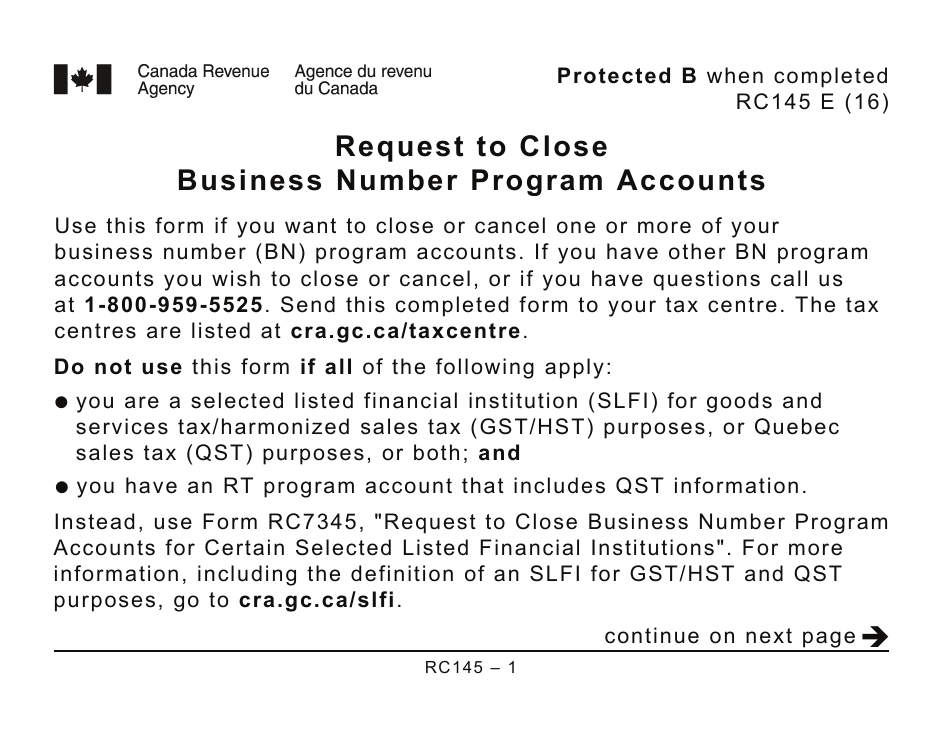

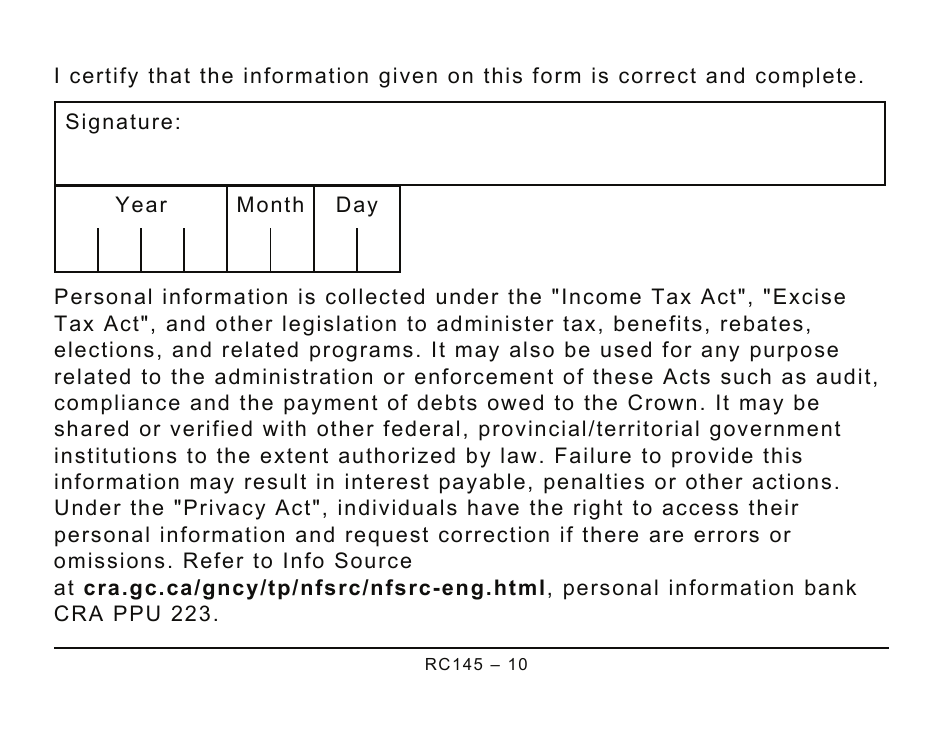

Form RC145 Request to Close Business Number Program Accounts (Large Print) - Canada

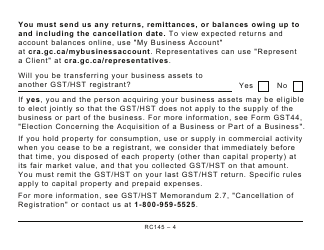

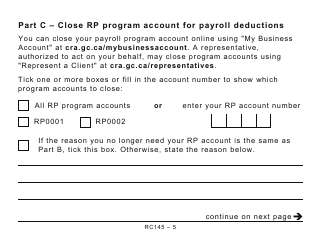

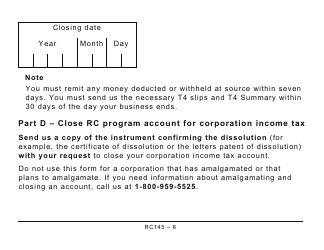

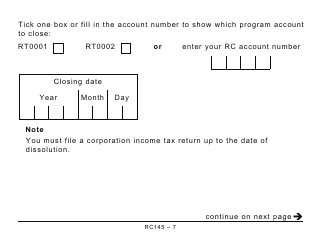

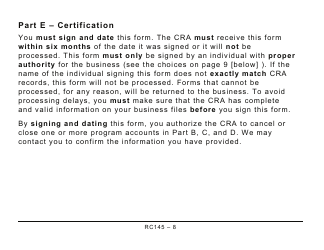

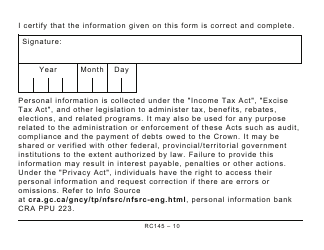

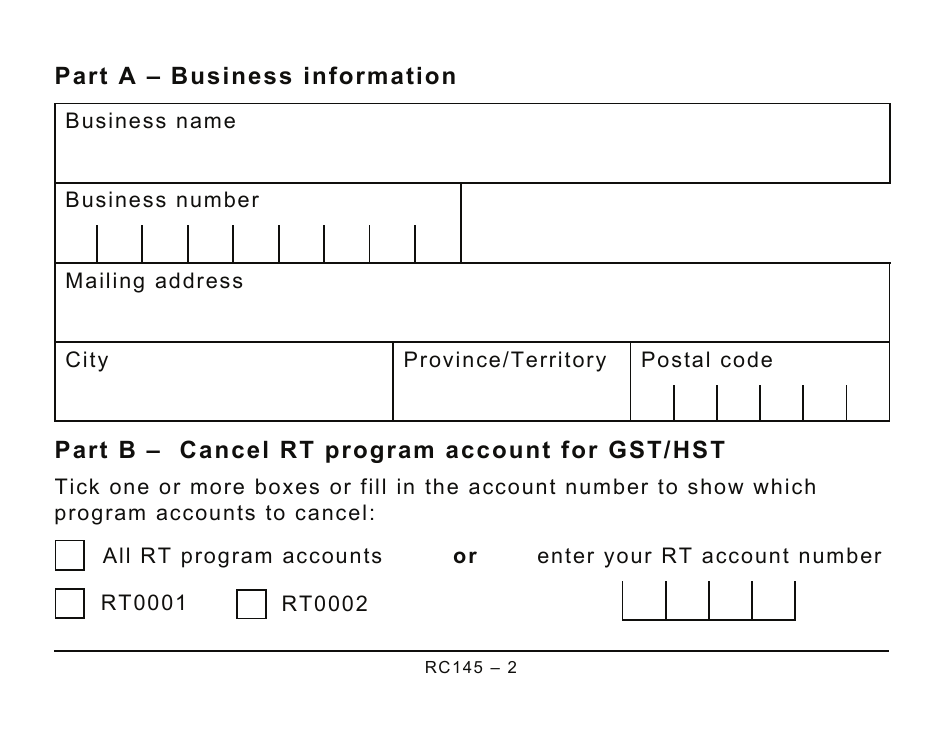

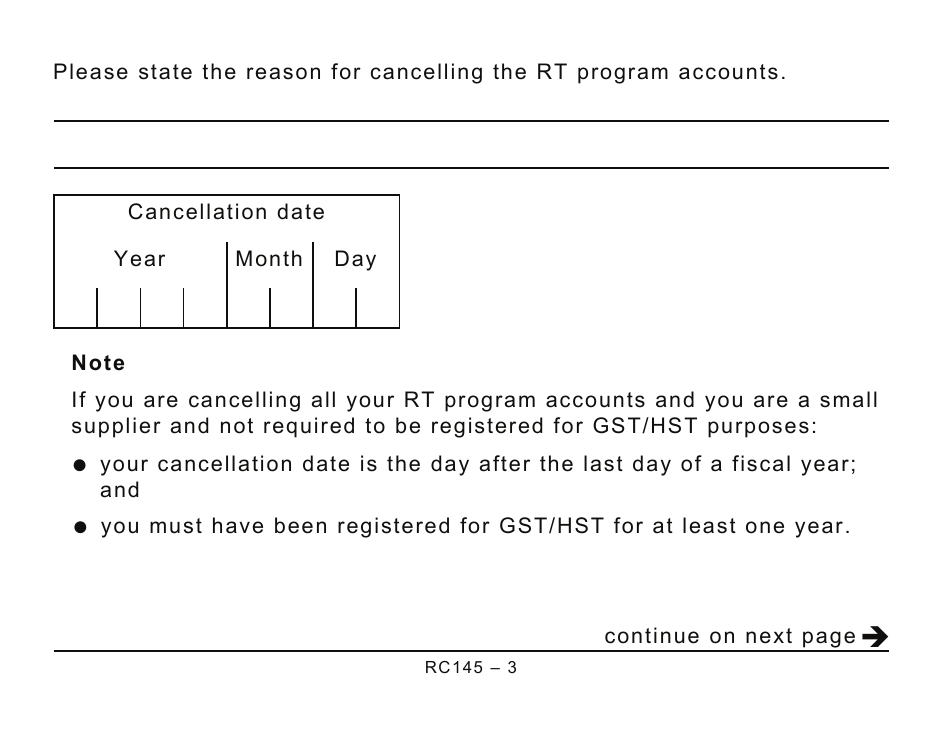

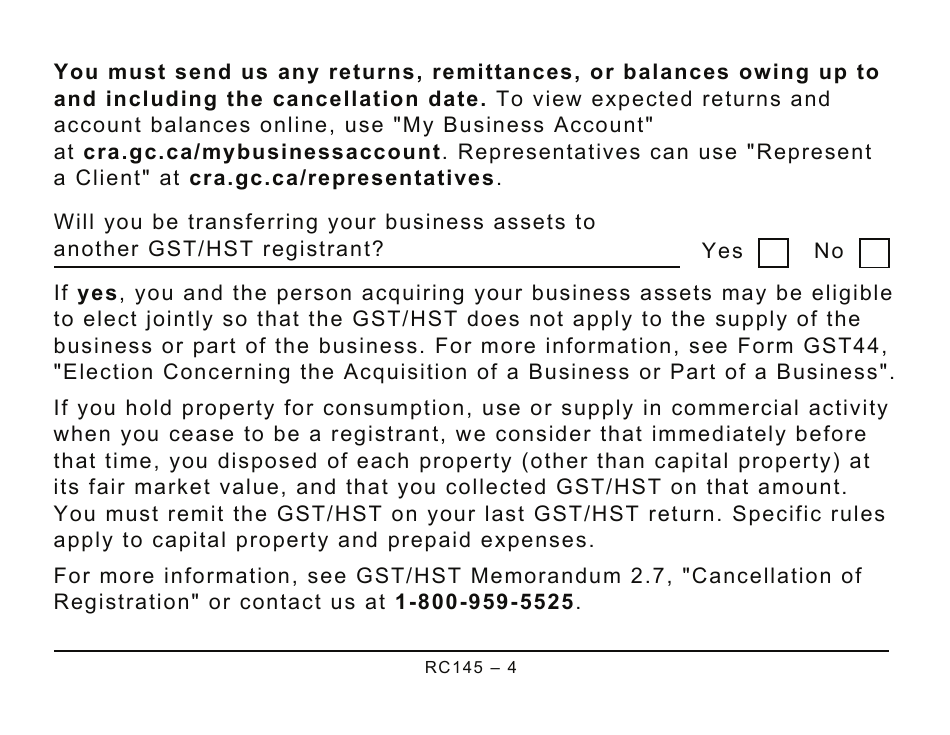

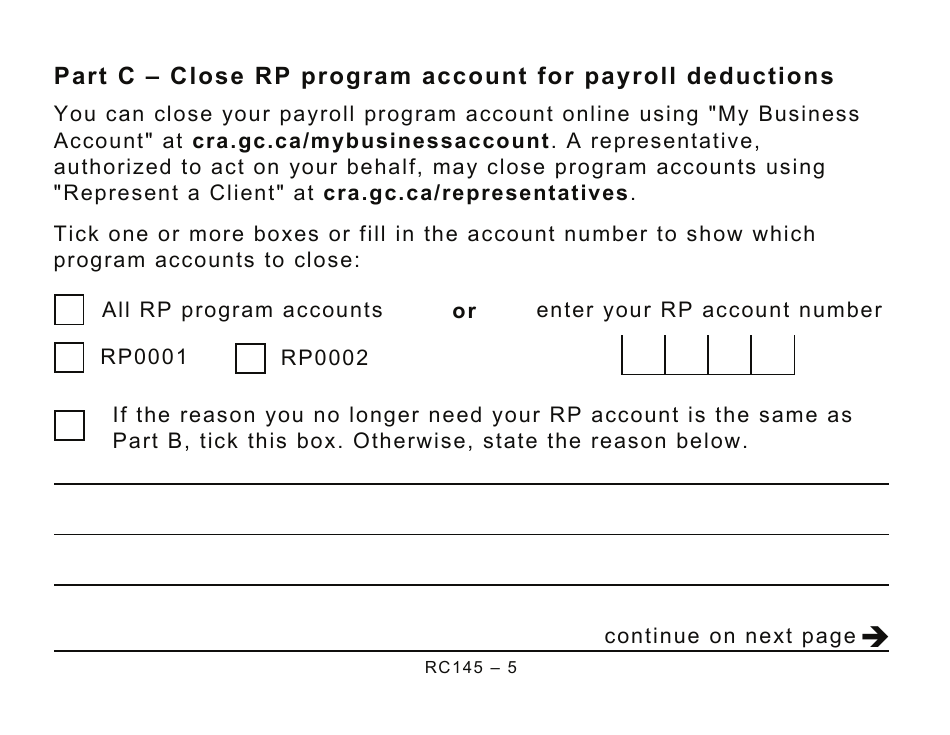

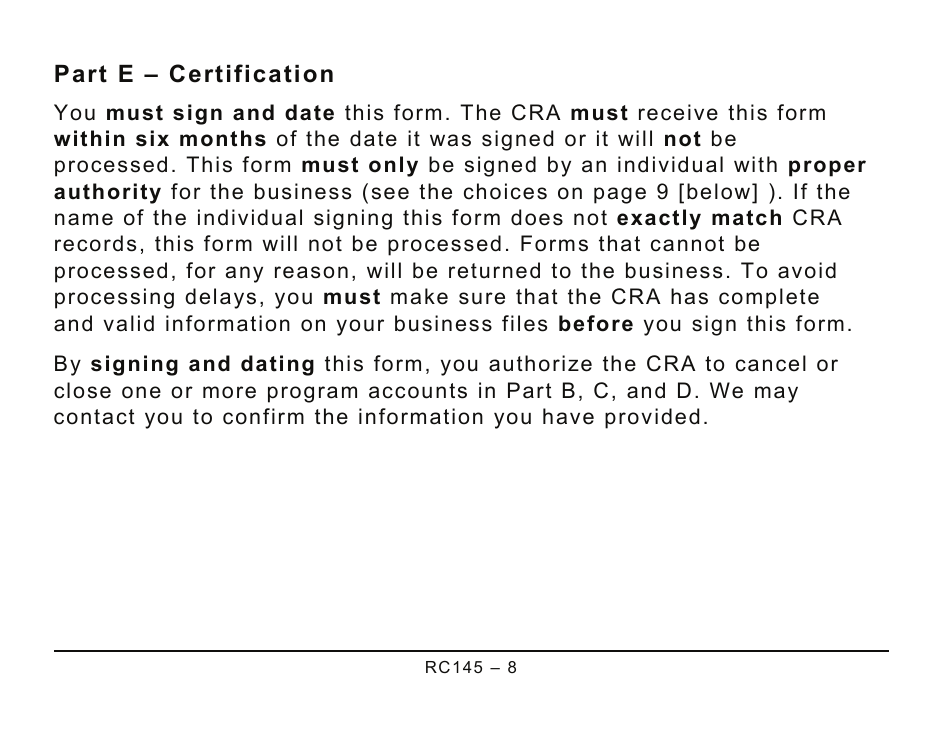

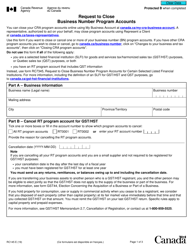

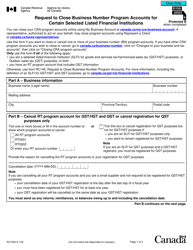

Form RC145, Request to Close Business Number Program Accounts (Large Print), is used in Canada to request the closure of program accounts associated with a business number. The form is used when a business wants to close its accounts with the Government of Canada, such as for GST/HST, payroll deductions, or import/export accounts. It is primarily used by businesses that are no longer operating and need to formally close their accounts.

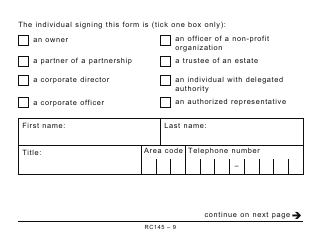

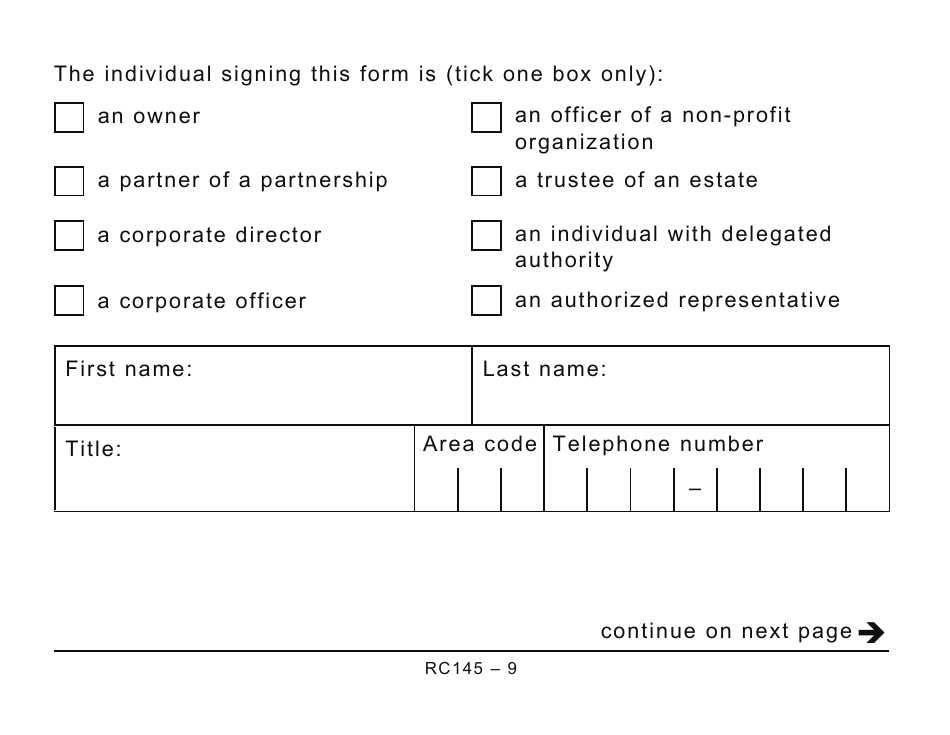

The Form RC145 Request to Close Business Number Program Accounts (Large Print) in Canada is typically filed by the business owner or authorized representative.

FAQ

Q: What is Form RC145?

A: Form RC145 is a request to close Business Number Program Accounts in Canada.

Q: Who should use Form RC145?

A: Form RC145 should be used by businesses or individuals who want to close their Business Number Program Accounts in Canada.

Q: What is the purpose of closing Business Number Program Accounts?

A: Closing Business Number Program Accounts is necessary when a business or individual no longer needs their account or is ceasing operations in Canada.

Q: Are there any fees associated with closing Business Number Program Accounts?

A: There are no fees associated with closing Business Number Program Accounts in Canada.

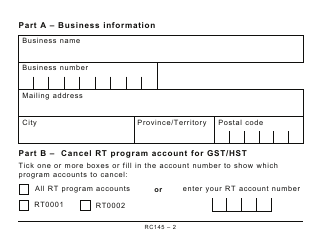

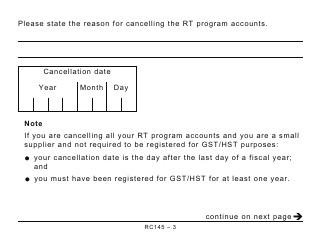

Q: What information do I need to provide on Form RC145?

A: You will need to provide your business or personal information, as well as the reason for closing your Business Number Program Accounts.

Q: How long does it take to process Form RC145?

A: The processing time for Form RC145 varies, but it typically takes several weeks for the Canada Revenue Agency to process the request.

Q: What should I do after submitting Form RC145?

A: After submitting Form RC145, you should wait for confirmation from the Canada Revenue Agency that your Business Number Program Accounts have been successfully closed.