This version of the form is not currently in use and is provided for reference only. Download this version of

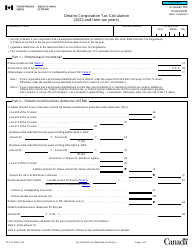

Form ON200

for the current year.

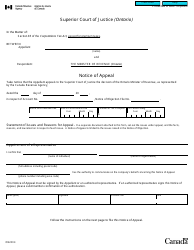

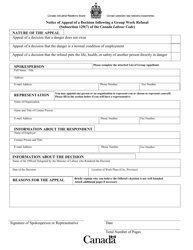

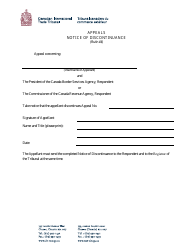

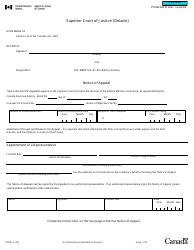

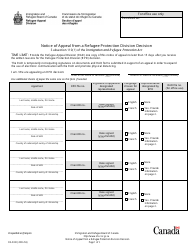

Form ON200 Notice of Appeal - Ontario Corporations Tax Act - Canada

Form ON200 Notice of Appeal - Ontario Corporations Tax Act - Canada is used to initiate an appeal by a corporation against an assessment made under the Ontario Corporations Tax Act. The form is filed with the Ontario Ministry of Finance to challenge the assessment and request a review or hearing.

The Form ON200 Notice of Appeal for Ontario Corporations Tax Act in Canada is typically filed by corporations who want to appeal a decision or assessment related to their tax obligations.

FAQ

Q: What is Form ON200?

A: Form ON200 is a Notice of Appeal form used in Ontario, Canada for appealing decisions related to the Ontario Corporations Tax Act.

Q: What is the purpose of Form ON200?

A: The purpose of Form ON200 is to initiate the appeals process for individuals or corporations dissatisfied with decisions made under the Ontario Corporations Tax Act.

Q: Who should complete Form ON200?

A: Individuals or corporations who want to appeal decisions made under the Ontario Corporations Tax Act should complete Form ON200.

Q: What information is required on Form ON200?

A: Form ON200 requires information such as the appellant's name, address, contact details, the date of the decision being appealed, the reasons for the appeal, and any supporting documentation.

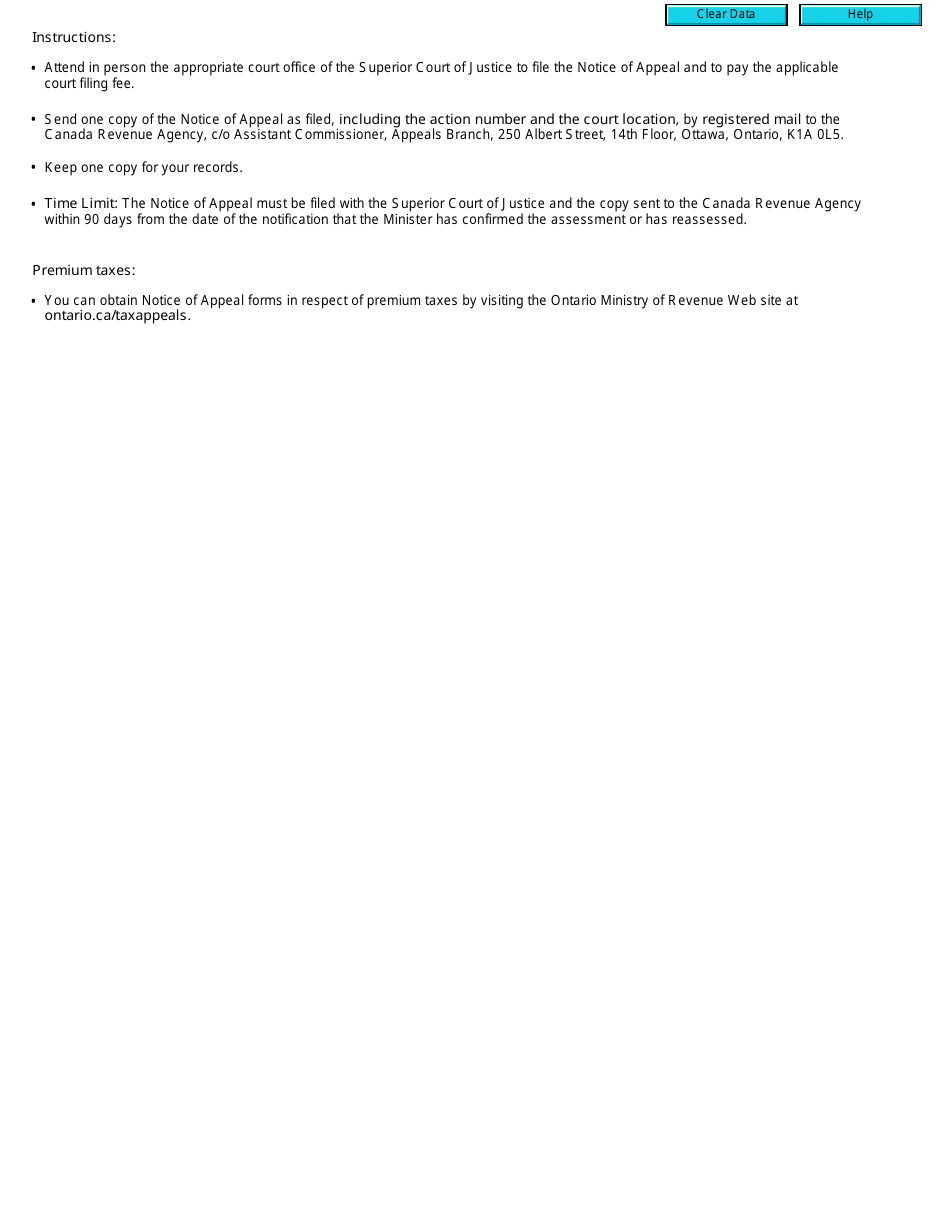

Q: Is there a deadline for submitting Form ON200?

A: Yes, there is a deadline for submitting Form ON200. It must be filed within 90 days from the date of the decision being appealed.

Q: What happens after Form ON200 is submitted?

A: After Form ON200 is submitted, it will be reviewed by the Ontario Ministry of Finance. The appellant will be notified of any further steps in the appeals process.

Q: Can I seek legal advice when completing Form ON200?

A: Yes, it is recommended to seek legal advice when completing Form ON200, especially if you are unfamiliar with the appeals process or require assistance with the information required.

Q: Can I withdraw my appeal after submitting Form ON200?

A: Yes, you can withdraw your appeal after submitting Form ON200 by notifying the Ontario Ministry of Finance in writing.