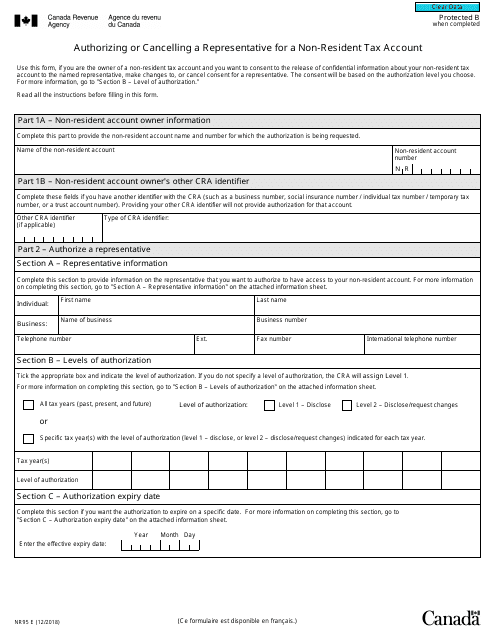

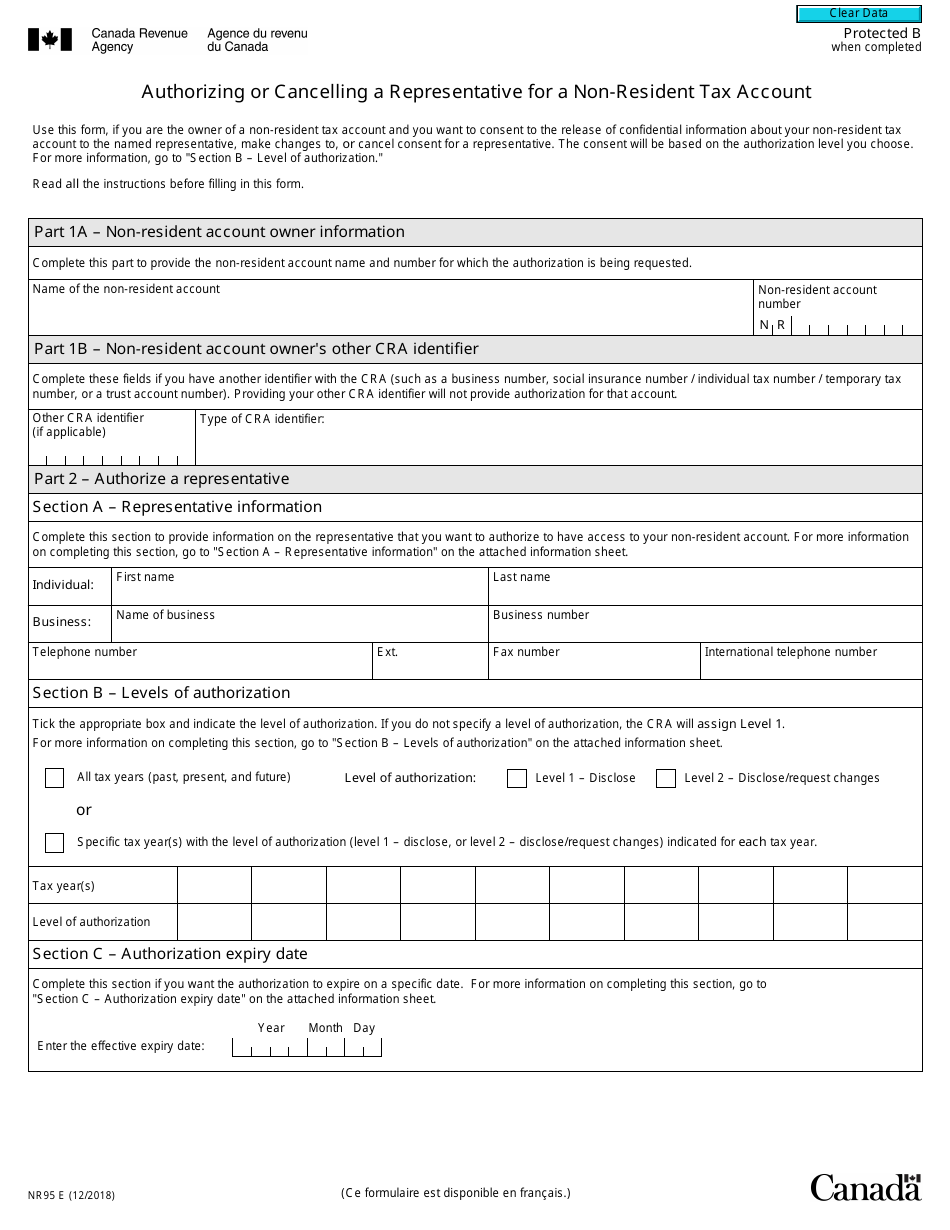

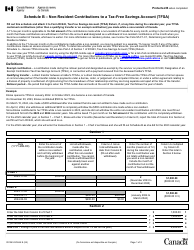

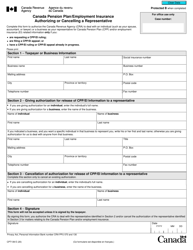

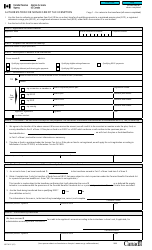

Form NR95 Authorizing or Cancelling a Representative for a Non-resident Tax Account - Canada

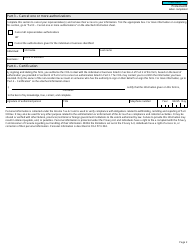

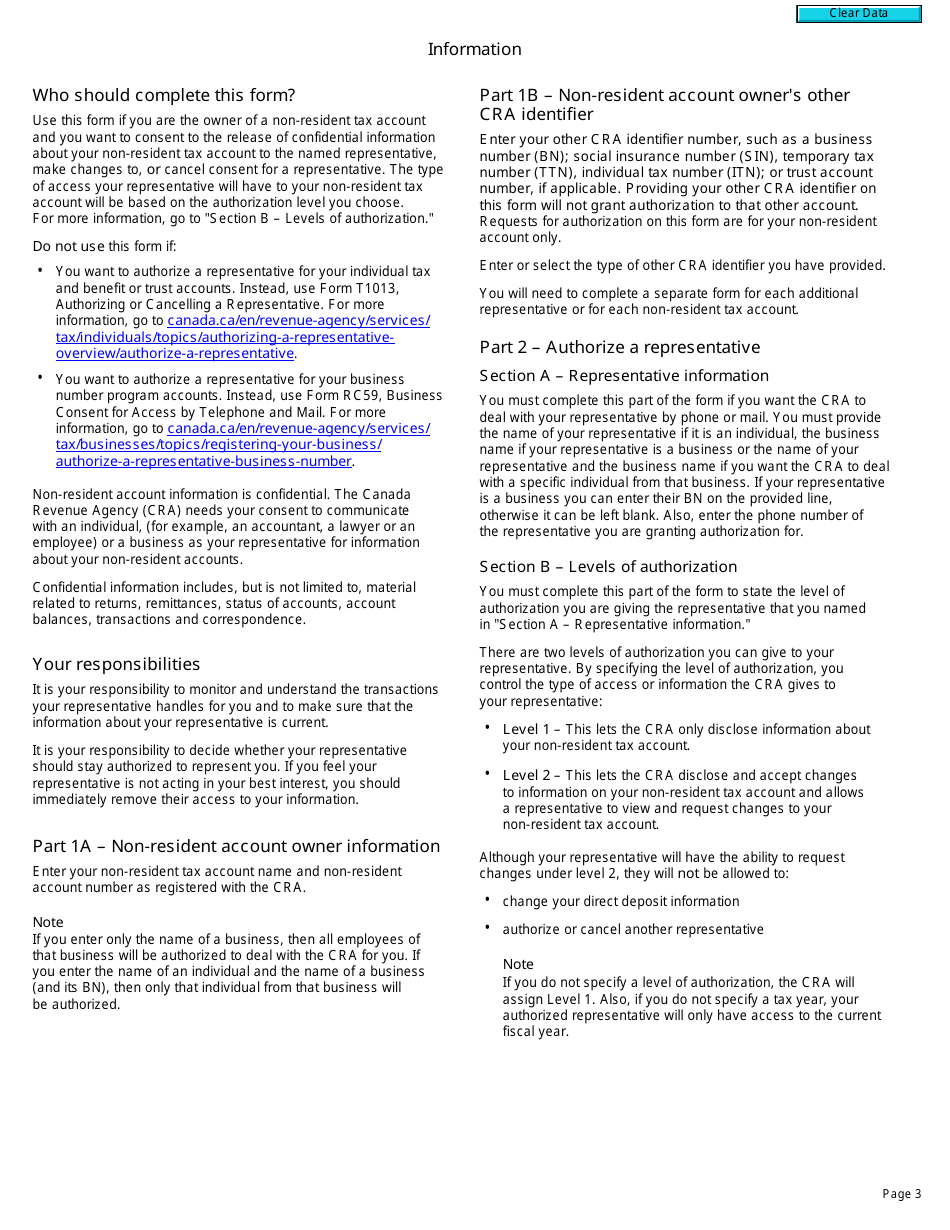

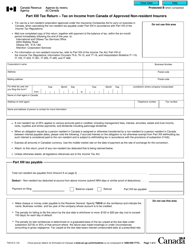

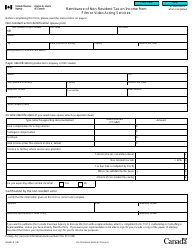

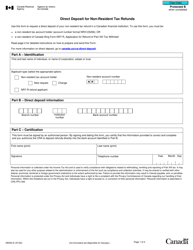

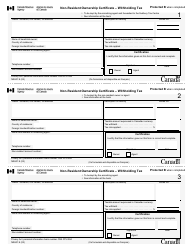

Form NR95 "Authorizing or Cancelling a Representative for a Non-resident Tax Account" in Canada is used to appoint or cancel a representative who will act on behalf of a non-resident taxpayer for tax matters with the Canada Revenue Agency (CRA). The representative can be authorized to handle various tax-related tasks, such as submitting tax returns, making tax payments, and corresponding with the CRA.

The Form NR95 for authorizing or cancelling a representative for a non-resident tax account in Canada is filed by the non-resident taxpayer.

FAQ

Q: What is Form NR95?

A: Form NR95 is a document that authorizes or cancels a representative for a non-resident tax account in Canada.

Q: Who can use Form NR95?

A: Form NR95 can be used by non-residents who need to authorize or cancel a representative for their tax account in Canada.

Q: How can I use Form NR95?

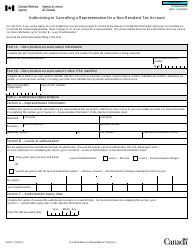

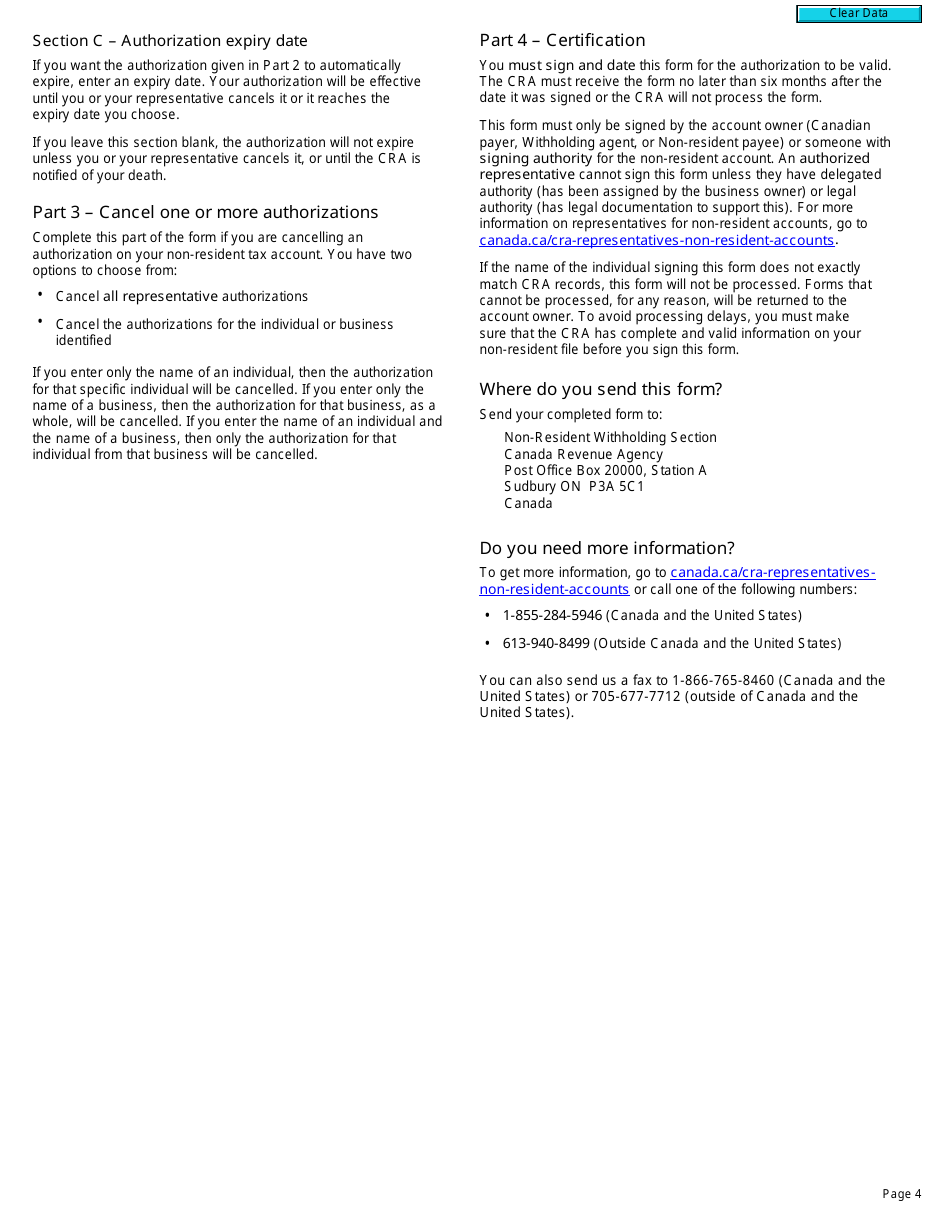

A: To use Form NR95, you need to fill out the required information, including your personal details and the details of the representative you want to authorize or cancel.

Q: What is the purpose of authorizing a representative?

A: Authorizing a representative allows them to act on your behalf and handle tax matters related to your non-resident tax account in Canada.

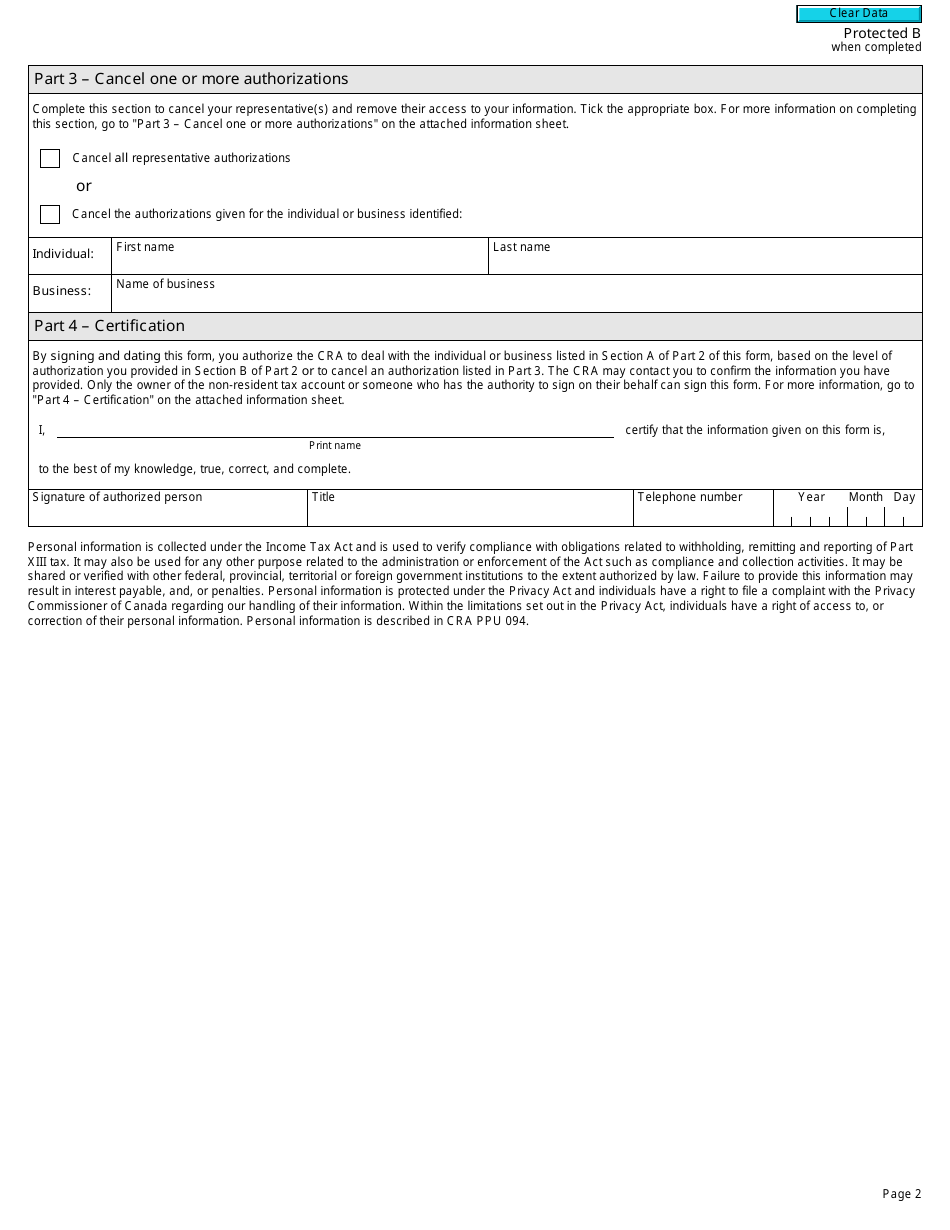

Q: What is the purpose of canceling a representative?

A: Canceling a representative revokes their authority to act on your behalf for your non-resident tax account in Canada.

Q: Are there any fees associated with Form NR95?

A: No, there are no fees associated with Form NR95.

Q: Can I authorize multiple representatives using Form NR95?

A: Yes, you can authorize multiple representatives by including their details on the form.

Q: Is Form NR95 only applicable to non-residents?

A: Yes, Form NR95 is specifically designed for non-residents who have a tax account in Canada.