This version of the form is not currently in use and is provided for reference only. Download this version of

Form B200

for the current year.

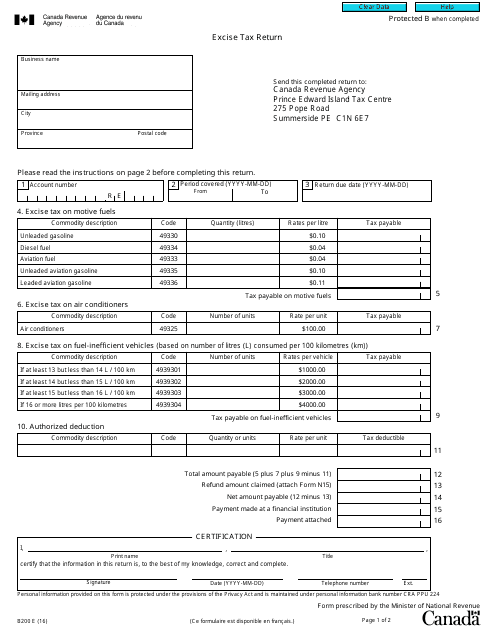

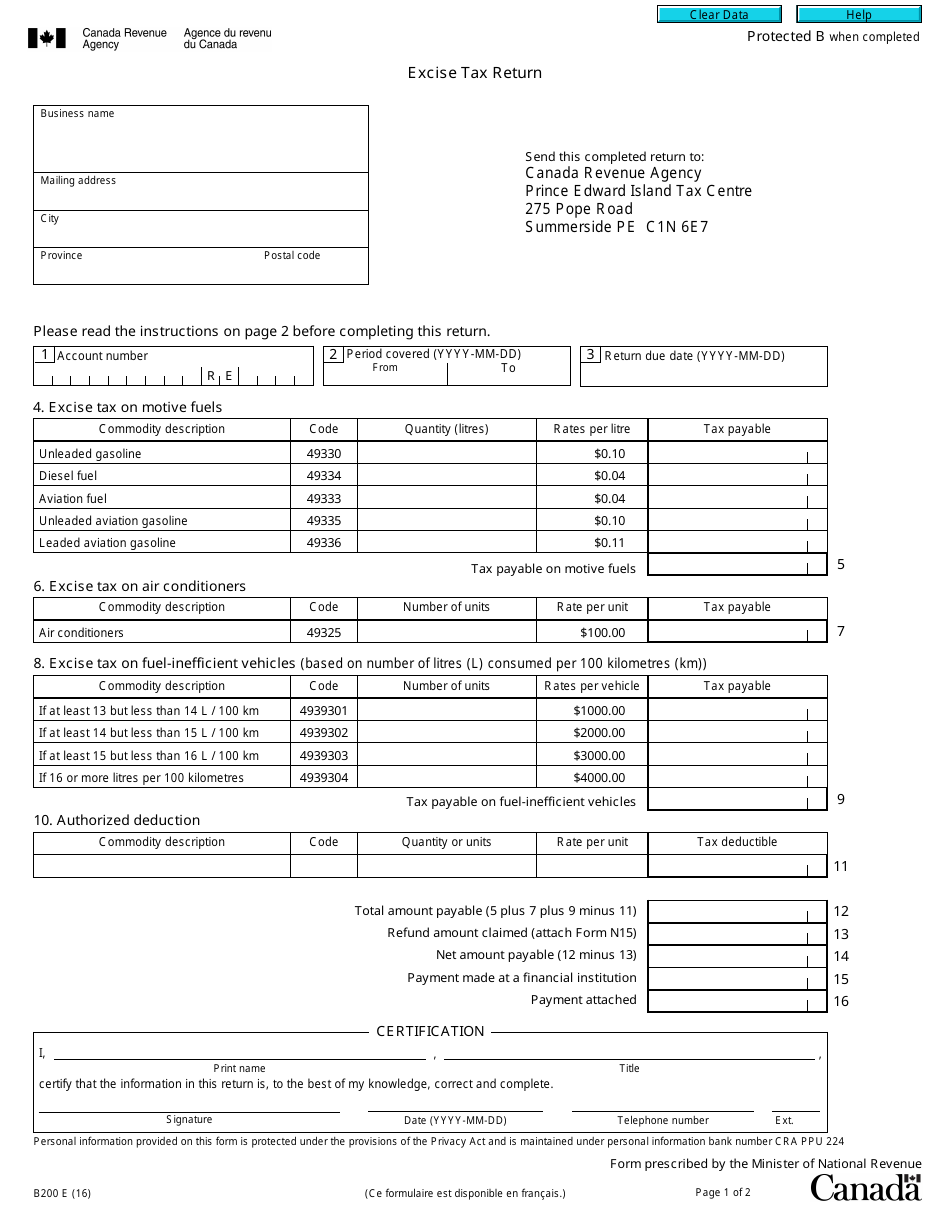

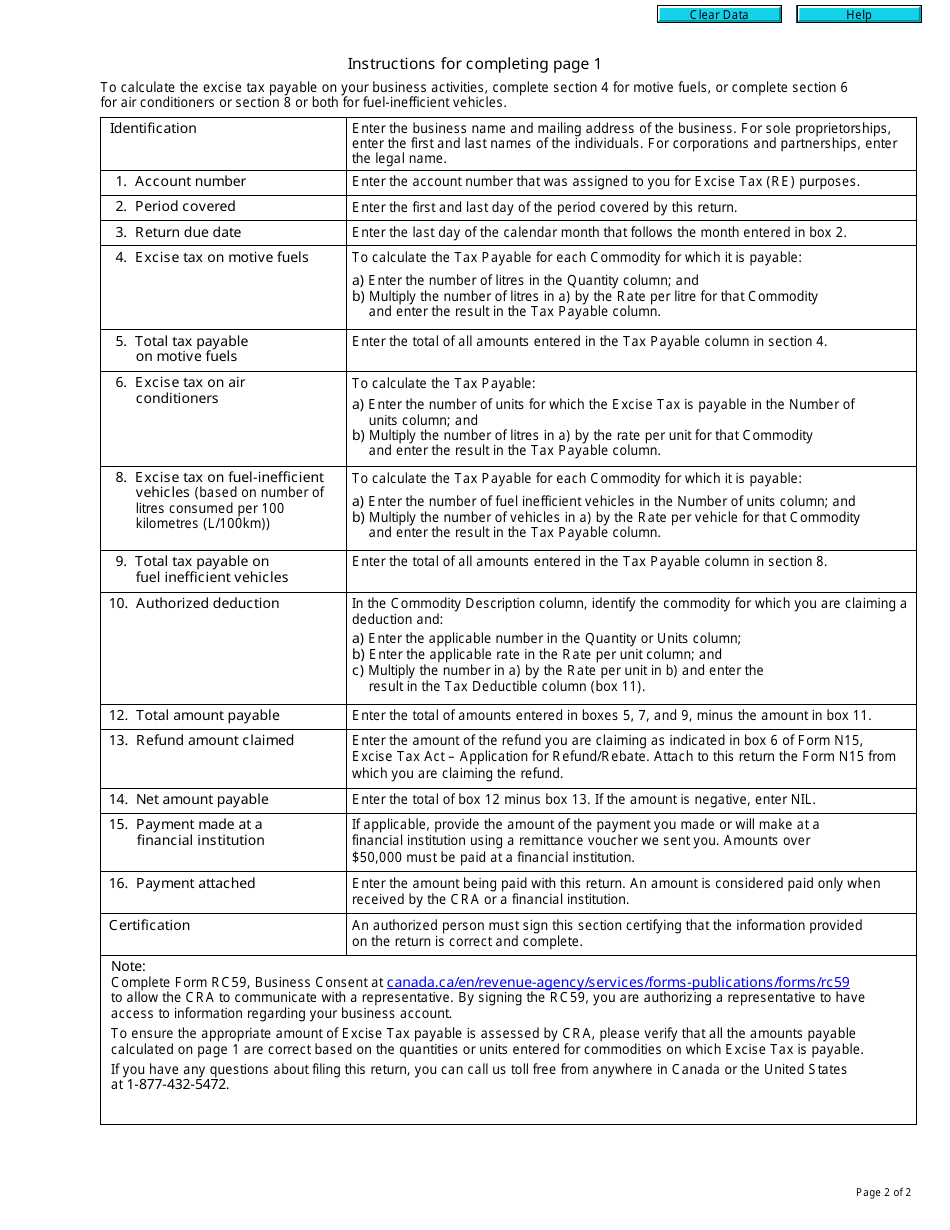

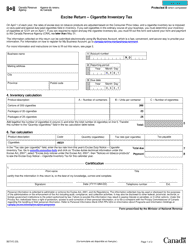

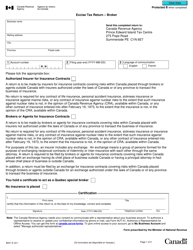

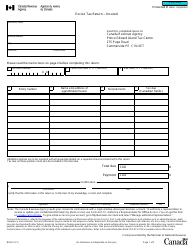

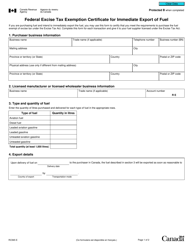

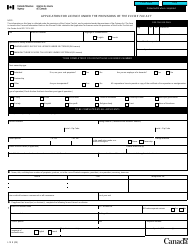

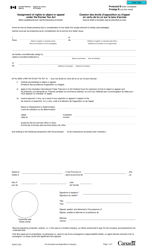

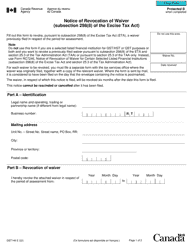

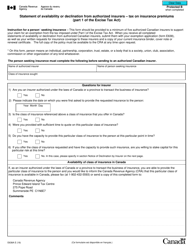

Form B200 Excise Tax Return - Canada

Form B200 or the "Form B200 "excise Tax Return" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form B200 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is the Form B200 Excise Tax Return?

A: The Form B200 Excise Tax Return is a tax form used in Canada to report and remit excise taxes.

Q: Who needs to file the Form B200 Excise Tax Return?

A: Businesses or individuals engaged in certain taxable activities, such as producing or selling excise taxable goods, need to file the Form B200 Excise Tax Return.

Q: What are excise taxes?

A: Excise taxes are special taxes imposed on specific goods, such as alcohol, tobacco, fuel, or certain vehicle sales, rather than on a general basis like income taxes.

Q: When is the deadline to file the Form B200 Excise Tax Return?

A: The deadline to file the Form B200 Excise Tax Return may vary depending on the reporting period and type of excise tax. It is important to check the specific due date for the applicable tax period.

Q: What happens if I don't file the Form B200 Excise Tax Return?

A: Failing to file the Form B200 Excise Tax Return or not remitting the appropriate amount of excise tax can result in penalties and interest charges imposed by the CRA. It is important to fulfill all filing and payment obligations to avoid these consequences.