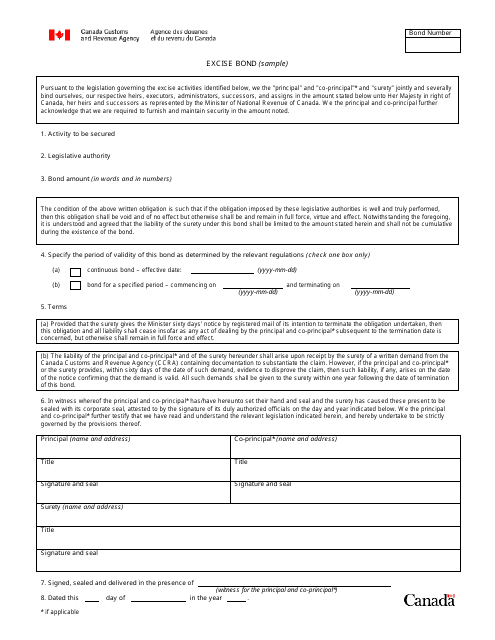

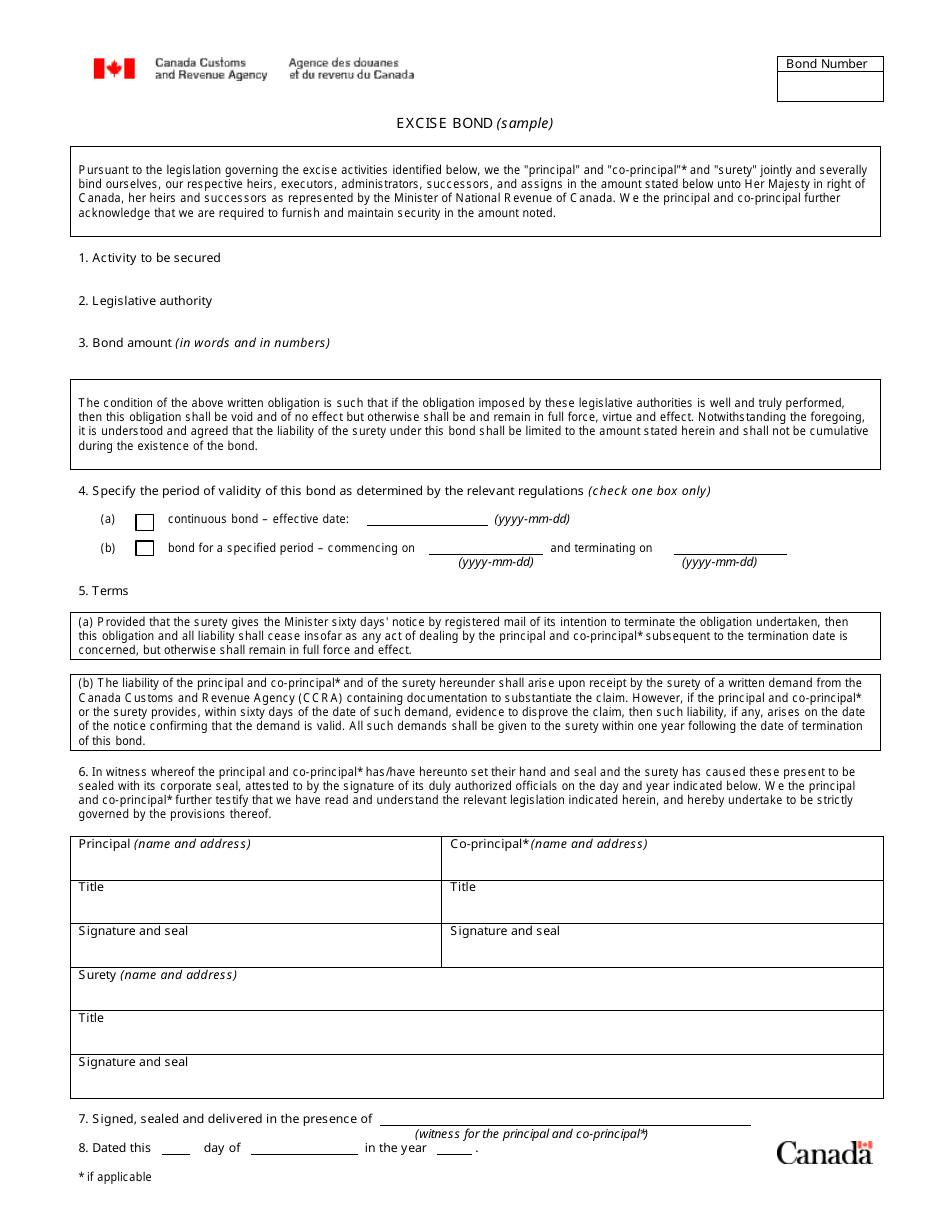

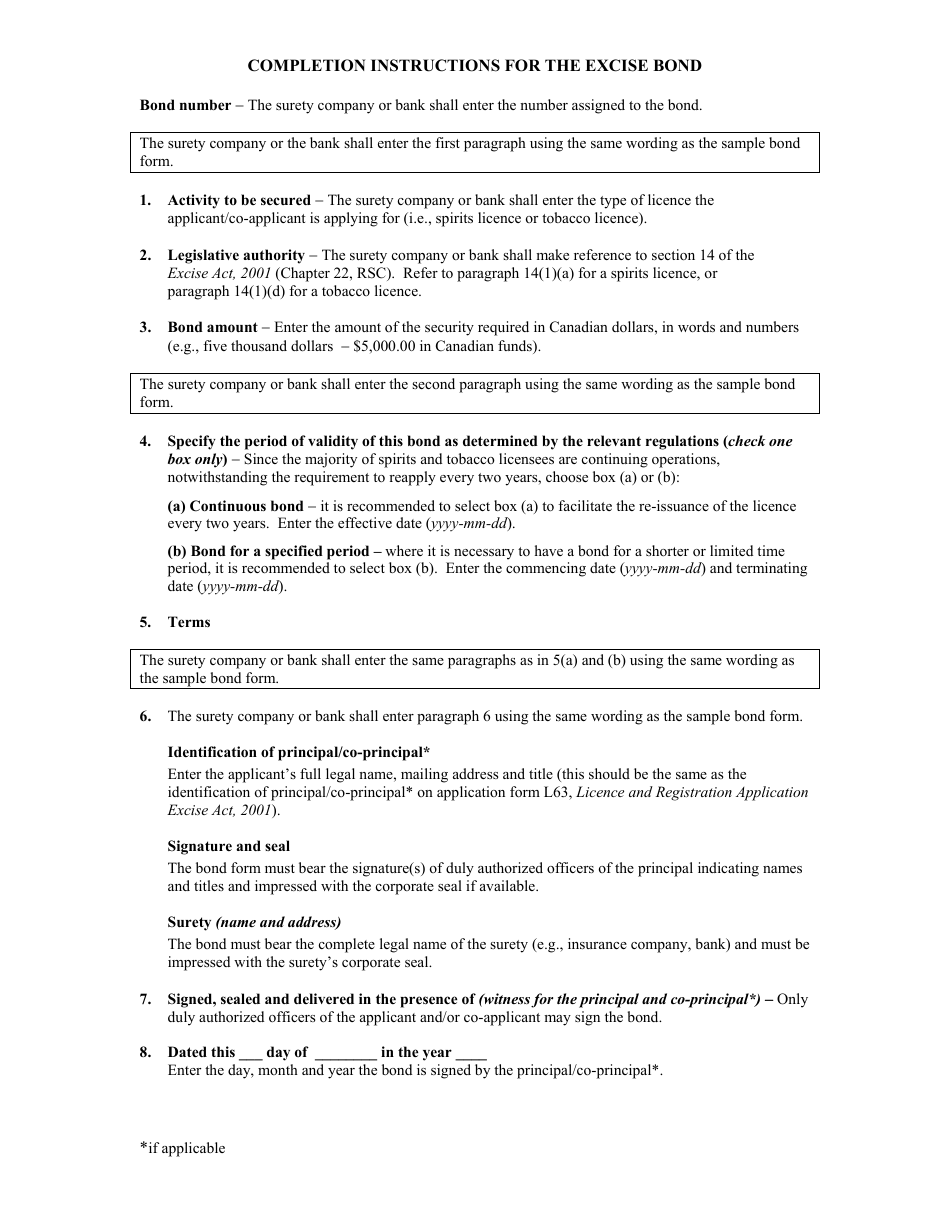

Sample Excise Bond - Canada

A Sample Excise Bond in Canada is typically used to secure payment of excise tax liabilities, particularly for businesses involved in importing, manufacturing, or selling goods that are subject to excise tax. It serves as a guarantee that the required excise taxes will be paid to the Canadian government.

The sample excise bond in Canada is typically filed by the importer or the person responsible for paying excise taxes.

FAQ

Q: What is a Sample Excise Bond?

A: A Sample Excise Bond is a type of bond required in Canada for businesses engaged in the manufacture, distribution, or warehousing of excisable goods.

Q: What are excisable goods?

A: Excisable goods are goods that are subject to excise taxes, such as alcohol, tobacco, fuel, and certain luxury goods.

Q: Why is a Sample Excise Bond required?

A: A Sample Excise Bond is required to ensure that businesses comply with the regulations and pay the appropriate excise taxes on goods.

Q: Who needs to obtain a Sample Excise Bond?

A: Businesses involved in the manufacture, distribution, or warehousing of excisable goods in Canada need to obtain a Sample Excise Bond.

Q: How does a Sample Excise Bond work?

A: A Sample Excise Bond acts as a guarantee that the business will fulfill its obligations, such as paying excise taxes. If the business fails to comply, the bond can be used to cover the outstanding taxes.

Q: How much does a Sample Excise Bond cost?

A: The cost of a Sample Excise Bond can vary depending on factors such as the type and volume of excisable goods. It is best to contact a bonding company for a quote.

Q: How long does a Sample Excise Bond need to be in place?

A: A Sample Excise Bond is typically required for as long as the business is engaged in the manufacture, distribution, or warehousing of excisable goods.

Q: Can a business operate without a Sample Excise Bond?

A: No, a business cannot legally engage in the manufacture, distribution, or warehousing of excisable goods in Canada without a Sample Excise Bond.

Q: Are there any alternatives to a Sample Excise Bond?

A: In some cases, businesses may be able to provide other forms of security, such as cash deposits or letters of credit, in lieu of a Sample Excise Bond. However, this is subject to approval by the relevant authorities.