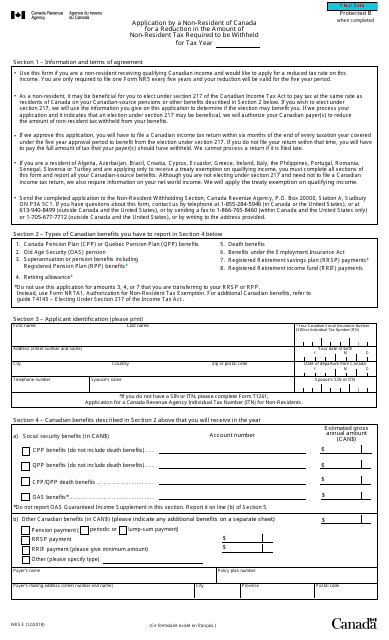

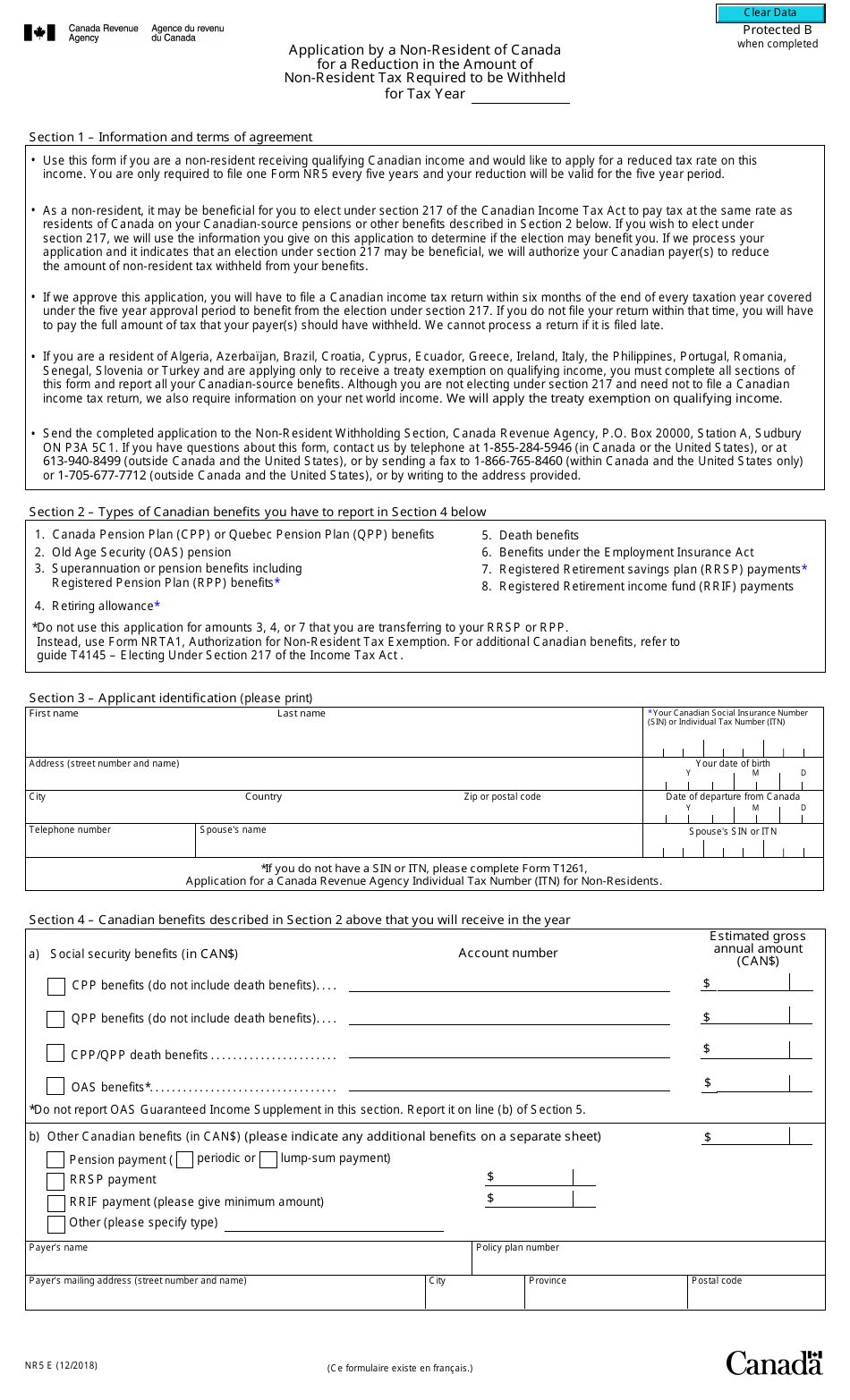

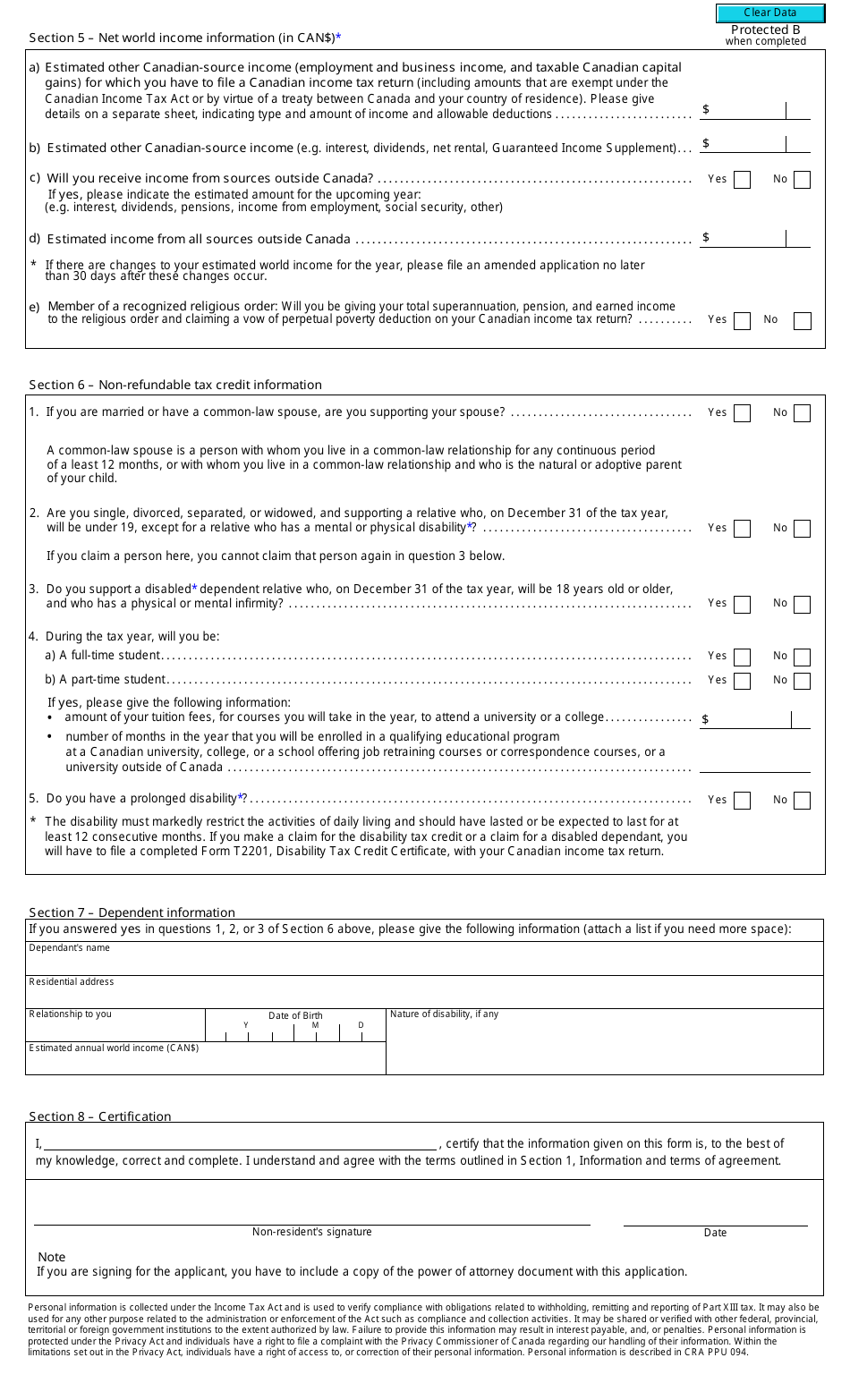

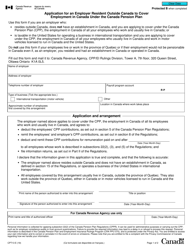

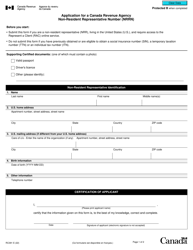

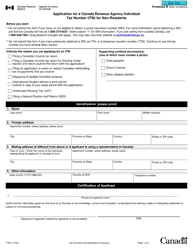

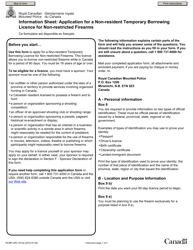

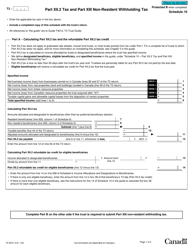

Form NR5 Application by a Non-resident of Canada for a Reduction in the Amount of Non-resident Tax Required to Be Withheld for Tax Year - Canada

Form NR5 is used by non-residents of Canada who want to apply for a reduction in the amount of non-resident tax required to be withheld for the tax year. This reduction is based on a tax treaty between Canada and the non-resident's country of residence. By submitting Form NR5, non-residents can potentially have less tax withheld from their Canadian income.

The non-resident of Canada files the Form NR5 application.

FAQ

Q: What is Form NR5?

A: Form NR5 is an application by a non-resident of Canada for a reduction in the amount of non-resident tax required to be withheld for tax year.

Q: Who can use Form NR5?

A: Non-residents of Canada can use Form NR5 to apply for a reduction in the amount of non-resident tax withholding.

Q: What is the purpose of Form NR5?

A: The purpose of Form NR5 is to reduce the amount of non-resident tax required to be withheld from income earned in Canada by non-residents.

Q: What information is required on Form NR5?

A: Form NR5 requires information such as the taxpayer's name, address, country of residence, and details about the income to be earned in Canada.

Q: Is there a deadline for submitting Form NR5?

A: Yes, Form NR5 should be submitted to the CRA before the first payment of income subject to non-resident tax withholding is made.

Q: Can Form NR5 be used for multiple tax years?

A: No, a separate Form NR5 must be submitted for each tax year.

Q: What happens after submitting Form NR5?

A: The CRA will review the application and determine the amount of non-resident tax withholding to be reduced.

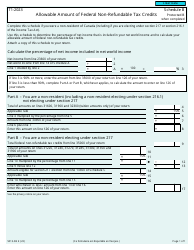

Q: Are there any exemptions from non-resident tax withholding?

A: Yes, certain exemptions may apply depending on the taxpayer's country of residence and the type of income being earned in Canada. Form NR5 can be used to claim these exemptions.