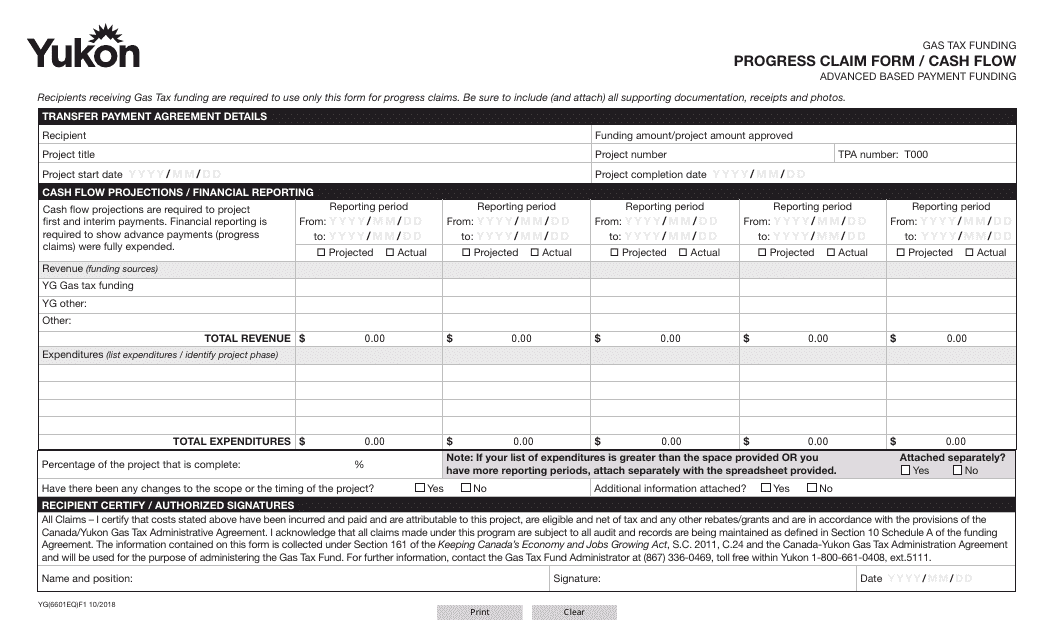

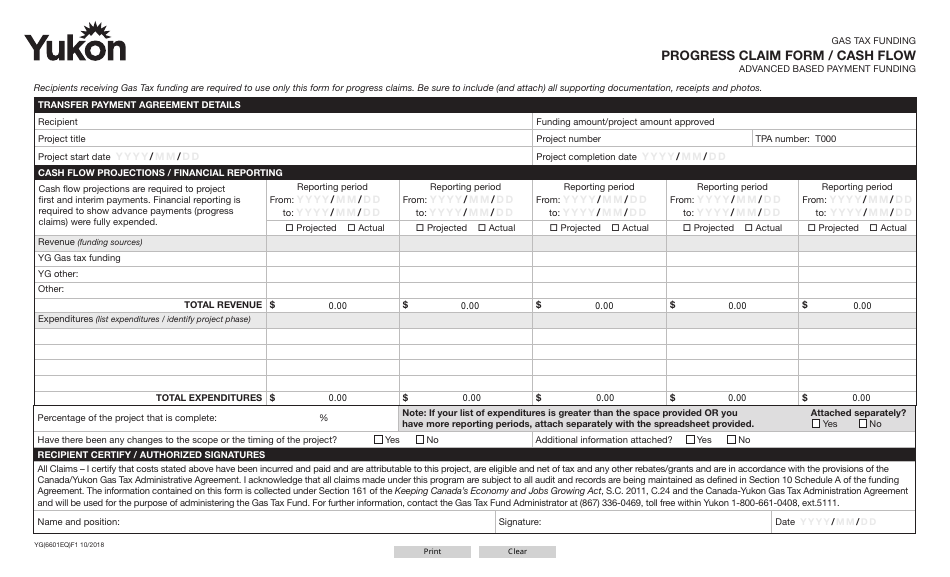

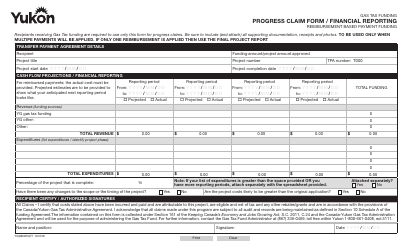

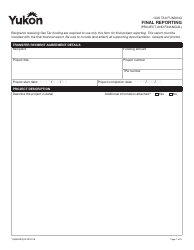

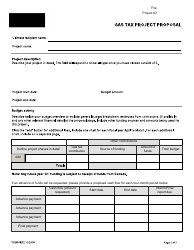

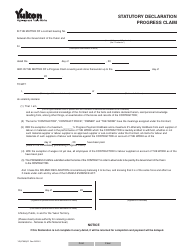

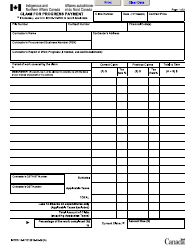

Form YG6601 Gas Tax Fund Progress Claim Form / Cash Flow - Yukon, Canada

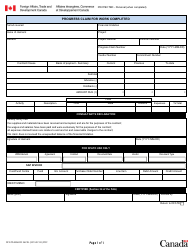

The Form YG6601 Gas Tax Fund Progress Claim Form/Cash Flow in Yukon, Canada is used to claim progress payments for projects supported by gas tax funding.

The Form YG6601 Gas Tax Fund Progress Claim Form / Cash Flow in Yukon, Canada is typically filed by the project proponents or individuals responsible for managing the gas tax fund projects. They submit this form to request reimbursement for eligible expenses incurred during the project.

FAQ

Q: What is the YG6601 Gas Tax Fund Progress Claim Form?

A: The YG6601 Gas Tax Fund Progress Claim Form is a form used in Yukon, Canada to claim progress payments for projects funded by the Gas Tax Fund.

Q: What is the purpose of the YG6601 Gas Tax Fund Progress Claim Form?

A: The purpose of the YG6601 Gas Tax Fund Progress Claim Form is to facilitate the payment process for projects funded by the Gas Tax Fund in Yukon.

Q: Who can use the YG6601 Gas Tax Fund Progress Claim Form?

A: The YG6601 Gas Tax Fund Progress Claim Form can be used by recipients of Gas Tax Fund funding in Yukon for their projects.

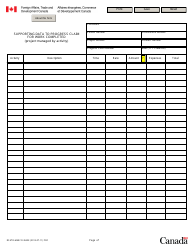

Q: What is the Cash Flow section in the YG6601 Gas Tax Fund Progress Claim Form?

A: The Cash Flow section in the YG6601 Gas Tax Fund Progress Claim Form is used to provide information about the financial aspects of the project, including income and expenditures.

Q: Why is the Cash Flow section important in the YG6601 Gas Tax Fund Progress Claim Form?

A: The Cash Flow section is important in the YG6601 Gas Tax Fund Progress Claim Form as it helps track and monitor the financial progress of the project and ensure that the funds are being used as intended.

Q: Are there any deadlines to submit the YG6601 Gas Tax Fund Progress Claim Form?

A: Yes, there are usually specific deadlines for submitting the YG6601 Gas Tax Fund Progress Claim Form. It is important to adhere to these deadlines to ensure timely processing and payment of project funds.

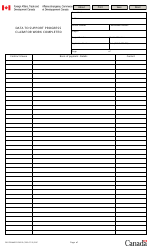

Q: What supporting documentation is required along with the YG6601 Gas Tax Fund Progress Claim Form?

A: The YG6601 Gas Tax Fund Progress Claim Form usually requires supporting documentation such as invoices, receipts, and financial statements to validate the expenses claimed.

Q: Who should I contact for assistance with the YG6601 Gas Tax Fund Progress Claim Form?

A: For assistance with the YG6601 Gas Tax Fund Progress Claim Form, you can reach out to the government department or agency responsible for administering the Gas Tax Fund in Yukon.