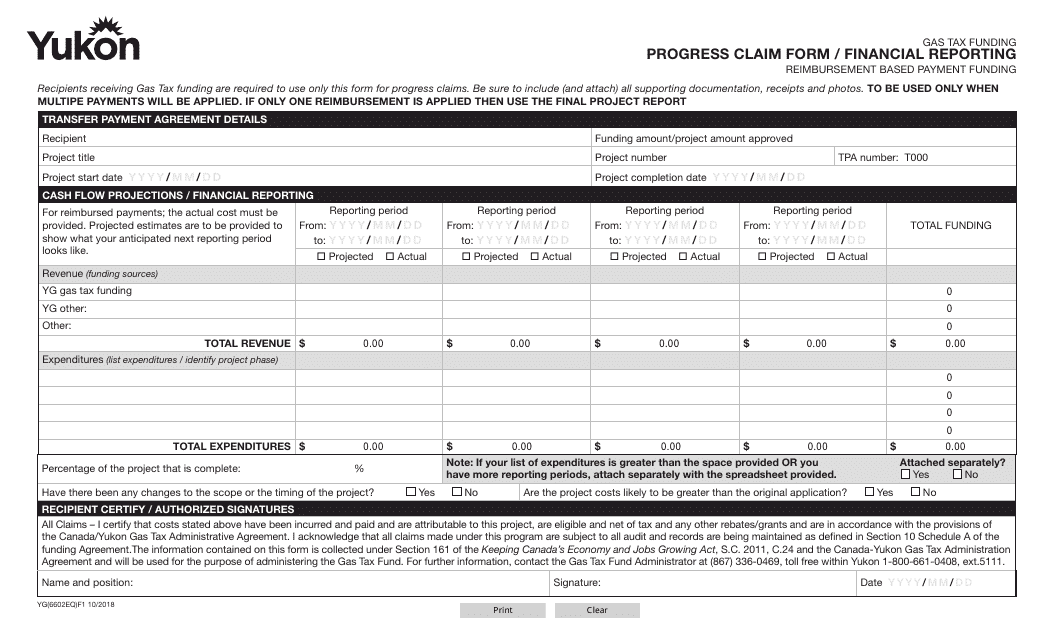

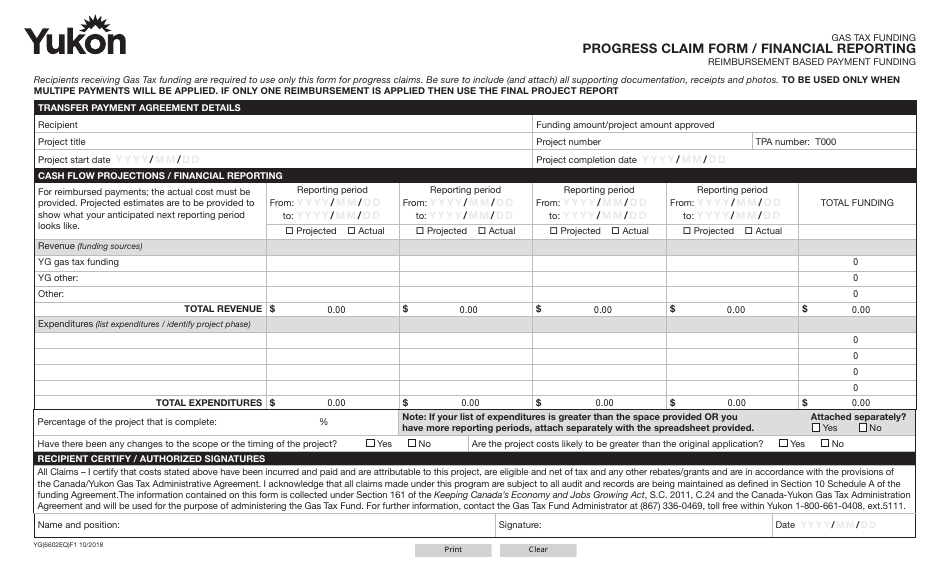

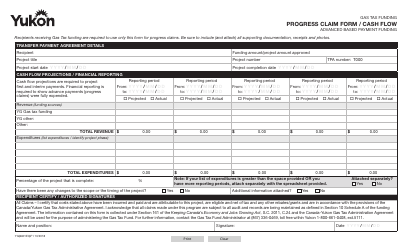

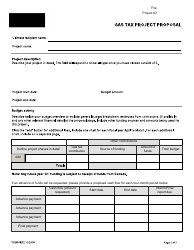

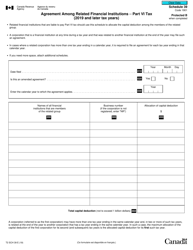

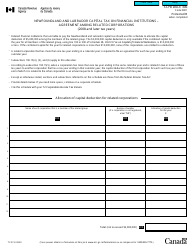

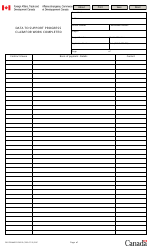

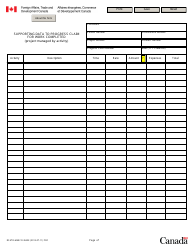

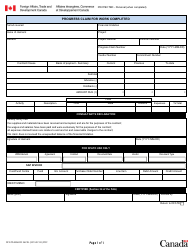

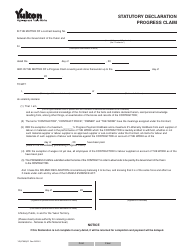

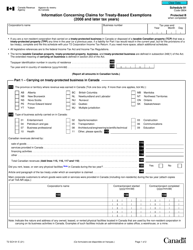

Form YG6602 Gas Tax Fund Progress Claim Form / Financial Reporting - Yukon, Canada

The Form YG6602 Gas Tax Fund Progress Claim Form / Financial Reporting in Yukon, Canada is used to track and report the progress of projects funded by the Gas Tax Fund. It allows recipients to claim reimbursement for eligible expenses incurred during the project.

The Form YG6602 Gas Tax Fund Progress Claim Form / Financial Reporting in Yukon, Canada is typically filed by the recipients or eligible organizations receiving the Gas Tax Fund for infrastructure projects.

FAQ

Q: What is the YG6602 Gas Tax Fund Progress Claim Form?

A: The YG6602 Gas Tax Fund Progress Claim Form is a form used for financial reporting in Yukon, Canada.

Q: What is the Gas Tax Fund?

A: The Gas Tax Fund is a federal funding program in Canada that provides money to municipalities for infrastructure projects.

Q: What is the purpose of the YG6602 Gas Tax Fund Progress Claim Form?

A: The purpose of the YG6602 Gas Tax Fund Progress Claim Form is to track and report the progress of infrastructure projects funded by the Gas Tax Fund.

Q: Who uses the YG6602 Gas Tax Fund Progress Claim Form?

A: Municipalities in Yukon, Canada use the YG6602 Gas Tax Fund Progress Claim Form to report on their infrastructure projects.

Q: What information is required on the YG6602 Gas Tax Fund Progress Claim Form?

A: The YG6602 Gas Tax Fund Progress Claim Form requires information such as project details, expenditures, and progress updates.

Q: How often is the YG6602 Gas Tax Fund Progress Claim Form submitted?

A: The YG6602 Gas Tax Fund Progress Claim Form is typically submitted on a quarterly basis.

Q: Is the YG6602 Gas Tax Fund Progress Claim Form specific to Yukon?

A: Yes, the YG6602 Gas Tax Fund Progress Claim Form is specific to Yukon, Canada.

Q: What happens after the YG6602 Gas Tax Fund Progress Claim Form is submitted?

A: After the YG6602 Gas Tax Fund Progress Claim Form is submitted, the municipality may receive additional funding or recommendations for project adjustments.