This version of the form is not currently in use and is provided for reference only. Download this version of

Form B267

for the current year.

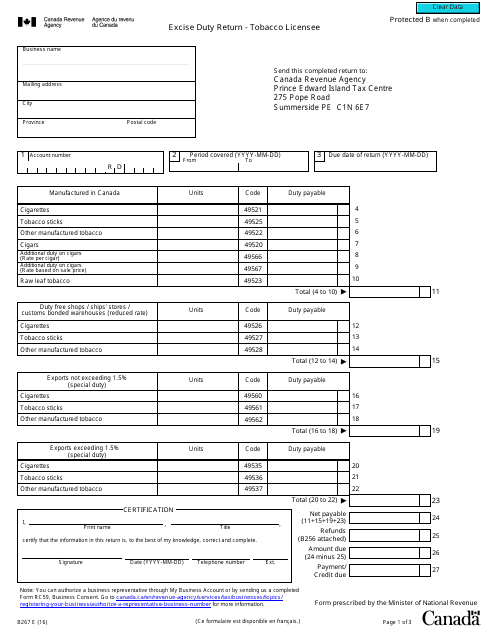

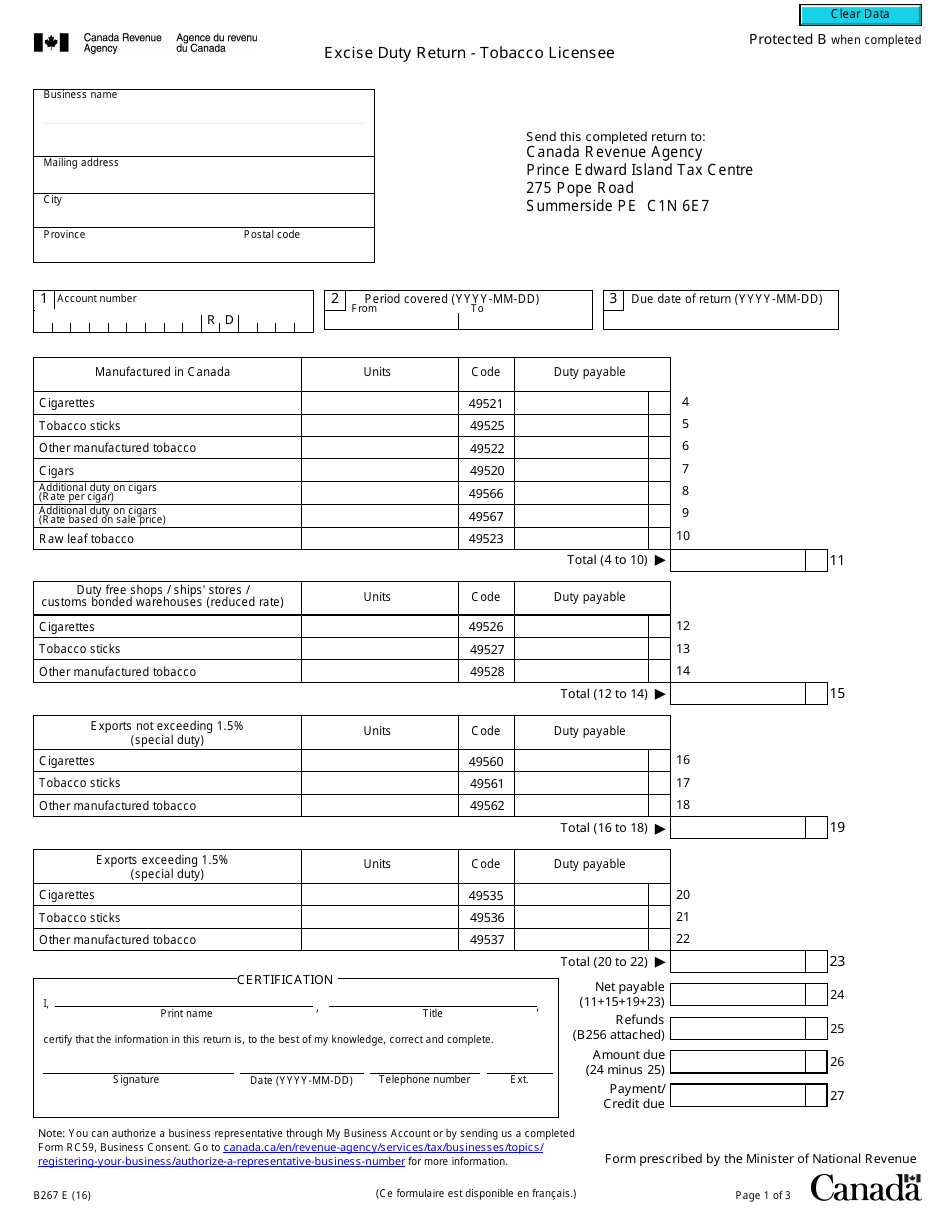

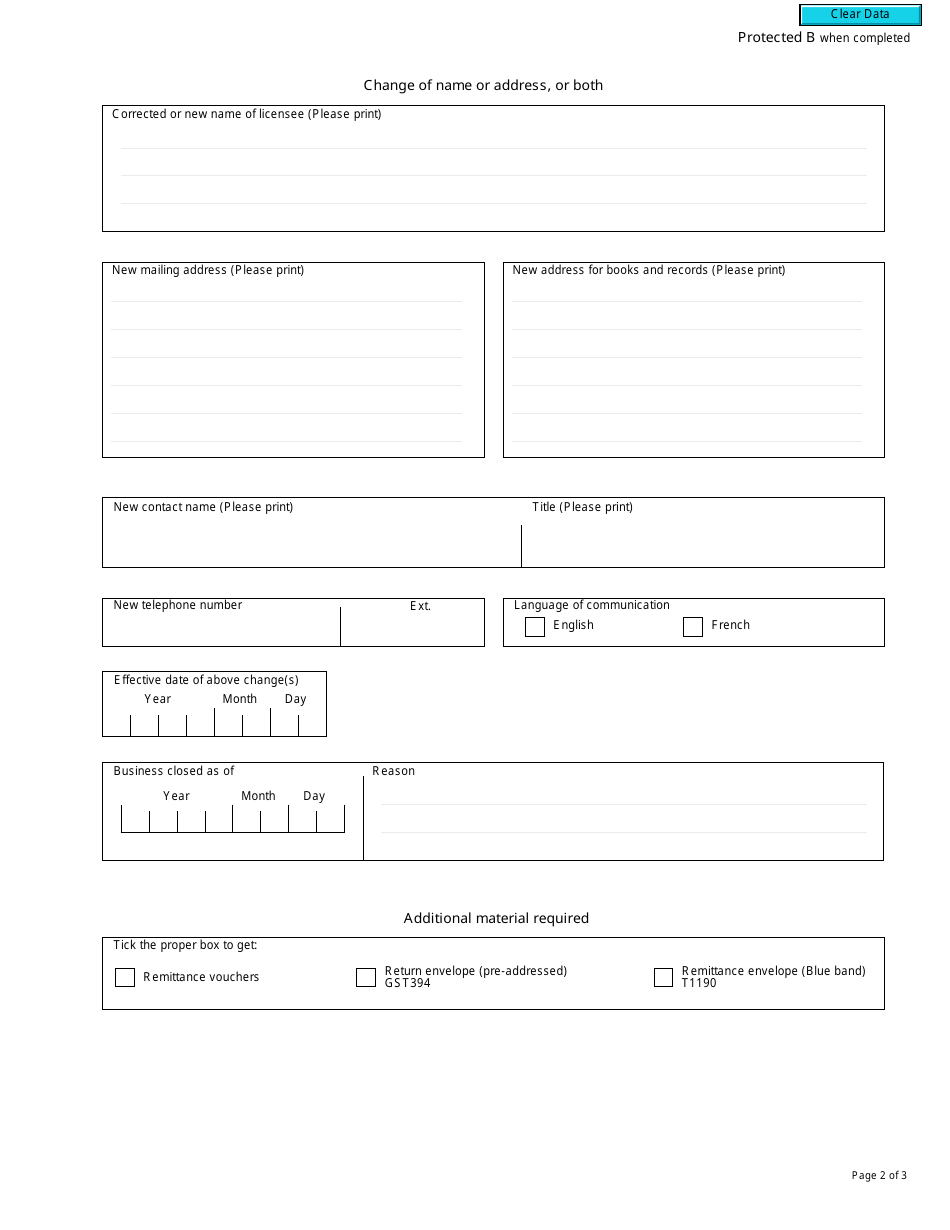

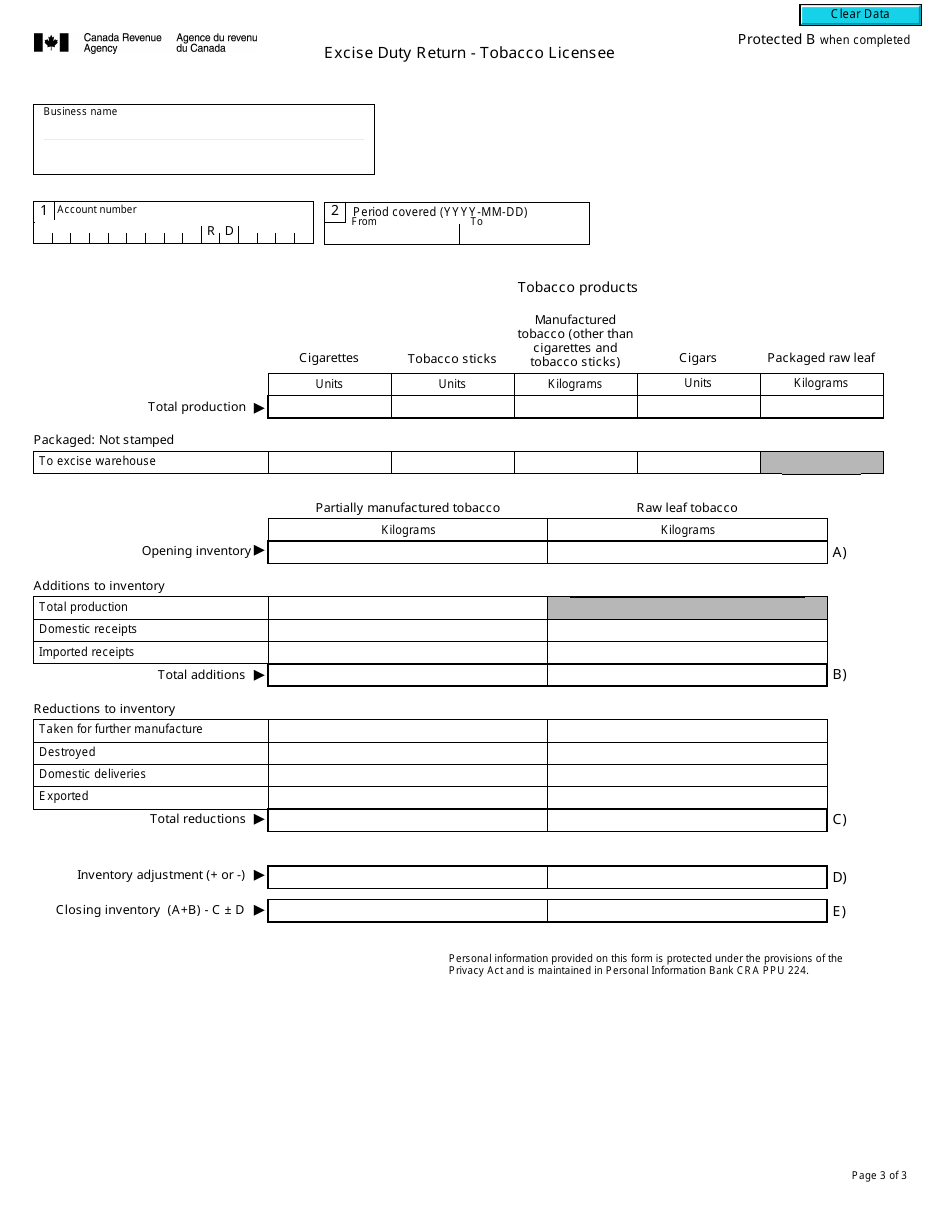

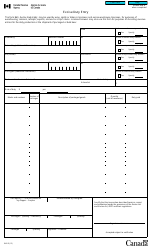

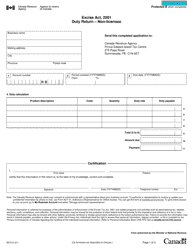

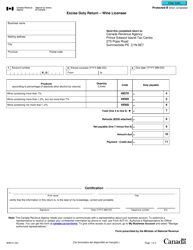

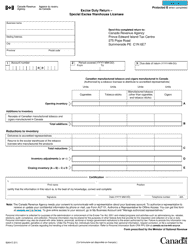

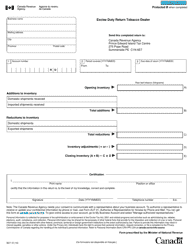

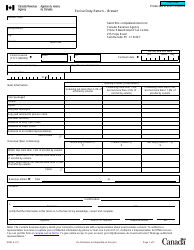

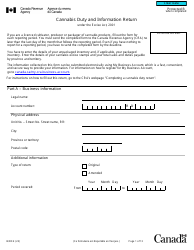

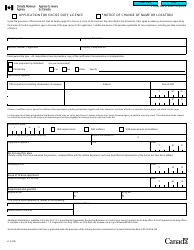

Form B267 Excise Duty Return - Tobacco Licensee - Canada

Form B267 Excise Duty Return - Tobacco Licensee in Canada is used to report the excise duty payable on tobacco products manufactured, imported, or sold by a tobacco licensee. It allows the government to track and collect the appropriate excise taxes on tobacco products.

The Form B267 Excise Duty Return for Tobacco Licensees in Canada is filed by the tobacco licensee themselves.

FAQ

Q: What is Form B267?

A: Form B267 is an Excise Duty Return for Tobacco Licensees in Canada.

Q: Who is required to file Form B267?

A: Tobacco Licensees in Canada are required to file Form B267.

Q: What is the purpose of Form B267?

A: Form B267 is used to report and remit excise duty on tobacco products.

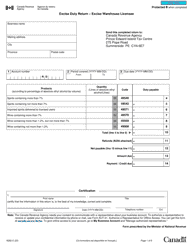

Q: When is Form B267 due?

A: Form B267 is typically due on the 5th day of the month following the reporting period.

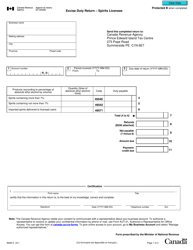

Q: What information is required on Form B267?

A: Form B267 requires information such as sales volume, tax rates, and other details related to the excise duty on tobacco products.

Q: Are there any penalties for late or incorrect filing of Form B267?

A: Yes, there may be penalties for late or incorrect filing of Form B267. It is important to ensure accurate and timely submission.