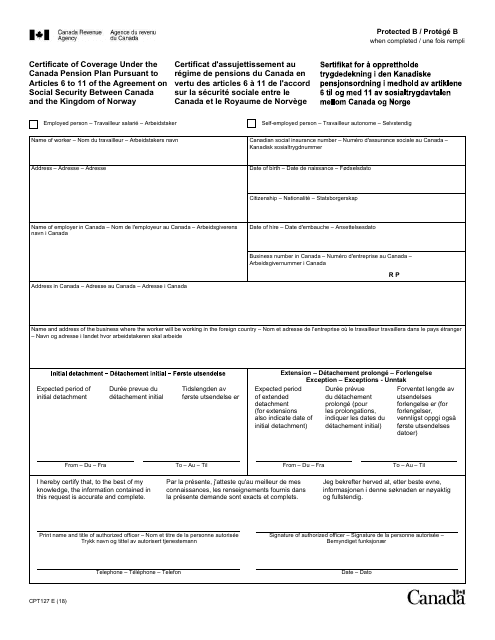

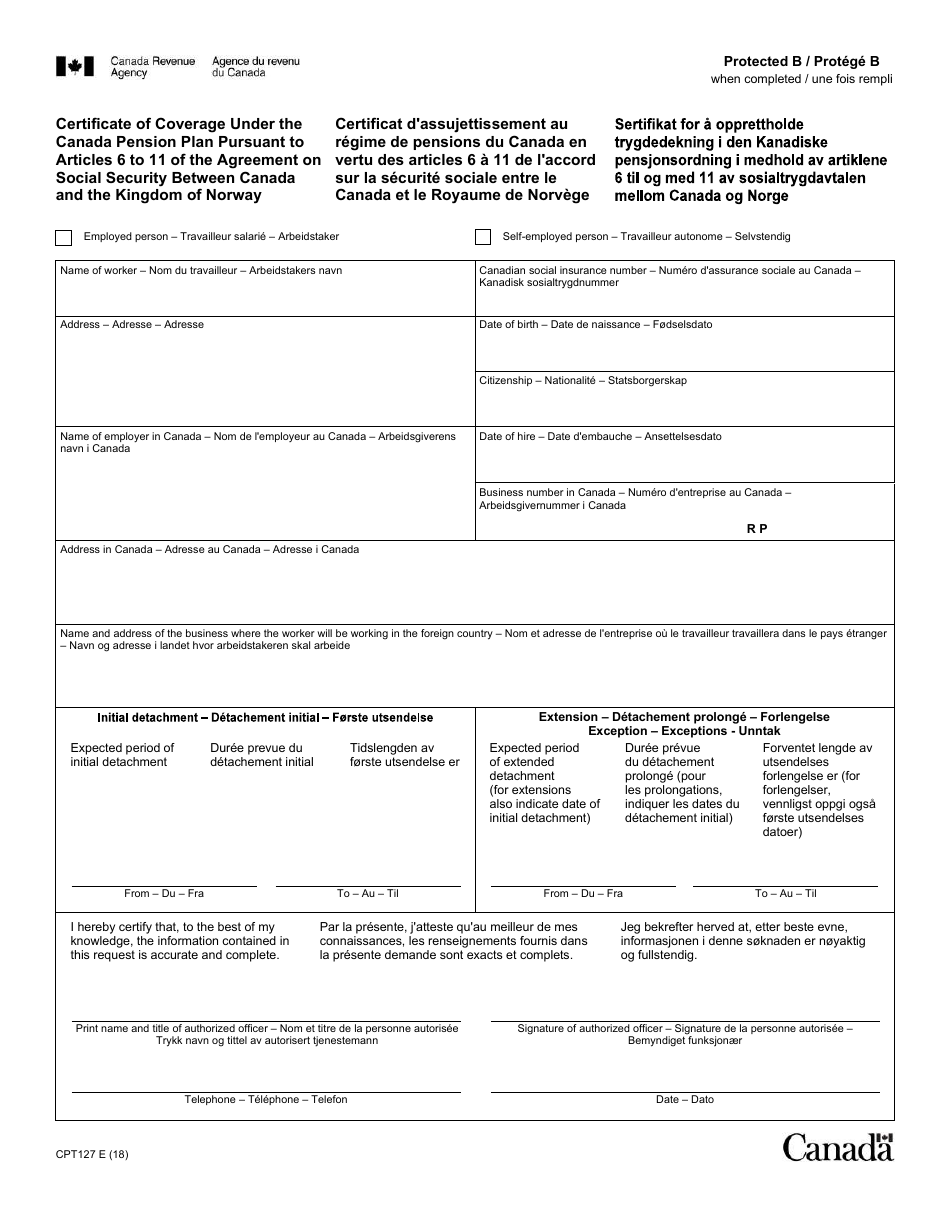

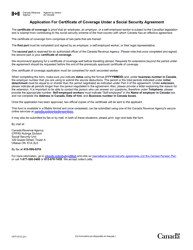

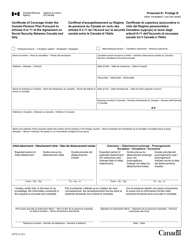

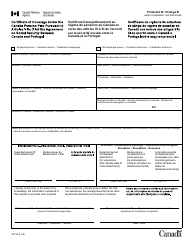

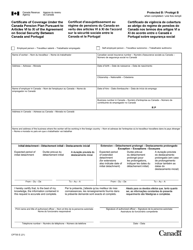

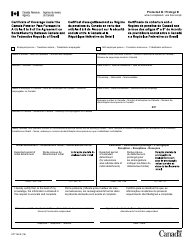

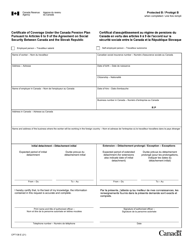

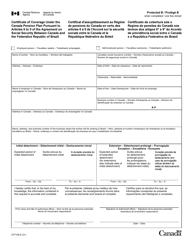

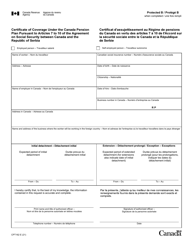

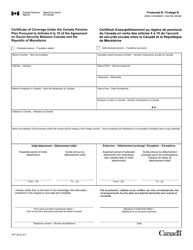

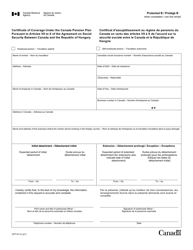

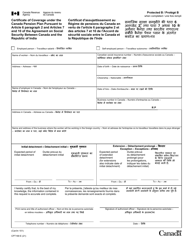

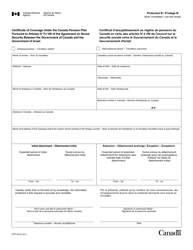

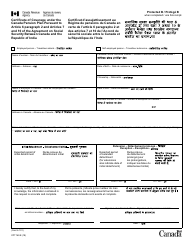

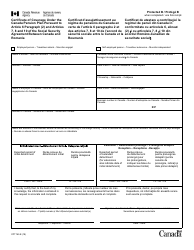

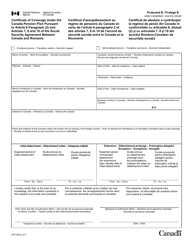

Form CPT127 Certificate of Coverage Under the Canada Pension Plan Pursuant to Articles 6 to 11 of the Agreement on Social Security Between Canada and the Kingdom of Norway - Canada (English / French)

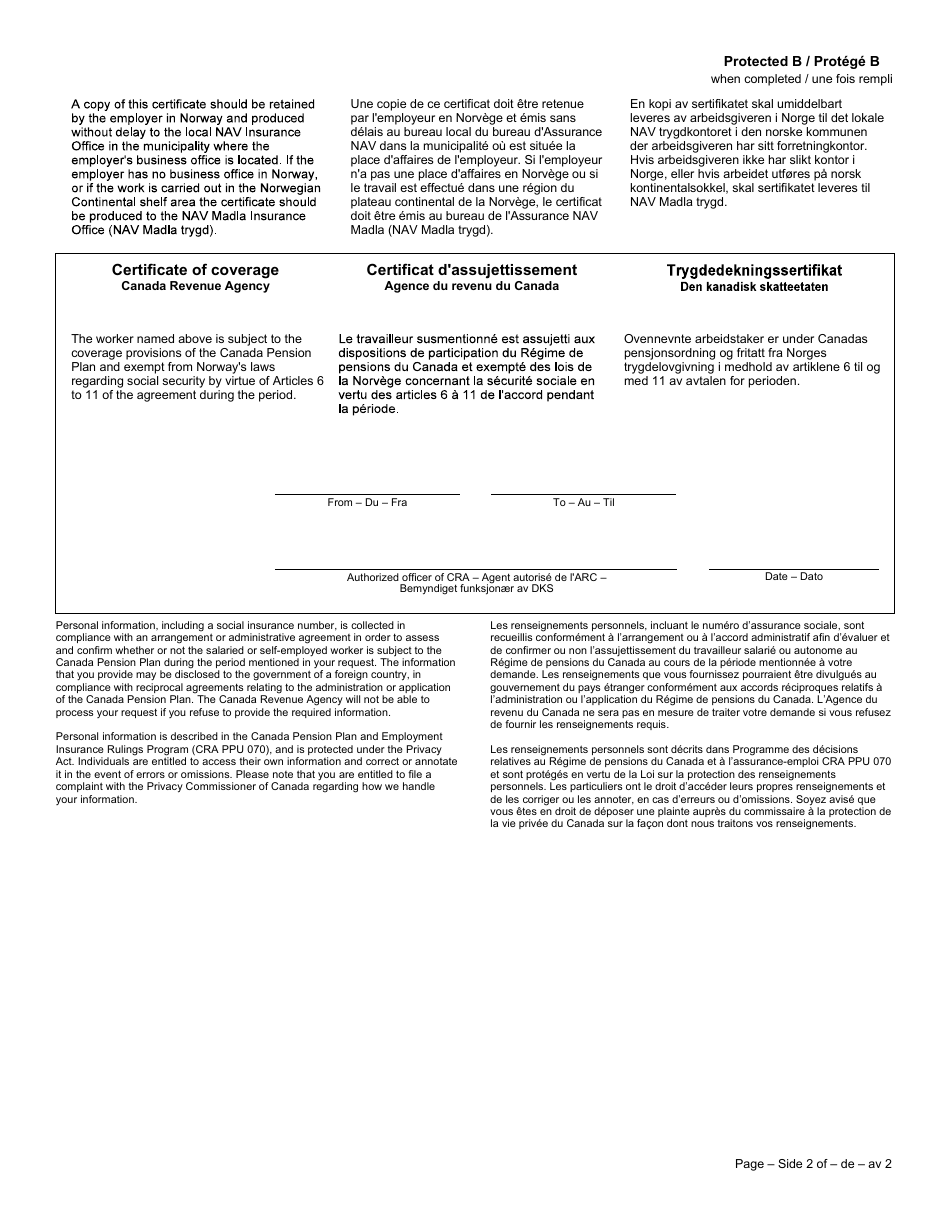

The Form CPT127 Certificate of Coverage Under the Canada Pension Plan is used for individuals who are working in both Canada and the Kingdom of Norway. It is issued to confirm that the person mentioned in the certificate is subject to the social security laws of Canada and exempt from contributing to the Norwegian social security system. This certificate helps individuals avoid having to pay social security contributions in both countries and ensures that they are covered under the Canada Pension Plan. The form is available in both English and French to accommodate the official languages of Canada.

The Form CPT127 Certificate of Coverage under the Canada Pension Plan pursuant to Articles 6 to 11 of the Agreement on Social Security between Canada and the Kingdom of Norway is filed by individuals who are covered by the Canada Pension Plan and are working temporarily in Norway. This form is filed with the Canada Revenue Agency.

FAQ

Q: What is the CPT127 Certificate of Coverage?

A: The CPT127 Certificate of Coverage is a document issued under the Canada Pension Plan (CPP) and is used to confirm that an employee or self-employed person is exempt from contributing to the social security system in another country.

Q: What is the purpose of the CPT127 Certificate of Coverage?

A: The purpose of the CPT127 Certificate of Coverage is to avoid dual social security coverage and ensure that a person is only required to contribute to the social security system of one country.

Q: Who is eligible to apply for a CPT127 Certificate of Coverage?

A: Employees or self-employed individuals who are subject to both the Canada Pension Plan (CPP) and the social security system of another country covered under the Agreement on Social Security between Canada and that country.

Q: Is there a fee for the CPT127 Certificate of Coverage?

A: No, there is no fee for obtaining the CPT127 Certificate of Coverage.

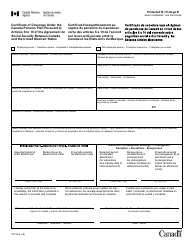

Q: What information is required to apply for a CPT127 Certificate of Coverage?

A: To apply for a CPT127 Certificate of Coverage, you will need to provide personal information such as your name, address, social insurance number, employment details, and information about the other country's social security system.

Q: How long does it take to receive a CPT127 Certificate of Coverage?

A: The processing time for a CPT127 Certificate of Coverage may vary, but it generally takes a few weeks to receive the document.

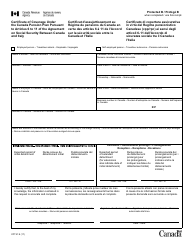

Q: How long is a CPT127 Certificate of Coverage valid for?

A: A CPT127 Certificate of Coverage is typically valid for a specified period, which is determined based on the duration of the assignment or employment in the other country.

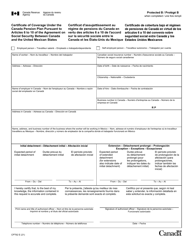

Q: What should I do with the CPT127 Certificate of Coverage?

A: You should provide a copy of the CPT127 Certificate of Coverage to both your employer or client in the other country and to the Canada Revenue Agency (CRA). It is important to keep the original document for your records.

Q: Can I cancel or revoke a CPT127 Certificate of Coverage?

A: If your employment or self-employment situation changes or if there is an error on the CPT127 Certificate of Coverage, you should contact the Canada Revenue Agency (CRA) to make the necessary amendments or cancellations.

Q: Can I use a CPT127 Certificate of Coverage for other purposes?

A: No, the CPT127 Certificate of Coverage is specifically issued for exemption from contributing to the social security system of another country. It cannot be used for any other purposes or as proof of residency or citizenship.