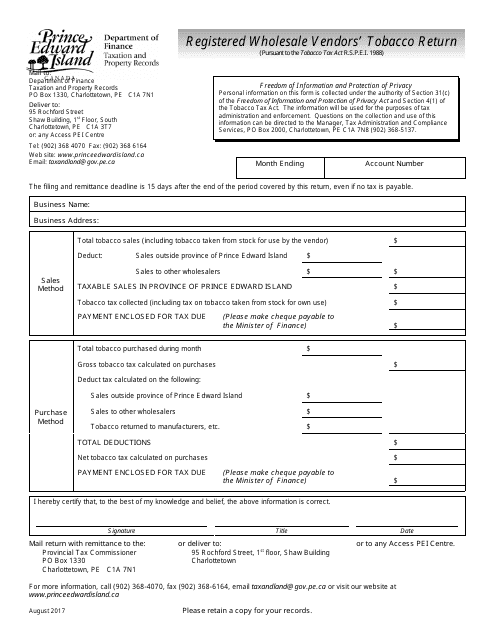

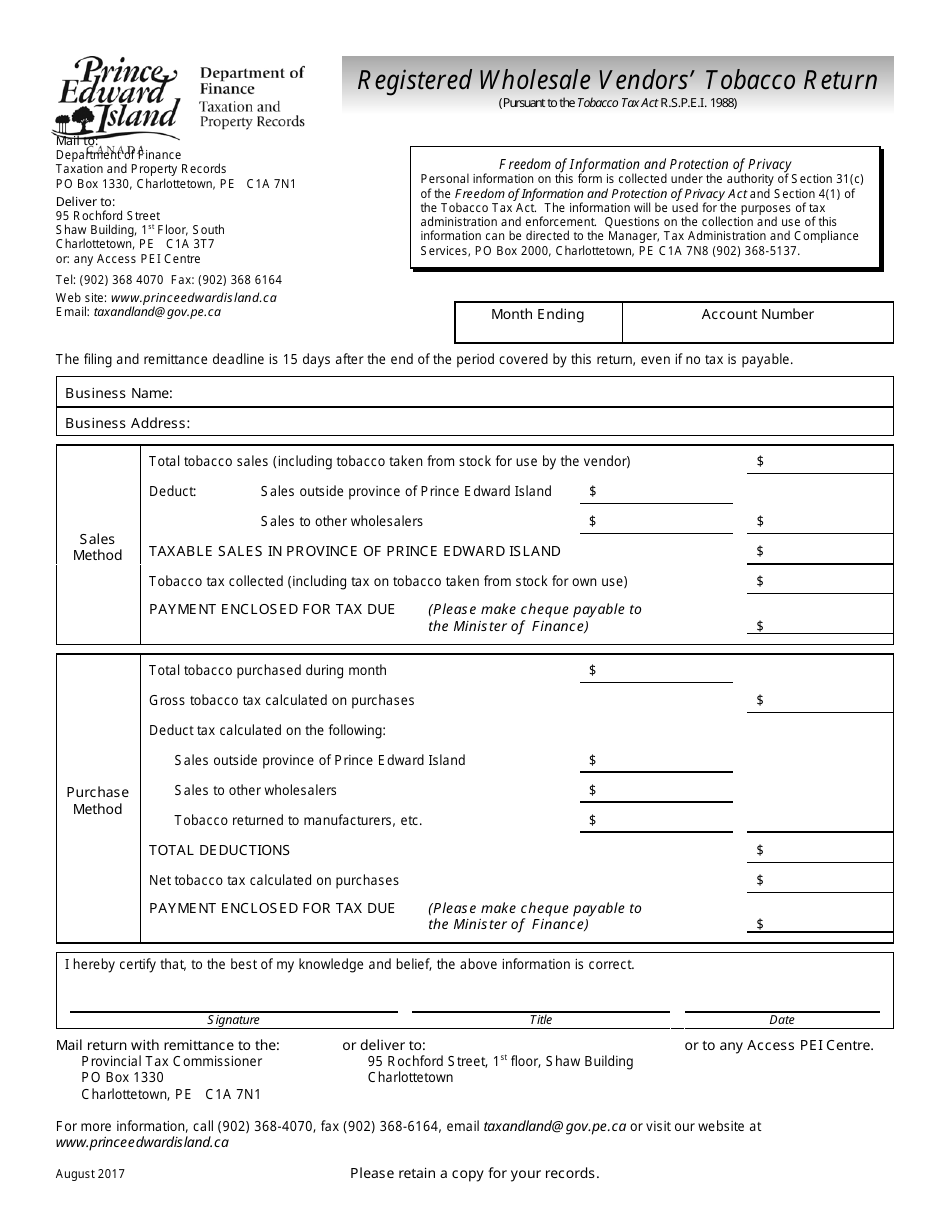

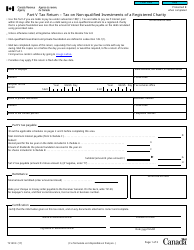

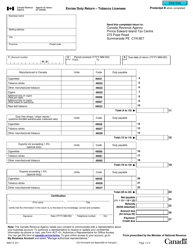

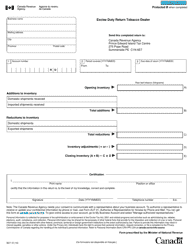

Registered Wholesale Vendors' Tobacco Return - Prince Edward Island, Canada

The Registered Wholesale Vendors' Tobacco Return in Prince Edward Island, Canada is used for tracking and reporting the sales and distribution of tobacco products by wholesale vendors.

The registered wholesale vendors in Prince Edward Island, Canada are responsible for filing the tobacco return.

FAQ

Q: What is the Registered Wholesale Vendors' Tobacco Return?

A: The Registered Wholesale Vendors' Tobacco Return is a form used by tobacco vendors in Prince Edward Island, Canada to report their wholesale tobacco sales.

Q: Who needs to file the Registered Wholesale Vendors' Tobacco Return?

A: All registered wholesale tobacco vendors in Prince Edward Island need to file this return.

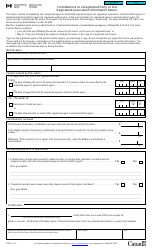

Q: What information needs to be included in the return?

A: The return requires vendors to provide details of their wholesale tobacco sales, including quantities sold, pricing, and other relevant information.

Q: When is the deadline for filing the Registered Wholesale Vendors' Tobacco Return?

A: The deadline for filing this return is typically on a monthly basis, with specific dates outlined by the government of Prince Edward Island.

Q: How can the Registered Wholesale Vendors' Tobacco Return be filed?

A: The return can be filed electronically or by mail, using the designated forms provided by the government of Prince Edward Island.

Q: Are there any penalties for late or non-filing of the Registered Wholesale Vendors' Tobacco Return?

A: Yes, there may be penalties for late or non-filing, including fines and potential suspension of the vendor's registration.