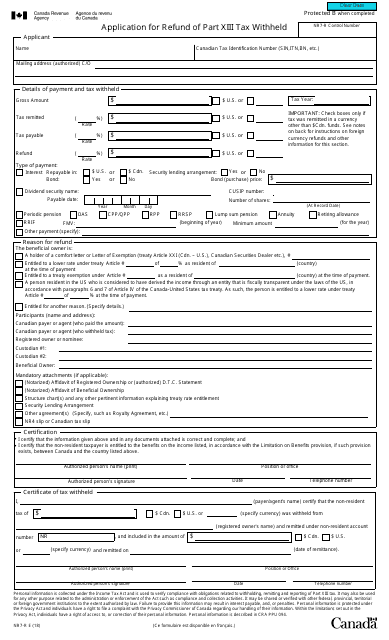

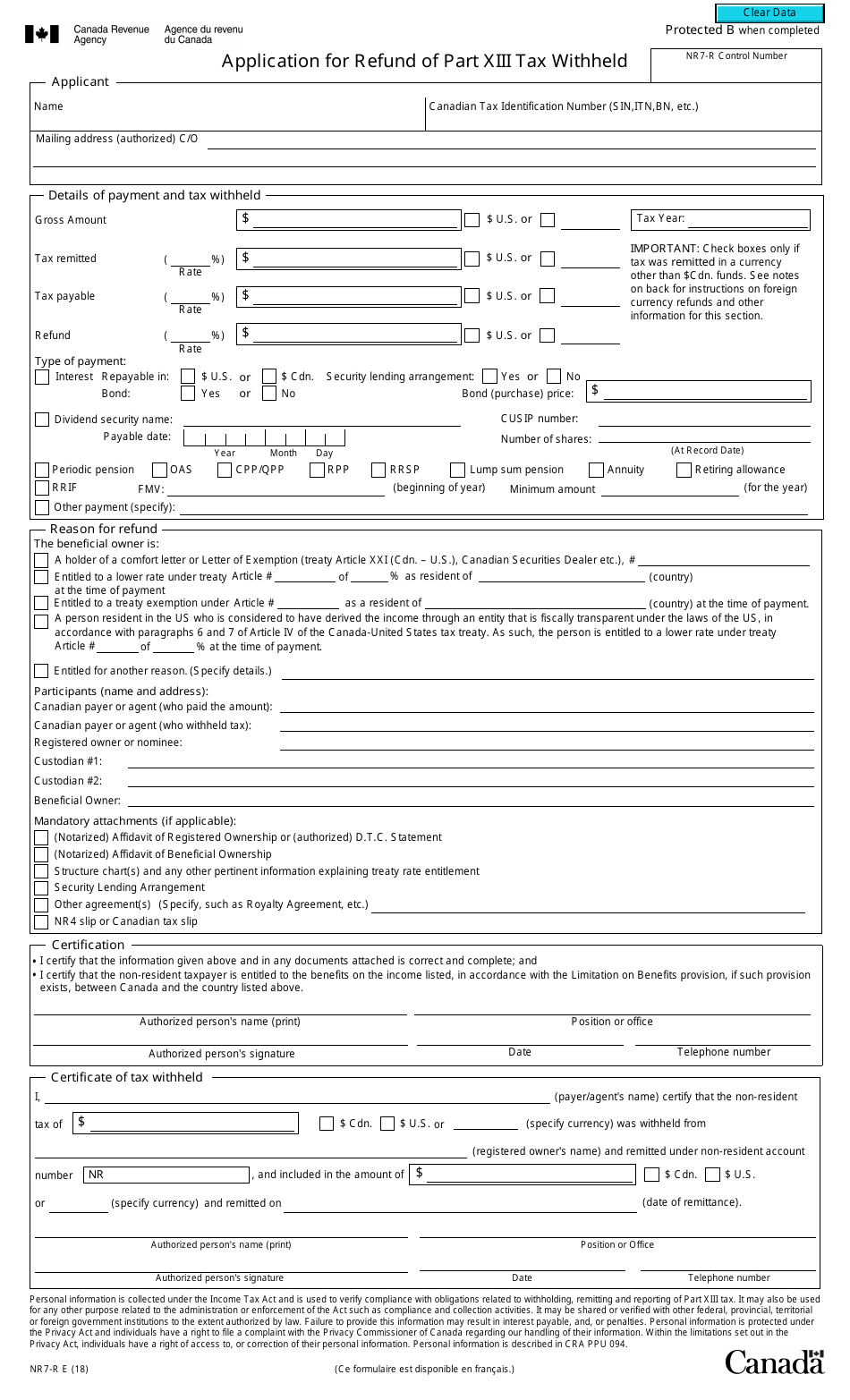

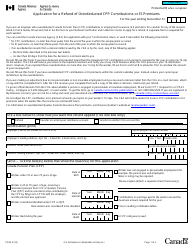

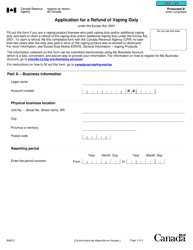

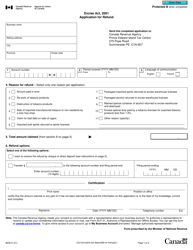

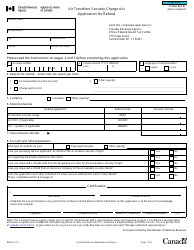

Form NR7-R Application for Refund Part Xiii Tax Withheld - Canada

Form NR7-R is the Application for Refund of Part XIII Tax Withheld in Canada. It is used by non-residents of Canada to claim a refund of tax that was withheld on certain types of Canadian income, such as dividends, interest, royalties, and rent.

The Form NR7-R Application for Refund Part XIII Tax Withheld in Canada is filed by the non-resident beneficiary.

FAQ

Q: What is Form NR7-R?

A: Form NR7-R is an application for refund of Part XIII tax withheld in Canada.

Q: What is Part XIII tax?

A: Part XIII tax refers to the tax withheld from certain types of income paid to non-residents of Canada.

Q: Who can use Form NR7-R?

A: Form NR7-R can be used by non-residents of Canada who are eligible for a refund of the Part XIII tax withheld.

Q: What information is required in Form NR7-R?

A: Form NR7-R requires information such as the taxpayer's name, address, country of residence, and details of the Part XIII tax withheld.

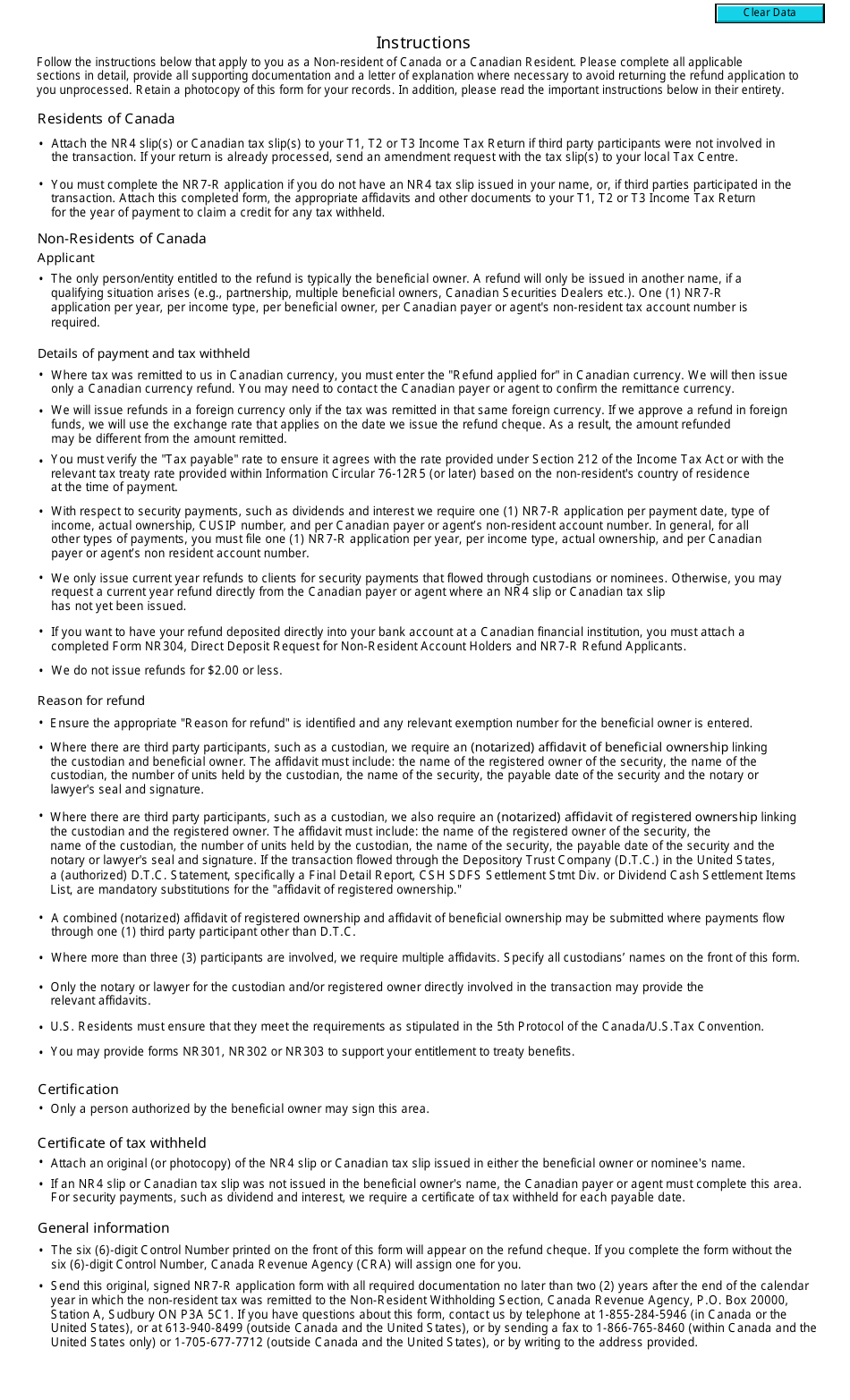

Q: How should Form NR7-R be submitted?

A: Form NR7-R should be completed and mailed to the tax services office of the CRA.

Q: Is there a deadline for submitting Form NR7-R?

A: Yes, Form NR7-R should be submitted within two years from the end of the year in which the Part XIII tax was withheld.

Q: Can I claim a refund if I am a resident of the United States?

A: Yes, residents of the United States can claim a refund of the Part XIII tax withheld in Canada.

Q: Are there any specific requirements for claiming a refund?

A: Yes, there are specific requirements for claiming a refund, such as providing a valid tax identification number for the United States.

Q: Will I receive the full amount of Part XIII tax withheld as a refund?

A: The refund amount may be subject to certain deductions or adjustments as per the tax laws of Canada.

Q: How long does it take to receive a refund?

A: The processing time for a refund can vary, but it usually takes several weeks to receive the refund.

Q: What should I do if my refund application is denied?

A: If your refund application is denied, you can contact the CRA for further assistance or to discuss your options.

Q: Can I file Form NR7-R electronically?

A: No, Form NR7-R cannot be filed electronically and must be submitted by mail.

Q: Can I claim a refund for Part XIII tax withheld for multiple years?

A: Yes, you can claim a refund for Part XIII tax withheld in multiple years by submitting separate applications for each year.

Q: Is there a fee for submitting Form NR7-R?

A: No, there is no fee for submitting Form NR7-R.

Q: Can I use Form NR7-R to claim a refund for other types of taxes withheld?

A: No, Form NR7-R is specifically for claiming a refund of Part XIII tax withheld.