This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST518

for the current year.

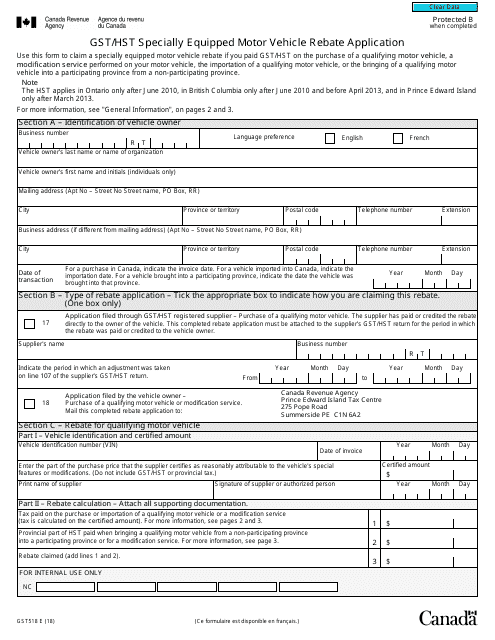

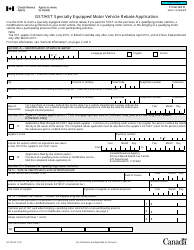

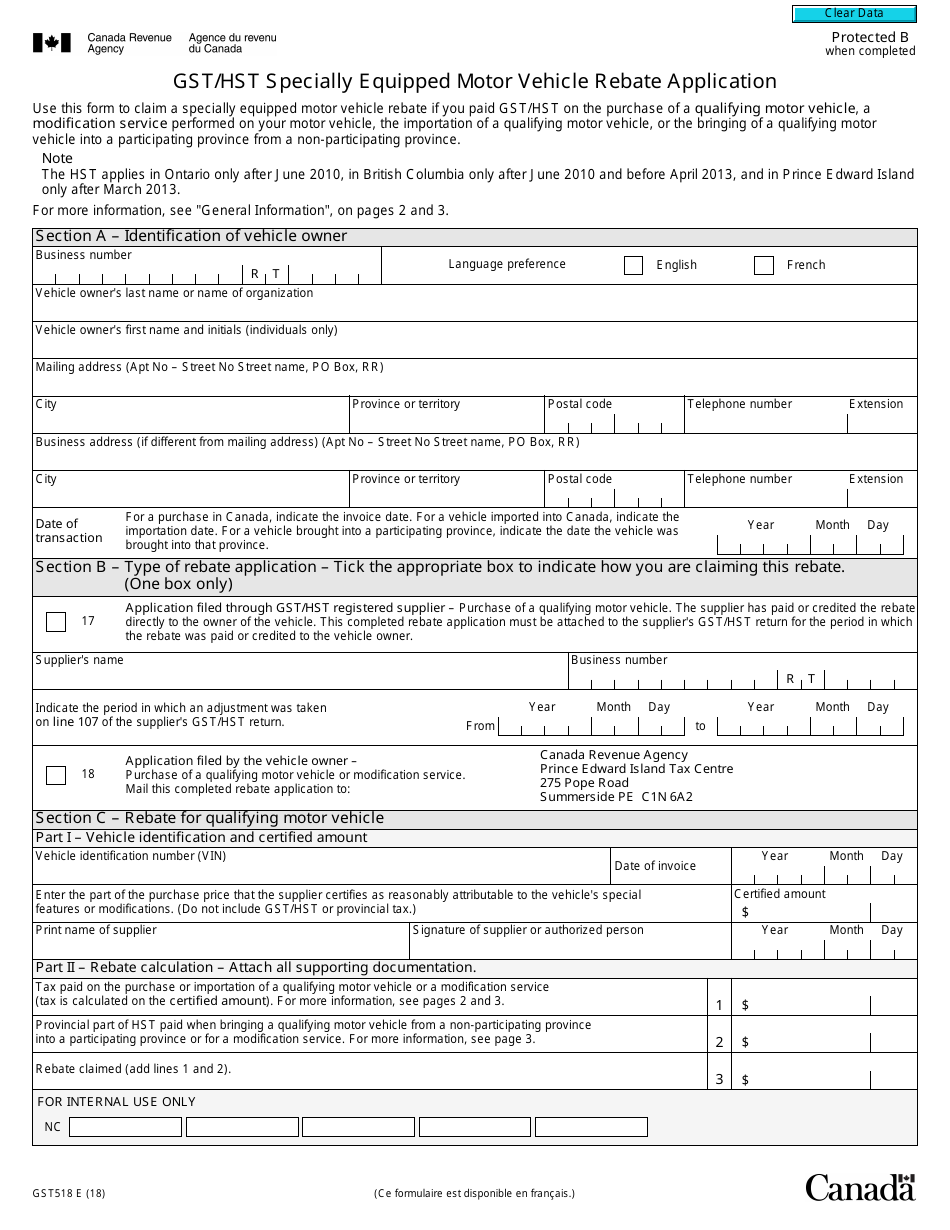

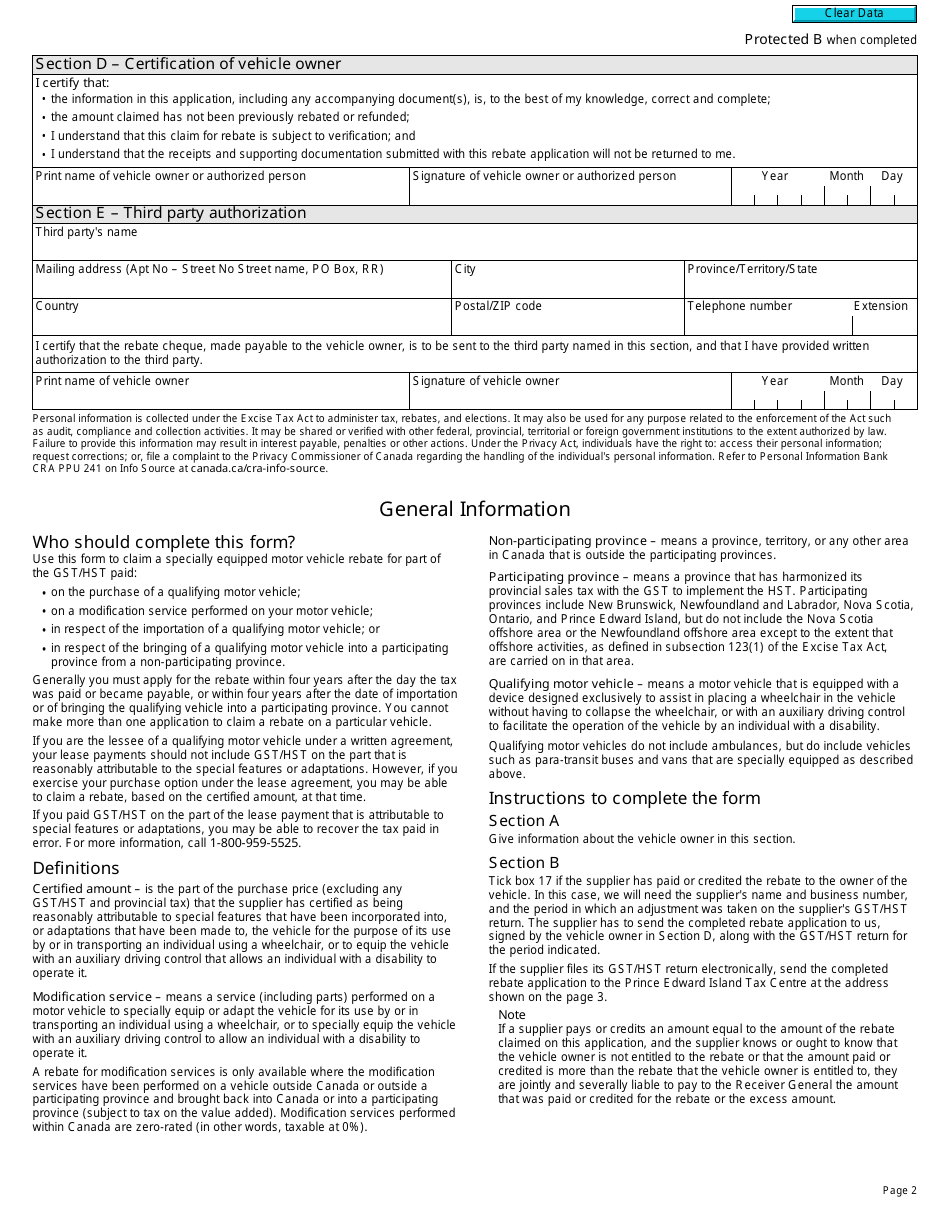

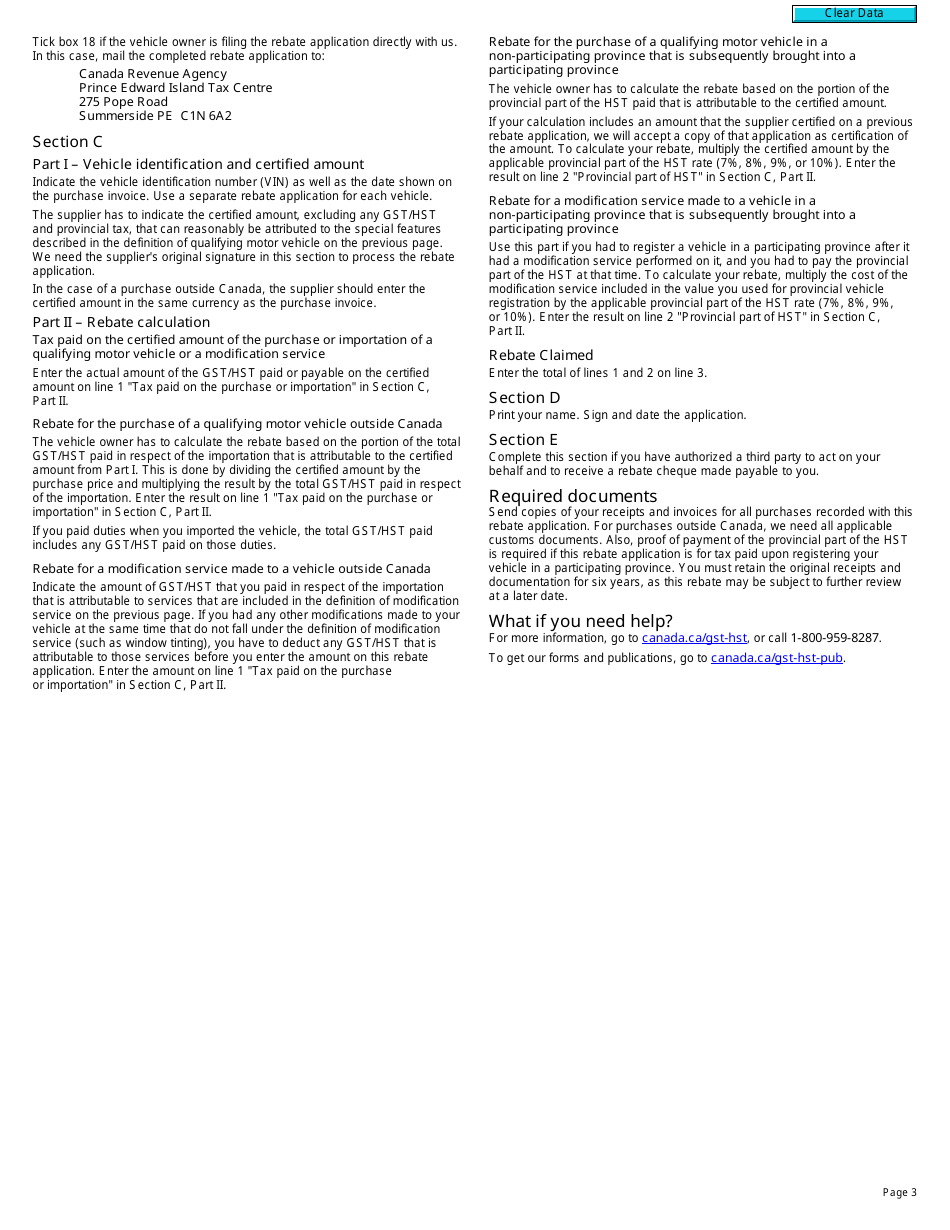

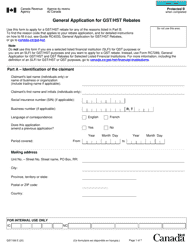

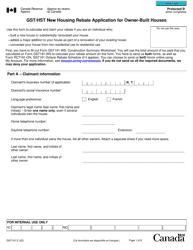

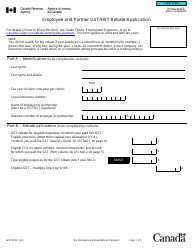

Form GST518 Gst / Hst Specially Equipped Motor Vehicle Rebate Application - Canada

The Form GST518 GST/HST Specially Equipped Motor Vehicle Rebate Application is used in Canada to claim a rebate for goods and services tax (GST) or harmonized sales tax (HST) paid on the purchase or importation of specially equipped motor vehicles.

The Form GST518 GST/HST Specially Equipped Motor Vehicle Rebate Application in Canada is filed by individuals or businesses who have purchased specially equipped motor vehicles and are eligible for a rebate on the GST/HST paid.

FAQ

Q: What is Form GST518?

A: Form GST518 is the GST/HST Specially Equipped Motor Vehicle Rebate Application.

Q: What is the purpose of Form GST518?

A: The purpose of Form GST518 is to apply for the GST/HST rebate on specially equipped motor vehicles in Canada.

Q: Who is eligible to use Form GST518?

A: Individuals, corporations, and partnerships who have purchased or imported specially equipped motor vehicles in Canada are eligible to use Form GST518.

Q: What is the rebate for?

A: The rebate is for the GST/HST paid on the purchase or importation of specially equipped motor vehicles.

Q: What are specially equipped motor vehicles?

A: Specially equipped motor vehicles are vehicles that have been modified to accommodate individuals with disabilities.