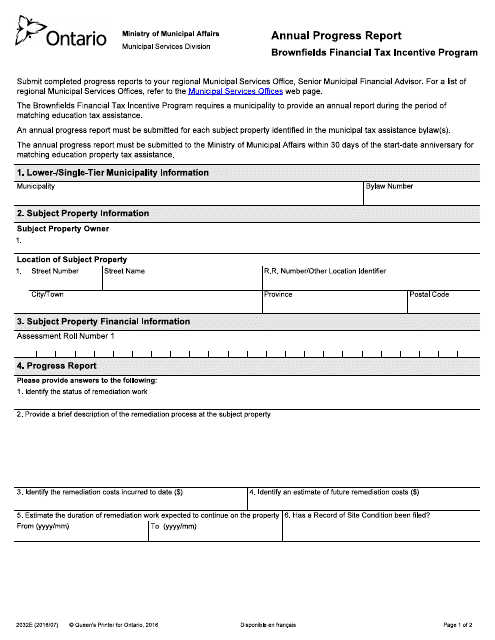

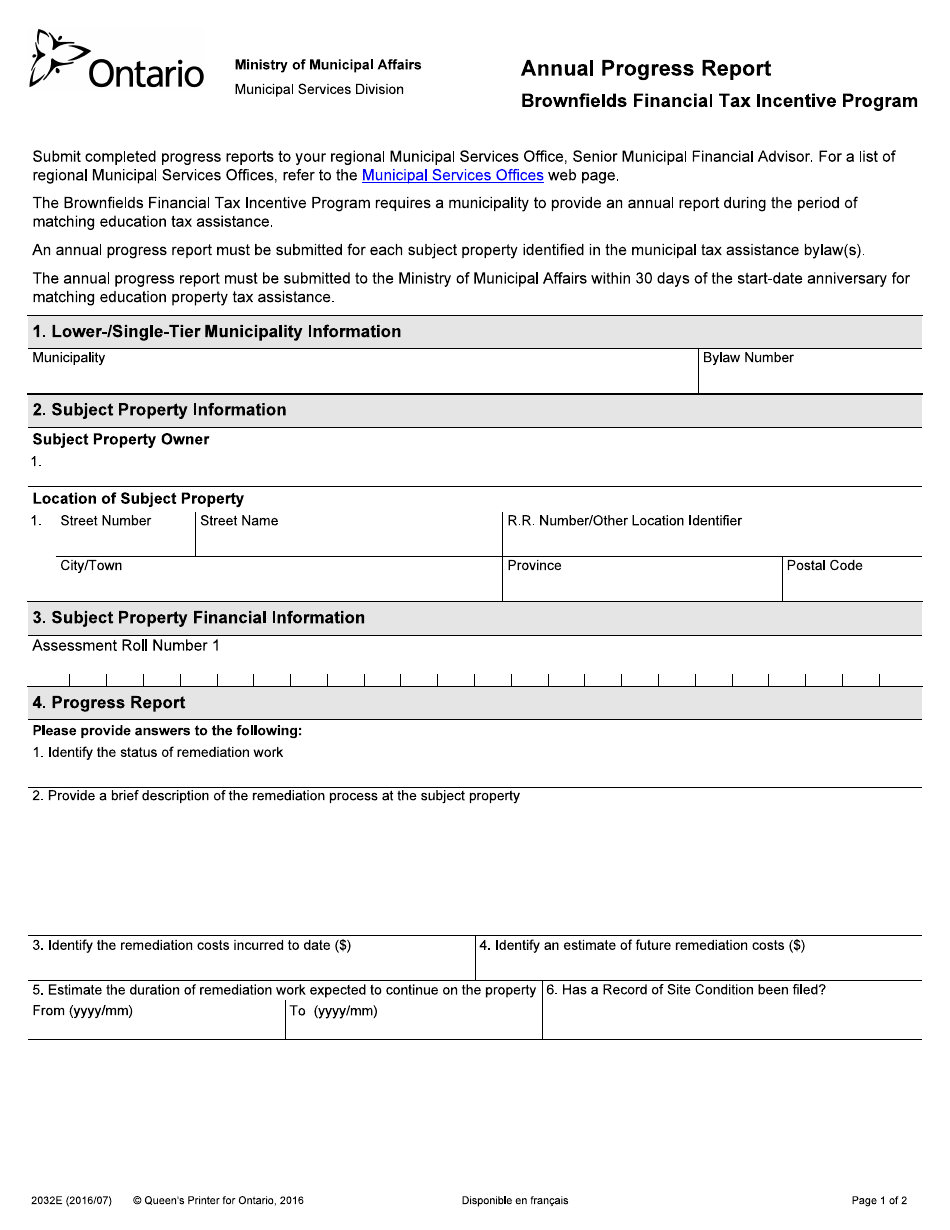

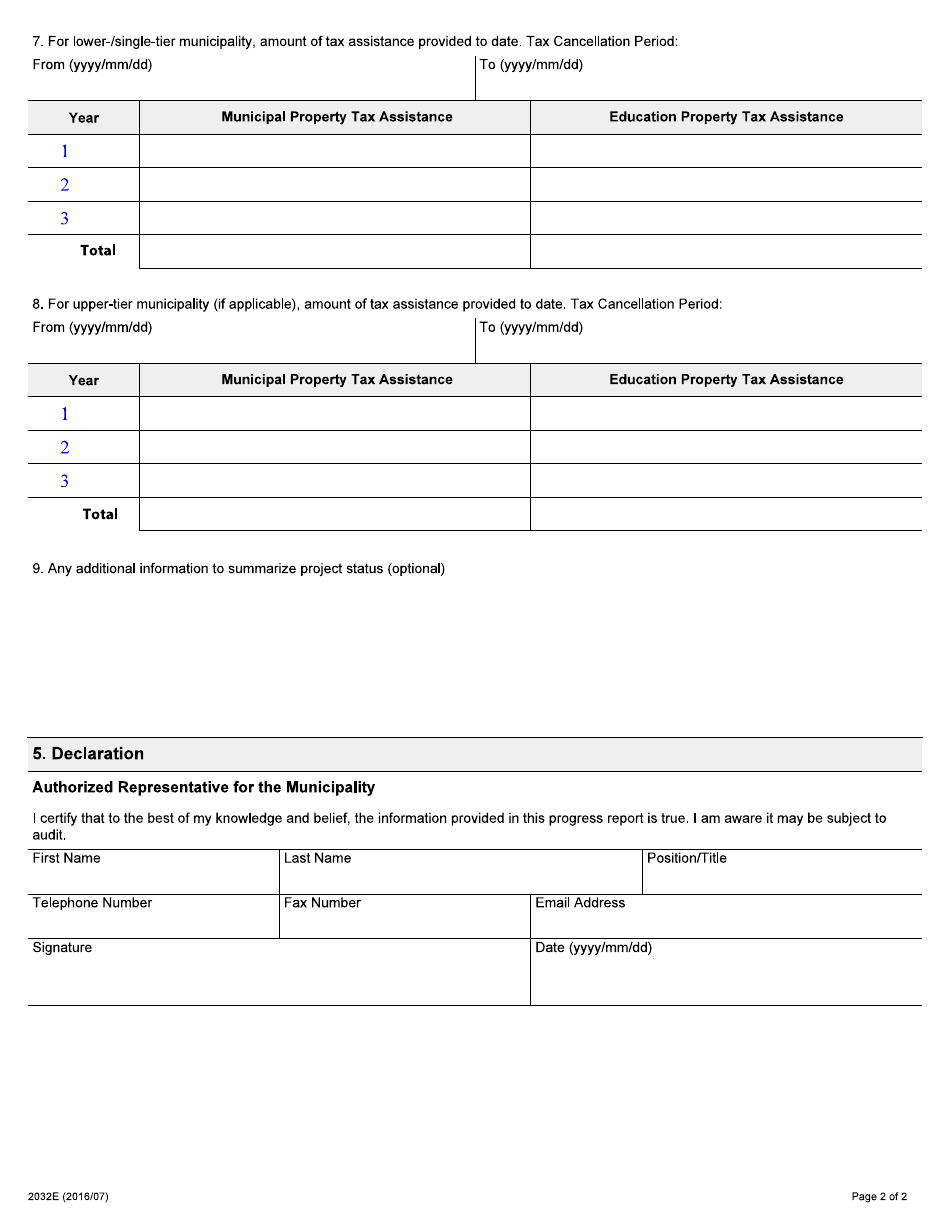

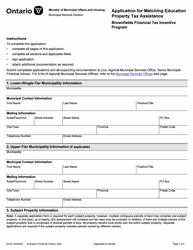

Form 2032E Brownfields Financial Tax Incentive Program Annual Progress Report - Ontario, Canada

Form 2032E Brownfields Financial Tax Incentive Program Annual Progress Report in Ontario, Canada is used to report the progress made in the Brownfields Financial Tax Incentive Program. This program aims to provide financial incentives for the redevelopment of contaminated or underutilized lands, known as brownfields, in Ontario. The report helps track the annual progress of projects participating in the program.

FAQ

Q: What is Form 2032E?

A: Form 2032E is the Annual Progress Report for the Brownfields Financial Tax Incentive Program.

Q: What is the Brownfields Financial Tax Incentive Program?

A: The Brownfields Financial Tax Incentive Program is a program in Ontario, Canada that provides financial incentives for the redevelopment of contaminated properties, known as brownfields.

Q: Who is required to fill out Form 2032E?

A: Property owners who are participating in the Brownfields Financial Tax Incentive Program are required to fill out Form 2032E.

Q: What information is included in Form 2032E?

A: Form 2032E includes information about the progress of the brownfield redevelopment project, such as the status of remediation activities and any changes to the property ownership.