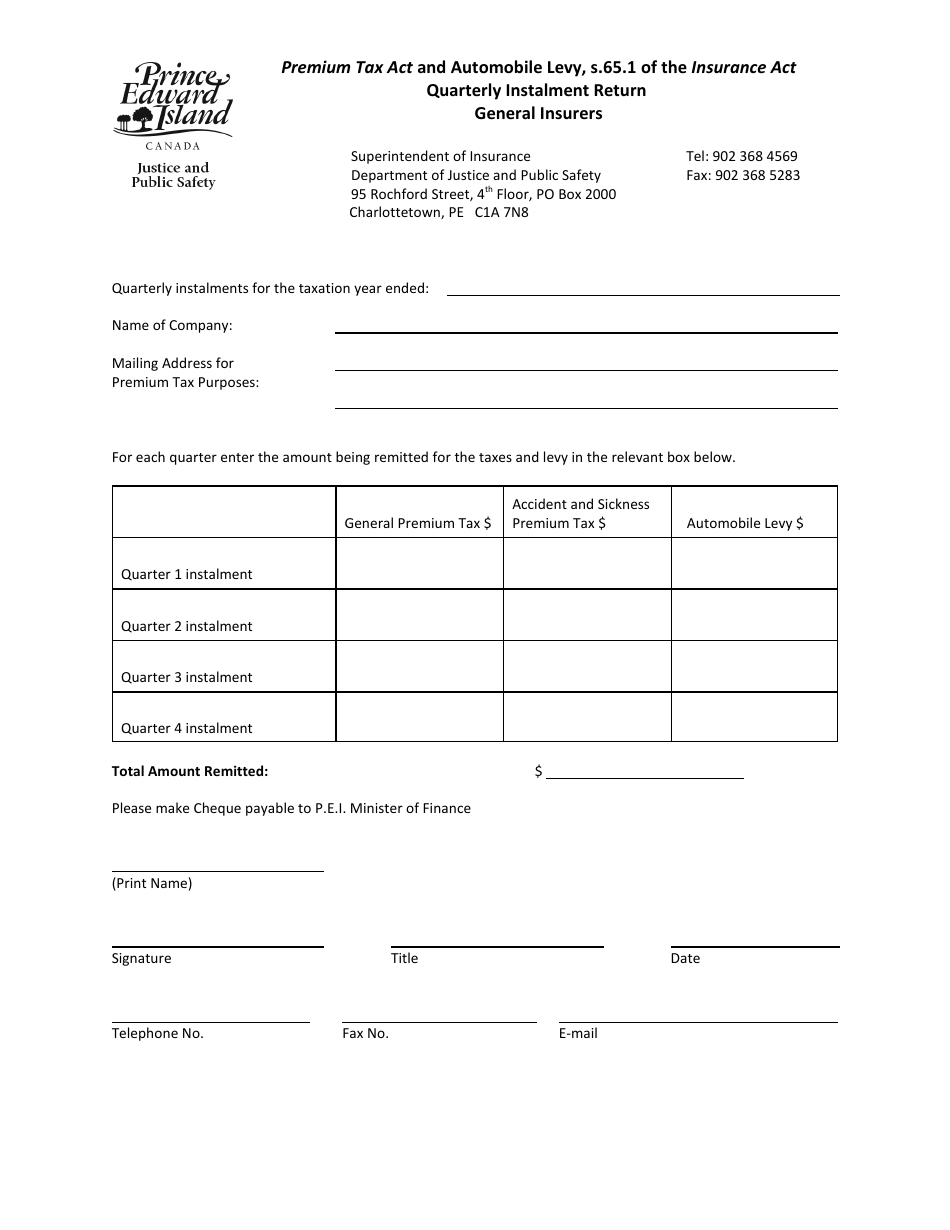

General Quarterly Instalment Return - Prince Edward Island, Canada

The General Quarterly Instalment Return in Prince Edward Island, Canada is a form used to report and remit the provincial sales tax for businesses. It is used to calculate and submit the taxes owed by businesses on a quarterly basis.

The general quarterly instalment return in Prince Edward Island, Canada is filed by individuals and corporations who are required to make quarterly instalment payments of their income tax.

FAQ

Q: What is the General Quarterly Instalment Return?

A: The General Quarterly Instalment Return is a tax form required to be filed by businesses in Prince Edward Island, Canada.

Q: Who needs to file the General Quarterly Instalment Return?

A: Businesses in Prince Edward Island, Canada need to file the General Quarterly Instalment Return.

Q: How often do businesses need to file the General Quarterly Instalment Return?

A: Businesses need to file the General Quarterly Instalment Return on a quarterly basis.

Q: What information is required on the General Quarterly Instalment Return?

A: The General Quarterly Instalment Return requires businesses to provide information about their income, deductions, and instalments made.

Q: What are the consequences of not filing the General Quarterly Instalment Return?

A: Not filing the General Quarterly Instalment Return can result in penalties and interest charges.

Q: Is there a deadline for filing the General Quarterly Instalment Return?

A: Yes, businesses must file the General Quarterly Instalment Return by the specified deadline for each quarter.

Q: Are there any exemptions or special rules for the General Quarterly Instalment Return?

A: There may be exemptions or special rules for certain types of businesses, so it's recommended to consult with a tax professional or the tax authorities for more information.

Q: What should I do if I have questions or need assistance with the General Quarterly Instalment Return?

A: If you have questions or need assistance with the General Quarterly Instalment Return, you can contact the Prince Edward Island tax authorities for guidance.