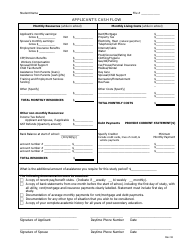

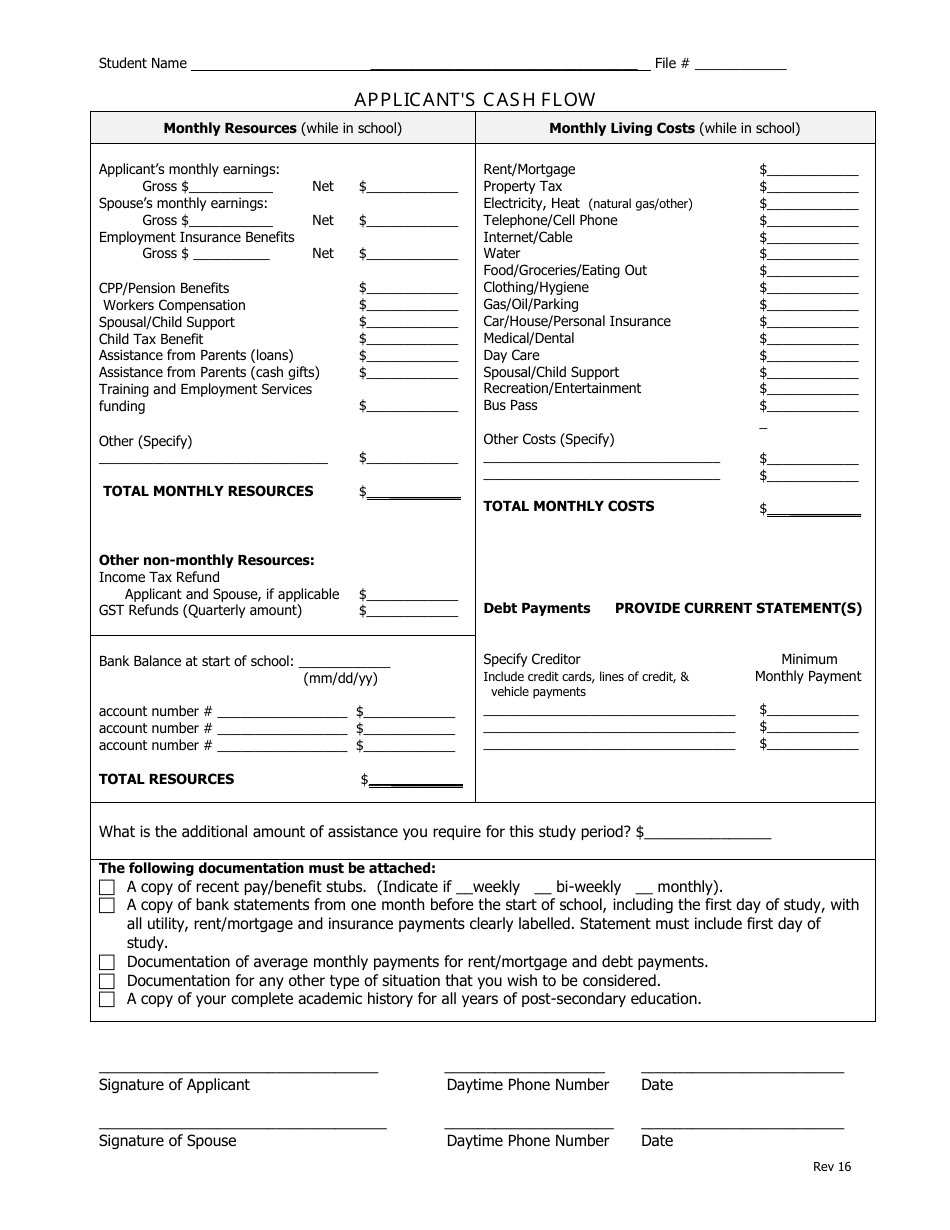

Applicant's Cash Flow - Manitoba, Canada

The Applicant's Cash Flow in Manitoba, Canada is a document that provides information about the financial situation and cash flow of an individual or business applying for a specific purpose or program in Manitoba. It helps assess their ability to meet financial obligations and demonstrate their financial stability.

In Manitoba, Canada, the applicant files their own cash flow documentation.

FAQ

Q: What is an applicant's cash flow?

A: An applicant's cash flow refers to the amount of money coming in and going out of their finances.

Q: Why is cash flow important for an applicant?

A: Cash flow is important for an applicant as it helps determine their ability to meet financial obligations and manage their finances effectively.

Q: How can an applicant calculate their cash flow?

A: An applicant can calculate their cash flow by subtracting their expenses from their income.

Q: What is considered income for an applicant?

A: Income for an applicant can include earnings from employment, rental income, investment income, and government benefits.

Q: What are some common expenses for an applicant?

A: Common expenses for an applicant can include housing costs, transportation expenses, utilities, food, and healthcare.

Q: What does a positive cash flow indicate for an applicant?

A: A positive cash flow indicates that an applicant has more money coming in than going out, which can be a sign of financial stability.

Q: What does a negative cash flow indicate for an applicant?

A: A negative cash flow indicates that an applicant has more money going out than coming in, which can be a sign of financial difficulties.

Q: How can an applicant improve their cash flow?

A: An applicant can improve their cash flow by increasing their income, reducing expenses, or a combination of both.

Q: Are there any programs or resources available to help applicants manage their cash flow?

A: Yes, there are programs and resources available, such as financial literacy courses and budgeting tools, to help applicants manage their cash flow.