This version of the form is not currently in use and is provided for reference only. Download this version of

Form NR73

for the current year.

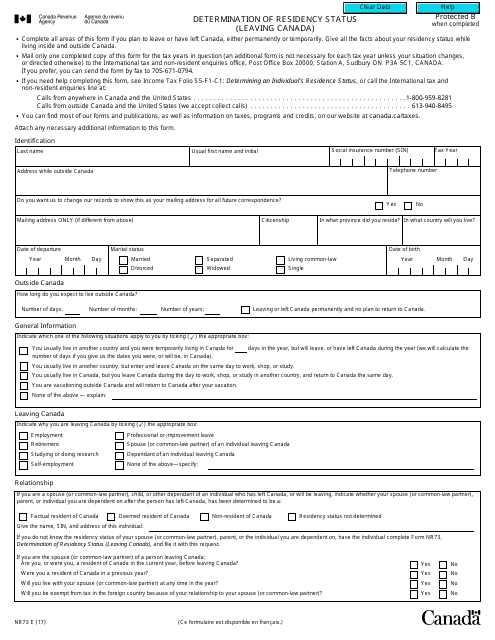

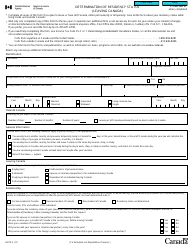

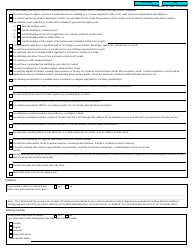

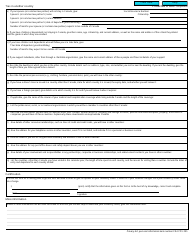

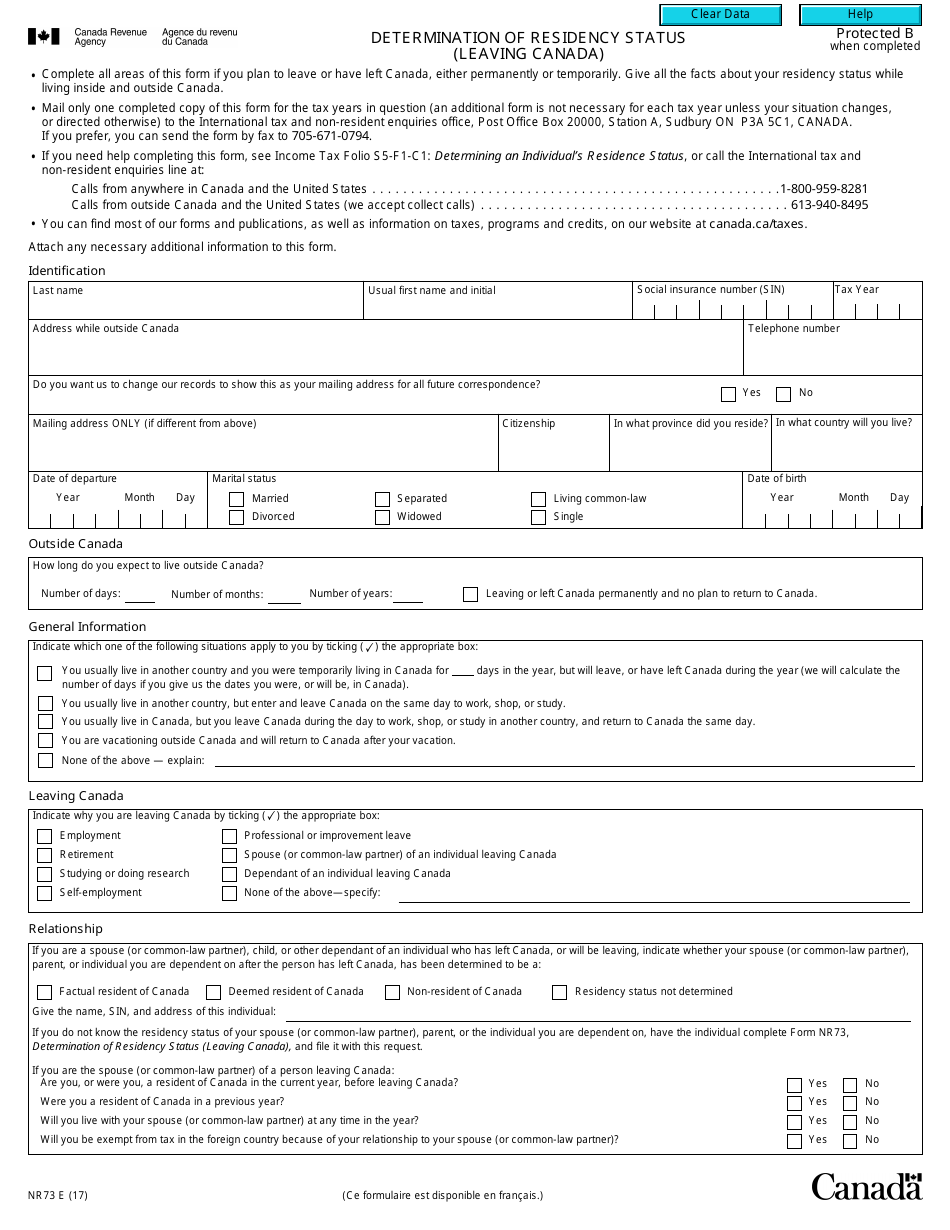

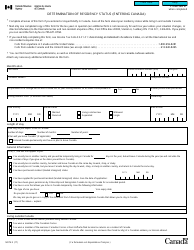

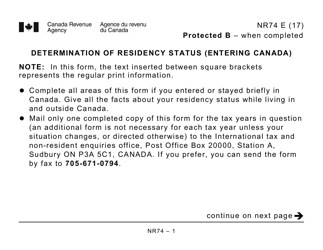

Form NR73 Determination of Residency Status (Leaving Canada) - Canada

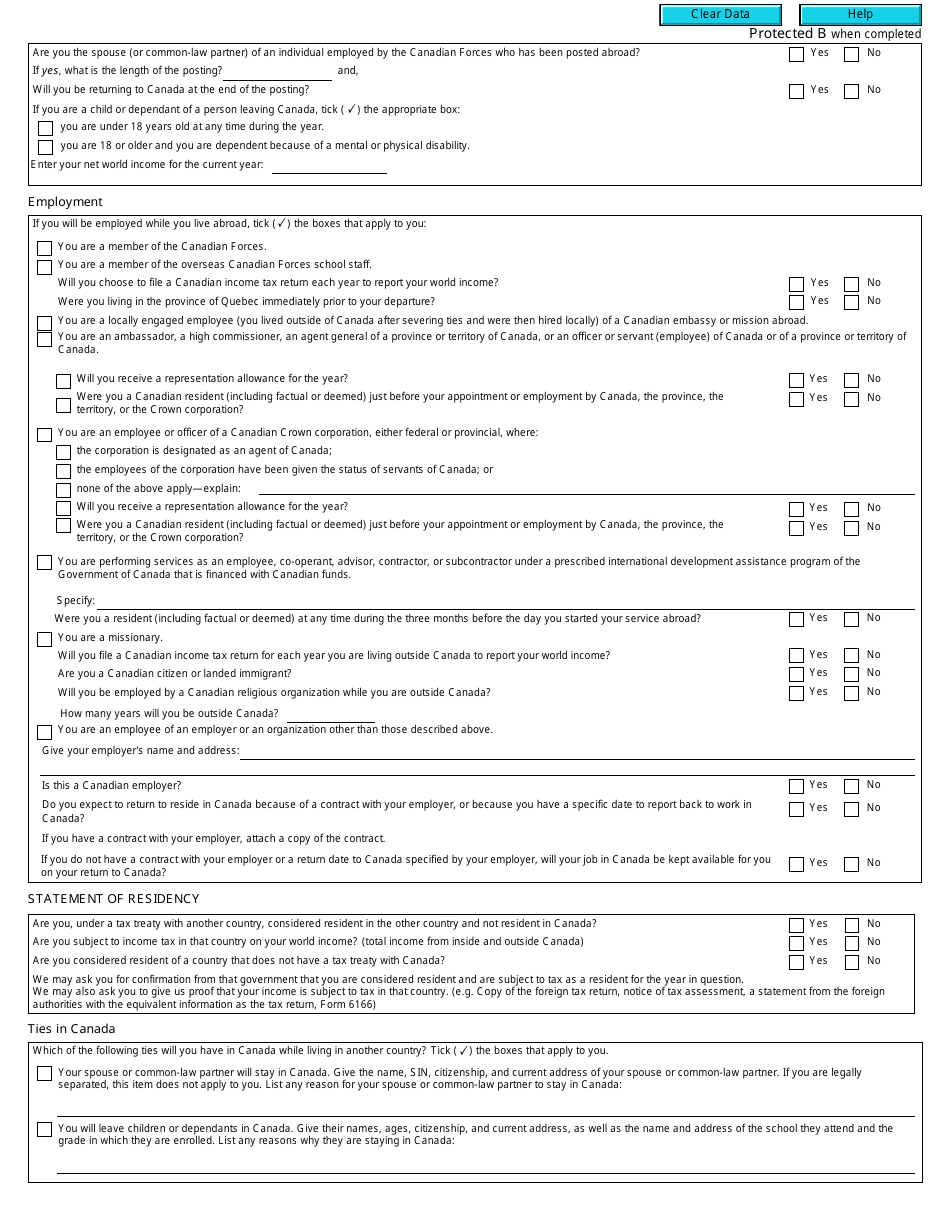

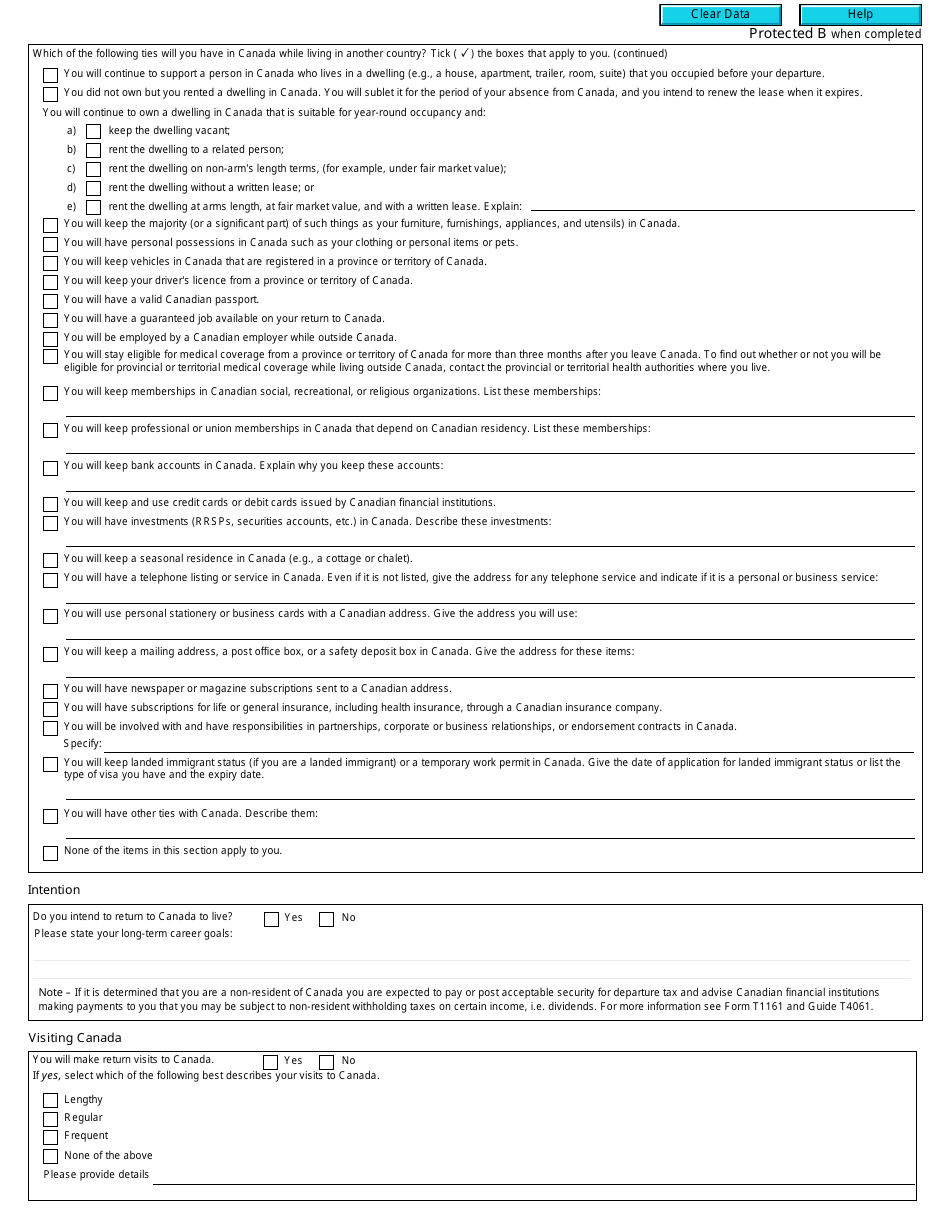

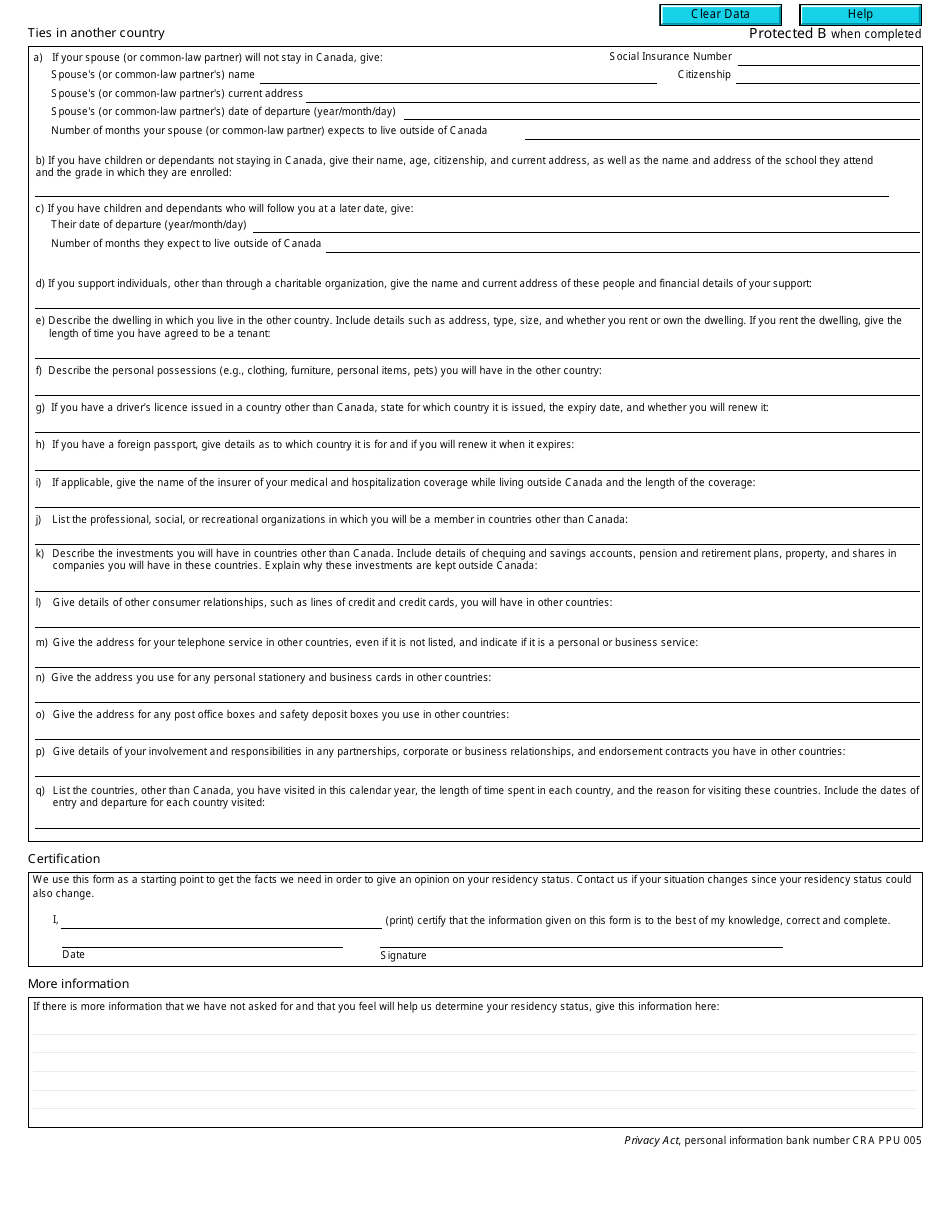

Form NR73, Determination of Residency Status (Leaving Canada), is used in Canada to determine an individual's residency status when they leave the country. This form helps the Canadian government determine whether the person is considered a non-resident for tax purposes. It is important to complete this form accurately to avoid any potential tax consequences.

The individual who is leaving Canada would file the Form NR73 Determination of Residency Status.

FAQ

Q: What is Form NR73?

A: Form NR73 is a form used to determine your residency status when leaving Canada.

Q: Why is Form NR73 required?

A: Form NR73 is required to determine if you are still considered a resident of Canada for tax purposes after leaving the country.

Q: Who needs to complete Form NR73?

A: Form NR73 should be completed by individuals who are planning to leave Canada and want to know if they will still be considered a resident for tax purposes.

Q: What information is required on Form NR73?

A: Form NR73 requires information about your residency status, planned departure date, ties to Canada, and future plans.

Q: How do I submit Form NR73?

A: Form NR73 should be submitted to the International Tax Services Office (ITSO) of the Canada Revenue Agency (CRA) either by mail or fax.

Q: What happens after submitting Form NR73?

A: After submitting Form NR73, the CRA will review your information and provide a determination of your residency status.

Q: What is the purpose of determining residency status?

A: Determining residency status is important for tax purposes as it determines if you need to pay taxes in Canada or if you are no longer a resident for tax purposes.

Q: How long does it take to get a determination of residency status?

A: The processing time for Form NR73 varies, but it typically takes several weeks.

Q: What should I do if my residency status changes?

A: If your residency status changes after submitting Form NR73, you should inform the CRA as soon as possible.

Q: Can I appeal a determination of residency status?

A: Yes, if you disagree with the determination of your residency status, you have the right to appeal by submitting a Notice of Objection to the CRA.