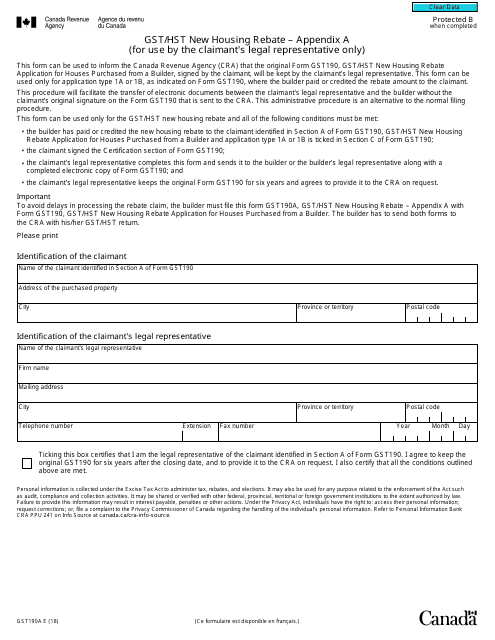

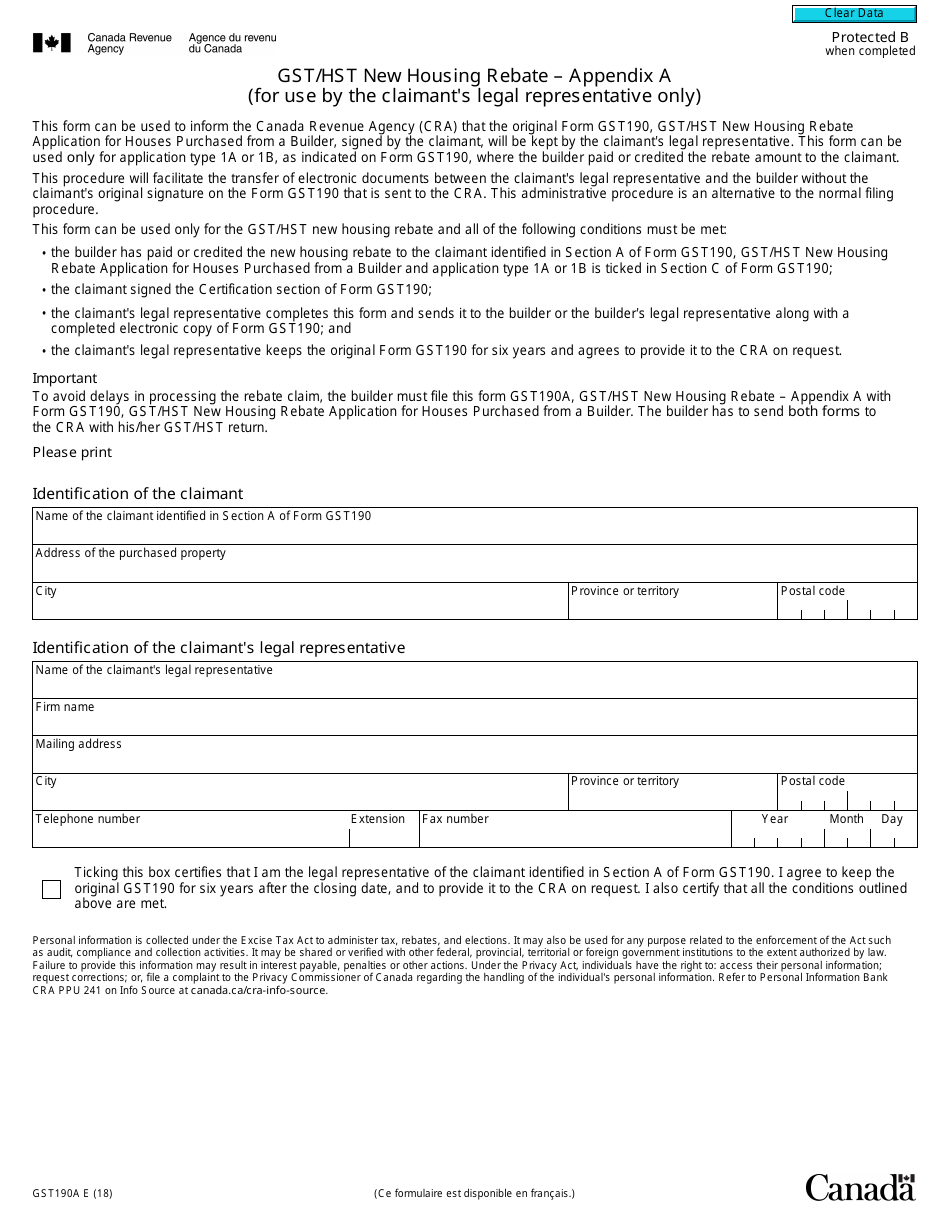

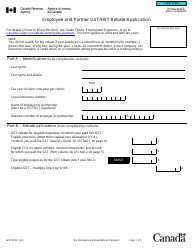

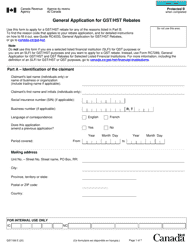

Form GST190A Schedule A Gst / Hst New Housing Rebate - Canada

Form GST190A Schedule A is used in Canada for claiming the GST/HST New Housing Rebate. This rebate is available for individuals who have purchased a new home or made significant renovations to an existing home and have paid GST/HST on the purchase or renovations. The schedule is used to provide details about the home, including the purchase price, date of purchase, and other relevant information, in order to claim the rebate.

The Form GST190A Schedule A for the GST/HST new housing rebate in Canada is filed by the home buyer.

FAQ

Q: What is the GST/HST New Housing Rebate?

A: The GST/HST New Housing Rebate is a rebate provided by the Canadian government to offset the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on a newly constructed or substantially renovated home.

Q: Who is eligible for the GST/HST New Housing Rebate?

A: Individuals who have purchased or built a new home, or have undertaken substantial renovations to an existing home, may be eligible for the GST/HST New Housing Rebate. There are specific criteria regarding residency, ownership, and use of the property that must be met.

Q: How much is the GST/HST New Housing Rebate?

A: The amount of the rebate depends on the purchase price or cost of construction, as well as the GST or HST rate applicable in the province or territory where the property is located. In some cases, the rebate may cover a portion of the taxes paid.

Q: How can I apply for the GST/HST New Housing Rebate?

A: To apply for the GST/HST New Housing Rebate, you need to complete and file Form GST190A Schedule A. This form requires detailed information about the property, the purchase or construction, and the GST or HST paid. Supporting documents, such as purchase agreements or invoices, must also be submitted.

Q: Is there a deadline for applying for the GST/HST New Housing Rebate?

A: Yes, there is a deadline for applying for the GST/HST New Housing Rebate. The application must be filed within two years from the date of purchase, or within two years from the substantial completion of the renovations. Late applications may not be accepted.

Q: Are there any other conditions or requirements for the GST/HST New Housing Rebate?

A: Yes, there are other conditions and requirements for the GST/HST New Housing Rebate. These include residency requirements, restrictions on the type of property that qualifies, and limits on the value of the property. It is important to review the eligibility criteria outlined by the Canada Revenue Agency.

Q: Is the GST/HST New Housing Rebate taxable?

A: No, the GST/HST New Housing Rebate is not considered taxable income. It is a rebate provided by the government to offset taxes paid on the purchase or construction of a new home.