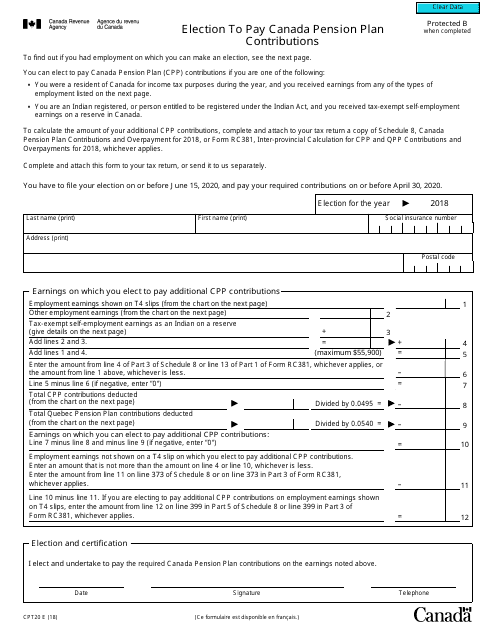

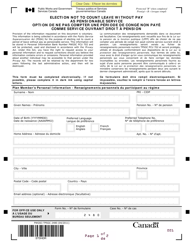

Form CPT20 E Election to Pay Canada Pension Plan Contributions - Canada

Form CPT20 E is a Canadian Revenue Agency form also known as the "Form Cpt20 E "election To Pay Canada Pension Plan Contributions" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form CPT20 E in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form CPT20 E?

A: Form CPT20 E is a document that allows individuals to make an election to pay Canada Pension Plan contributions.

Q: Who needs to fill out Form CPT20 E?

A: Individuals who want to make an election to pay Canada Pension Plan contributions need to fill out Form CPT20 E.

Q: What is the purpose of Form CPT20 E?

A: The purpose of Form CPT20 E is to allow individuals to voluntarily contribute to the Canada Pension Plan.

Q: Do I have to fill out Form CPT20 E every year?

A: No, you only need to fill out Form CPT20 E once unless you want to change your election.

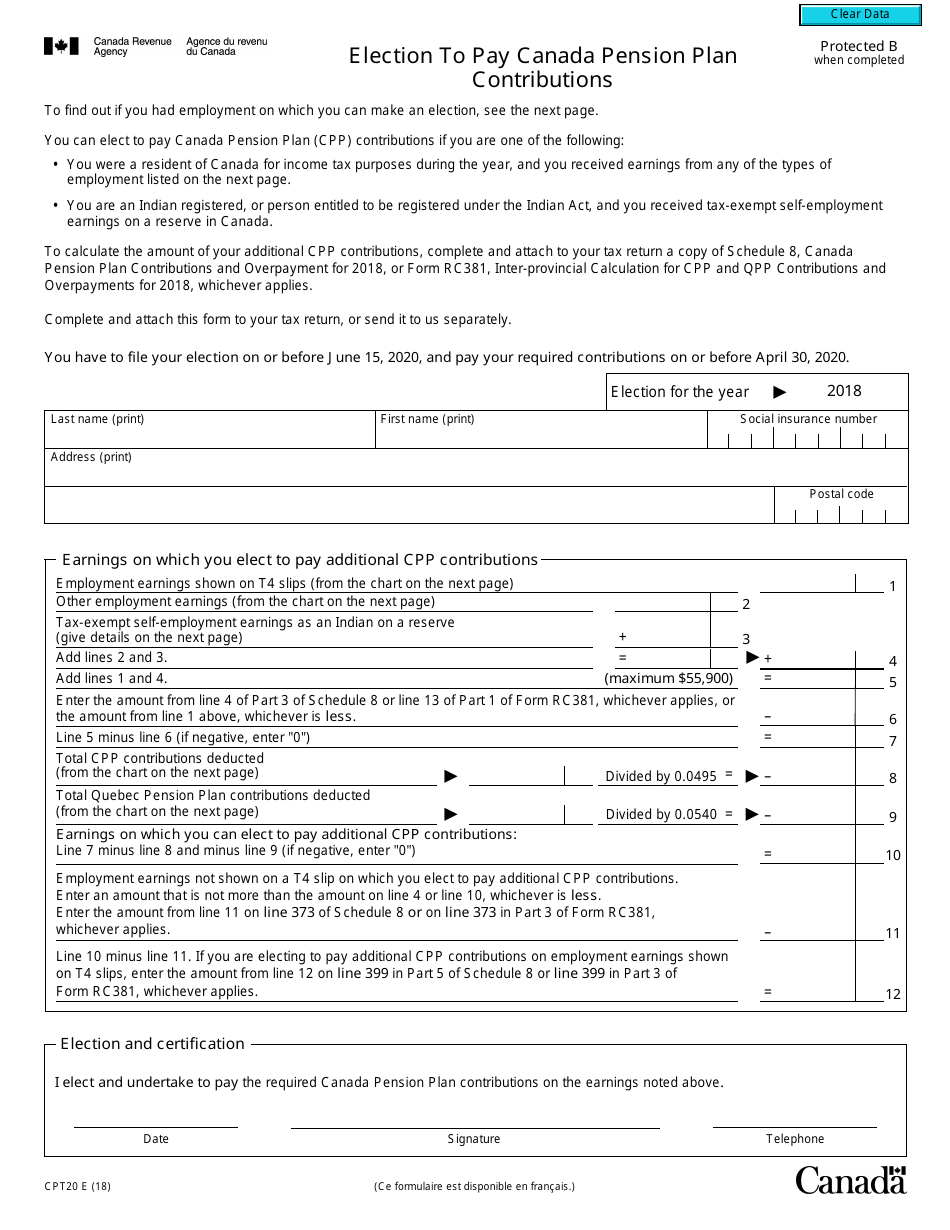

Q: Are there any eligibility requirements to make an election to pay Canada Pension Plan contributions?

A: Yes, there are eligibility requirements. You must be between the ages of 18 and 70 and working outside of Quebec.

Q: What are the benefits of making an election to pay Canada Pension Plan contributions?

A: Making an election to pay Canada Pension Plan contributions can increase your future retirement benefits.

Q: Is there a deadline to submit Form CPT20 E?

A: There is no specific deadline to submit Form CPT20 E, but it's recommended to do so as soon as possible to ensure your contributions are made.

Q: What happens if I don't submit Form CPT20 E?

A: If you don't submit Form CPT20 E, you won't be able to make voluntary contributions to the Canada Pension Plan.

Q: Can I cancel my election to pay Canada Pension Plan contributions?

A: Yes, you can cancel your election by completing the appropriate form and submitting it to the Canada Revenue Agency.