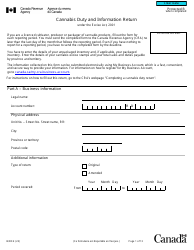

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B261

for the current year.

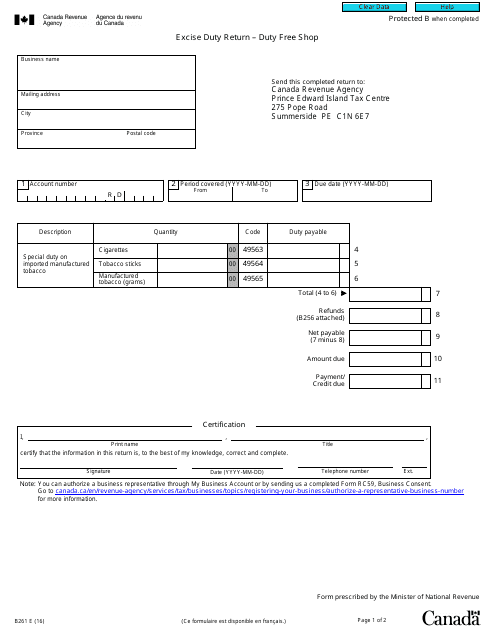

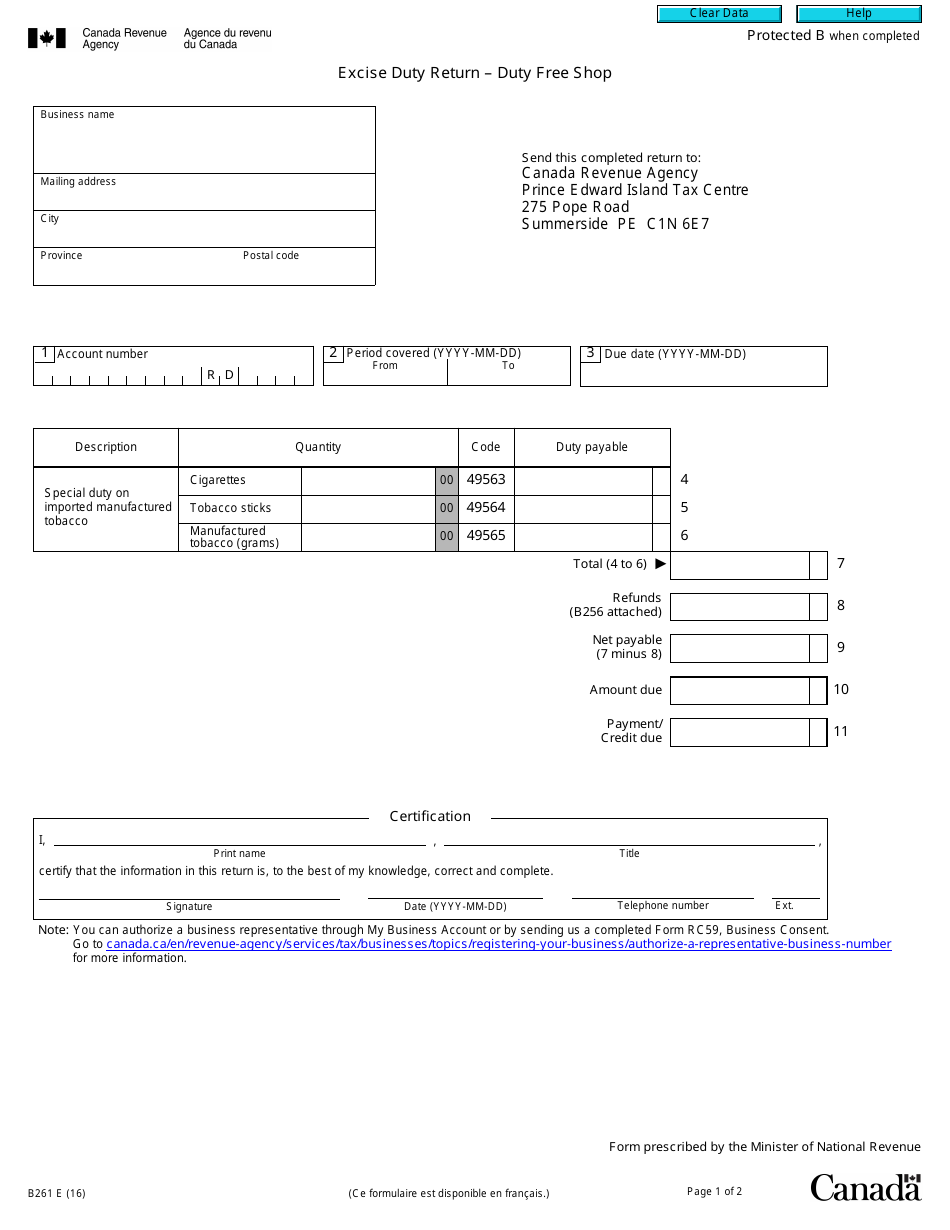

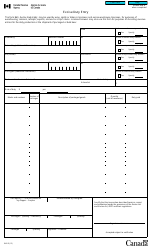

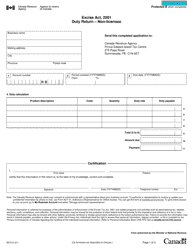

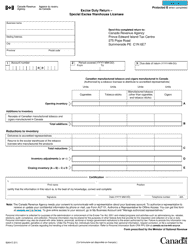

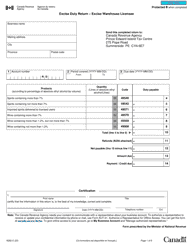

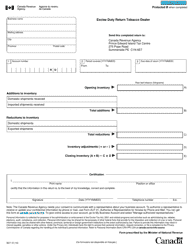

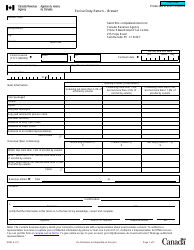

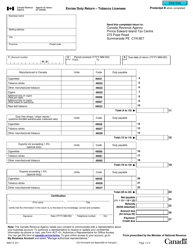

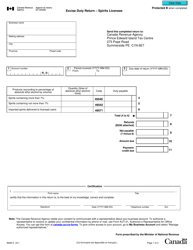

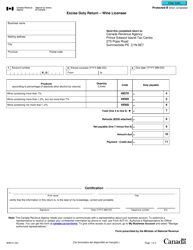

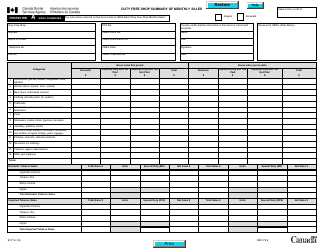

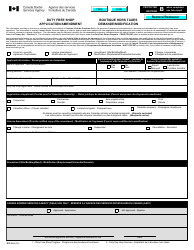

Form B261 Excise Duty Return - Duty Free Shop - Canada

Form B261 Excise Duty Return - Duty Free Shop in Canada is used by duty-free shops to report and pay excise duties on the goods they sell. This form helps the Canadian government track and collect taxes on items sold at duty-free shops.

The Duty Free Shop in Canada is responsible for filing the Form B261 Excise Duty Return.

FAQ

Q: What is Form B261?

A: Form B261 is an Excise Duty Return specifically for Duty Free Shops in Canada.

Q: Who needs to file Form B261?

A: Duty Free Shops in Canada need to file Form B261.

Q: What is the purpose of Form B261?

A: The purpose of Form B261 is to report and remit the excise duties on goods sold in Duty Free Shops.

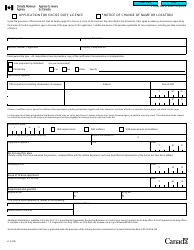

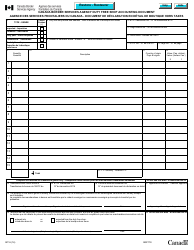

Q: What information is required on Form B261?

A: Form B261 requires information such as the quantities and types of goods sold, the corresponding excise duties, and the total sales.

Q: How often should Form B261 be filed?

A: Form B261 should be filed on a monthly basis.