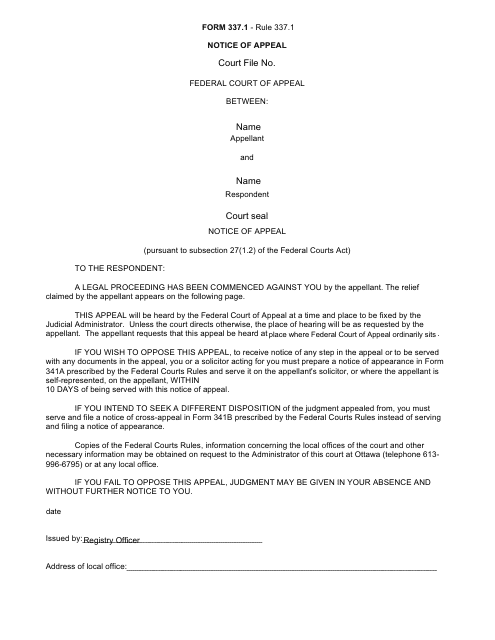

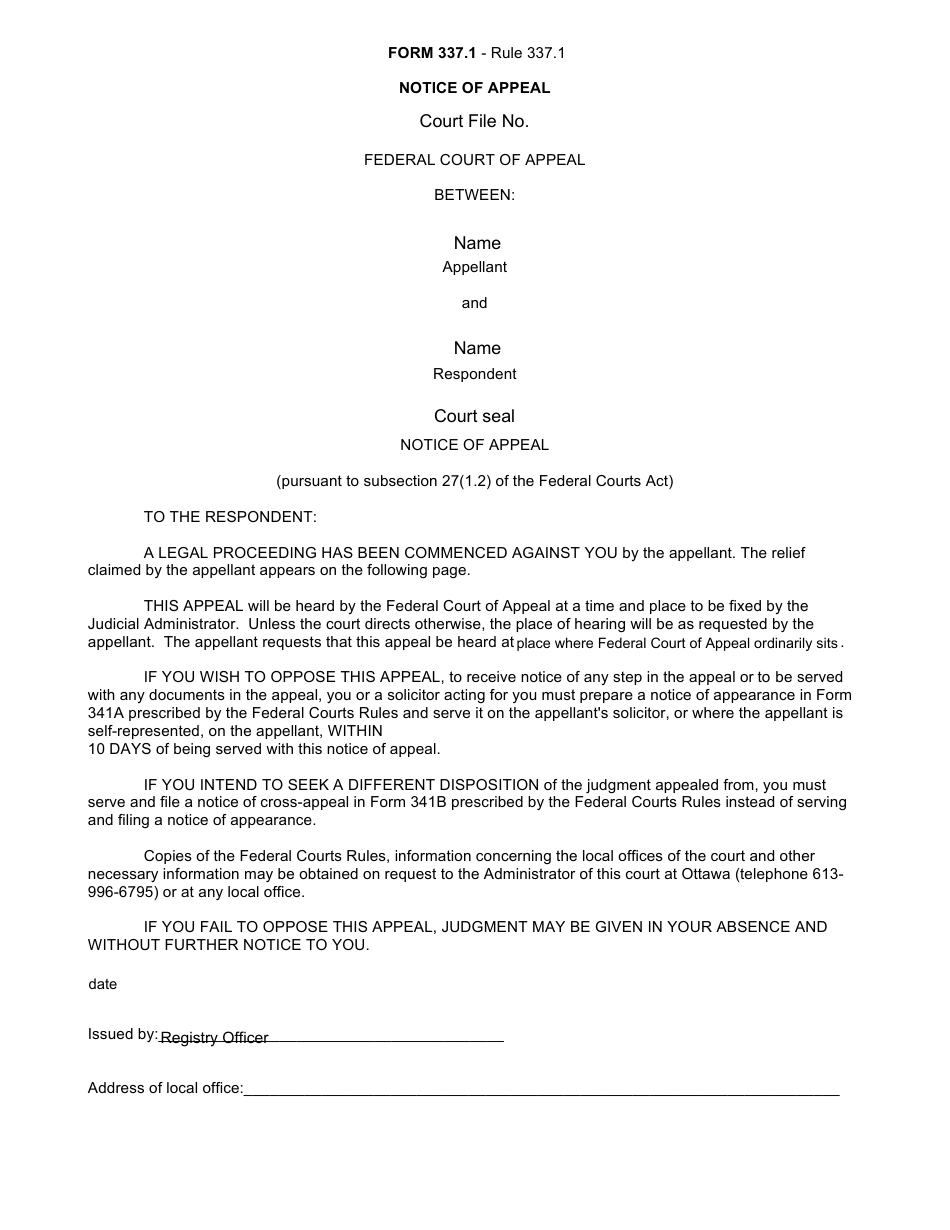

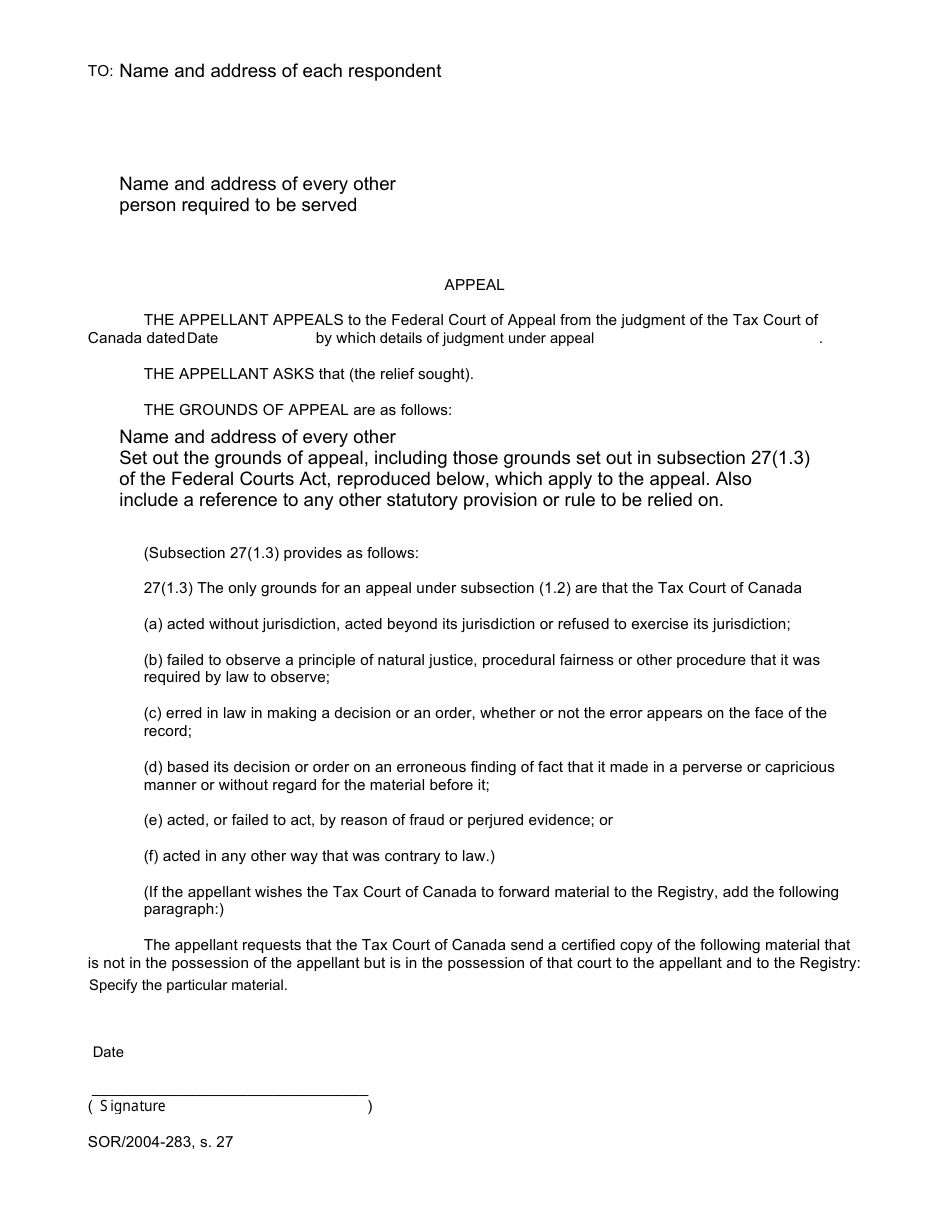

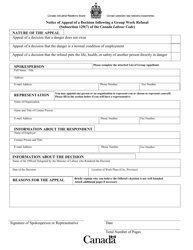

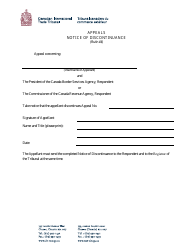

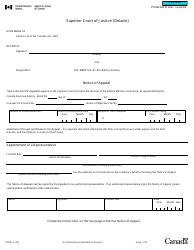

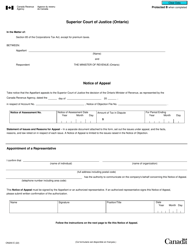

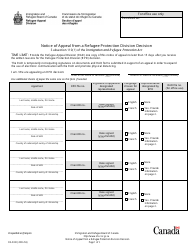

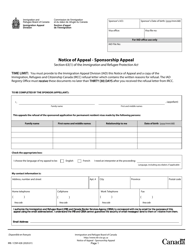

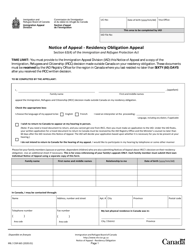

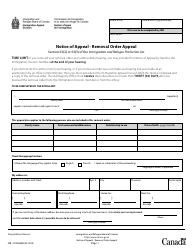

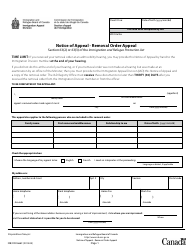

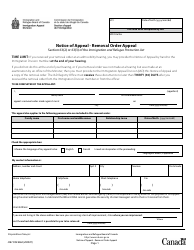

Form 337.1 Notice of Appeal - Canada

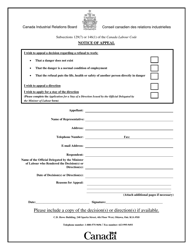

Form 337.1, Notice of Appeal, is used in Canada for initiating the process of appealing a decision made by a tribunal or board.

In Canada, Form 337.1 Notice of Appeal is filed by the appellant or their authorized representative.

FAQ

Q: What is Form 337.1?

A: Form 337.1 is a Notice of Appeal form used in Canada.

Q: What is the purpose of Form 337.1?

A: The purpose of Form 337.1 is to officially appeal a decision made by a Canadian authority.

Q: Is there a fee for filing Form 337.1?

A: Yes, there is usually a fee associated with filing Form 337.1. The specific fee amount may vary depending on the jurisdiction.

Q: What is the deadline for filing Form 337.1?

A: The deadline for filing Form 337.1 varies depending on the specific case and jurisdiction. It is important to check the relevant rules and regulations.

Q: Do I need a lawyer to file Form 337.1?

A: You are not required to have a lawyer to file Form 337.1, but it is recommended to seek legal advice, especially for complex cases.

Q: What information is required in Form 337.1?

A: Form 337.1 typically requires information such as the appellant's name, contact information, details of the decision being appealed, and the grounds for the appeal.

Q: What happens after filing Form 337.1?

A: After filing Form 337.1, the appeal process will vary depending on the jurisdiction. It may involve a hearing or other proceedings before a decision is reached.

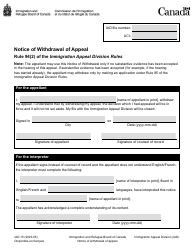

Q: Can I withdraw my appeal after filing Form 337.1?

A: Yes, in most cases, you can withdraw your appeal by notifying the relevant authority in writing.

Q: Can I file Form 337.1 for any type of decision?

A: Form 337.1 is generally used for administrative decisions made by Canadian authorities, such as immigration, tax, or labor-related matters. Other types of decisions may require a different form or process.