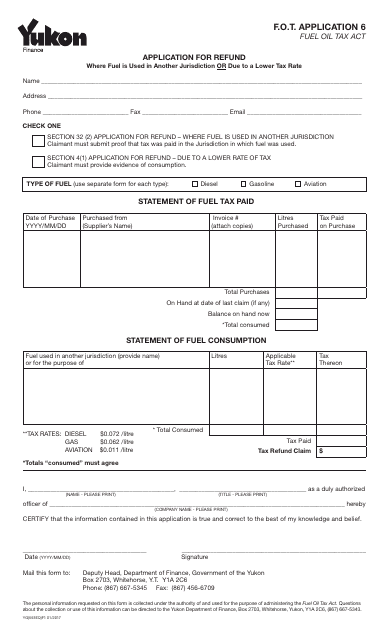

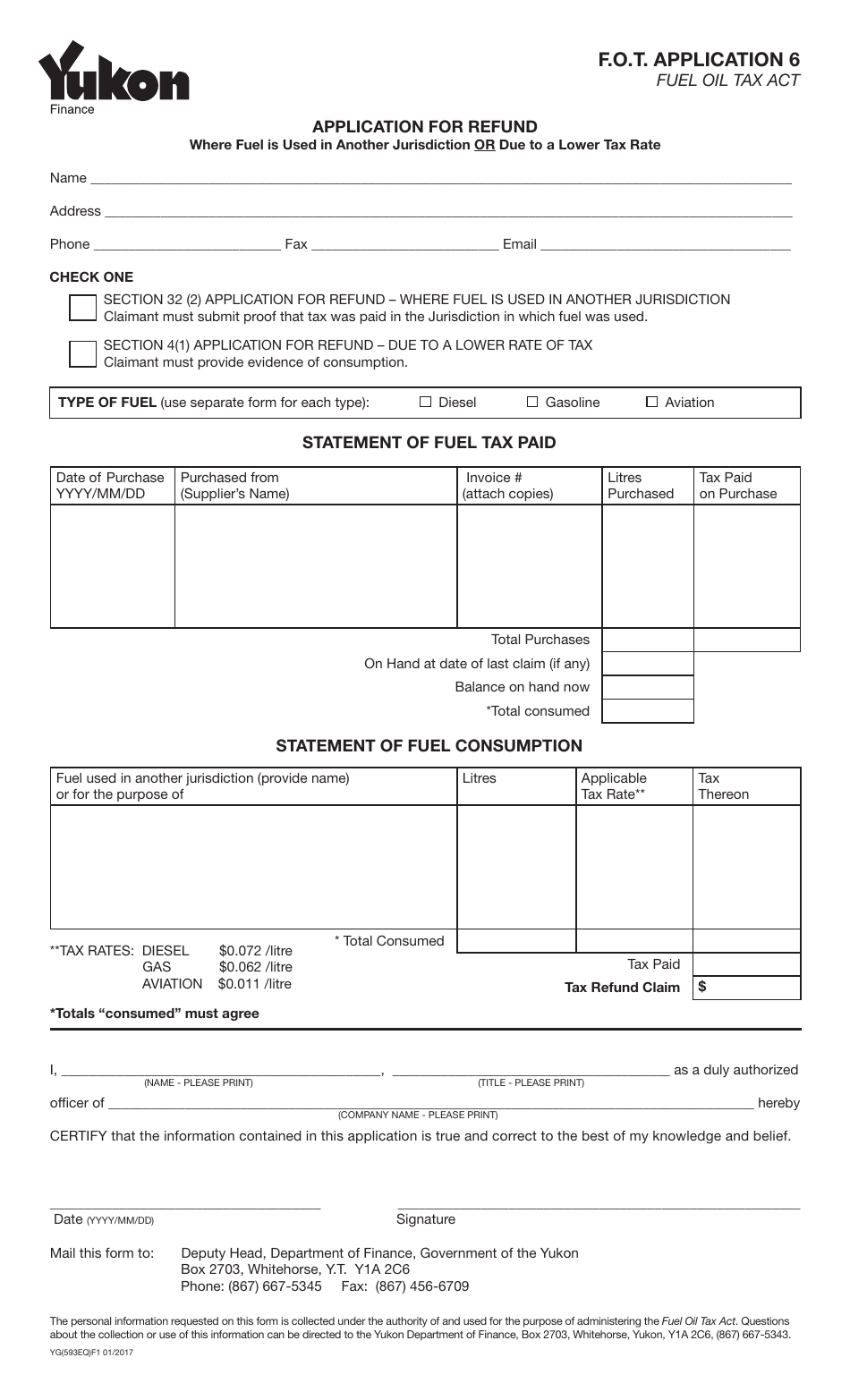

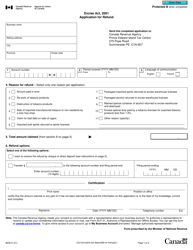

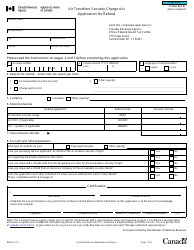

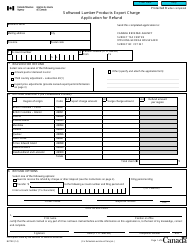

Form YG593 Application for Refund Form - Yukon, Canada

Form YG593 Application for Refund Form in Yukon, Canada is used for individuals or businesses to request a refund of taxes paid to the Yukon government. This form is typically used for various tax-related purposes, such as claiming a refund of overpaid taxes, applying for tax credits or exemptions, or requesting a refund for specific transactions. It is important to carefully fill out this form and provide all necessary supporting documents to ensure a smooth and accurate processing of your refund request.

The Form YG593 Application for Refund in Yukon, Canada is typically filed by individuals or businesses who are seeking a refund for overpaid taxes or fees. This form is specific to the government of Yukon and is used to claim a refund for certain expenses or taxes paid to the territorial government.

FAQ

Q: What is YG593 Application for Refund Form?

A: YG593 Application for Refund Form is a form used in Yukon, Canada for claiming a refund on certain taxes or fees.

Q: What can I claim a refund for using YG593 Application for Refund Form?

A: You can claim a refund for various taxes or fees such as fuel tax, carbon tax, or tobacco tax using the YG593 Application for Refund Form.

Q: Who is eligible to use YG593 Application for Refund Form?

A: Any individual or business who has paid taxes or fees that are refundable in Yukon, Canada can use the YG593 Application for Refund Form.

Q: How do I fill out YG593 Application for Refund Form?

A: To fill out the YG593 Application for Refund Form, you need to provide your personal or business information, details of the taxes or fees you are claiming a refund for, and any supporting documents required.

Q: Are there any deadlines for submitting YG593 Application for Refund Form?

A: Yes, there are specific deadlines for submitting the YG593 Application for Refund Form. It is important to check the official guidelines or instructions provided with the form for the applicable deadlines.

Q: What documents should I attach with YG593 Application for Refund Form?

A: You may need to attach supporting documents such as receipts, invoices, or other proof of payment for the taxes or fees you are claiming a refund for. The specific requirements will be mentioned in the instructions provided with the form.

Q: How long does it take to receive a refund after submitting YG593 Application for Refund Form?

A: The processing time for a refund can vary, but generally, it takes several weeks to process and issue refunds after submitting the YG593 Application for Refund Form.

Q: What should I do if I have questions or need assistance with YG593 Application for Refund Form?

A: If you have any questions or need assistance with the YG593 Application for Refund Form, you can contact the appropriate government department or agency in Yukon, Canada for guidance.