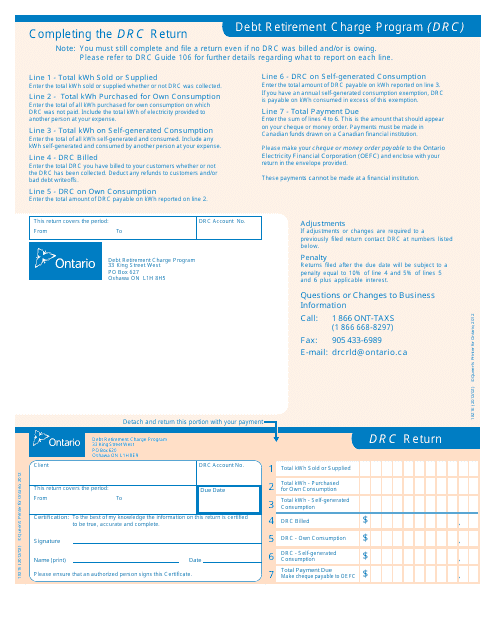

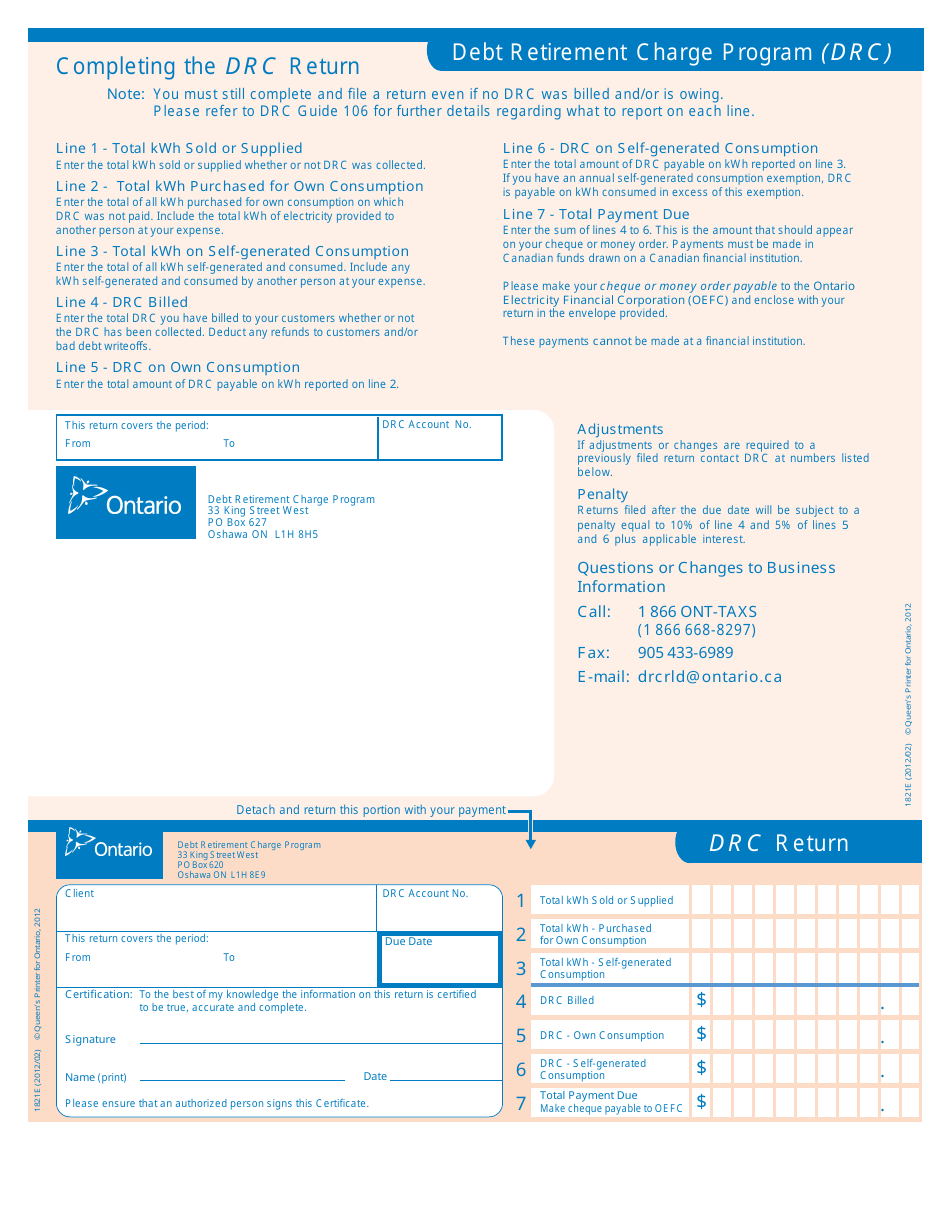

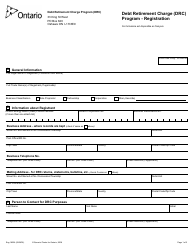

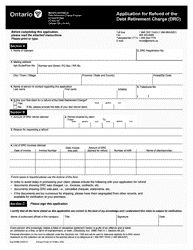

Form 1821 Debt Retirement Charge (Drc) Return - Ontario, Canada

Form 1821 or the "Form 1821 "debt Retirement Charge (drc) Return" - Ontario, Canada" is a form issued by the Ontario Ministry of Finance .

Download a PDF version of the Form 1821 down below or find it on the Ontario Ministry of Finance Forms website.

FAQ

Q: What is Form 1821 Debt Retirement Charge (DRC) Return?

A: Form 1821 Debt Retirement Charge (DRC) Return is a tax form used in Ontario, Canada to report and remit the Debt Retirement Charge.

Q: What is the Debt Retirement Charge (DRC)?

A: The Debt Retirement Charge (DRC) was a fee charged to Ontario electricity consumers to retire the debt of the former Ontario Hydro.

Q: Who needs to file Form 1821?

A: Businesses and organizations that are required to collect and remit the Debt Retirement Charge (DRC) in Ontario need to file Form 1821.

Q: What information is required on Form 1821?

A: Form 1821 requires information such as the reporting period, total DRC collected, and the total amount of DRC remitted.

Q: When is Form 1821 due?

A: Form 1821 is due on or before the last day of the month following the end of the reporting period.