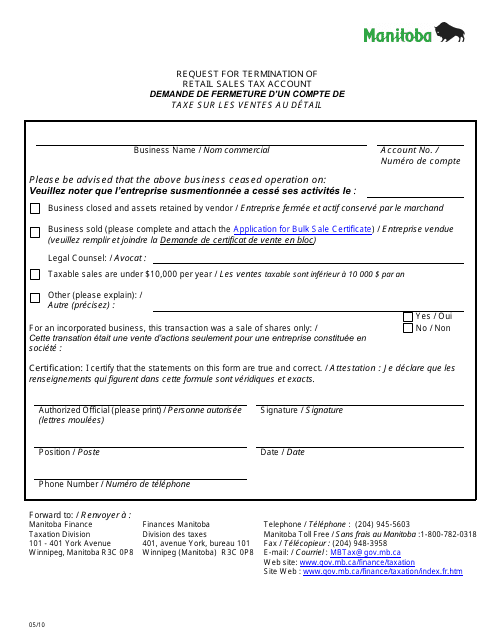

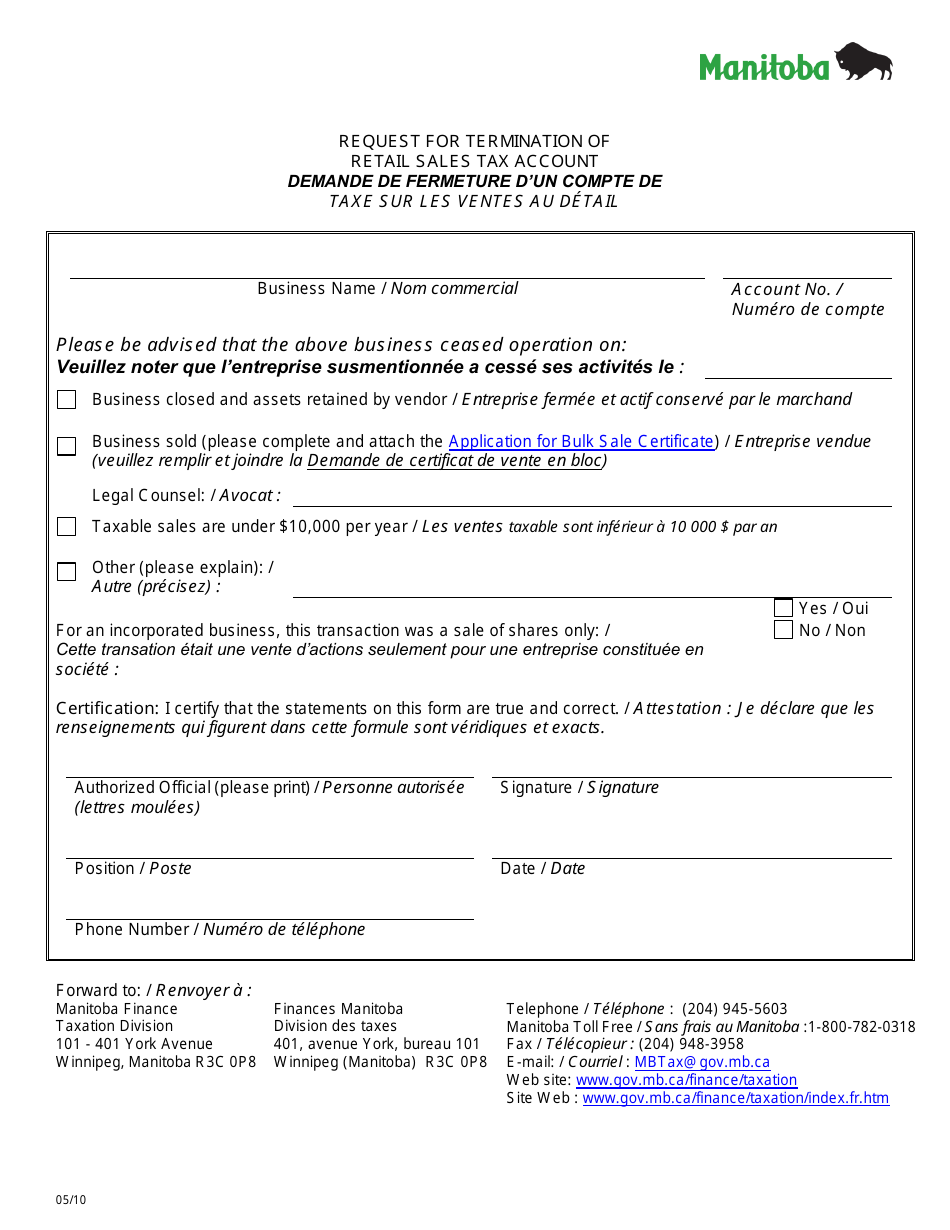

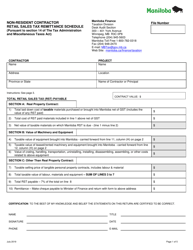

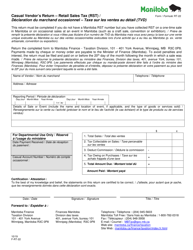

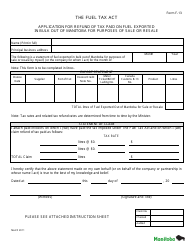

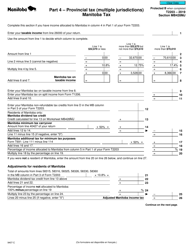

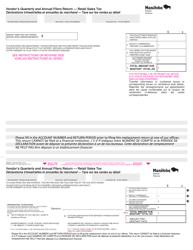

Request for Termination of Retail Sales Tax Account - Manitoba, Canada (English / French)

The Request for Termination of Retail SalesTax Account in Manitoba, Canada is used when a business wants to end their obligation to collect and remit retail sales tax. This form is available in both English and French.

The request for termination of a retail sales tax account in Manitoba, Canada can be filed by the business or individual that wants to close the account.

FAQ

Q: What is a Retail Sales Tax Account?

A: A Retail Sales Tax Account is a registration with the government that allows businesses to collect and remit sales tax on taxable goods and services.

Q: How can I terminate my Retail Sales Tax Account in Manitoba?

A: To terminate your Retail Sales Tax Account in Manitoba, you must complete and submit a Request for Termination of Retail Sales Tax Account form to the Manitoba Taxation Division.

Q: Do I need to provide any supporting documents when submitting the form?

A: No, you do not need to provide any supporting documents when submitting the Request for Termination of Retail Sales Tax Account form.

Q: Is there a fee to terminate a Retail Sales Tax Account in Manitoba?

A: No, there is no fee to terminate a Retail Sales Tax Account in Manitoba.

Q: How long does it take to process the termination request?

A: The processing time for a termination request can vary. You should contact the Manitoba Taxation Division for more information.

Q: Should I continue to collect sales tax while my termination request is being processed?

A: Yes, you should continue to collect sales tax on taxable goods and services until your Retail Sales Tax Account is officially terminated.