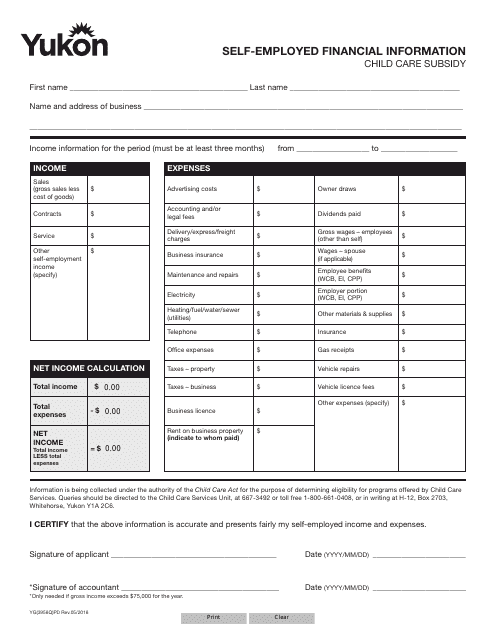

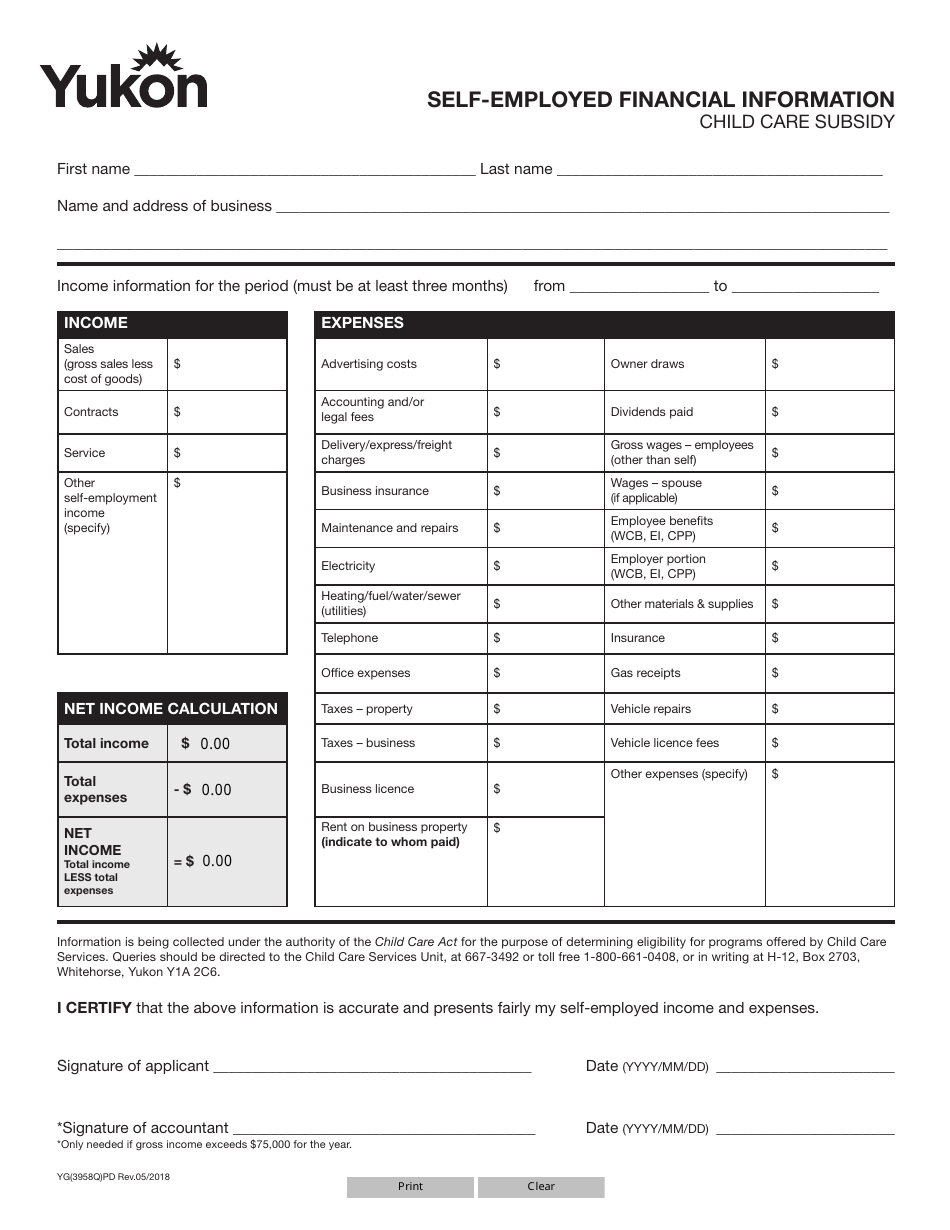

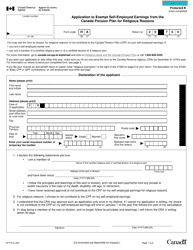

Form YG3958 Self-employed Financial Information - Yukon, Canada

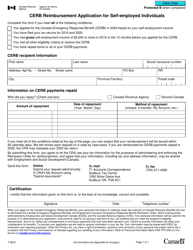

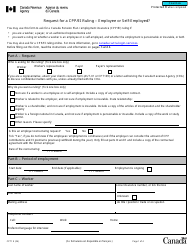

Form YG3958 Self-employed Financial Information is used in Yukon, Canada for self-employed individuals to report their financial information to the government. It helps determine the tax liabilities and eligibility for certain benefits and programs.

According to the information available, self-employed individuals in Yukon, Canada may need to file the Form YG3958 - Self-Employed Financial Information. However, for more specific details and to ensure accuracy, it is recommended to consult the official government resources or contact the appropriate authorities in Yukon.

FAQ

Q: What is Form YG3958?

A: Form YG3958 is a self-employed financial information form used in Yukon, Canada.

Q: Who needs to fill out Form YG3958?

A: Self-employed individuals in Yukon, Canada need to fill out Form YG3958.

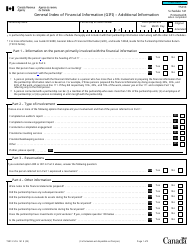

Q: What information is required on Form YG3958?

A: Form YG3958 requires self-employed individuals to provide their financial information.

Q: Why do I need to fill out Form YG3958?

A: You need to fill out Form YG3958 to report your self-employed income and expenses to the government.

Q: When is the deadline to submit Form YG3958?

A: The deadline to submit Form YG3958 is usually April 30th of each year.

Q: Are there any penalties for not submitting Form YG3958 on time?

A: Yes, there may be penalties for not submitting Form YG3958 on time.

Q: Is Form YG3958 specific to Yukon, Canada?

A: Yes, Form YG3958 is specific to self-employed individuals in Yukon, Canada.

Q: Do I need to keep a copy of Form YG3958 for my records?

A: Yes, it is recommended to keep a copy of Form YG3958 for your records.