This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST145

for the current year.

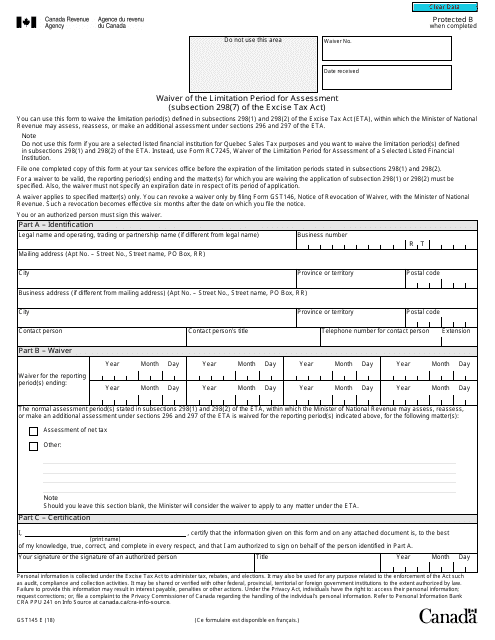

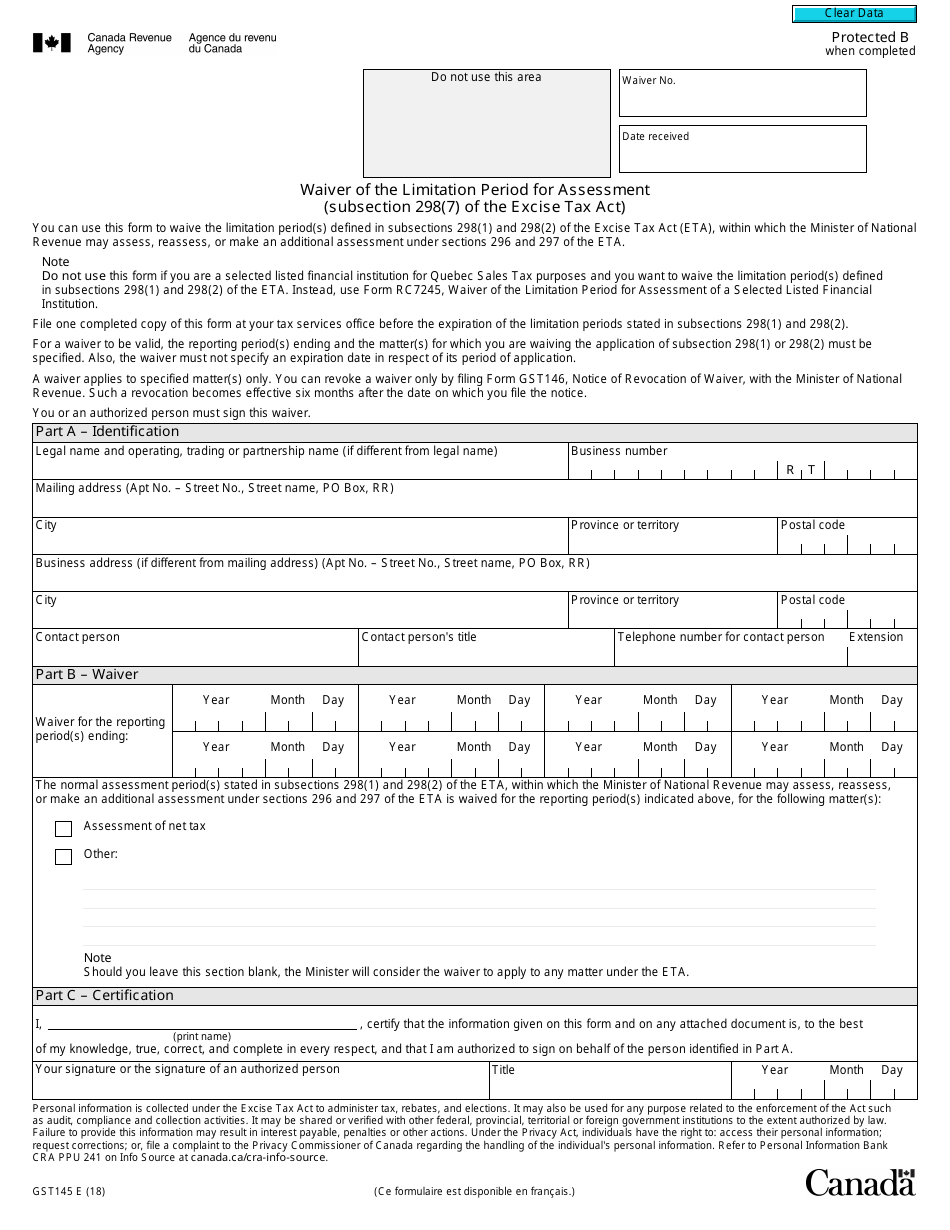

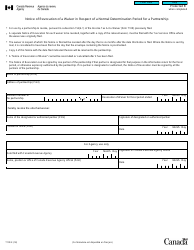

Form GST145 Waiver of the Limitation Period for Assessment - Canada

Form GST145, Waiver of the Limitation Period for Assessment, is used in Canada for taxpayers who wish to extend the limitation period for the Canada Revenue Agency (CRA) to assess their tax liability. By filling out this form, taxpayers give the CRA more time to review and assess their tax returns beyond the usual timeframe.

The Form GST145 for Waiver of the Limitation Period for Assessment in Canada is filed by the taxpayer or their authorized representative.

FAQ

Q: What is Form GST145?

A: Form GST145 is a waiver of the limitation period for assessment in Canada.

Q: What is the limitation period for assessment?

A: The limitation period for assessment is the timeframe within which the Canada Revenue Agency (CRA) can assess or reassess a taxpayer's tax return.

Q: Why would someone need to use Form GST145?

A: Someone may need to use Form GST145 to extend the limitation period for assessment, allowing the CRA more time to assess or reassess their tax return.

Q: Is there a fee to file Form GST145?

A: No, there is no fee to file Form GST145.

Q: What happens after I file Form GST145?

A: After you file Form GST145, the CRA will review your request to extend the limitation period and notify you of their decision.

Q: Can I file Form GST145 electronically?

A: Yes, you can file Form GST145 electronically through the CRA's My Business Account or Represent a Client services.

Q: Is there a deadline to file Form GST145?

A: There is no specific deadline to file Form GST145, but it is recommended to file it as soon as you become aware of the need to extend the limitation period.

Q: Can I request multiple waivers using Form GST145?

A: Yes, you can request multiple waivers using Form GST145 if needed.

Q: Can Form GST145 be used for personal taxes?

A: No, Form GST145 is specifically for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes. Other forms may be needed for personal taxes.