This version of the form is not currently in use and is provided for reference only. Download this version of

Form B264

for the current year.

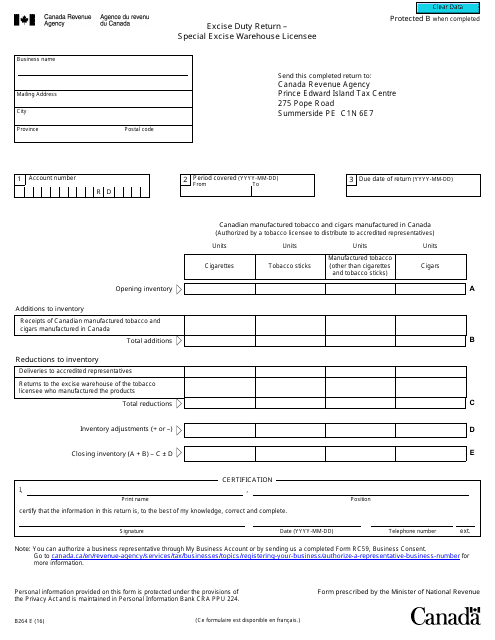

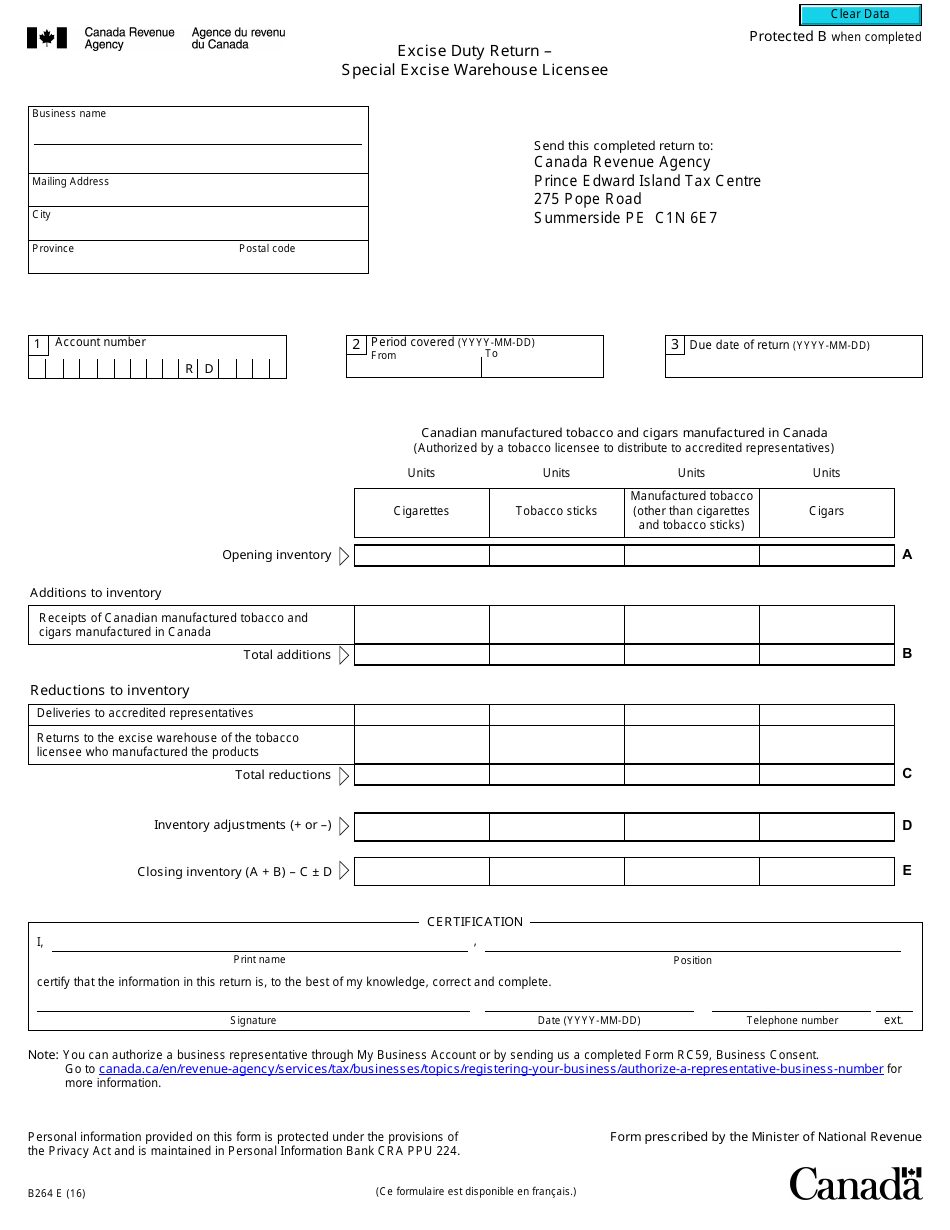

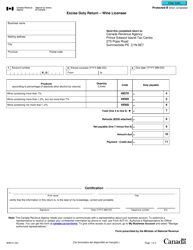

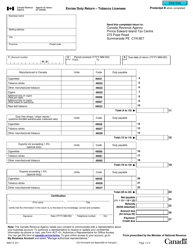

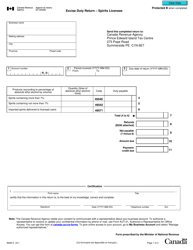

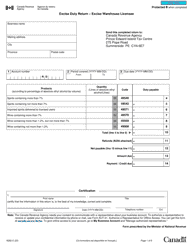

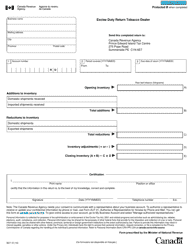

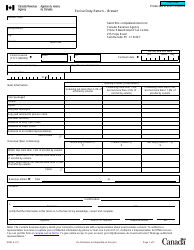

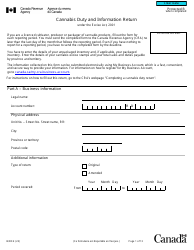

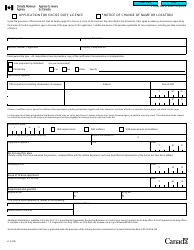

Form B264 Excise Duty Return - Special Excise Warehouse Licensee - Canada

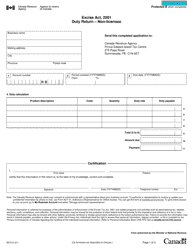

Form B264 Excise Duty Return - Special Excise Warehouse Licensee in Canada is a document used for reporting and paying excise duties by businesses that hold a special excise warehouse license. This form is specifically designed for licensees who store and handle excisable goods in their warehouses and are required to fulfill their excise duty obligations.

The Form B264 Excise Duty Return is filed by the Special Excise Warehouse Licensee in Canada.

FAQ

Q: What is Form B264?

A: Form B264 is the Excise Duty Return for Special Excise Warehouse Licensees in Canada.

Q: Who should fill out Form B264?

A: Special Excise Warehouse Licensees in Canada should fill out Form B264.

Q: What is the purpose of Form B264?

A: The purpose of Form B264 is to report and pay excise duties for goods stored in a special excise warehouse.

Q: When should Form B264 be filed?

A: Form B264 should be filed on a monthly basis, within one month from the end of the reporting period.

Q: What information is required on Form B264?

A: Form B264 requires information such as the quantity and value of goods removed from the special excise warehouse, as well as the amount of excise duty payable.

Q: Are there any penalties for not filing Form B264?

A: Yes, there may be penalties for not filing Form B264, such as late filing penalties and interest charges on unpaid excise duties.

Q: What should I do with Form B264 after filing?

A: After filing Form B264, you should keep a copy for your records and ensure that all excise duties owing are paid on time.