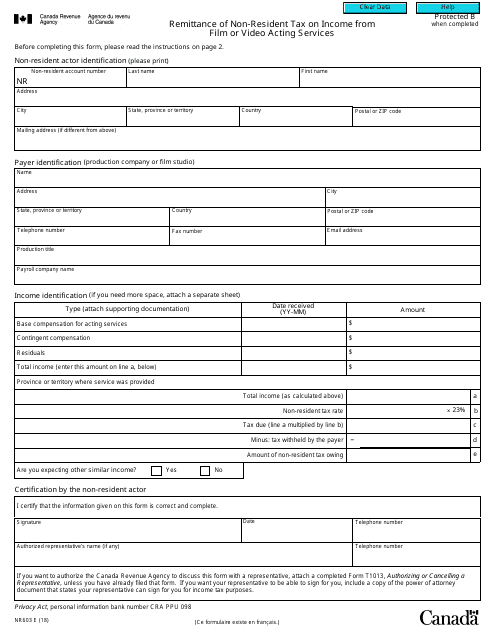

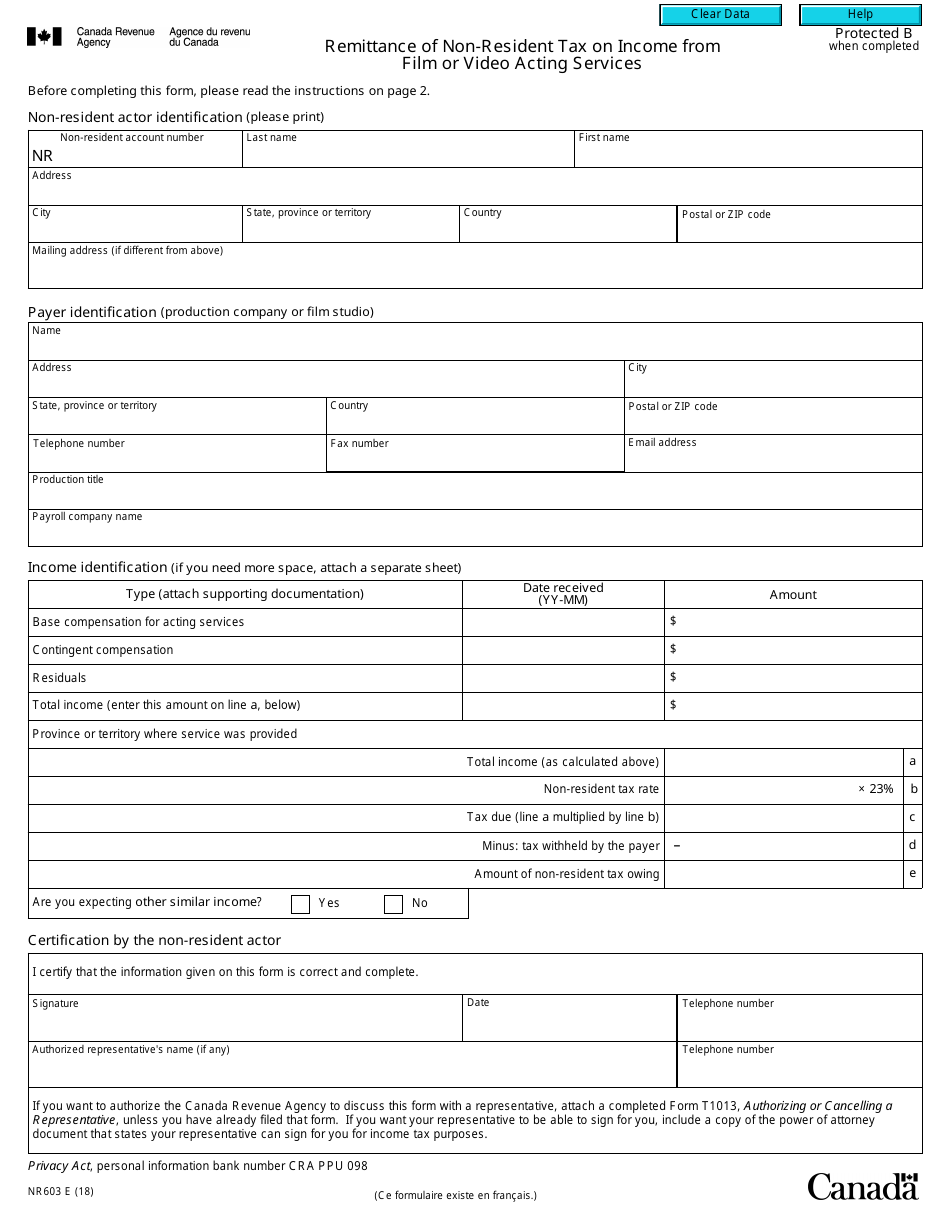

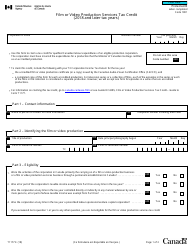

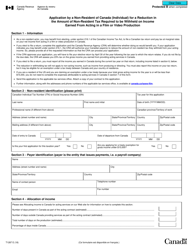

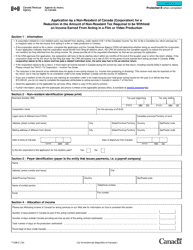

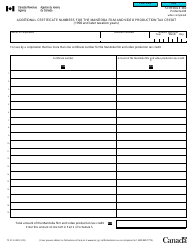

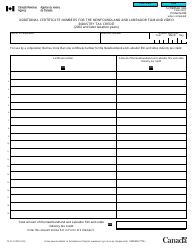

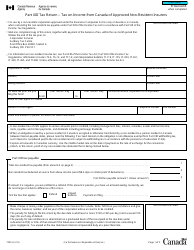

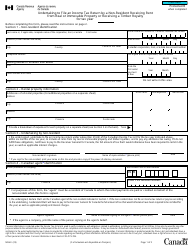

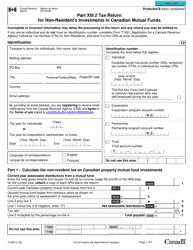

Form NR603 Remittance of Non-resident Tax on Income From Film or Video Acting Services - Canada

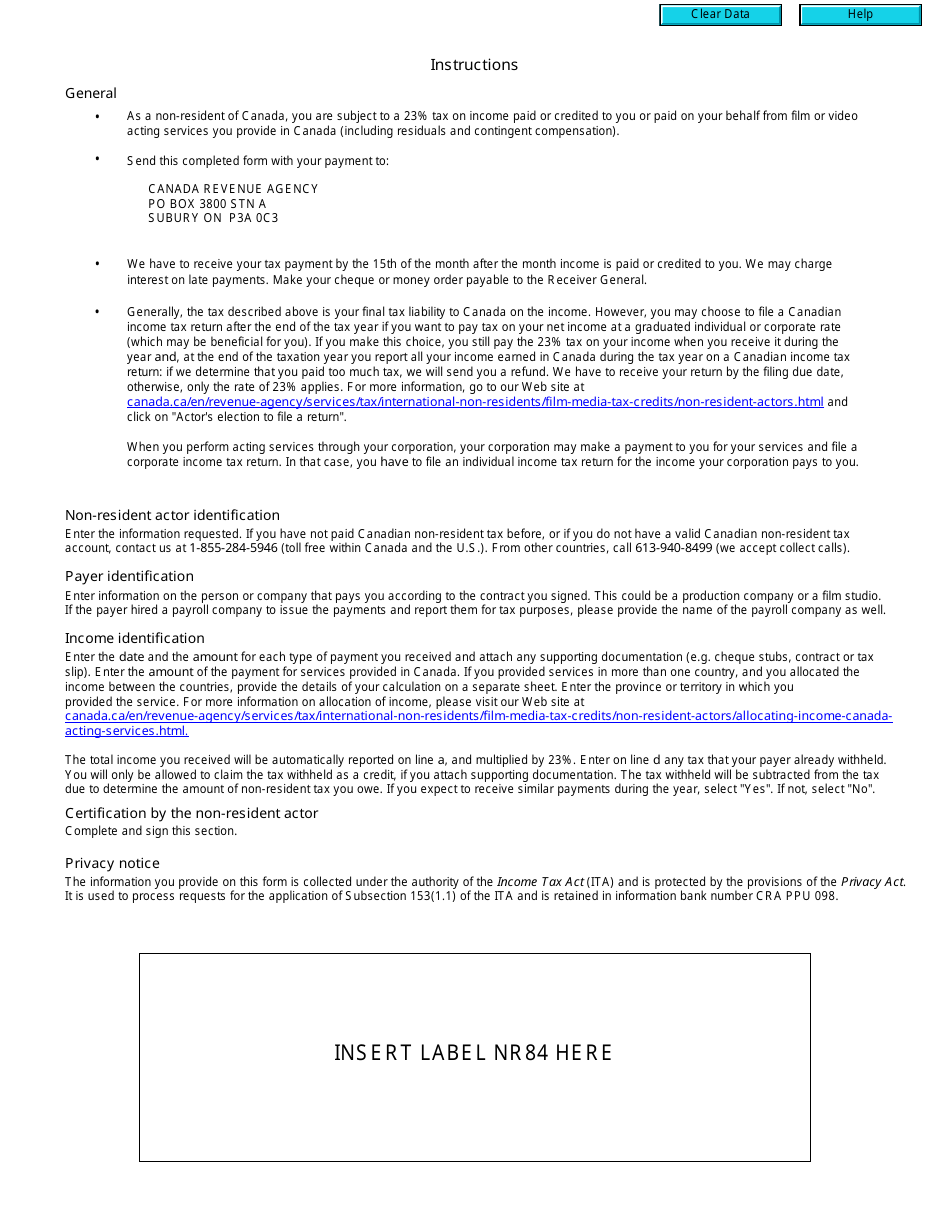

Form NR603, Remittance of Non-resident Tax on Income From Film or Video Acting Services, is used in Canada to report and remit taxes on income earned by non-resident individuals from acting services in film or video productions.

The Form NR603 Remittance of Non-resident Tax on Income From Film or Video Acting Services in Canada is typically filed by non-resident actors who have earned income from film or video acting services in Canada.

FAQ

Q: What is Form NR603?

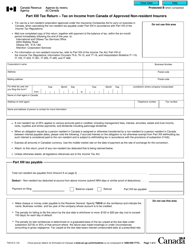

A: Form NR603 is used for remittance of non-resident tax on income from film or video acting services in Canada.

Q: Who needs to file Form NR603?

A: Non-resident individuals earning income from film or video acting services in Canada need to file Form NR603.

Q: What is the purpose of Form NR603?

A: The purpose of Form NR603 is to remit non-resident tax on income earned from film or video acting services in Canada.

Q: Can non-residents claim any deductions on Form NR603?

A: No, non-residents cannot claim any deductions on Form NR603.

Q: How can Form NR603 be filed?

A: Form NR603 can be filed electronically or by mail to the International and Ottawa Tax Services Office.