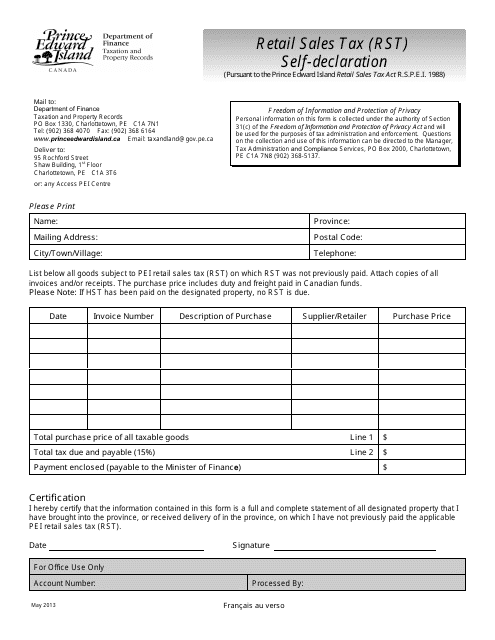

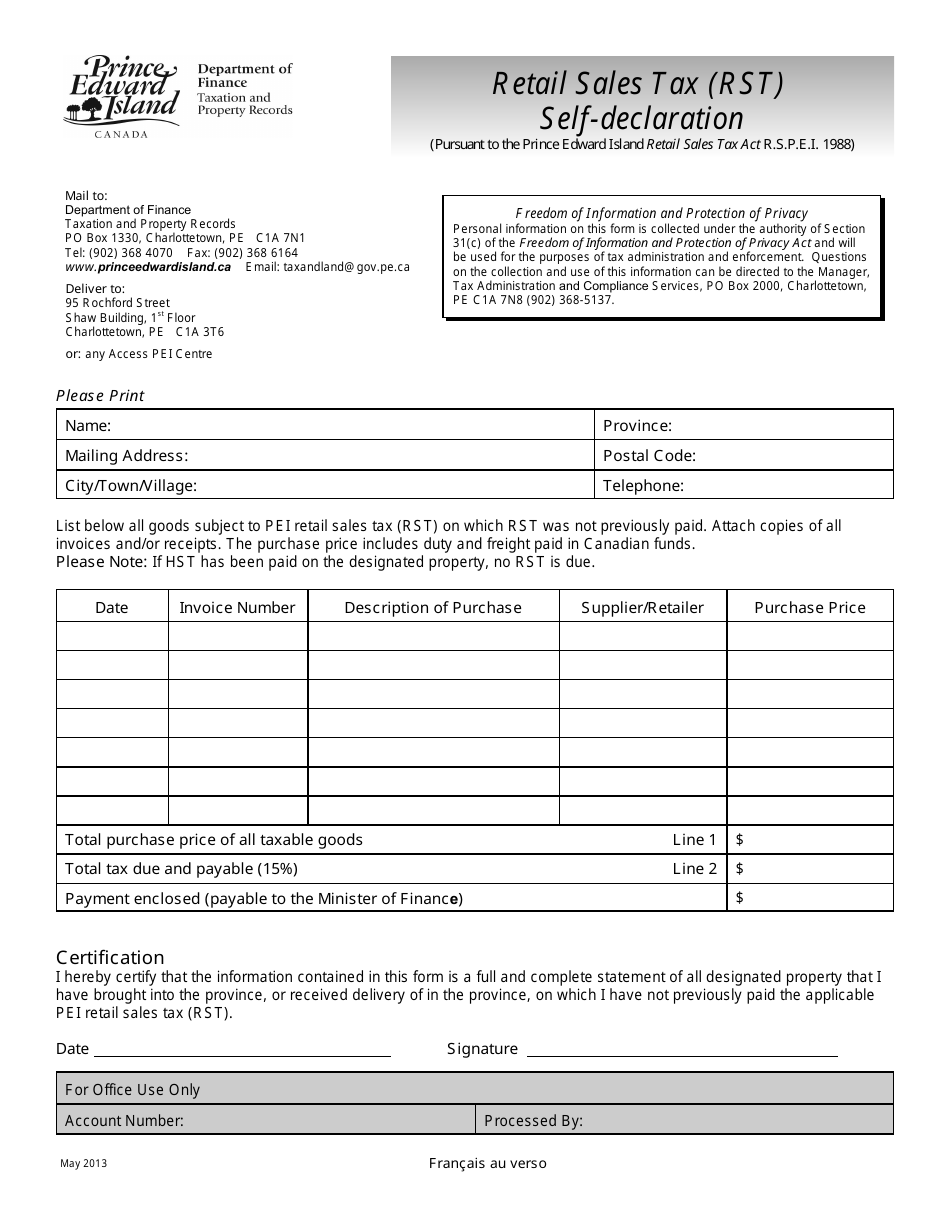

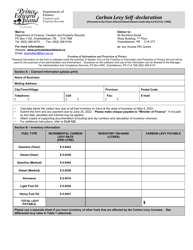

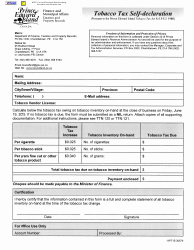

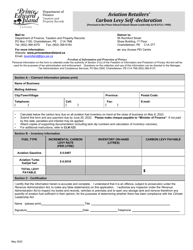

Retail Sales Tax (Rst) Self-declaration - Prince Edward Island, Canada

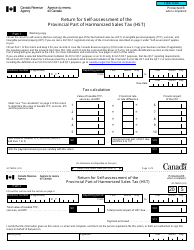

The Retail Sales Tax (RST) self-declaration form in Prince Edward Island, Canada is used for individuals or businesses to report and pay the sales tax they owe on certain goods and services sold. It is a way for the government to collect taxes from retailers in the province.

The retail sales tax (RST) self-declaration in Prince Edward Island, Canada is filed by businesses that are registered to collect and remit the RST to the government.

FAQ

Q: What is Retail Sales Tax (RST)?

A: Retail Sales Tax (RST) is a tax levied on the sale or rental of most goods and services in Prince Edward Island, Canada.

Q: How is Retail Sales Tax (RST) collected?

A: Retail Sales Tax (RST) is typically collected by businesses at the time of sale or rental and remitted to the government.

Q: Who is responsible for self-declaration of Retail Sales Tax (RST)?

A: Businesses in Prince Edward Island, Canada are responsible for self-declaration and remittance of Retail Sales Tax (RST).

Q: What is the purpose of self-declaration?

A: Self-declaration helps ensure that businesses comply with the Retail Sales Tax (RST) regulations and accurately report and remit the tax.

Q: What are the requirements for self-declaration of Retail Sales Tax (RST) in Prince Edward Island?

A: Businesses must register for a Retail Sales Tax (RST) account, keep records of sales and purchases, and file regular returns to report and remit the tax.

Q: Is there a threshold for Retail Sales Tax (RST) self-declaration?

A: Yes, businesses with annual taxable sales exceeding a certain threshold must register for a Retail Sales Tax (RST) account and self-declare the tax.

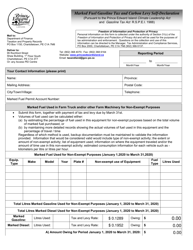

Q: Are there any exemptions from Retail Sales Tax (RST)?

A: Yes, certain goods and services may be exempt from Retail Sales Tax (RST), such as prescription drugs and basic groceries.

Q: Can businesses claim refunds for Retail Sales Tax (RST) paid on purchases?

A: Yes, businesses can claim refunds for Retail Sales Tax (RST) paid on eligible purchases by submitting refund applications to the government.