This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT61

for the current year.

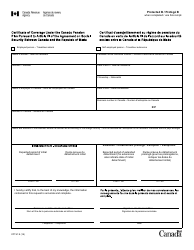

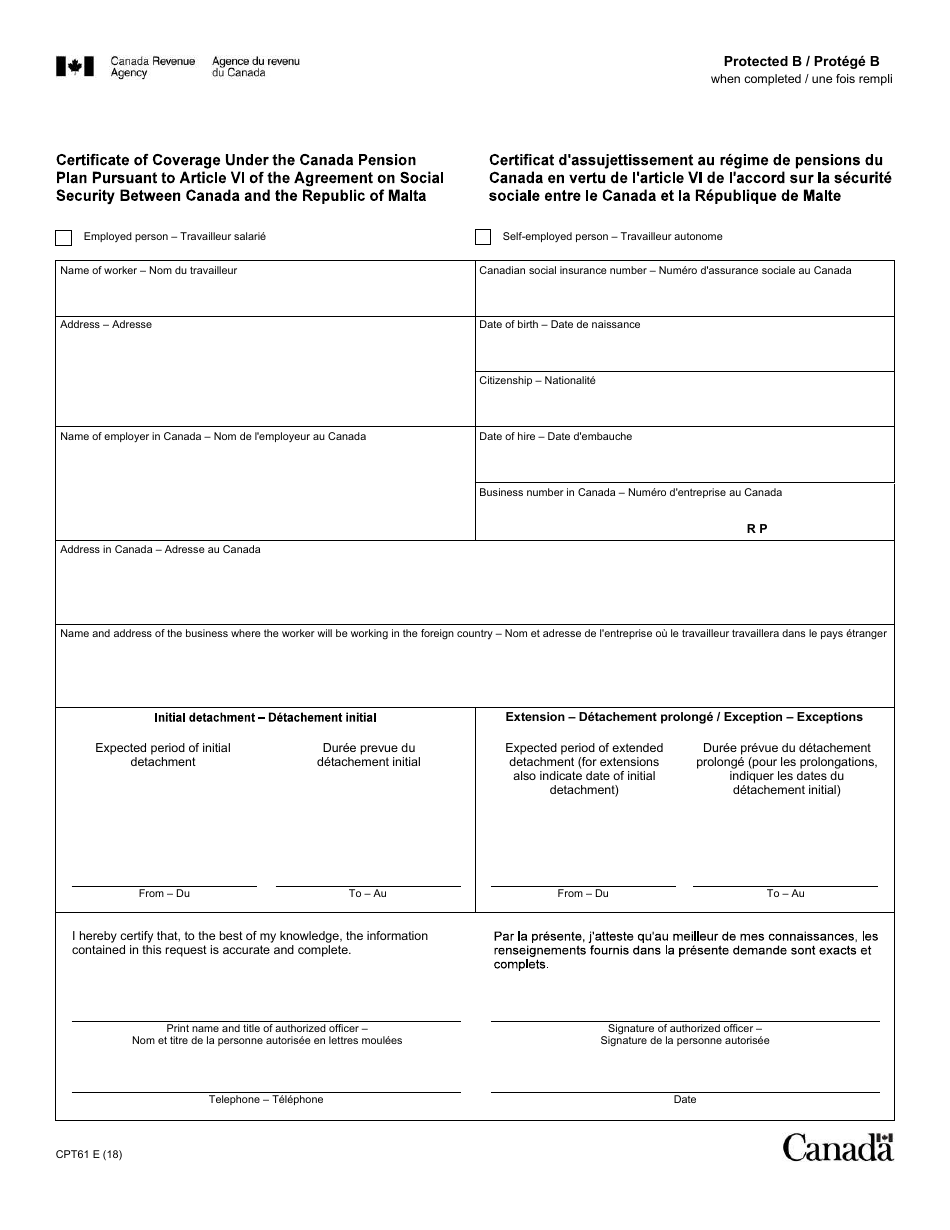

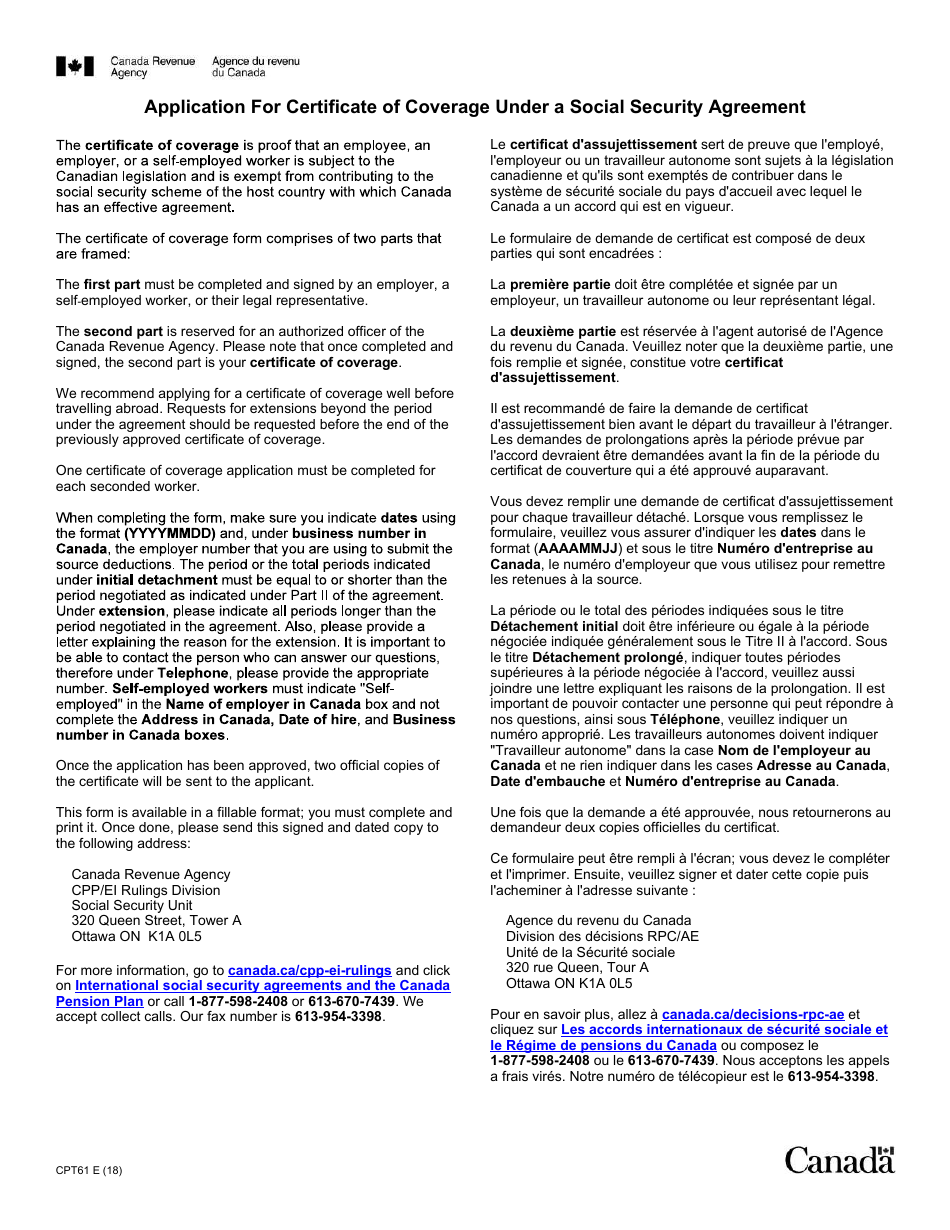

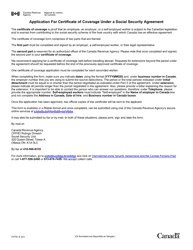

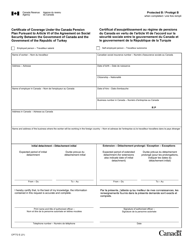

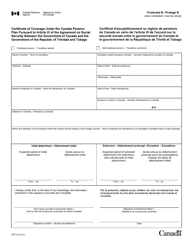

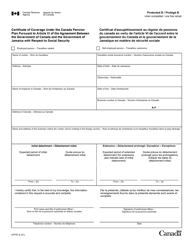

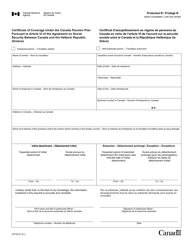

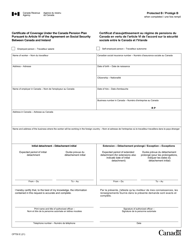

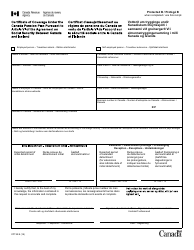

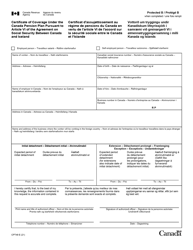

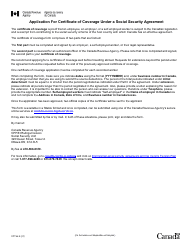

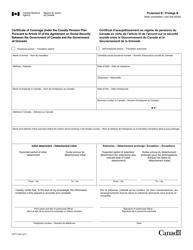

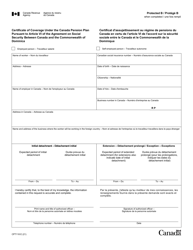

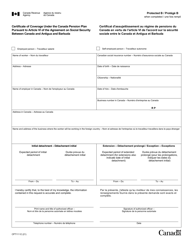

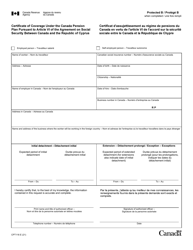

Form CPT61 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of Malta - Canada (English / French)

The Form CPT61 Certificate of Coverage Under the Canada Pension Plan is used to prove that an individual is exempt from contributing to the Canada Pension Plan while working in Malta under the Agreement on Social Security between Canada and the Republic of Malta. It is available in both English and French languages.

The Form CPT61 Certificate of Coverage under the Canada Pension Plan is filed by individuals who are covered by the Canada Pension Plan and are working temporarily in Malta, pursuant to the Agreement on Social Security between Canada and Malta.

FAQ

Q: What is Form CPT61?

A: Form CPT61 is the Certificate of Coverage Under the Canada Pension Plan.

Q: What is the purpose of Form CPT61?

A: The purpose of Form CPT61 is to certify an individual's coverage under the Canada Pension Plan.

Q: Which countries are covered by Form CPT61?

A: Form CPT61 covers the Republic of Malta and Canada.

Q: Is Form CPT61 available in English and French?

A: Yes, Form CPT61 is available in both English and French.

Q: What is the Agreement on Social Security Between Canada and the Republic of Malta?

A: The Agreement on Social Security is a bilateral agreement between Canada and the Republic of Malta that ensures cooperation in the area of social security benefits.

Q: Who needs to complete Form CPT61?

A: Individuals who are covered under the Canada Pension Plan and are moving to or from the Republic of Malta need to complete Form CPT61.

Q: Can I use Form CPT61 to apply for social security benefits?

A: No, Form CPT61 is not used to apply for social security benefits. Its purpose is to certify an individual's coverage under the Canada Pension Plan.