This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT70

for the current year.

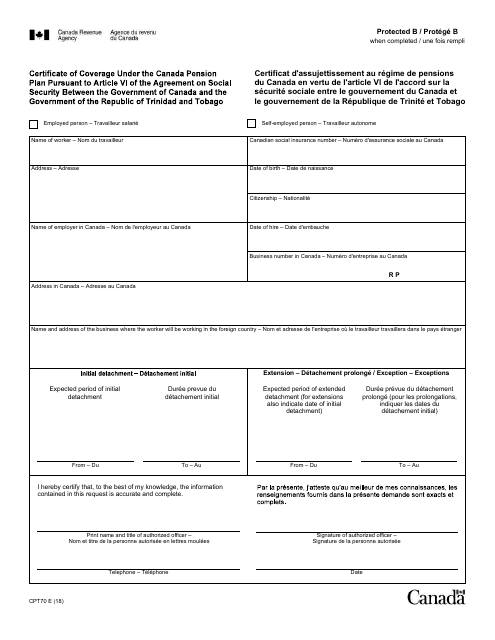

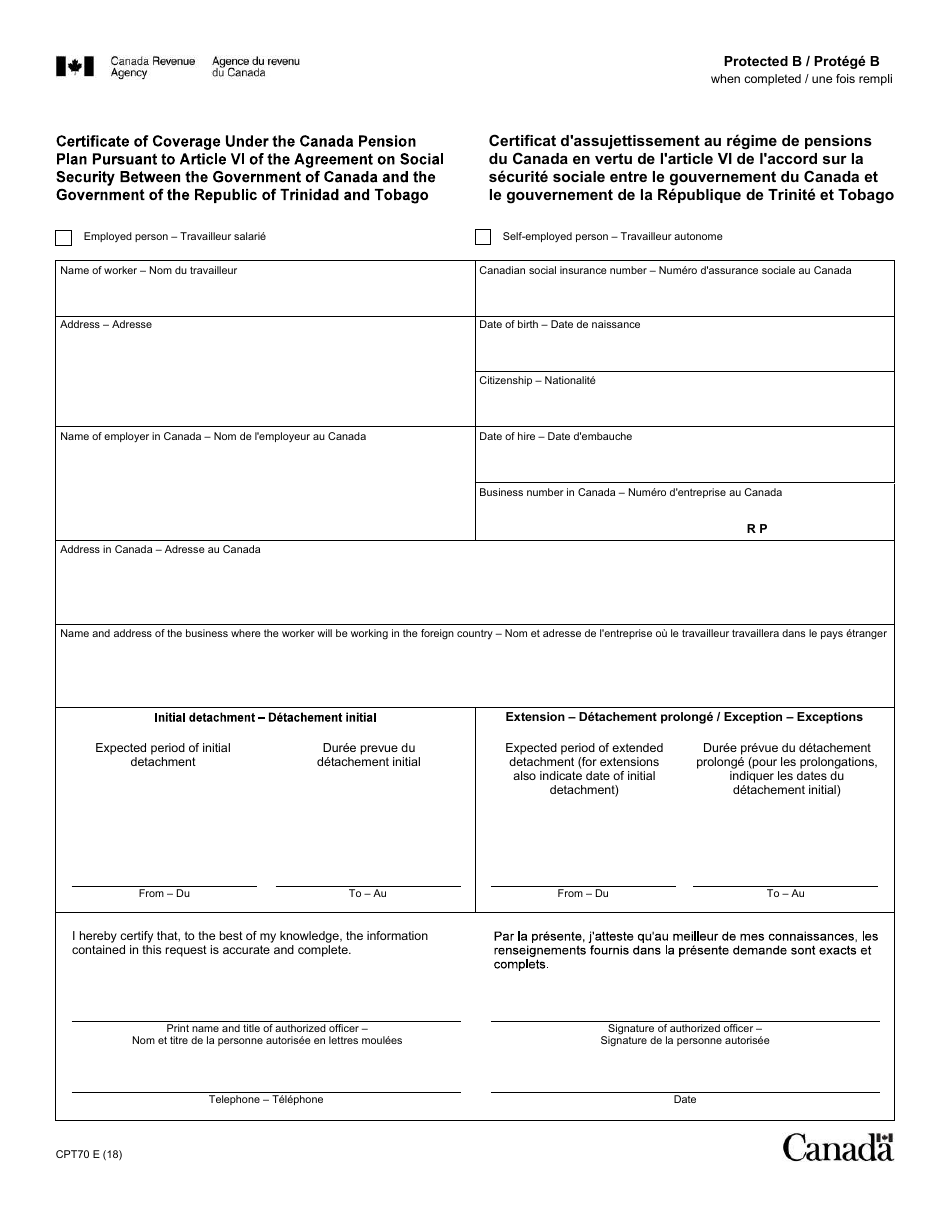

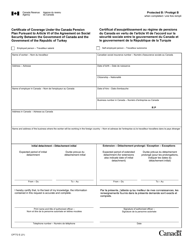

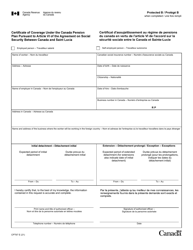

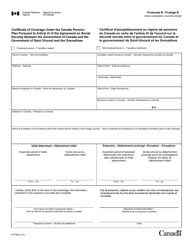

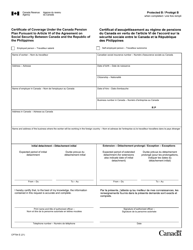

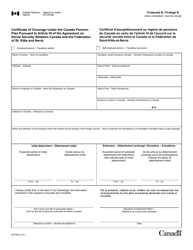

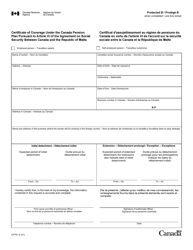

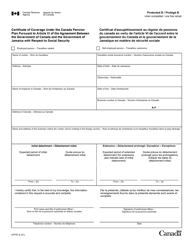

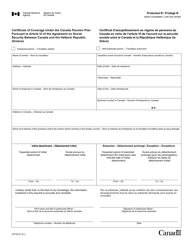

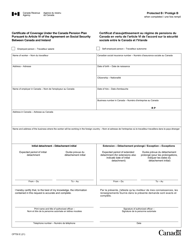

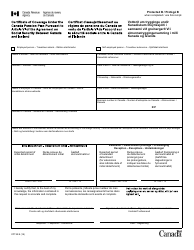

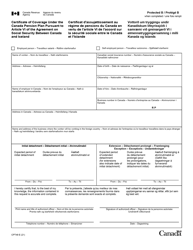

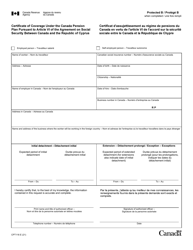

Form CPT70 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of Trinidad and Tobago - Canada (English / French)

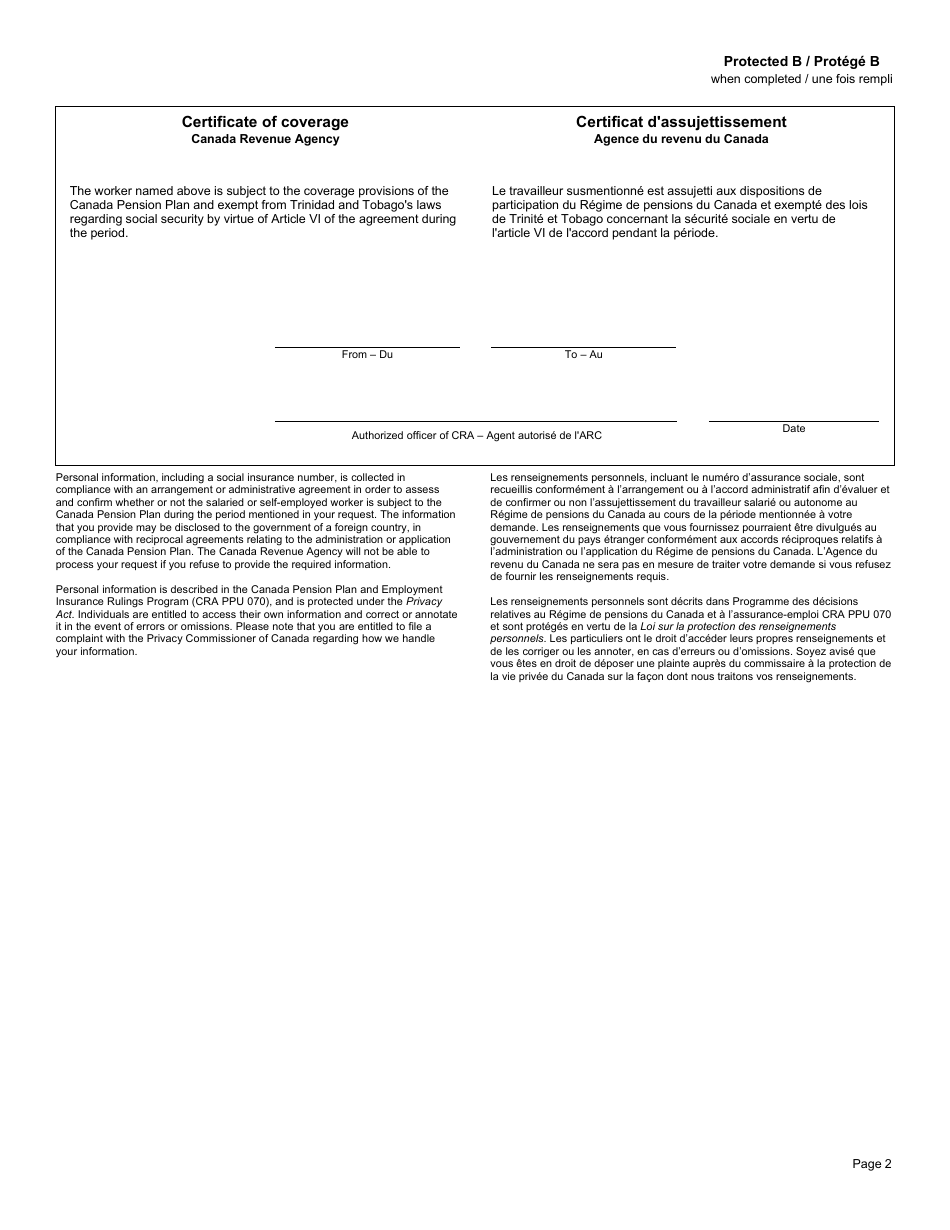

Form CPT70 Certificate of Coverage Under the Canada Pension Plan is used to document an individual's periods of coverage under the Canada Pension Plan (CPP) for the purpose of the Agreement on Social Security between Canada and the Republic of Trinidad and Tobago. It helps determine eligibility for benefits in both countries.

The Form CPT70 Certificate of Coverage under the Canada Pension Plan is filed by workers and employers in the Republic of Trinidad and Tobago.

FAQ

Q: What is the Form CPT70?

A: The Form CPT70 is a Certificate of Coverage under the Canada Pension Plan.

Q: What is the purpose of the Form CPT70?

A: The purpose of the Form CPT70 is to certify that a person is covered under the Canada Pension Plan.

Q: Who is eligible to apply for the Form CPT70?

A: Individuals who are covered under the Canada Pension Plan and are residents of Trinidad and Tobago.

Q: What is the Agreement on Social Security Between Canada and the Republic of Trinidad and Tobago?

A: It is an agreement that establishes cooperation between Canada and Trinidad and Tobago in the administration and enforcement of their respective social security laws.

Q: Is the Form CPT70 available in both English and French?

A: Yes, the Form CPT70 is available in both English and French.

Q: Is there a fee for applying for the Form CPT70?

A: No, there is no fee for applying for the Form CPT70.

Q: How long does it take to process the Form CPT70?

A: The processing time for the Form CPT70 can vary, but it generally takes a few weeks.

Q: Who can I contact for more information about the Form CPT70?

A: You can contact the Canada Revenue Agency for more information about the Form CPT70.