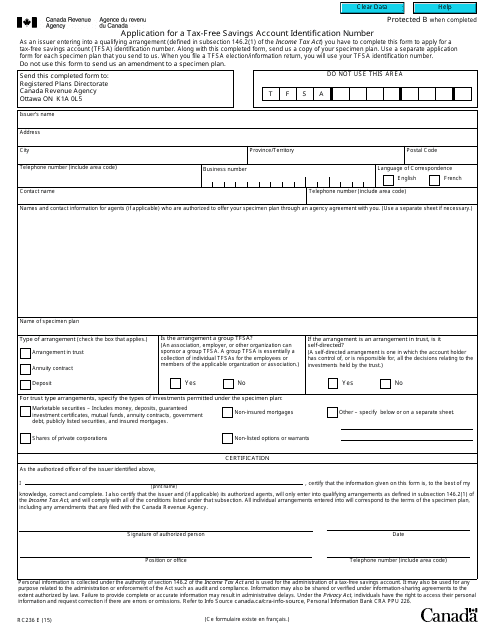

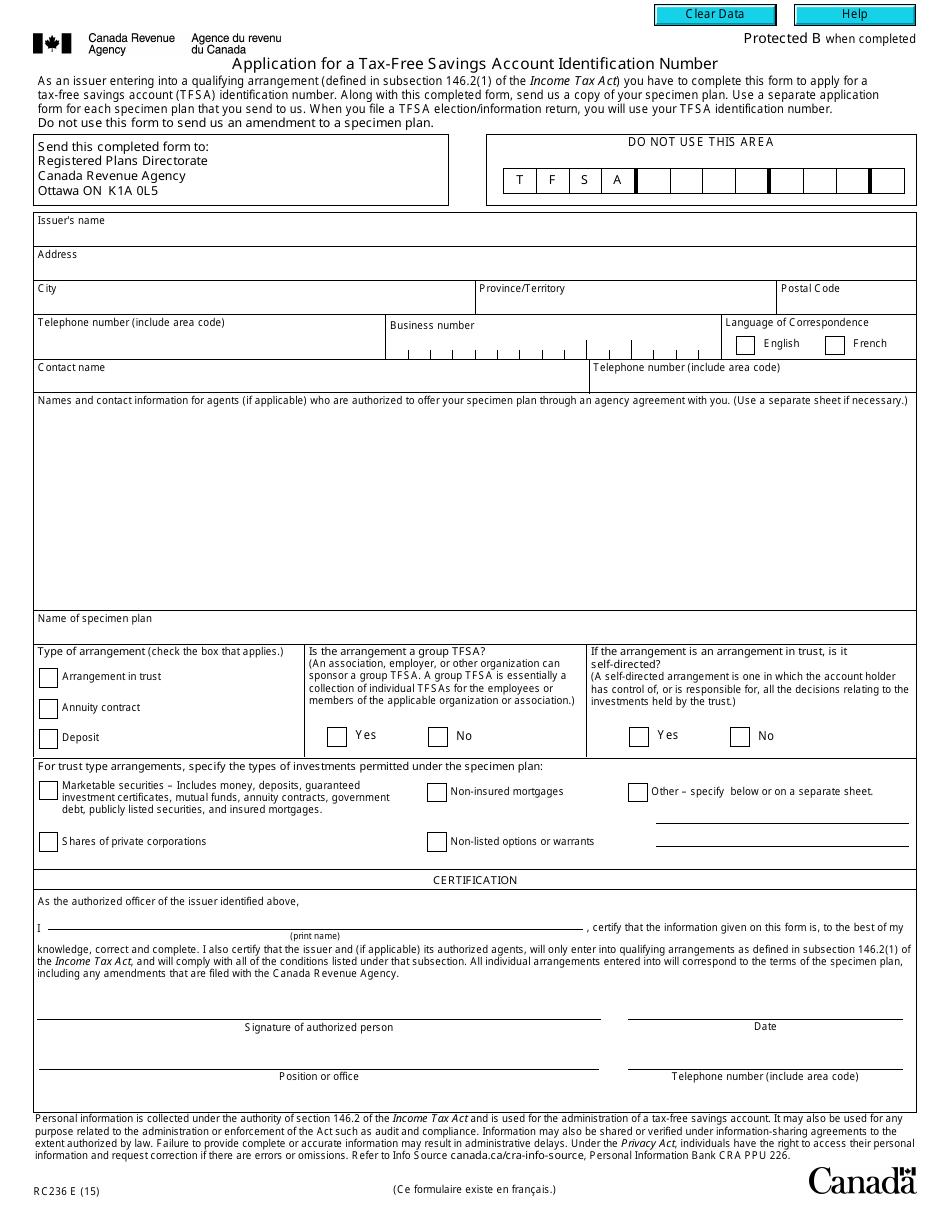

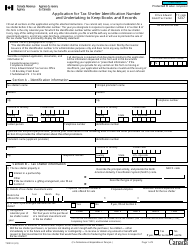

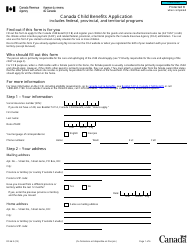

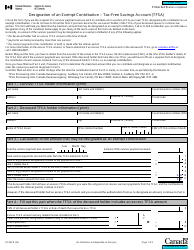

Form RC236 Application for a Tax-Free Savings Account Identification Number - Canada

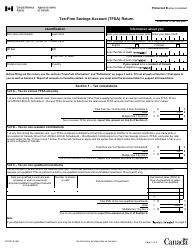

Form RC236 Application for a Tax-Free Savings Account Identification Number in Canada is used to apply for an identification number for a Tax-Free Savings Account (TFSA). It is used to open a TFSA and track contributions and withdrawals made from the account for tax purposes.

The individual who wants to open a tax-free savings account in Canada files the Form RC236 Application for a Tax-Free Savings Account Identification Number.

FAQ

Q: What is Form RC236?

A: Form RC236 is an application form used in Canada to obtain a Tax-Free Savings Account (TFSA) Identification Number.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a type of savings account in Canada that offers tax benefits on contributions and earnings.

Q: Who needs to fill out Form RC236?

A: Anyone who wants to open a Tax-Free Savings Account (TFSA) in Canada needs to fill out Form RC236.

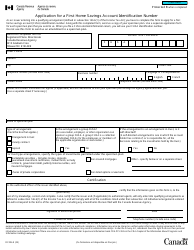

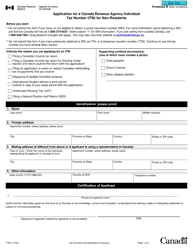

Q: What information is required on Form RC236?

A: Form RC236 requires personal information such as your name, social insurance number, and contact details, as well as information about your financial institution.

Q: Is there a fee to submit Form RC236?

A: No, there is no fee to submit Form RC236.

Q: How long does it take to process Form RC236?

A: The processing time for Form RC236 can vary, but it generally takes a few weeks for the Canada Revenue Agency (CRA) to issue a Tax-Free Savings Account (TFSA) Identification Number.