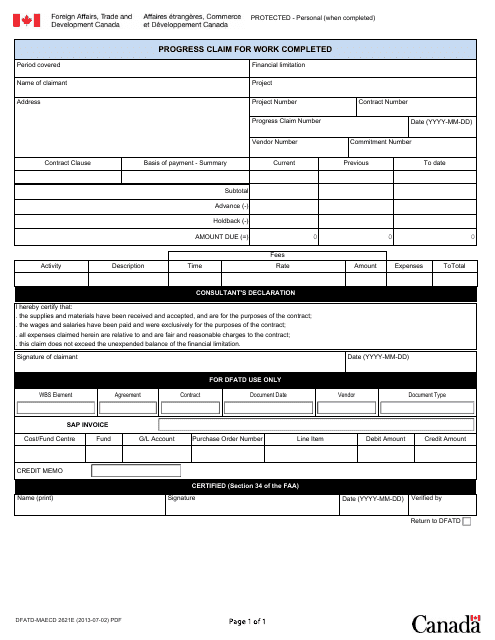

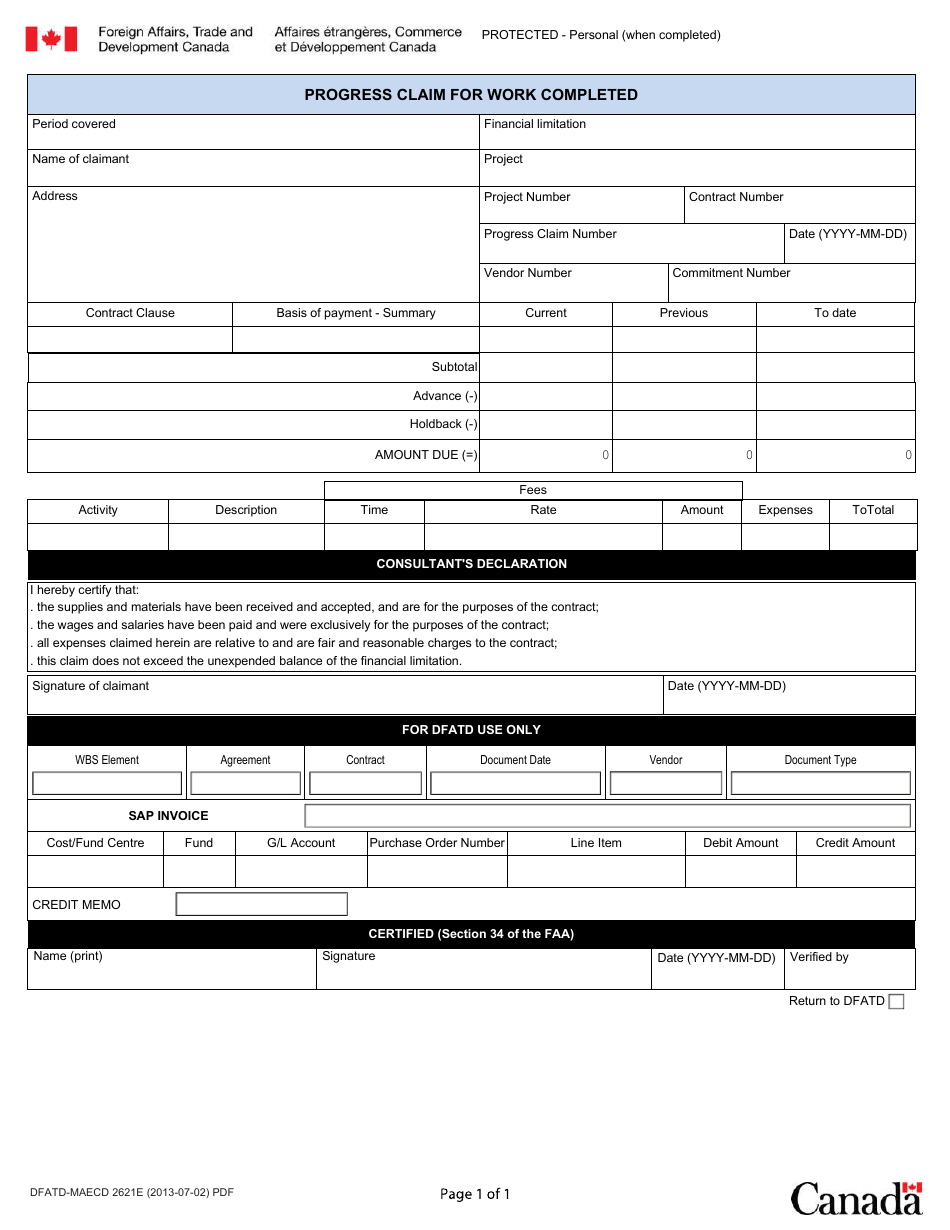

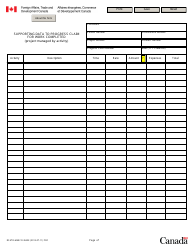

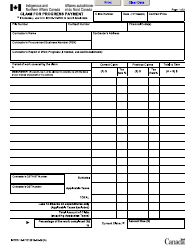

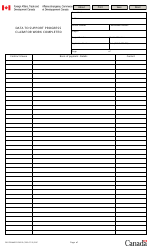

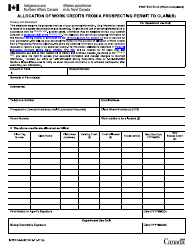

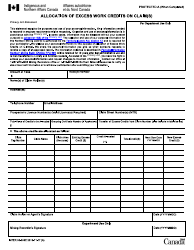

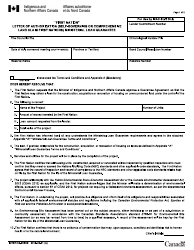

Form DFATD-MAECD2621 E Progress Claim for Work Completed - Canada

Form DFATD-MAECD2621 E Progress Claim for Work Completed is used in Canada for the purpose of submitting progress claims for work completed. It is likely a form used in a government or contractual context to request payment or reimbursement based on completed work.

The Form DFATD-MAECD2621 E Progress Claim for Work Completed in Canada is filed by the government or its authorized representative who is responsible for overseeing the project.

FAQ

Q: What is Form DFATD-MAECD2621 E?

A: Form DFATD-MAECD2621 E is the Progress Claim for Work Completed in Canada.

Q: What is the purpose of Form DFATD-MAECD2621 E?

A: The purpose of Form DFATD-MAECD2621 E is to claim progress payment for work completed in Canada.

Q: Who uses Form DFATD-MAECD2621 E?

A: Form DFATD-MAECD2621 E is used by contractors or suppliers to claim payment from the Department of Foreign Affairs, Trade and Development Canada (DFATD) for completed work in Canada.

Q: What information is required on Form DFATD-MAECD2621 E?

A: Form DFATD-MAECD2621 E requires information such as the contractor's name and address, contract number, description of work completed, and the amount being claimed.

Q: Are there any deadlines for submitting Form DFATD-MAECD2621 E?

A: Yes, there are specific deadlines for submitting Form DFATD-MAECD2621 E. These deadlines are usually outlined in the contract or agreement between the contractor and the DFATD.

Q: Is Form DFATD-MAECD2621 E applicable to both Canada and the US?

A: Form DFATD-MAECD2621 E is specifically for work completed in Canada and is not applicable to the US.

Q: Can Form DFATD-MAECD2621 E be used for claiming payment in other countries?

A: No, Form DFATD-MAECD2621 E is only for claiming payment for work completed in Canada under the DFATD.

Q: What should I do if I have questions or need assistance with Form DFATD-MAECD2621 E?

A: If you have questions or need assistance with Form DFATD-MAECD2621 E, you should contact the DFATD or the contracting authority for guidance.