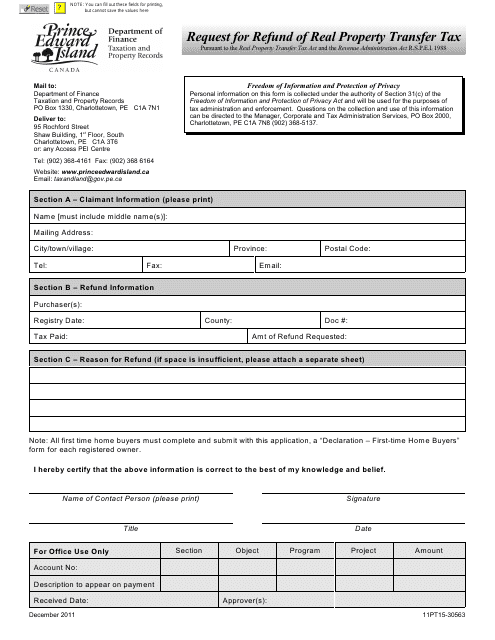

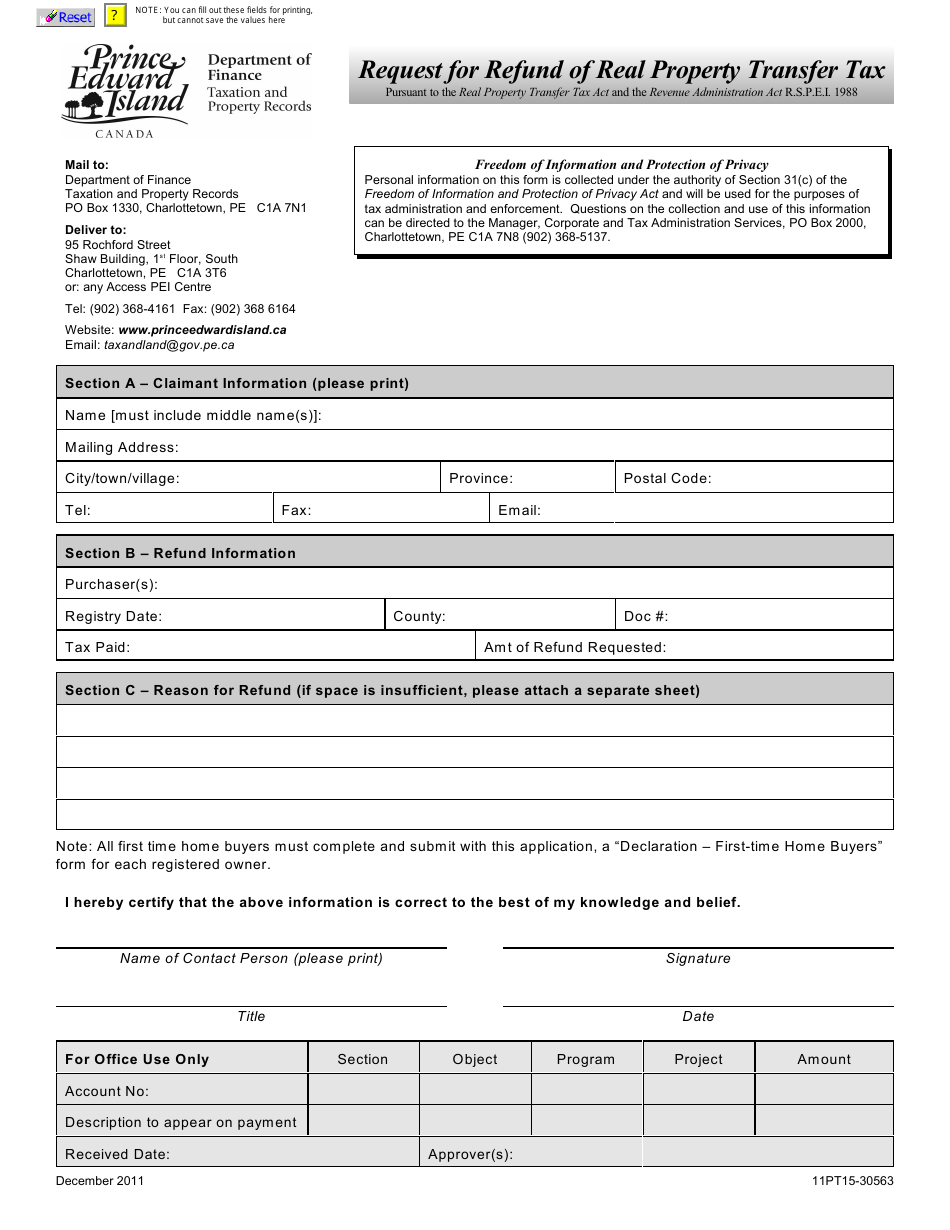

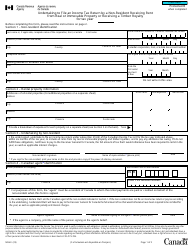

Request for Refund of Real Property Transfer Tax - Prince Edward Island, Canada

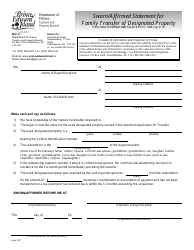

The "Request for Refund of Real Property Transfer Tax" in Prince Edward Island, Canada is used to request a refund of the transfer tax paid when buying or transferring real property. It is typically used when certain conditions are met, such as the property being sold within a certain time period or being used for specific purposes.

The buyer typically files the request for refund of real property transfer tax in Prince Edward Island, Canada.

FAQ

Q: What is the Real Property Transfer Tax in Prince Edward Island, Canada?

A: The Real Property Transfer Tax is a tax imposed on the transfer of real estate in Prince Edward Island, Canada.

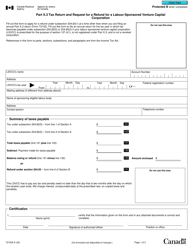

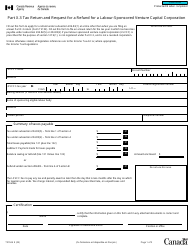

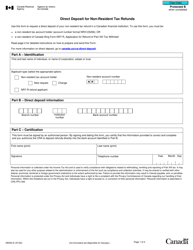

Q: How can I request a refund of Real Property Transfer Tax in Prince Edward Island?

A: To request a refund of Real Property Transfer Tax in Prince Edward Island, you need to complete a Refund Application form and submit it to the province's tax authority.

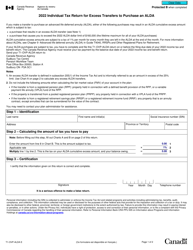

Q: What are the eligibility criteria for a refund of Real Property Transfer Tax in Prince Edward Island?

A: To be eligible for a refund of Real Property Transfer Tax in Prince Edward Island, the property must be your principal residence, and you must meet certain residency and other requirements.

Q: What documents do I need to include with my refund application for Real Property Transfer Tax in Prince Edward Island?

A: You will typically need to include a copy of the Agreement of Purchase and Sale, proof of residency, and other supporting documents as specified on the refund application form.

Q: How long does it take to receive a refund of Real Property Transfer Tax in Prince Edward Island?

A: The processing time for a refund of Real Property Transfer Tax in Prince Edward Island can vary, but it generally takes several weeks.

Q: Is there a deadline to apply for a refund of Real Property Transfer Tax in Prince Edward Island?

A: Yes, there is a deadline to apply for a refund of Real Property Transfer Tax in Prince Edward Island. You must submit your refund application within 18 months of the date of registration of the property transfer.