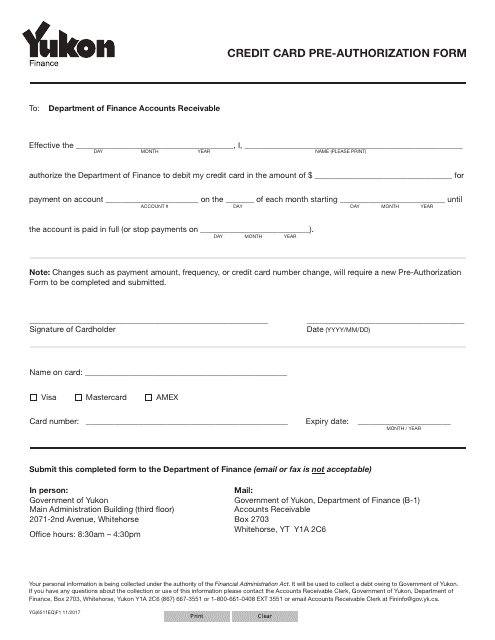

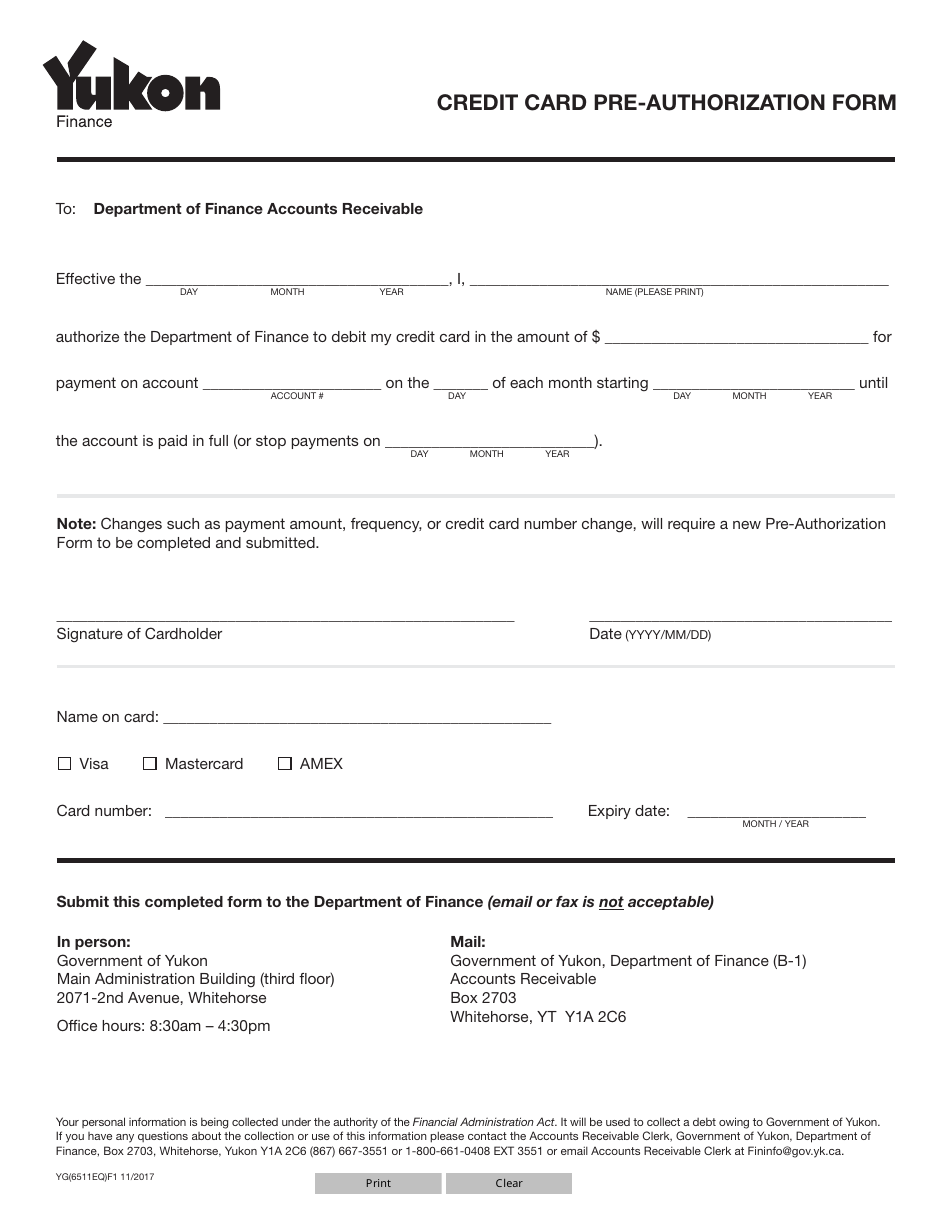

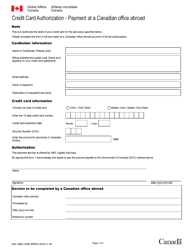

Form YG6511 Credit Card Pre-authorization Form - Yukon, Canada

The Form YG6511 Credit Card Pre-authorization Form in Yukon, Canada is used to obtain authorization from a credit cardholder for the pre-authorization of a certain amount on their credit card. This form is commonly used by businesses such as hotels, car rental agencies, or other service providers to ensure that they can charge the credit card for potential expenses or damages. It serves as a guarantee of payment for the services or products provided.

The Form YG6511 Credit Card Pre-authorization Form in Yukon, Canada is typically filed by the individual or organization requesting the pre-authorization.

FAQ

Q: What is the purpose of the YG6511 Credit Card Pre-authorization Form?

A: The form is used to obtain pre-authorization for credit card payments in Yukon, Canada.

Q: Is the YG6511 Credit Card Pre-authorization Form specific to Yukon, Canada?

A: Yes, the form is specifically for use in Yukon, Canada.

Q: What information is required on the YG6511 Credit Card Pre-authorization Form?

A: The form will typically require the cardholder's name, card number, expiration date, billing address, and the amount to be pre-authorized.

Q: Can the YG6511 Credit Card Pre-authorization Form be used for any type of credit card?

A: The form is generally designed to be used with Visa and Mastercard, but other credit cards may be accepted depending on the merchant's policies.

Q: What happens after the YG6511 Credit Card Pre-authorization Form is submitted?

A: The merchant will verify the provided information and, if approved, hold the specified amount on the cardholder's credit limit until the transaction is completed.

Q: Is a pre-authorized amount on a credit card a guaranteed payment?

A: No, a pre-authorization only reserves funds on the credit card and does not guarantee that the transaction will be completed or the pre-authorized amount will be charged.

Q: Is there a time limit for how long a pre-authorization can be held on a credit card?

A: The duration of a pre-authorization hold can vary depending on the merchant's policies, but it typically ranges from a few days to a week.

Q: Can a pre-authorization hold be cancelled?

A: Yes, a pre-authorization hold can be cancelled by the merchant, which will release the reserved funds back to the cardholder's credit limit.

Q: What should I do if I have a dispute or issue regarding a pre-authorization?

A: If you have any concerns or questions about a pre-authorization, it is recommended to contact the merchant directly to resolve the issue.