This version of the form is not currently in use and is provided for reference only. Download this version of

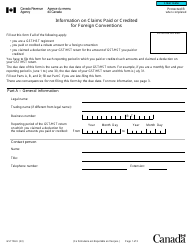

Form GST106

for the current year.

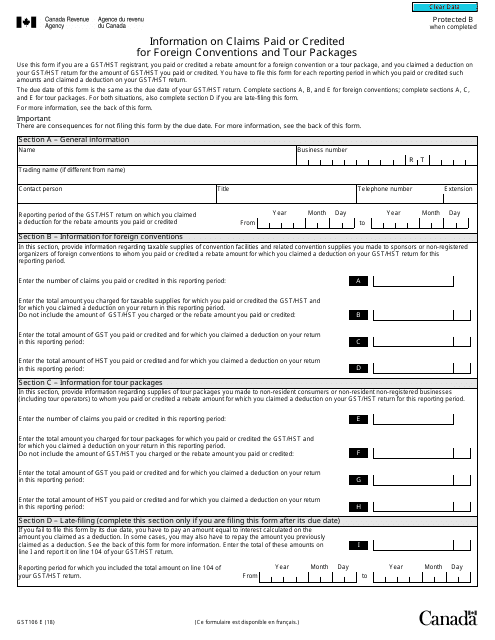

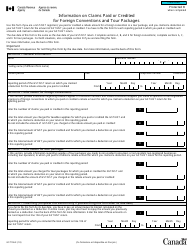

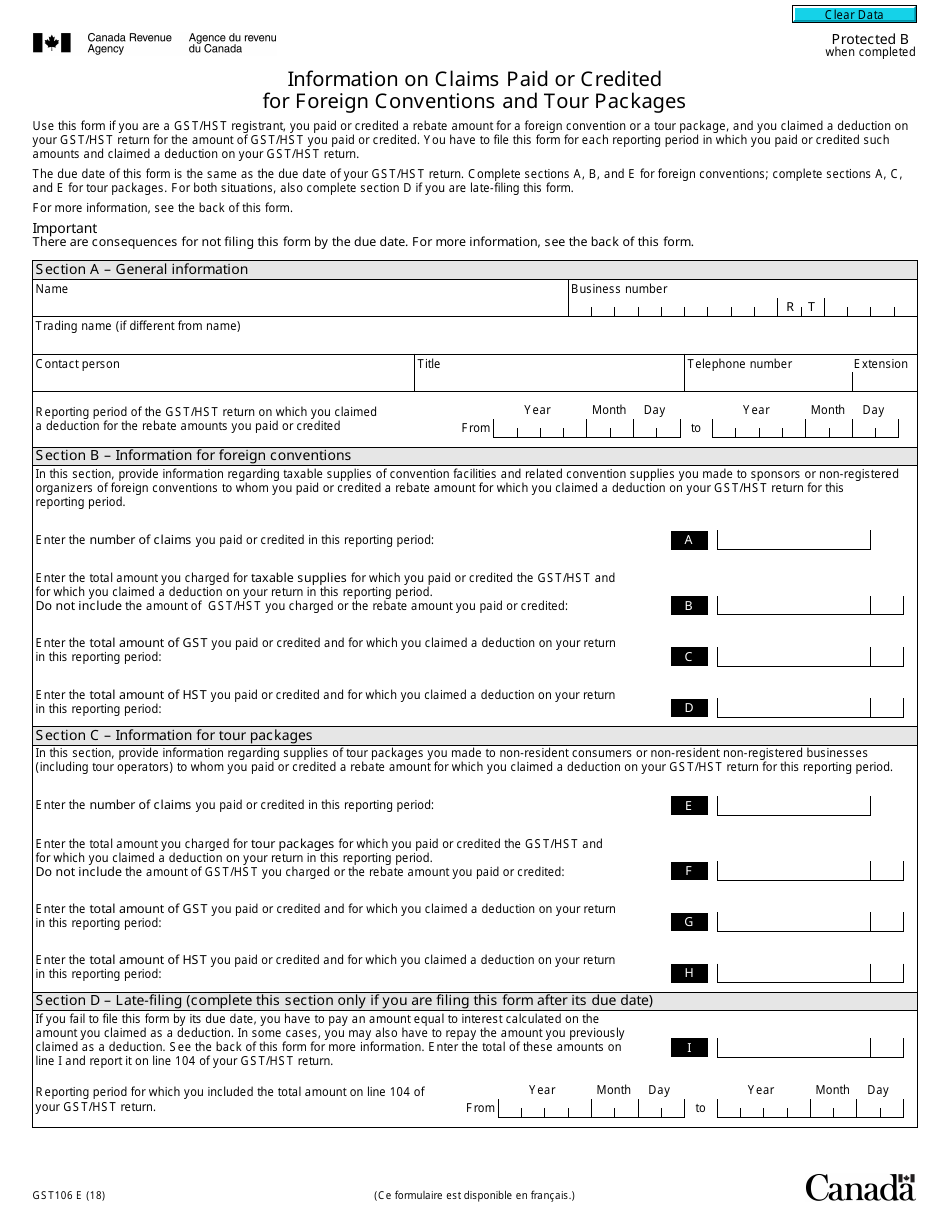

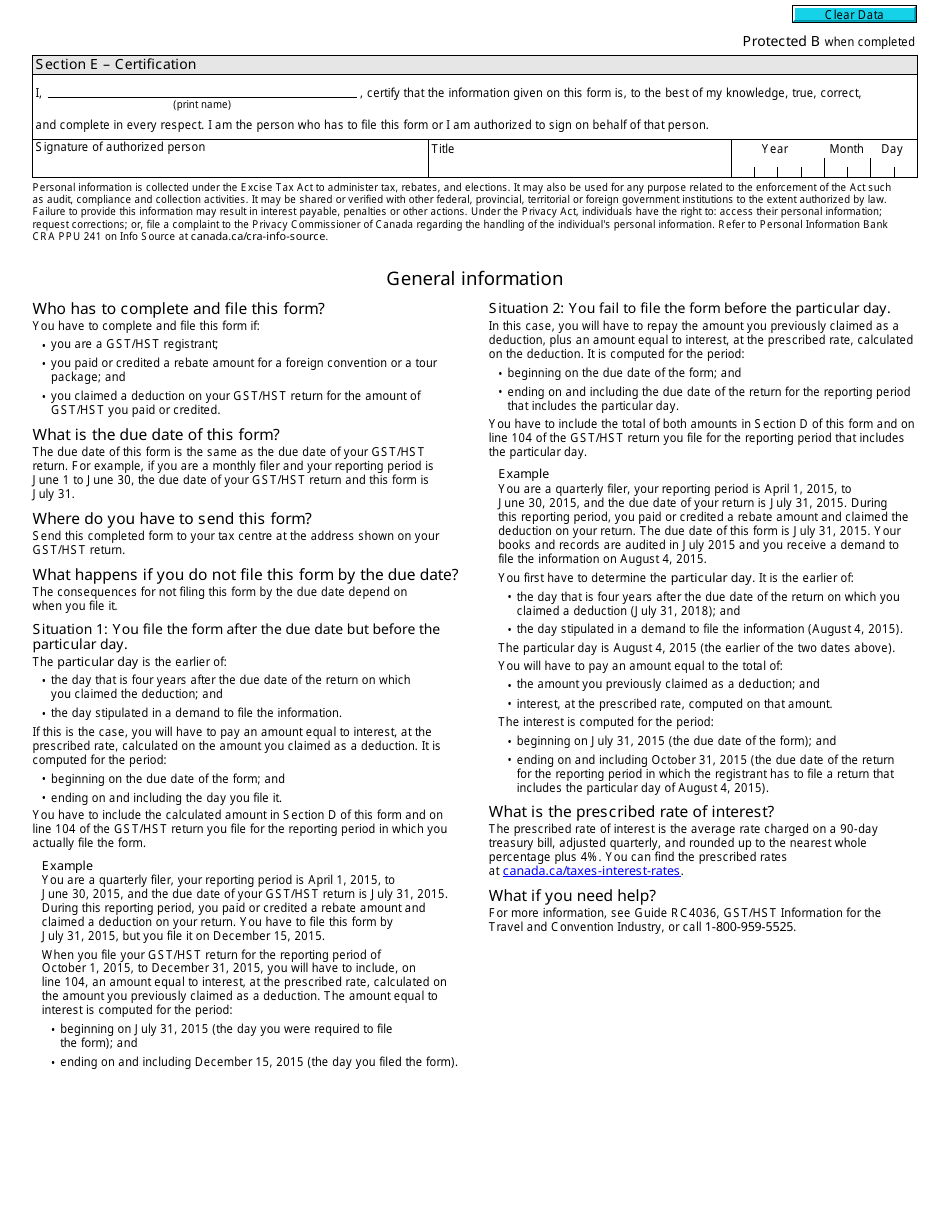

Form GST106 Information on Claims Paid or Credited for Foreign Conventions and Tour Packages - Canada

Form GST106 or the "Form Gst106 "information On Claims Paid Or Credited For Foreign Conventions And Tour Packages" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2018 and is available for digital filing. Download an up-to-date Form GST106 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

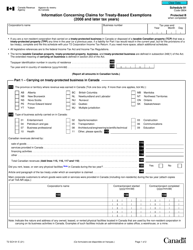

Q: What is Form GST106?

A: Form GST106 is a form used in Canada to report claims paid or credited for foreign conventions and tour packages.

Q: What information does Form GST106 require?

A: Form GST106 requires information on the amount of claims paid or credited for foreign conventions and tour packages.

Q: Who should use Form GST106?

A: Businesses in Canada that have paid or credited claims for foreign conventions and tour packages should use Form GST106.

Q: Do I need to report claims for domestic conventions and tour packages on Form GST106?

A: No, Form GST106 is specifically for claims related to foreign conventions and tour packages.

Q: Are there any specific guidelines for completing Form GST106?

A: Yes, the Canada Revenue Agency provides specific guidelines on how to complete Form GST106.