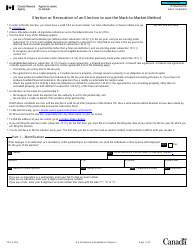

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST24

for the current year.

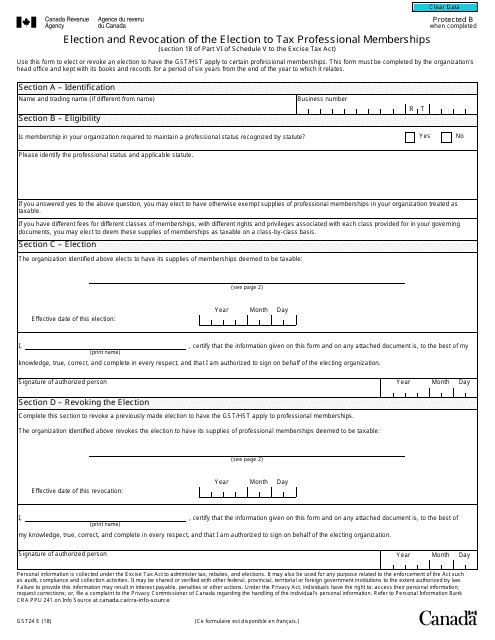

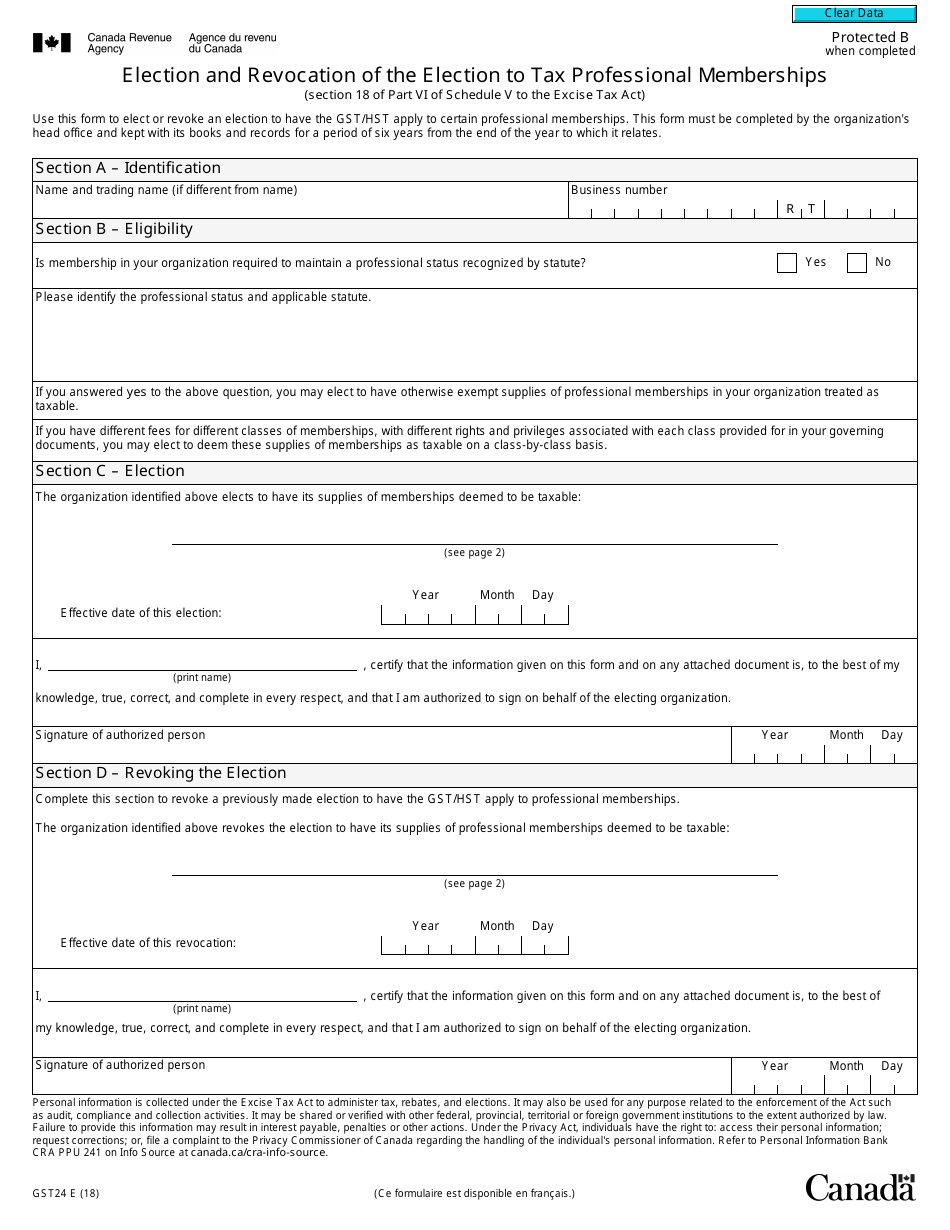

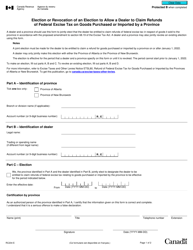

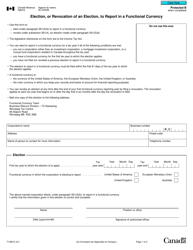

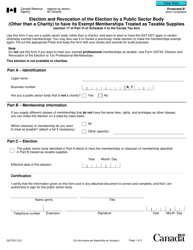

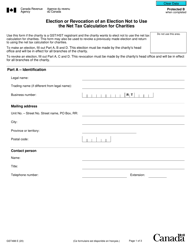

Form GST24 Election and Revocation of the Election to Tax Professional Memberships - Canada

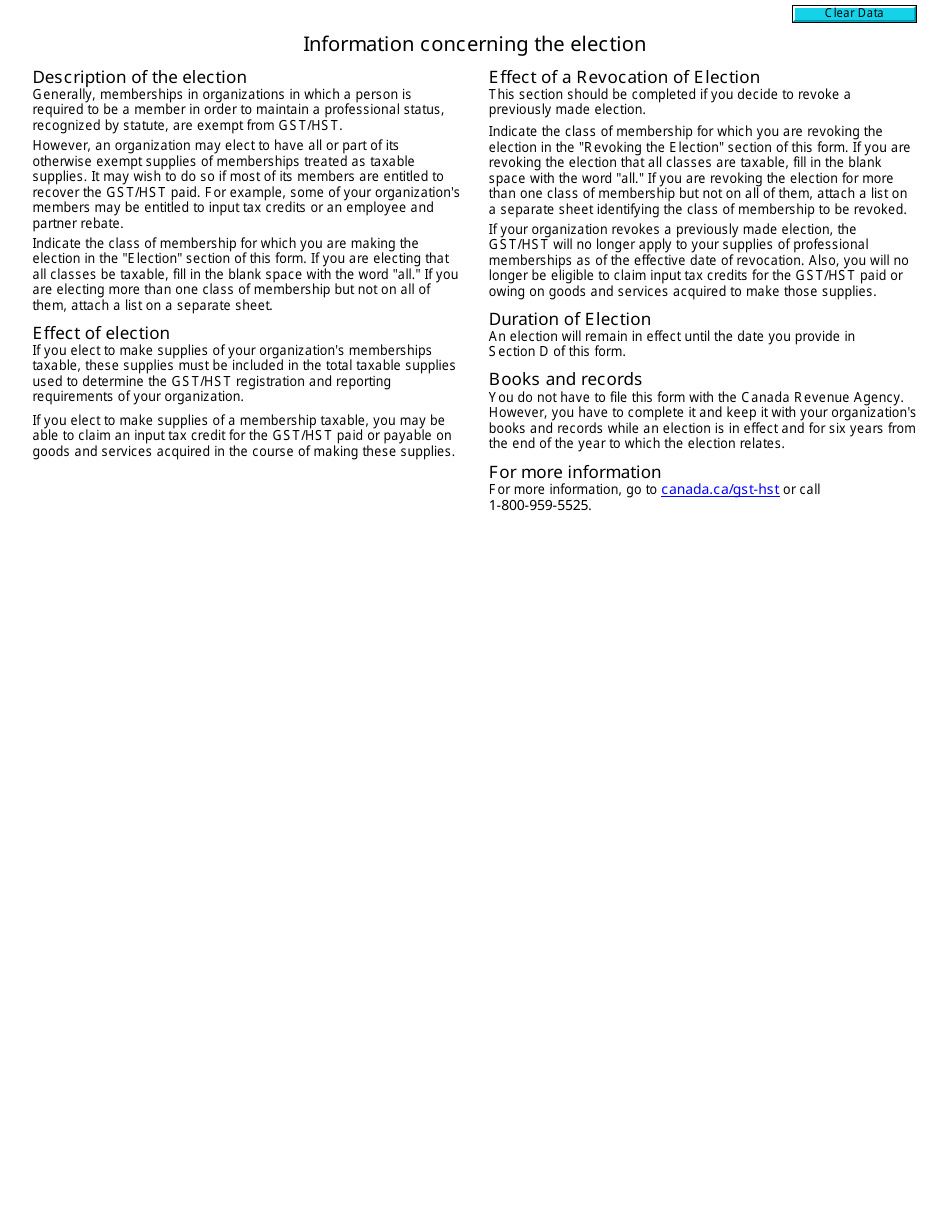

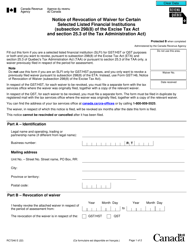

Form GST24 is used in Canada for the election and revocation of the election to tax professional memberships. By submitting this form, individuals or businesses can either elect to have their professional memberships exempt from Goods and Services Tax/Harmonized Sales Tax (GST/HST) or revoke their previous election. This form helps in determining the tax treatment of professional membership fees for GST/HST purposes in Canada.

The Form GST24 for election and revocation of the election to tax professional memberships in Canada is filed by the eligible registrant themselves.

FAQ

Q: What is GST24?

A: GST24 is a form in Canada for Election and Revocation of the Election to Tax Professional Memberships.

Q: Who needs to fill out GST24?

A: Individuals or businesses in Canada who want to make an election or revoke the election to tax professional memberships need to fill out GST24.

Q: What is the purpose of GST24?

A: The purpose of GST24 is to notify the Canada Revenue Agency (CRA) about the election or revocation of the election to tax professional memberships.

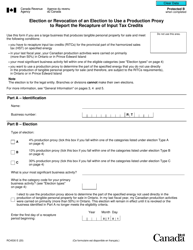

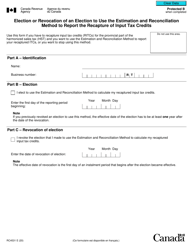

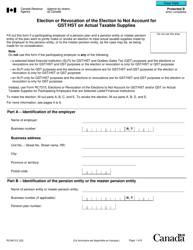

Q: How do I fill out GST24?

A: You need to provide your personal or business information, indicate the type of election or revocation, and follow the instructions provided on the form.

Q: Is there a deadline for submitting GST24?

A: There is no specific deadline mentioned for submitting GST24. However, it is recommended to submit the form as soon as possible after making the election or revocation.

Q: Are there any fees to submit GST24?

A: No, there are no fees required to submit the GST24 form.

Q: Can I submit GST24 electronically?

A: Yes, you can submit GST24 electronically using the CRA's My Business Account, Represent a Client, or by using certified tax preparation software.

Q: What should I do after submitting GST24?

A: After submitting GST24, keep a copy of the form for your records and wait for any further communication from the Canada Revenue Agency (CRA).