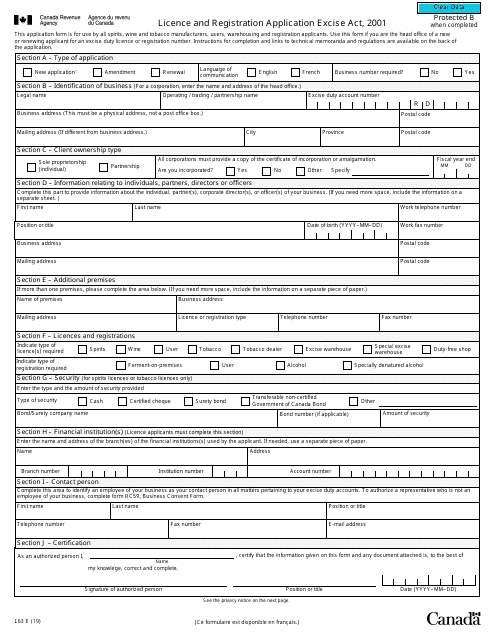

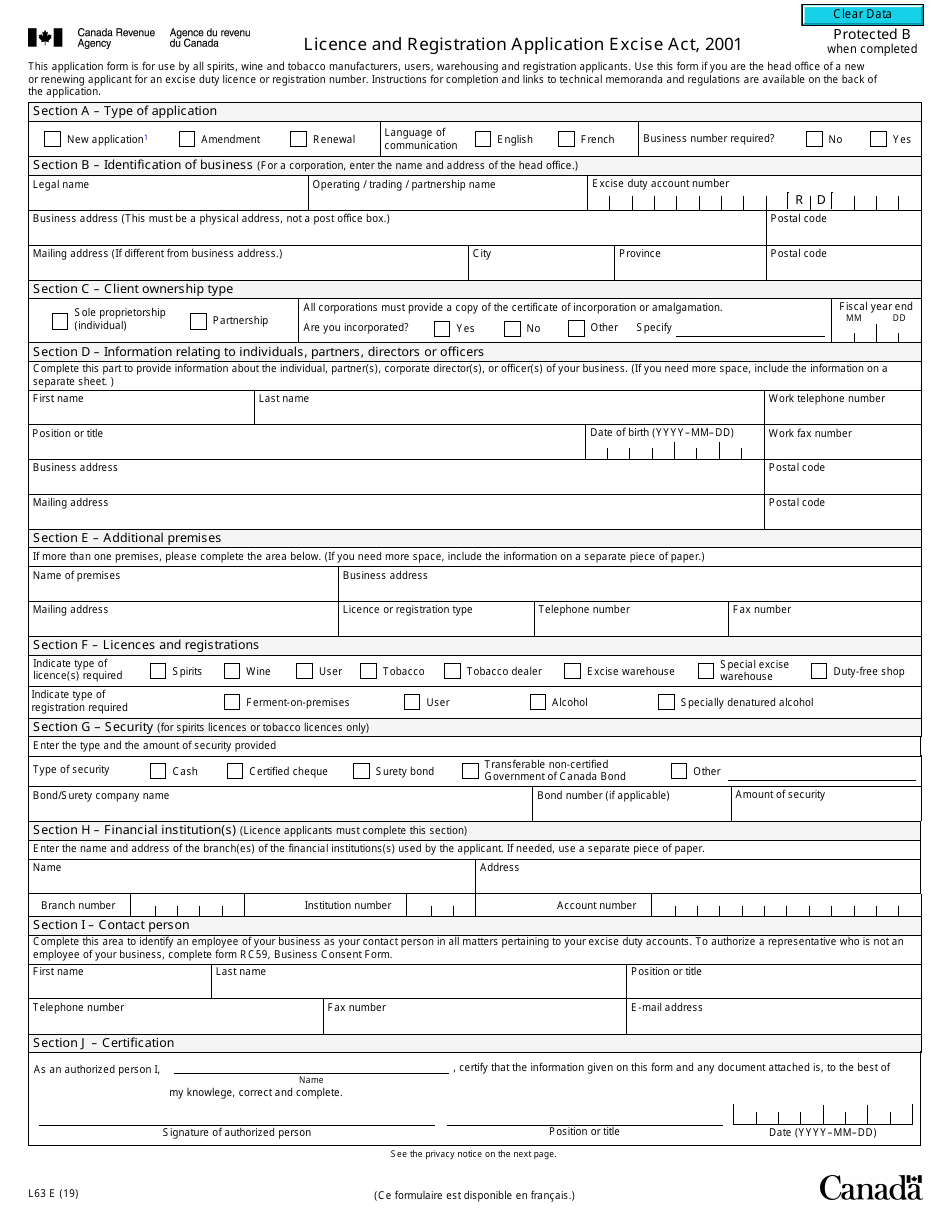

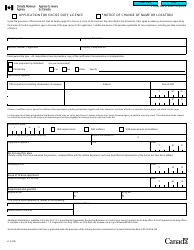

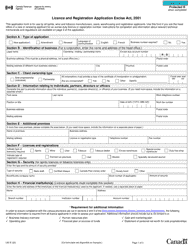

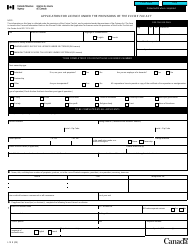

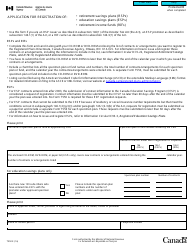

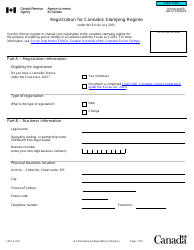

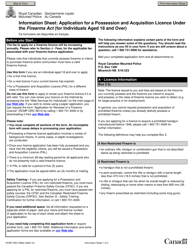

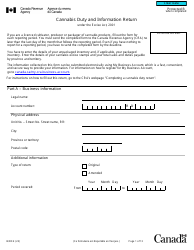

Form L63 E Licence and Registration Application Excise Act, 2001 - Canada

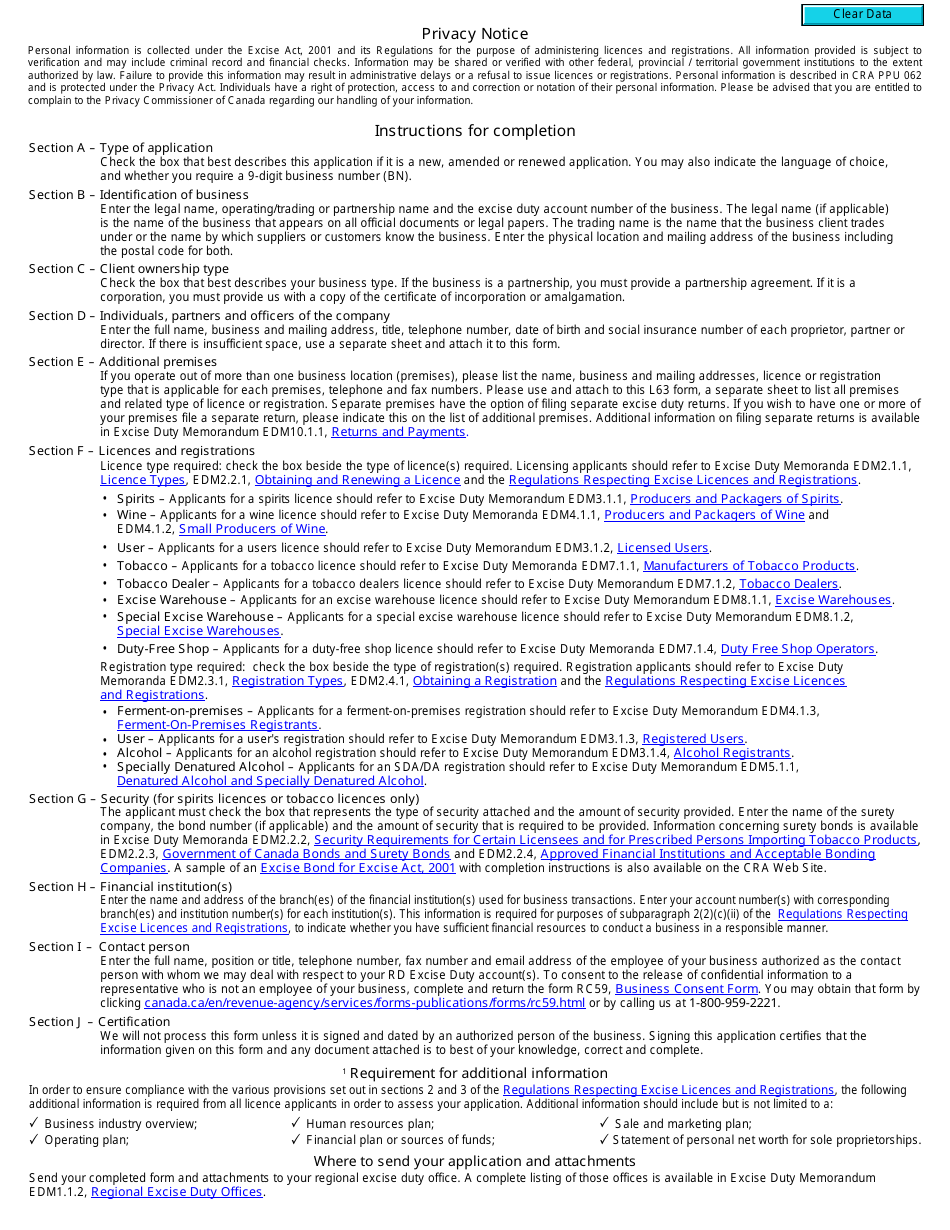

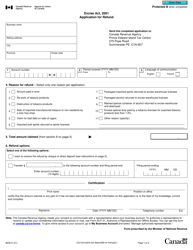

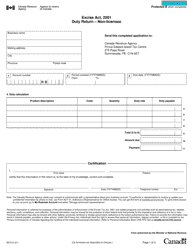

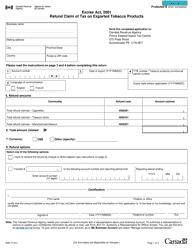

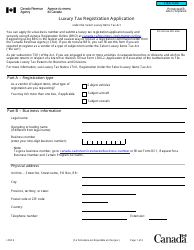

Form L63 E Licence and Registration Application Excise Act, 2001 - Canada is used for applying for a license and registration related to excise tax in Canada. It is a form that individuals or businesses can use to apply for a license to engage in activities regulated by the Excise Act, 2001. These activities may include the production, sale, or importation of certain goods that are subject to excise tax, such as alcohol, fuel, tobacco, or cannabis.

The Form L63 E Licence and Registration Application under the Excise Act, 2001 is filed by the businesses or individuals who engage in excise-related activities in Canada.

FAQ

Q: What is Form L63 E?

A: Form L63 E is an application form for the licence and registration under the Excise Act, 2001 in Canada.

Q: What is the purpose of Form L63 E?

A: The purpose of Form L63 E is to apply for a licence and registration under the Excise Act, 2001 in Canada.

Q: Who needs to fill out Form L63 E?

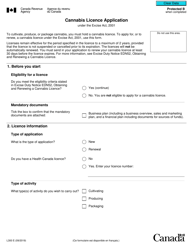

A: Anyone who wants to obtain a licence and registration under the Excise Act, 2001 in Canada needs to fill out Form L63 E.

Q: What information is required in Form L63 E?

A: Form L63 E requires information such as applicant details, proposed activities, financial information, and references.

Q: Are there any fees associated with Form L63 E?

A: Yes, there are fees associated with Form L63 E. The specific fees depend on the type of licence and registration being applied for.

Q: How long does it take to process Form L63 E?

A: The processing time for Form L63 E varies and can take several weeks. It is recommended to submit the form well in advance of the intended start date of the proposed activities.

Q: What happens after submitting Form L63 E?

A: After submitting Form L63 E, the Canada Revenue Agency will review the application and may request additional information or documentation. Once approved, the applicant will receive the licence and registration.

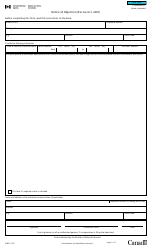

Q: What if there are changes to the information provided in Form L63 E?

A: If there are changes to the information provided in Form L63 E, it is important to notify the Canada Revenue Agency as soon as possible to ensure the accuracy of the licence and registration.