This version of the form is not currently in use and is provided for reference only. Download this version of

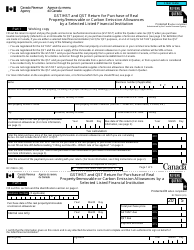

Form GST111

for the current year.

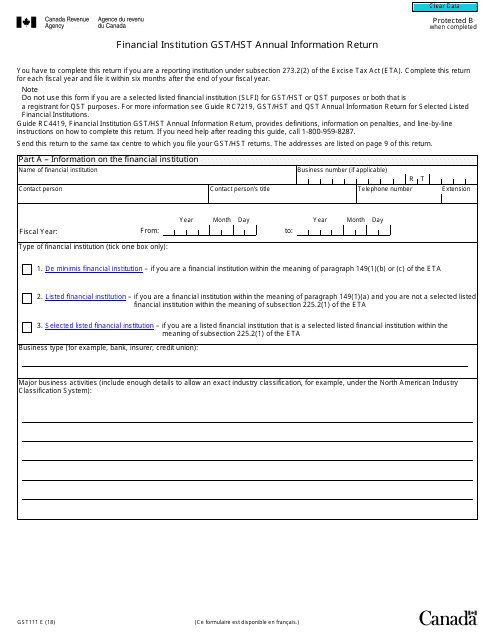

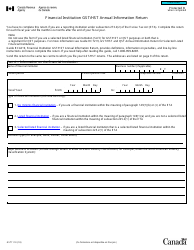

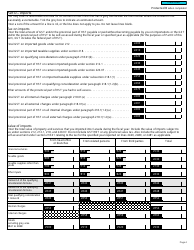

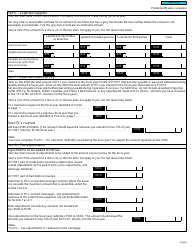

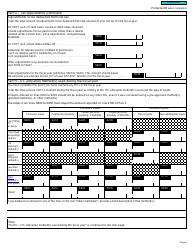

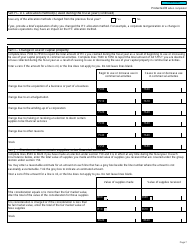

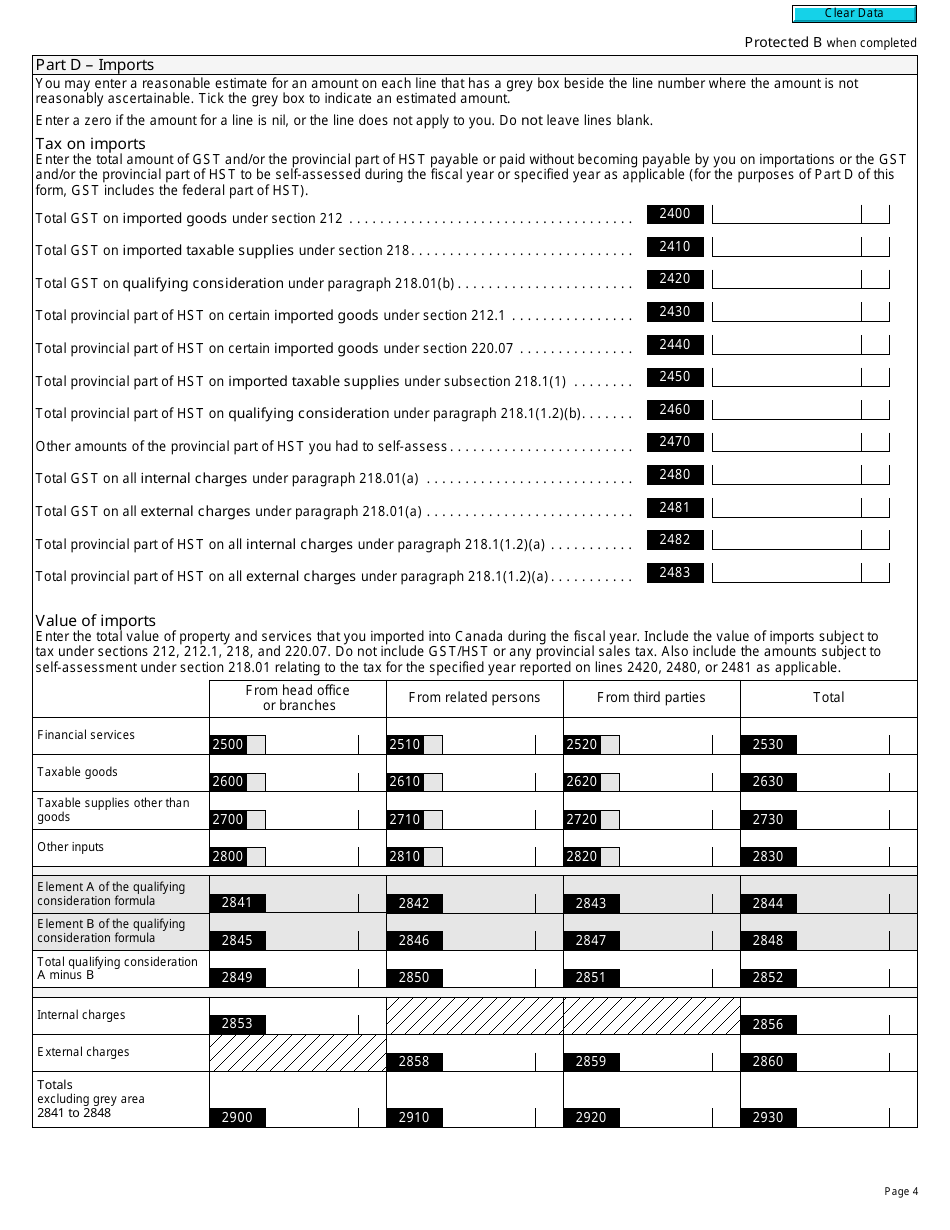

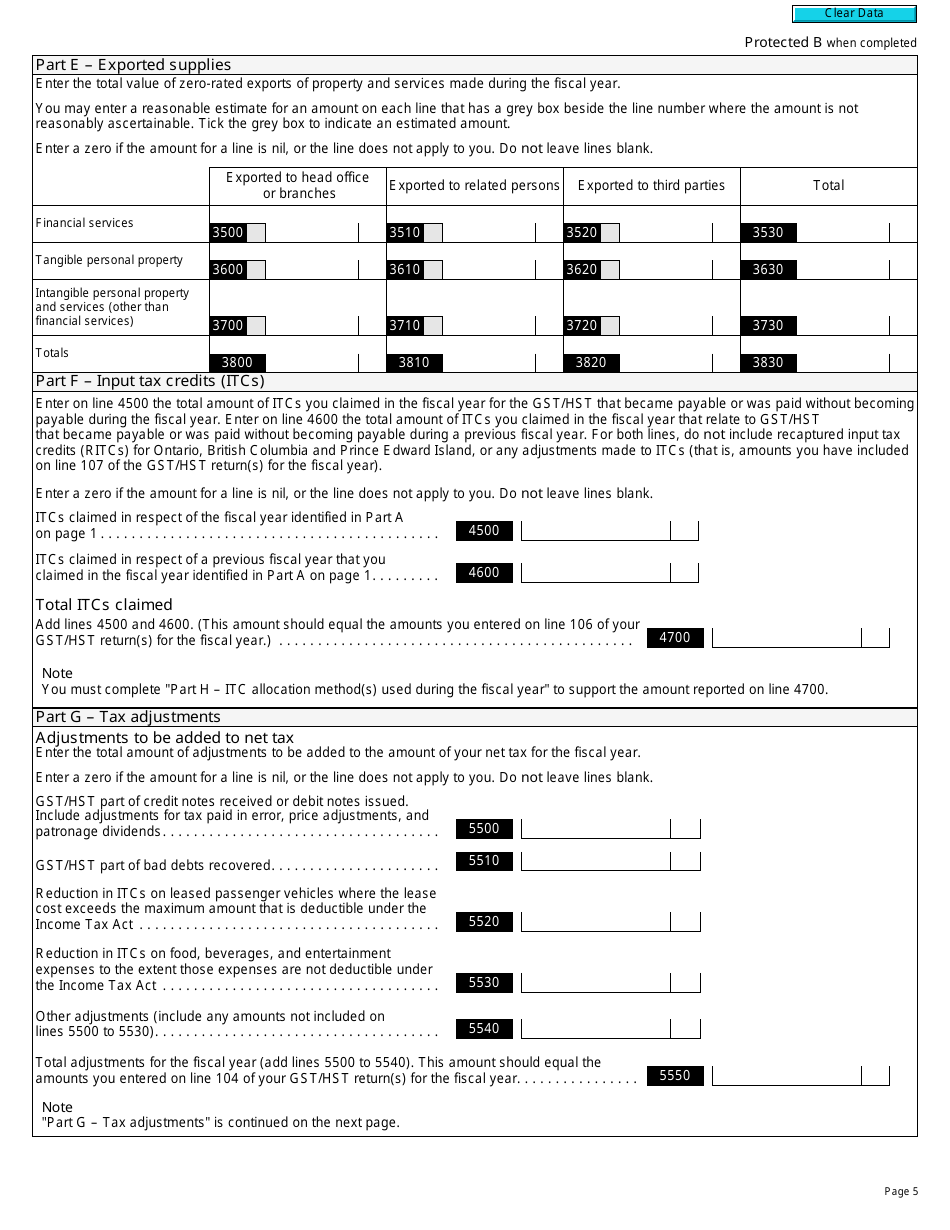

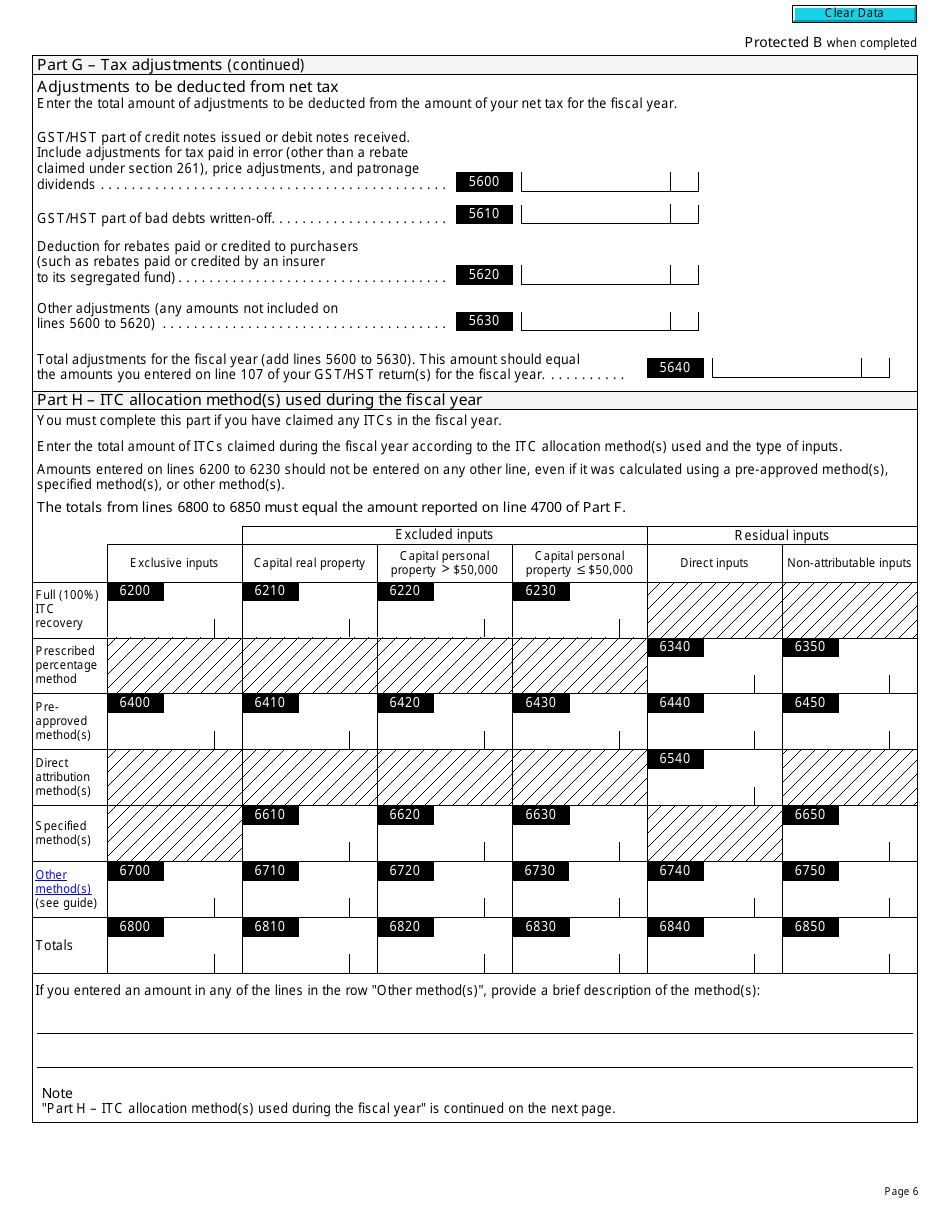

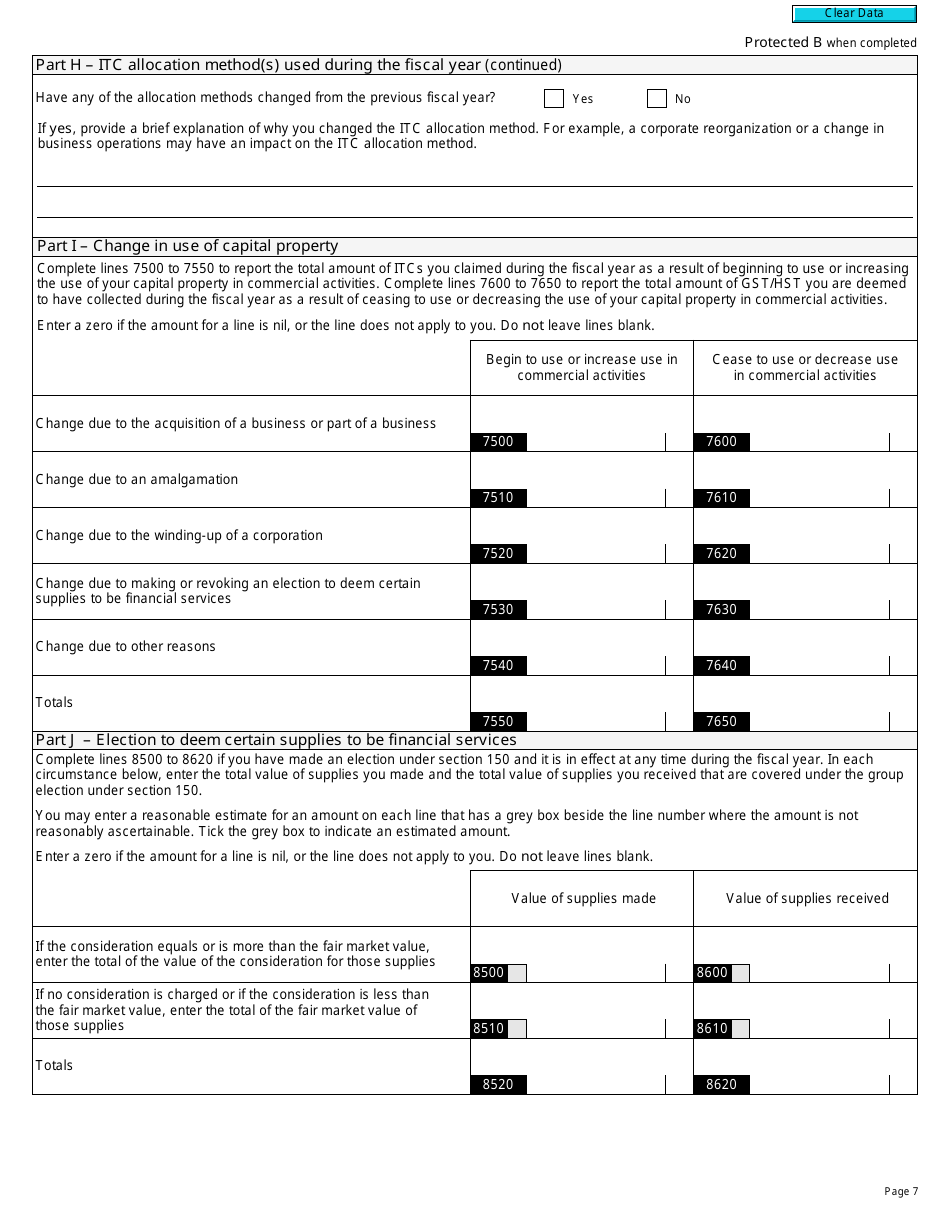

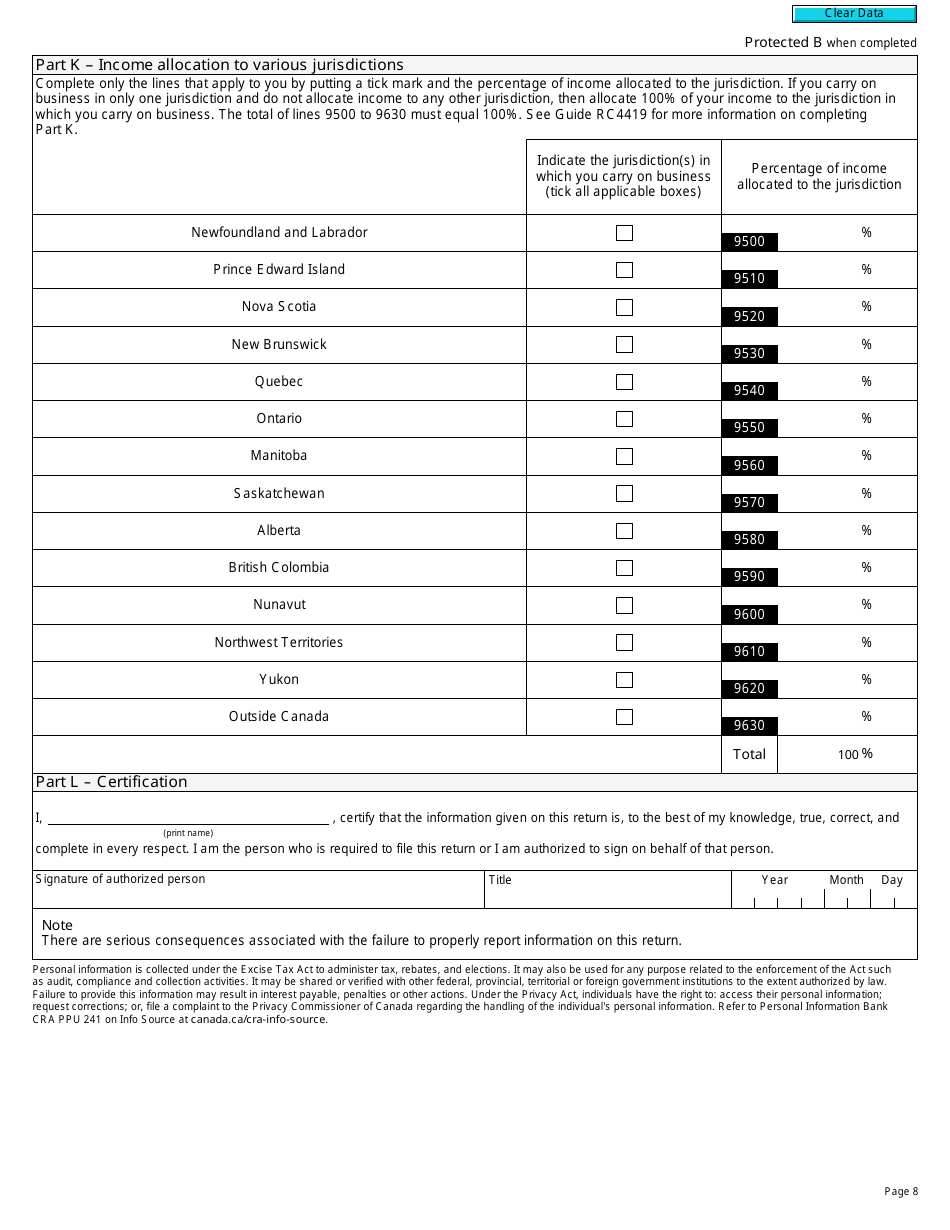

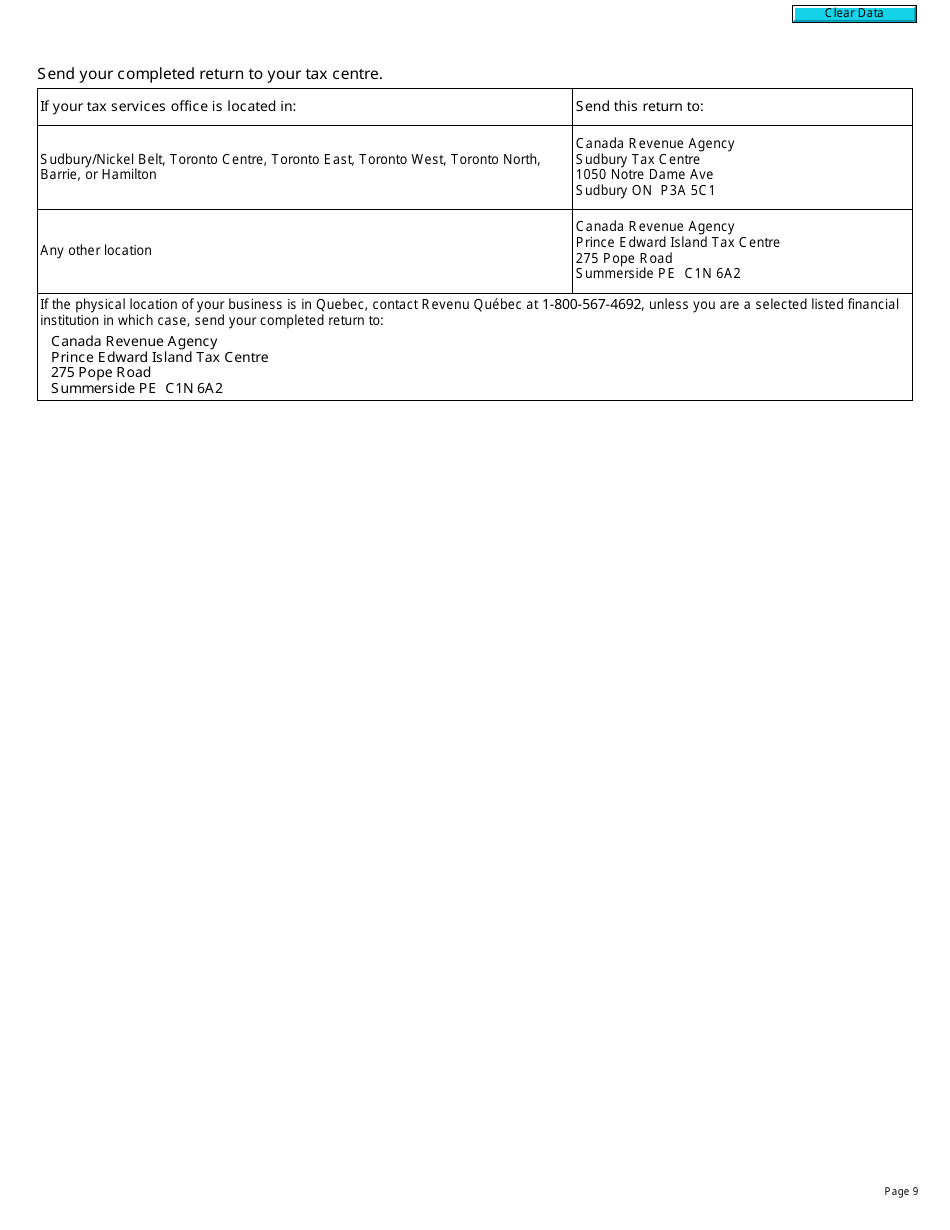

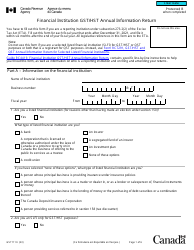

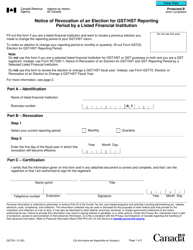

Form GST111 Financial Institution Gst / Hst Annual Information Return - Canada

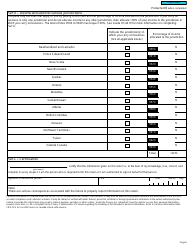

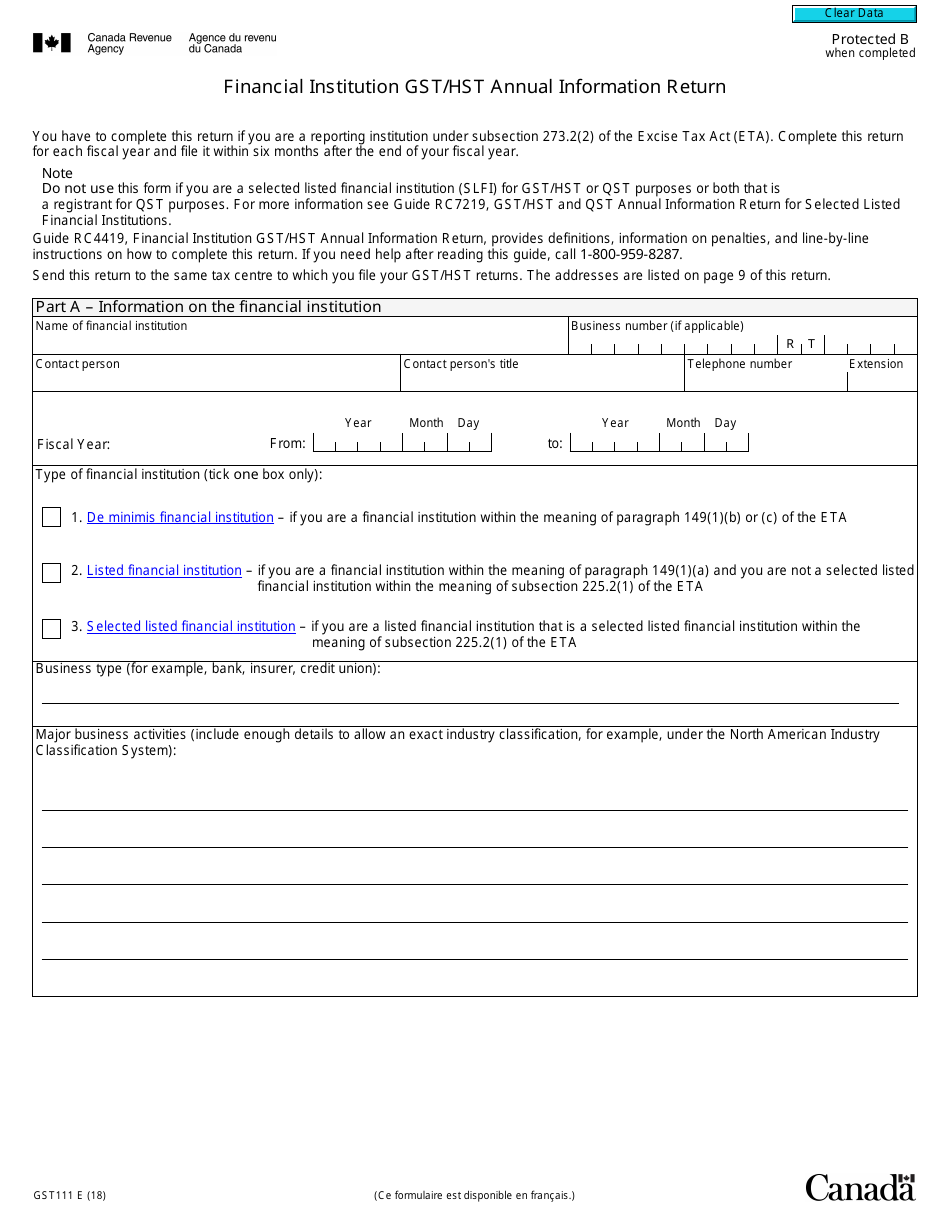

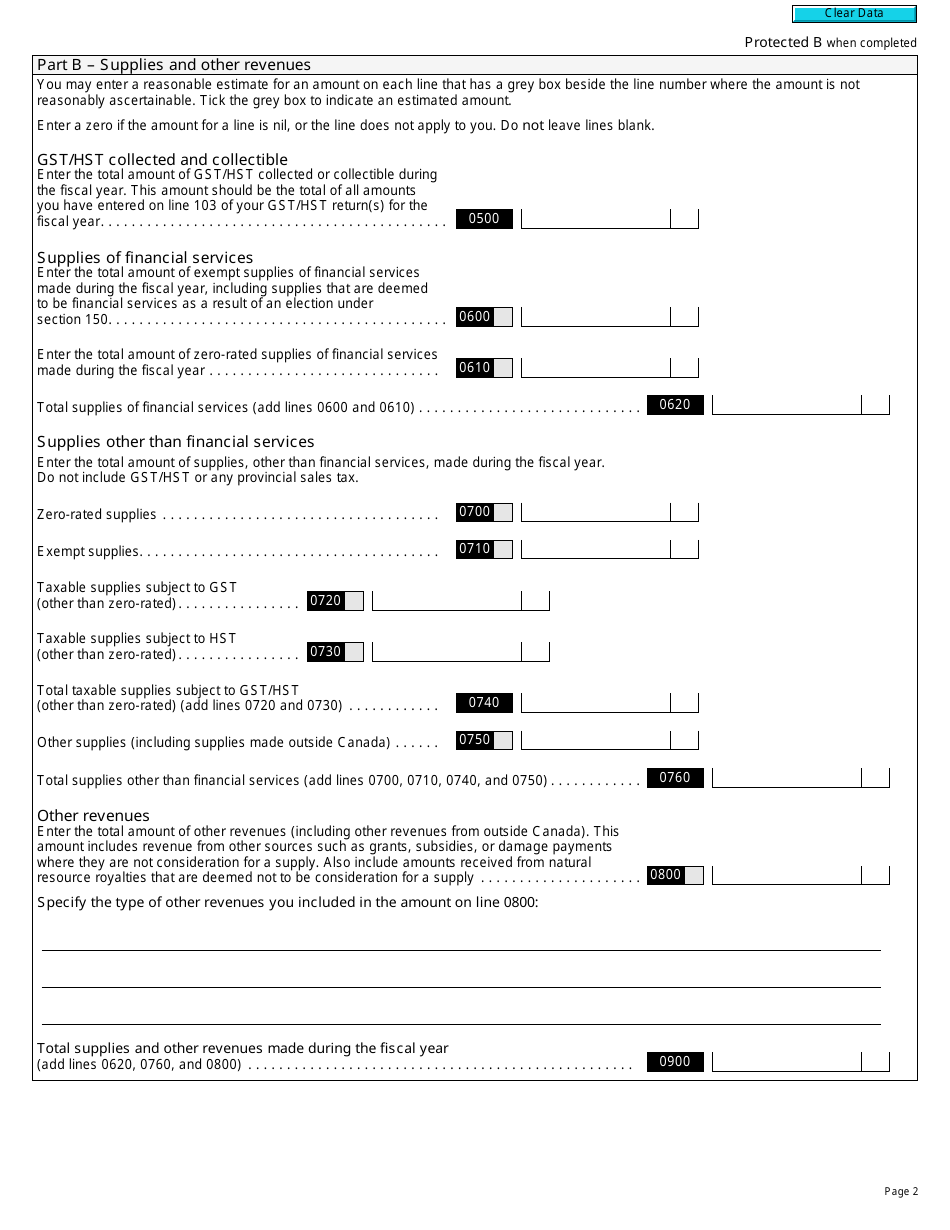

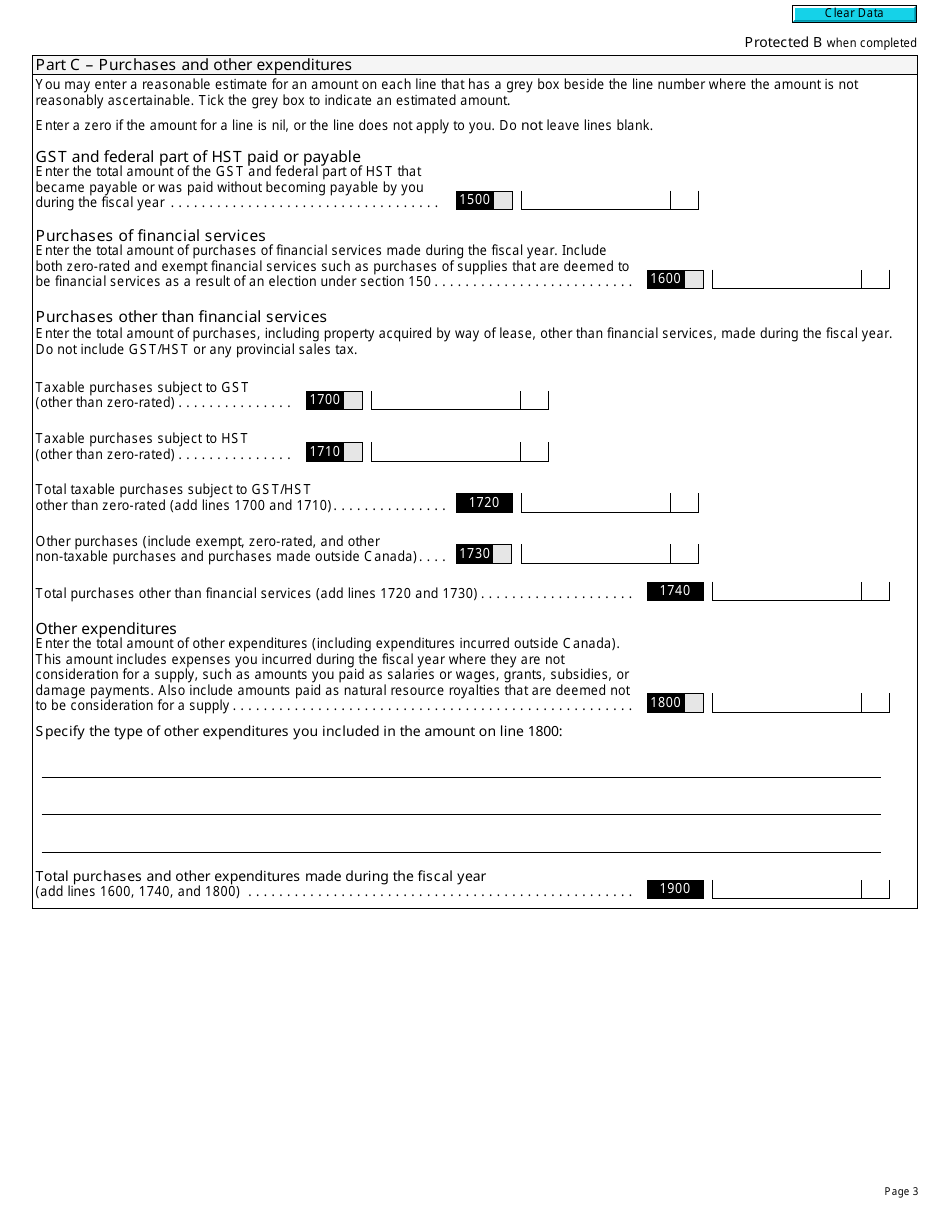

Form GST111, the Financial Institution GST/HST Annual Information Return, is used by Canadian financial institutions to report their GST/HST (Goods and Services Tax/Harmonized Sales Tax) collected and paid during the year. It helps the Canada Revenue Agency (CRA) to administer the GST/HST program and ensure compliance with tax obligations.

The Form GST111 Financial Institution GST/HST Annual Information Return in Canada is filed by financial institutions that meet certain criteria. It includes banks, credit unions, trust companies, and other similar institutions.

FAQ

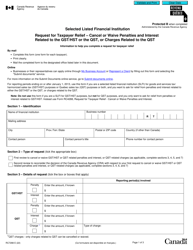

Q: What is the Form GST111 Financial Institution GST/HST Annual Information Return?

A: The Form GST111 is an annual return that financial institutions in Canada must file to report their GST/HST information.

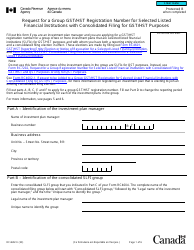

Q: Who needs to file Form GST111?

A: Financial institutions in Canada need to file Form GST111.

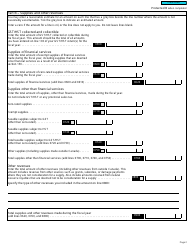

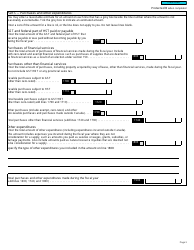

Q: What information is reported on Form GST111?

A: Form GST111 is used to report GST/HST information, including the total amount of GST/HST collected, the total amount of input tax credits claimed, and other relevant details.

Q: How often is Form GST111 filed?

A: Form GST111 is an annual return, meaning it needs to be filed once every year.