This version of the form is not currently in use and is provided for reference only. Download this version of

Form ON100

for the current year.

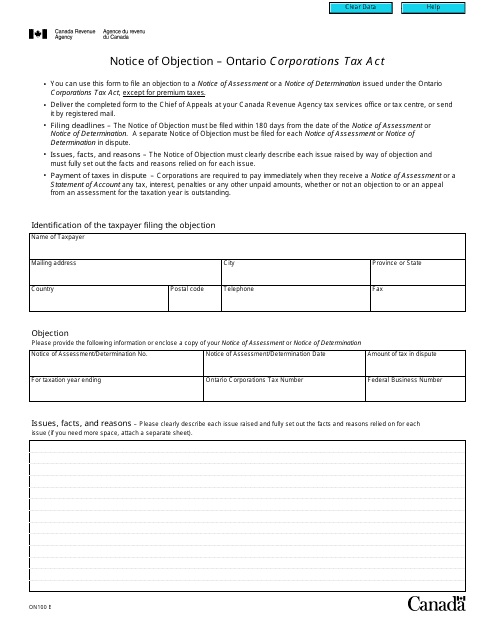

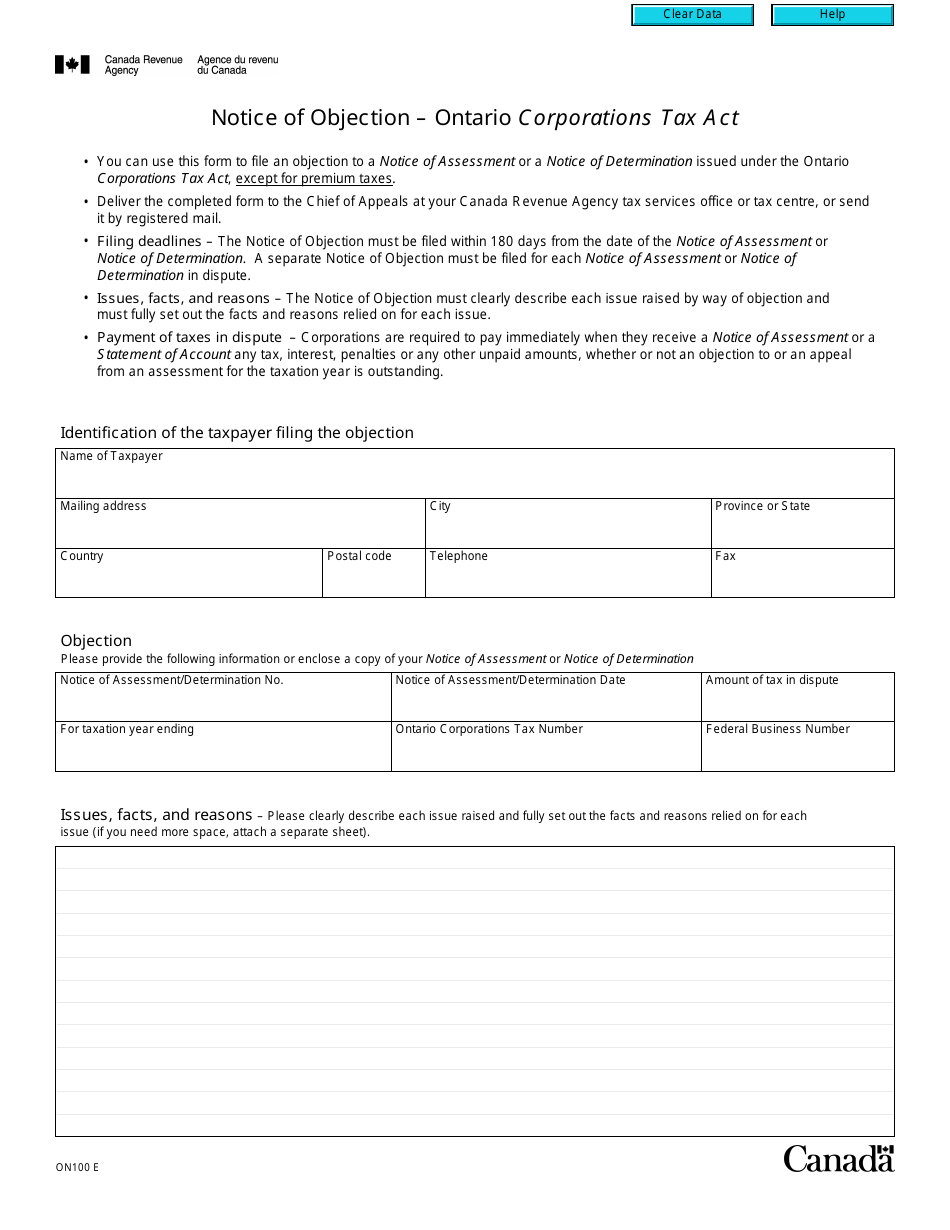

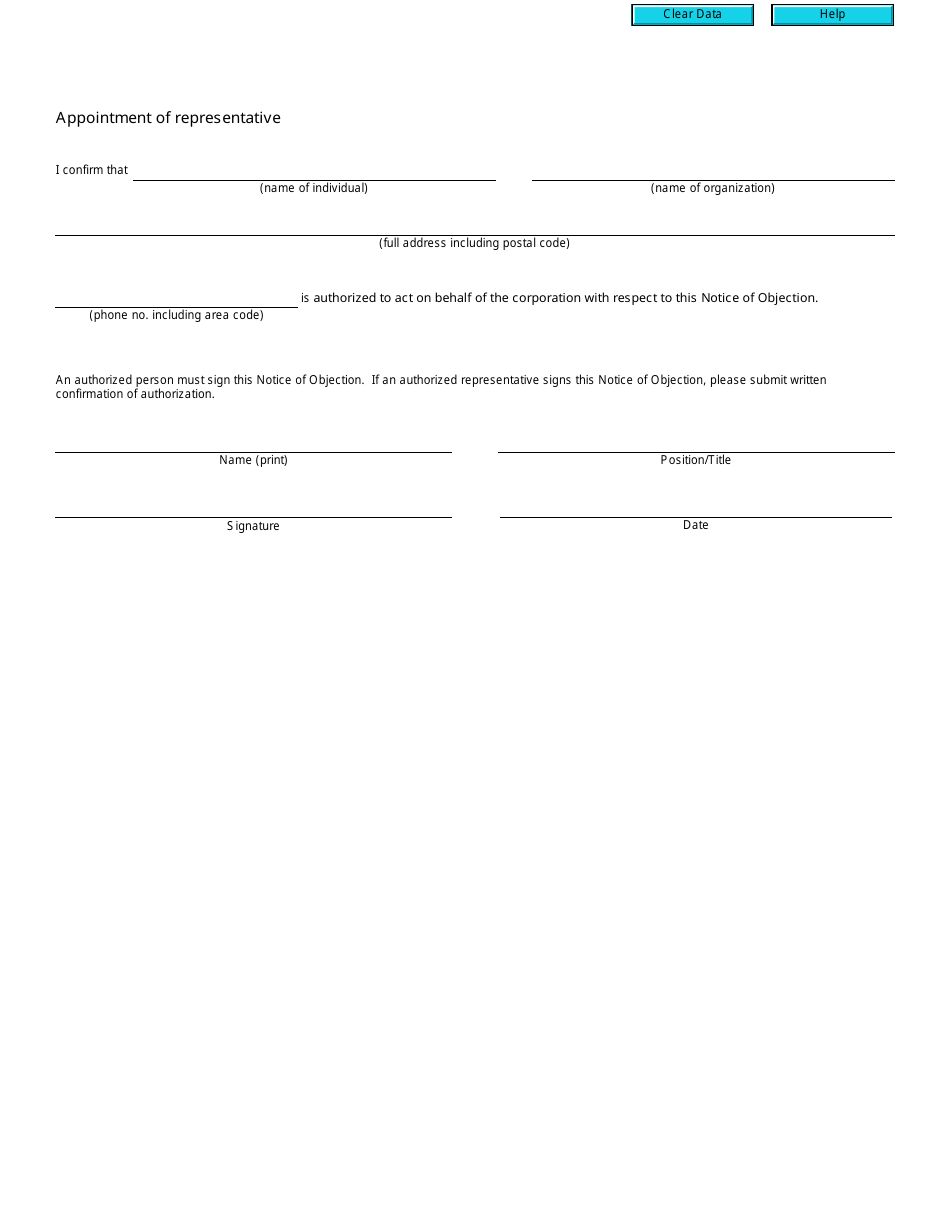

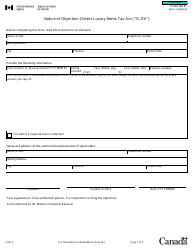

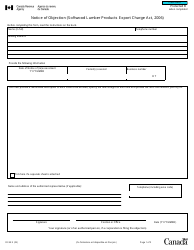

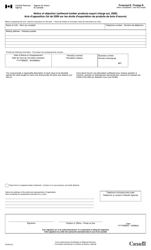

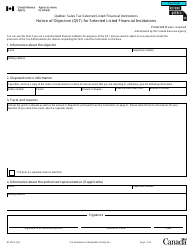

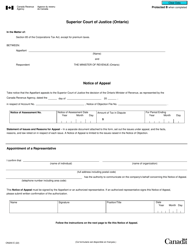

Form ON100 Notice of Objection - Ontario Corporations Tax Act - Canada

Form ON100 Notice of Objection is used in Ontario, Canada for taxpayers who wish to formally challenge an assessment or decision made by the Ontario Ministry of Finance regarding their corporations tax under the Ontario Corporations Tax Act.

The Form ON100 Notice of Objection is filed by corporations in Ontario, Canada, who want to object to the assessment or determination made by the Ontario Corporations Tax Act.

FAQ

Q: What is Form ON100?

A: Form ON100 is the Notice of Objection form used for objecting to an assessment under the Ontario Corporations Tax Act in Canada.

Q: What is the Ontario Corporations Tax Act?

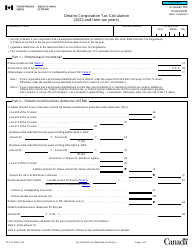

A: The Ontario Corporations Tax Act is a tax law in Canada that imposes a tax on the taxable income of corporations doing business in Ontario.

Q: When should I use Form ON100?

A: You should use Form ON100 when you want to object to an assessment made under the Ontario Corporations Tax Act.

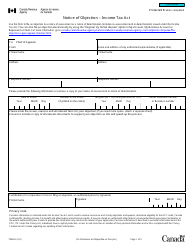

Q: What information should I include in Form ON100?

A: You should include your name, address, tax account number, a detailed explanation of your objection, and any supporting documents.