This version of the form is not currently in use and is provided for reference only. Download this version of

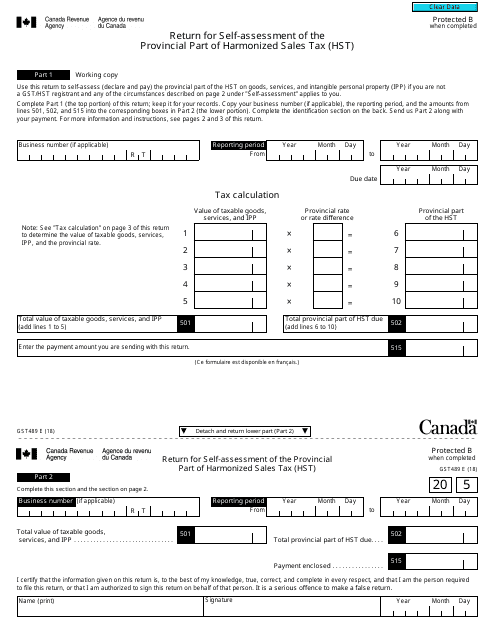

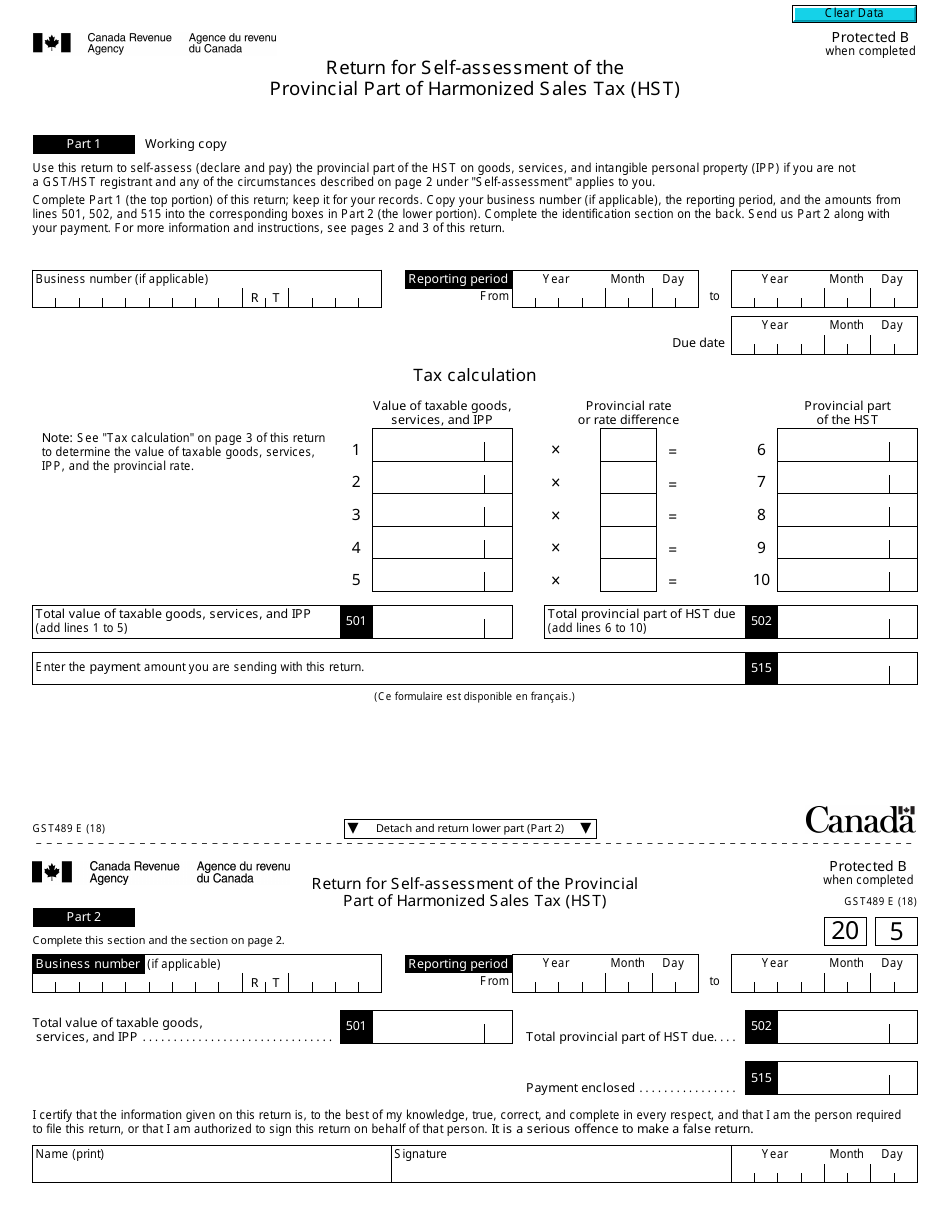

Form GST489

for the current year.

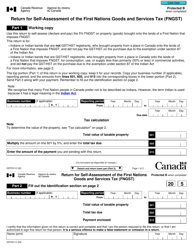

Form GST489 Return for Self-assessment of the Provincial Part of Harmonized Sales Tax (Hst) - Canada

Form GST489 is a Canadian Revenue Agency form also known as the "Form Gst489 "return For Self-assessment Of The Provincial Part Of Harmonized Sales Tax (hst)" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form GST489 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is GST489?

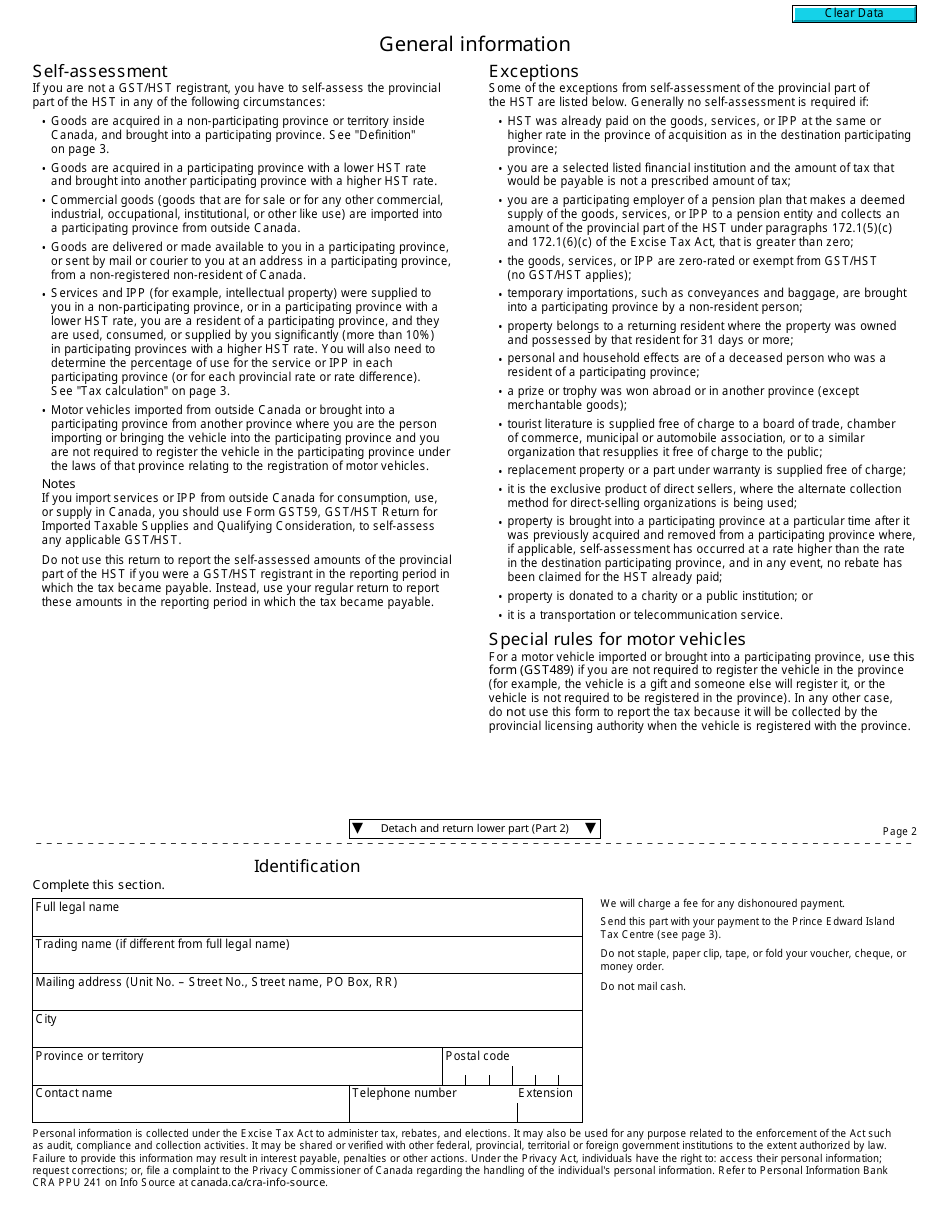

A: GST489 is a form used for self-assessment of the provincial part of Harmonized Sales Tax (HST) in Canada.

Q: Who needs to fill out GST489?

A: Individuals or businesses who are obligated to collect and remit HST in the participating provinces of Canada need to fill out GST489.

Q: What is the purpose of GST489?

A: The purpose of GST489 is to report and pay the provincial portion of HST to the Canada Revenue Agency (CRA).

Q: Which provinces in Canada have HST?

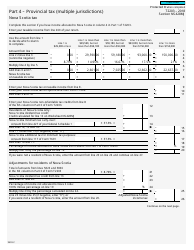

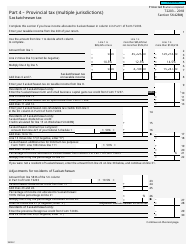

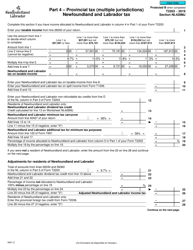

A: Currently, the participating provinces in Canada that have HST are Ontario, New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

Q: What information is required to fill out GST489?

A: To fill out GST489, you will need to provide your business information, HST account number, sales and self-assessment amounts, and any applicable rebates or adjustments.

Q: How often should GST489 be filed?

A: GST489 should be filed based on the reporting period specified by the CRA. Usually, it is filed on a quarterly or annual basis.

Q: What are the penalties for not filing GST489?

A: Penalties for not filing GST489 or late filing can include financial penalties and interest charges imposed by the CRA.

Q: Is GST489 applicable for all businesses in Canada?

A: No, GST489 is specifically for businesses in participating provinces that are required to collect and remit the provincial part of HST.