This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC161

for the current year.

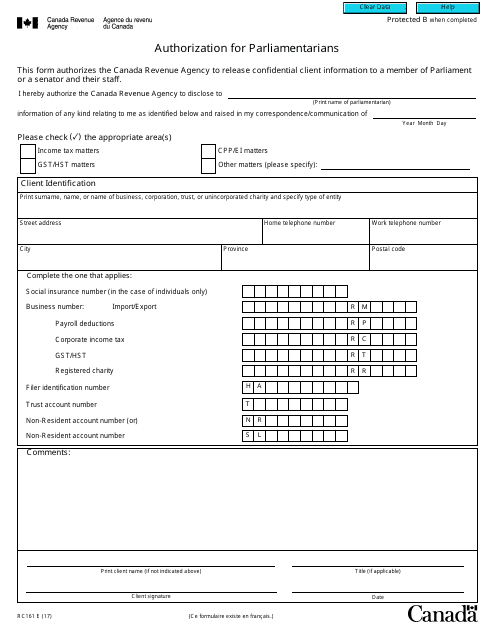

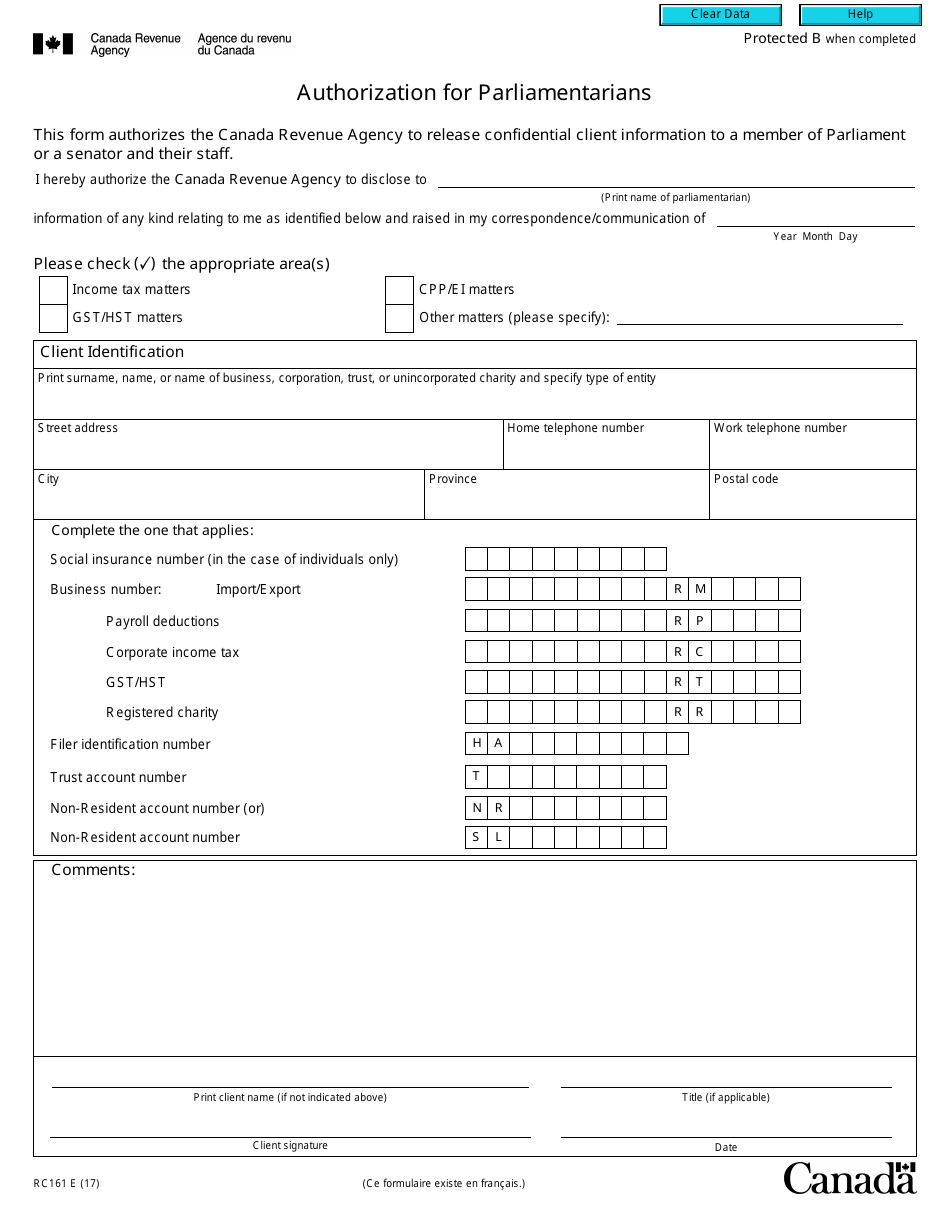

Form RC161 Authorization for Parliamentarians - Canada

Form RC161 Authorization for Parliamentarians - Canada is used by Members of Parliament (MPs) or Senators in Canada to authorize the Canada Revenue Agency (CRA) to disclose their tax information to another individual or organization. This form allows parliamentarians to grant permission for the release of their tax information for specific purposes or in certain situations.

The Form RC161 Authorization for Parliamentarians - Canada is filed by Members of Parliament in Canada.

FAQ

Q: What is Form RC161?

A: Form RC161 is an Authorization for Parliamentarians, which is used in Canada.

Q: Who uses Form RC161?

A: Form RC161 is used by parliamentarians in Canada.

Q: What is the purpose of Form RC161?

A: The purpose of Form RC161 is to authorize the Canada Revenue Agency (CRA) to disclose information about a taxpayer's account to a designated parliamentarian.

Q: What information is required on Form RC161?

A: Form RC161 requires the parliamentarian's name, address, phone number, and signature, as well as the taxpayer's name, social insurance number, and Taxpayer ID number.

Q: How can Form RC161 be submitted?

A: Form RC161 can be submitted by mail, fax, or in person at a CRA tax services office.

Q: Is there a fee for submitting Form RC161?

A: No, there is no fee for submitting Form RC161.