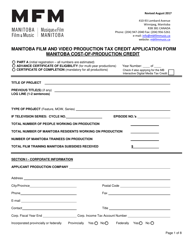

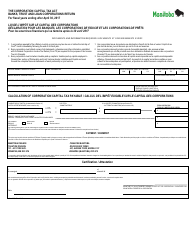

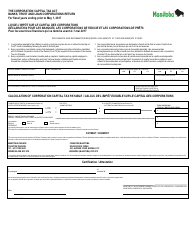

Manitoba Cultural Industries Printing Tax Credit - Manitoba, Canada

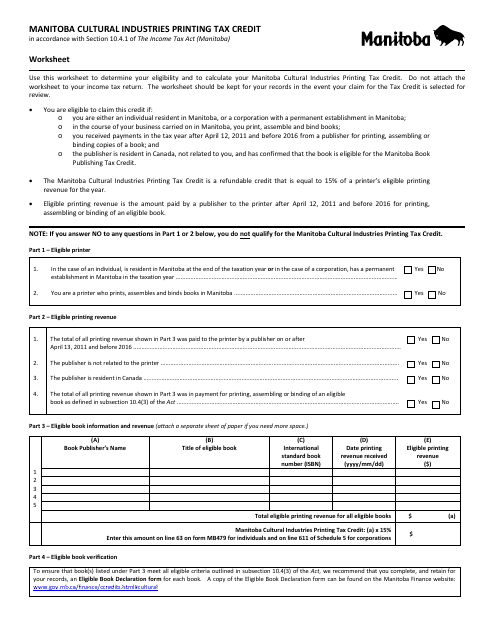

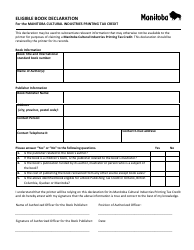

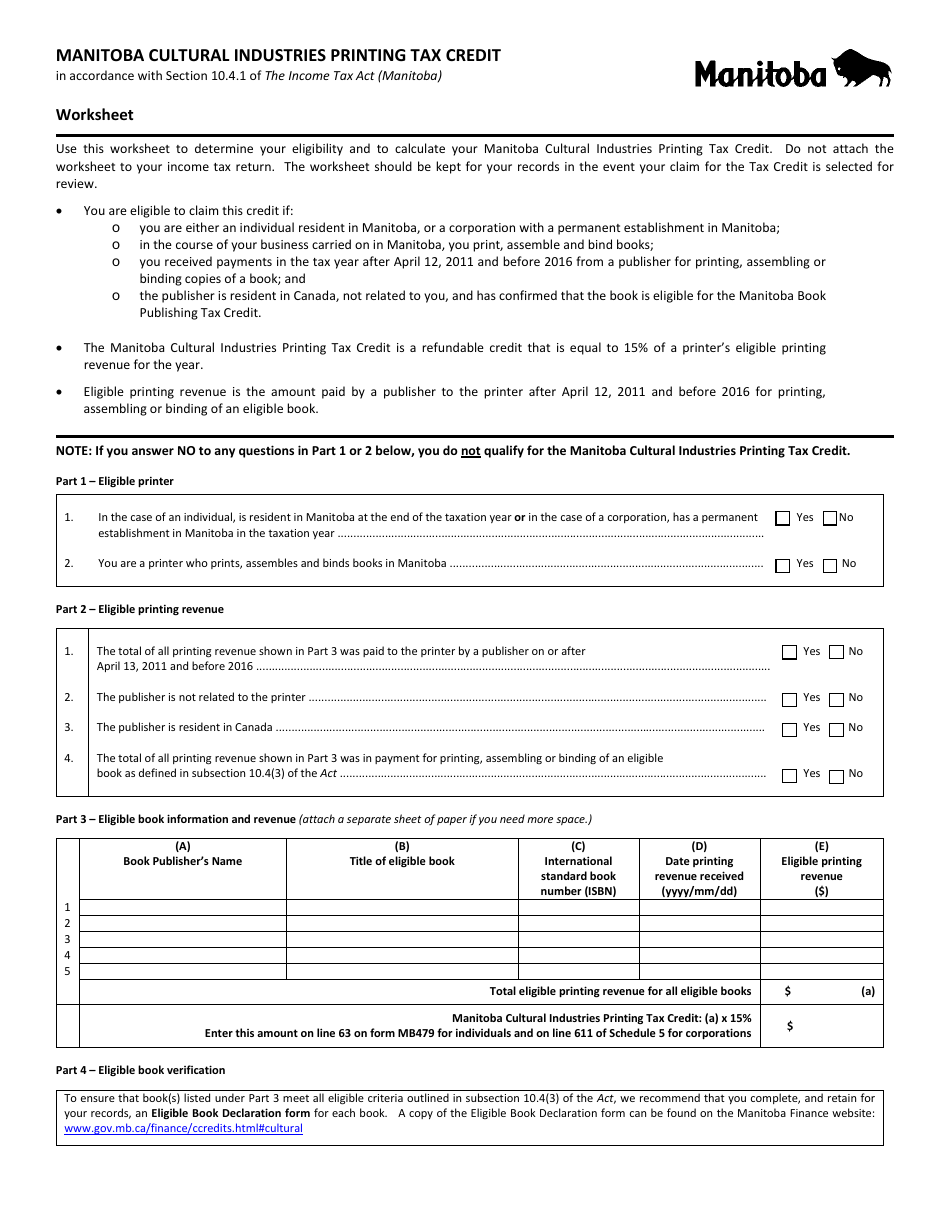

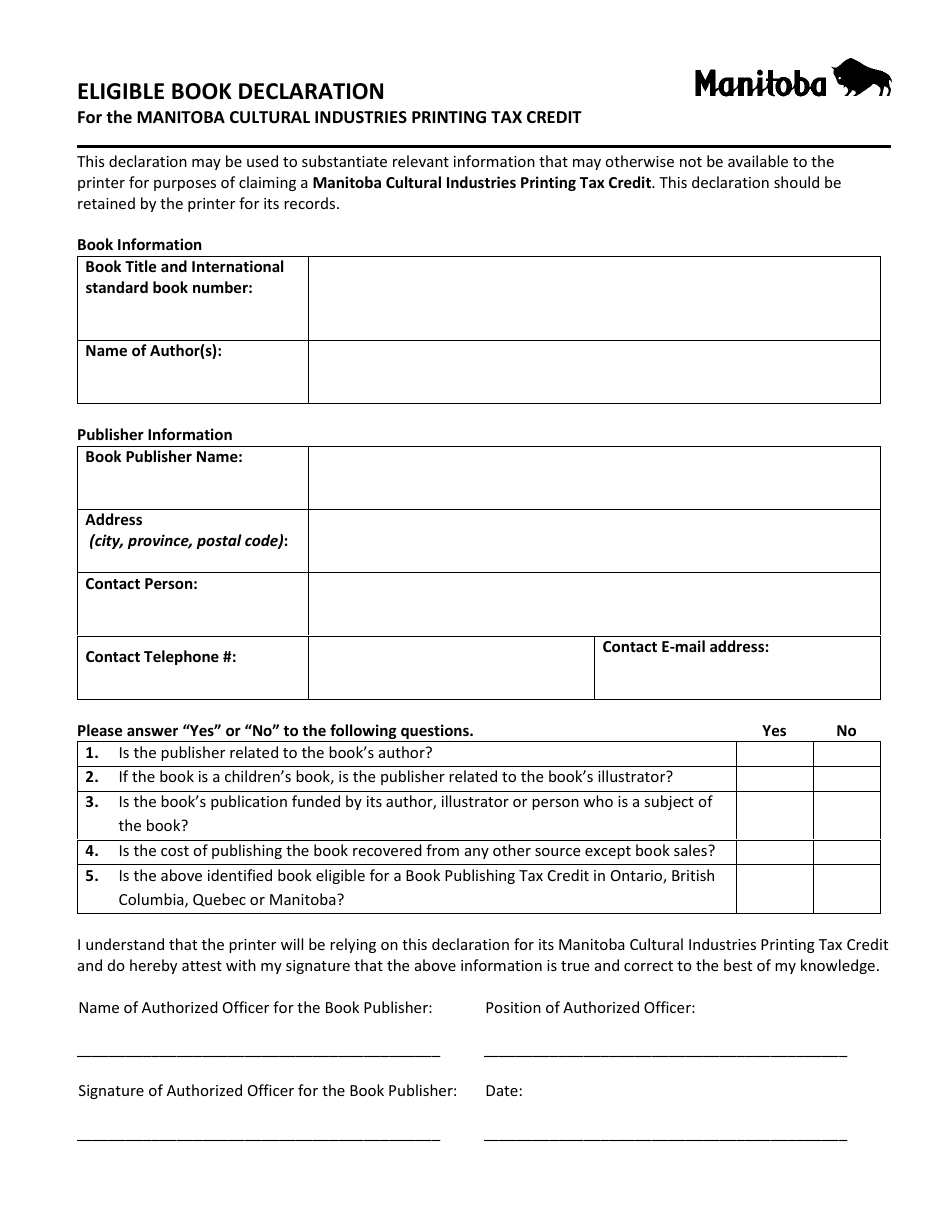

The Manitoba Cultural Industries Printing Tax Credit in Manitoba, Canada is a tax credit program designed to support and promote the printing and publishing industry in the province. It provides financial assistance to eligible companies engaged in the production of printed materials, such as books, magazines, and newspapers, to help them offset the cost of labour and production expenses.

The Manitoba Cultural Industries Printing Tax Credit is typically filed by the eligible corporations engaged in the cultural industries printing business in Manitoba, Canada.

FAQ

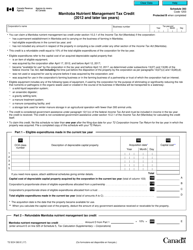

Q: What is the Manitoba Cultural Industries Printing Tax Credit?

A: The Manitoba Cultural Industries Printing Tax Credit is a tax credit provided by the government of Manitoba in Canada.

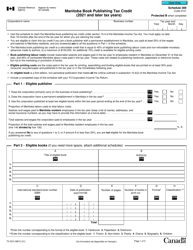

Q: Who is eligible for the tax credit?

A: Companies that are engaged in printing activities and meet certain eligibility criteria can apply for the tax credit.

Q: What are the benefits of the tax credit?

A: The tax credit provides financial assistance to companies in the cultural industries printing sector, helping them offset costs and stimulate growth.

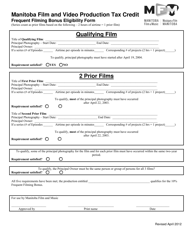

Q: How can companies apply for the tax credit?

A: Companies can apply for the tax credit by completing the necessary application forms and meeting all the eligibility requirements.

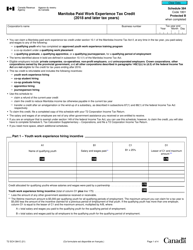

Q: Is the tax credit available in other provinces of Canada?

A: No, the Manitoba Cultural Industries Printing Tax Credit is specific to the province of Manitoba.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions on the tax credit, which companies need to fulfill in order to be eligible.

Q: Is the tax credit refundable?

A: Yes, the tax credit is refundable, meaning that eligible companies can receive a refund for any unused portion of the credit.

Q: Are there any deadlines for applying for the tax credit?

A: Yes, there are specific deadlines for applying for the tax credit, and companies need to submit their applications within those deadlines.