This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST525

for the current year.

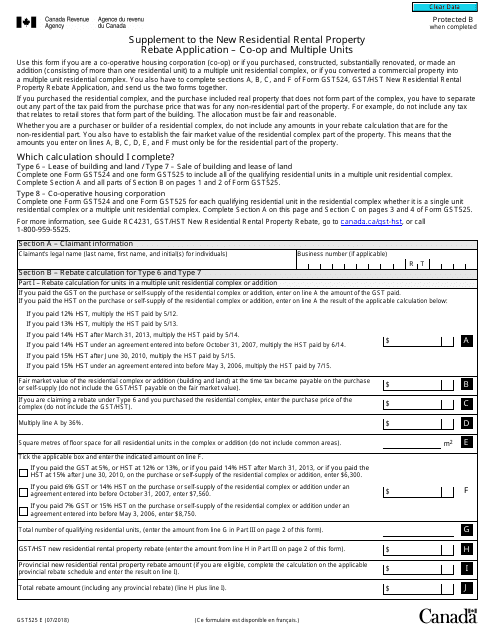

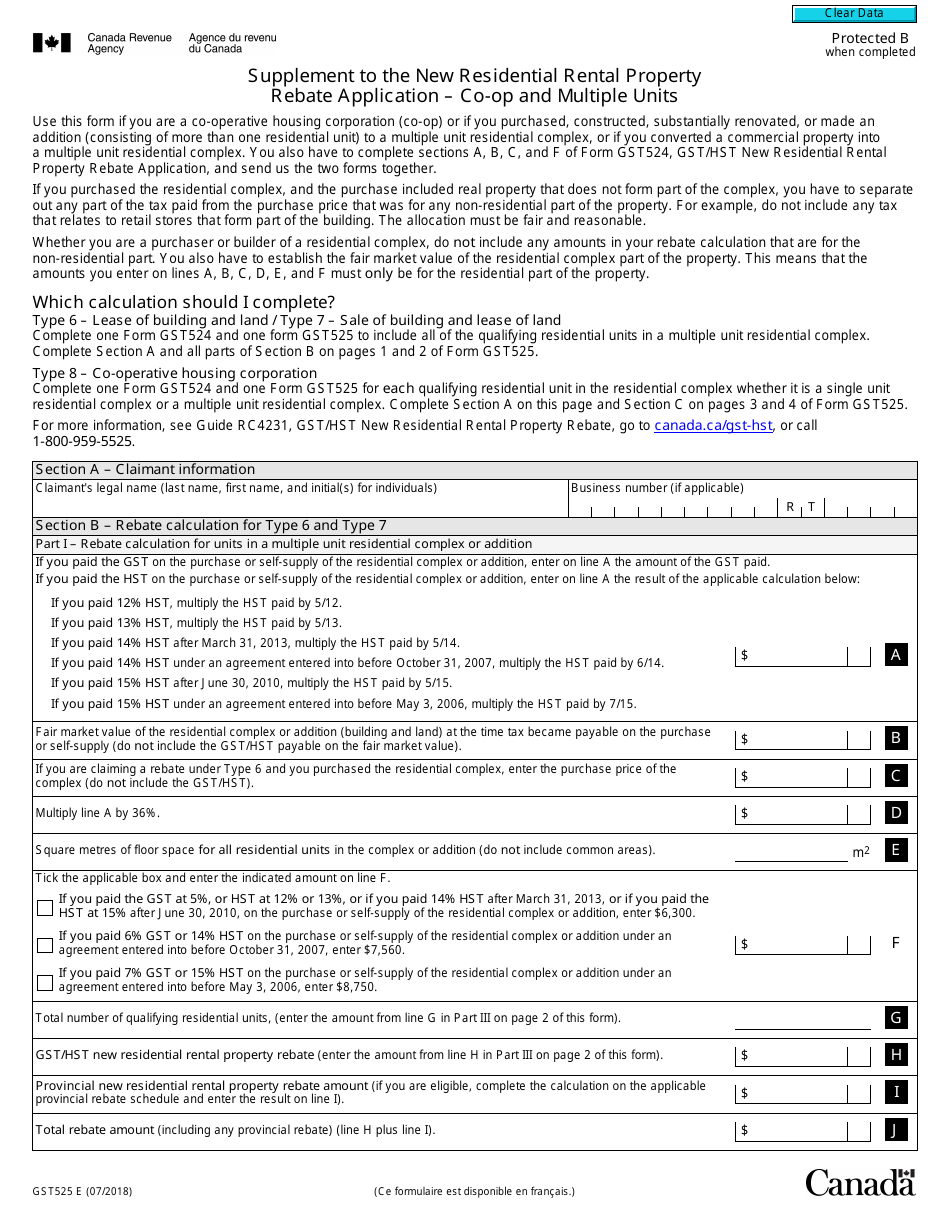

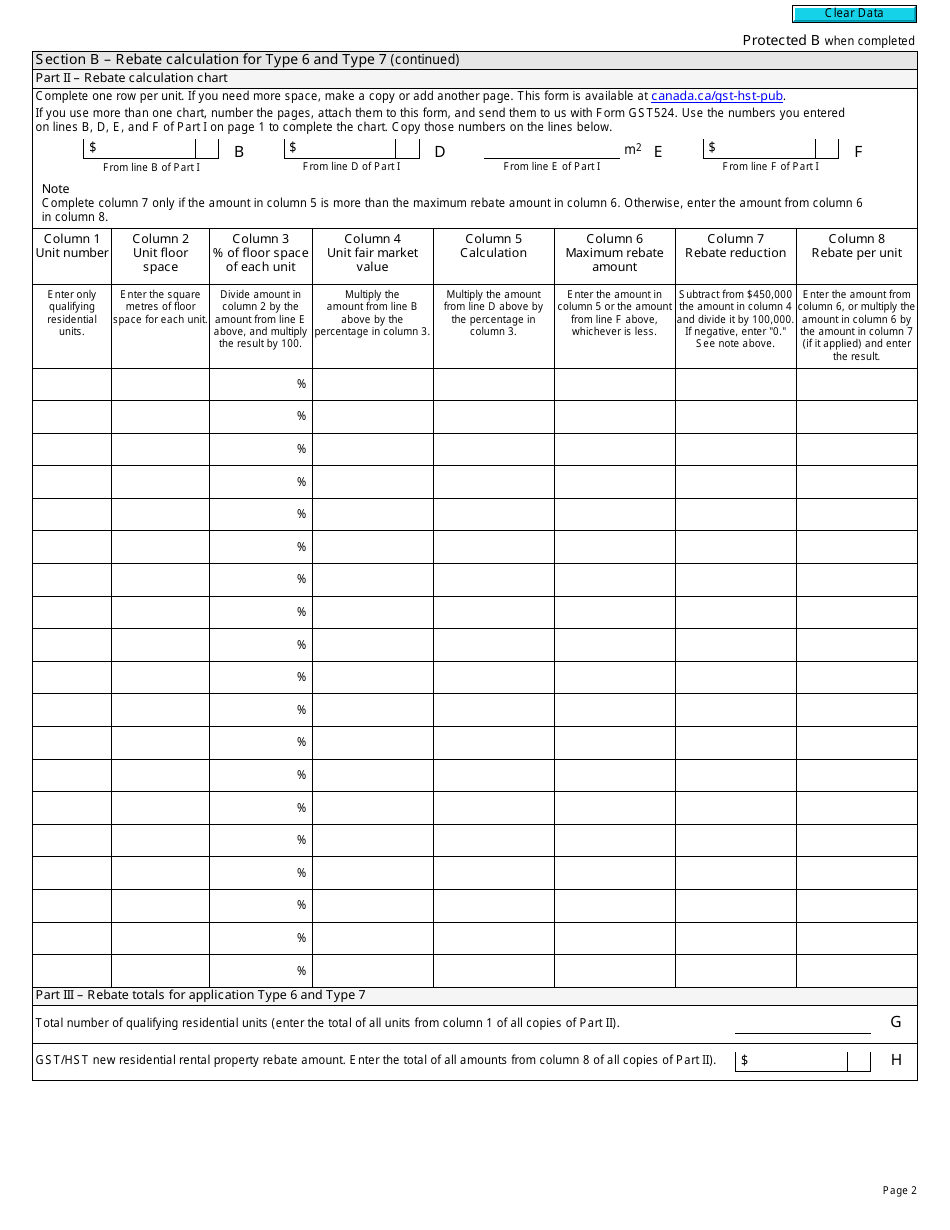

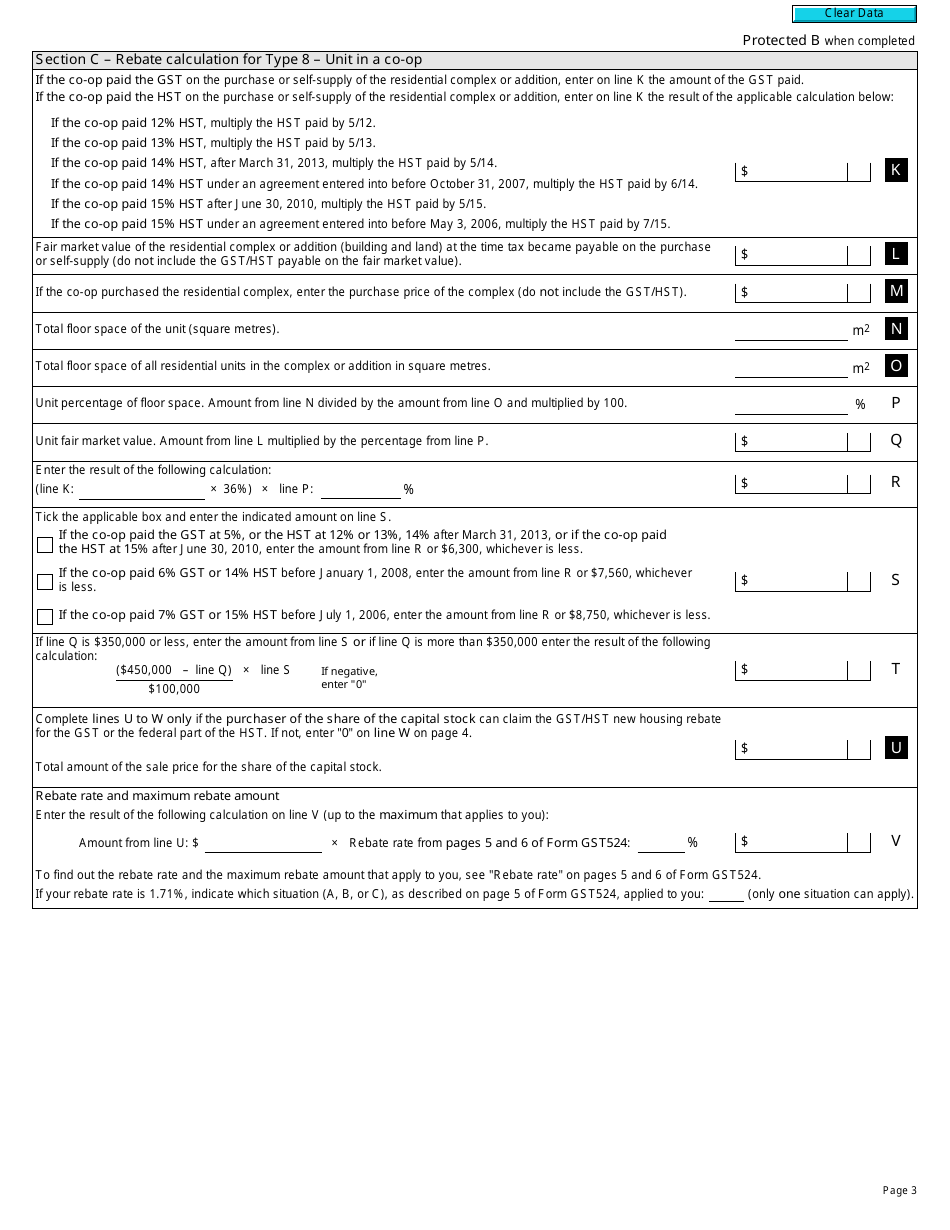

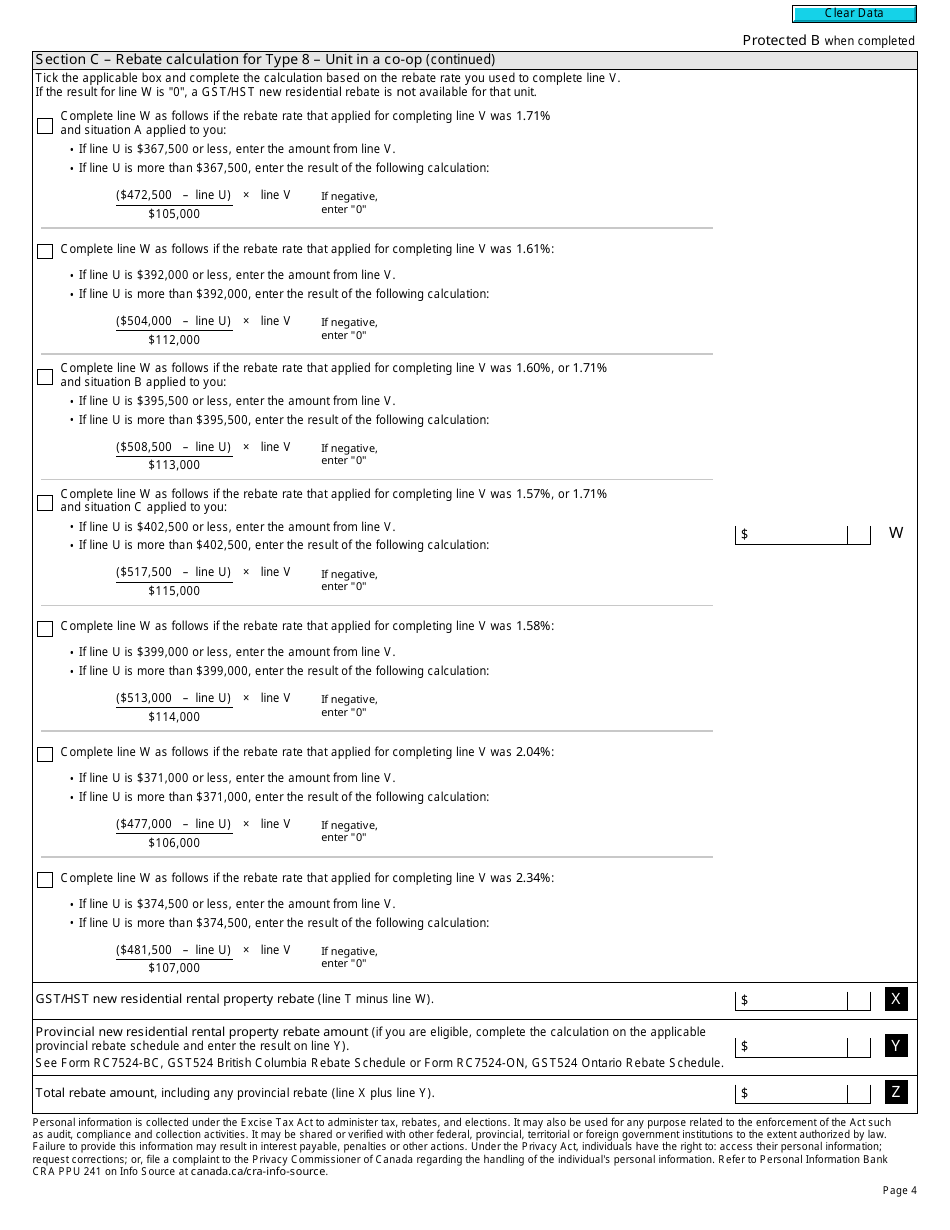

Form GST525 Supplement to the New Residential Rental Property Rebate Application - Co-op and Multiple Units - Canada

Form GST525 is a supplement to the New Residential Rental Property Rebate Application in Canada. It is specifically for claiming the Goods and Services Tax/Harmonized Sales Tax (GST/HST) rebate on co-op units and multiple rental units that are newly constructed or substantially renovated.

The Form GST525 Supplement to the New Residential Rental Property Rebate Application - Co-op and Multiple Units in Canada is filed by the individual or entity applying for the New Residential Rental Property Rebate for co-op and multiple units.

FAQ

Q: What is the GST525 form?

A: The GST525 form is the Supplement to the New Residential Rental Property Rebate Application - Co-op and Multiple Units in Canada.

Q: Who should use the GST525 form?

A: This form should be used by individuals who are applying for the New Residential Rental Property Rebate for co-op and multiple units in Canada.

Q: What is the purpose of the GST525 form?

A: The GST525 form is used to provide additional information and details about the co-op or multiple units for which the rebate is being applied.

Q: Do I need to submit the GST525 form with the New Residential Rental Property Rebate application?

A: Yes, the GST525 form must be submitted along with the main application for the New Residential Rental Property Rebate for co-op and multiple units in Canada.