This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC193

for the current year.

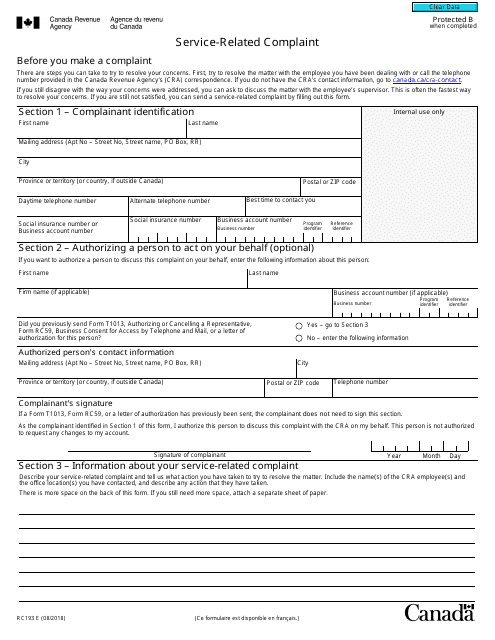

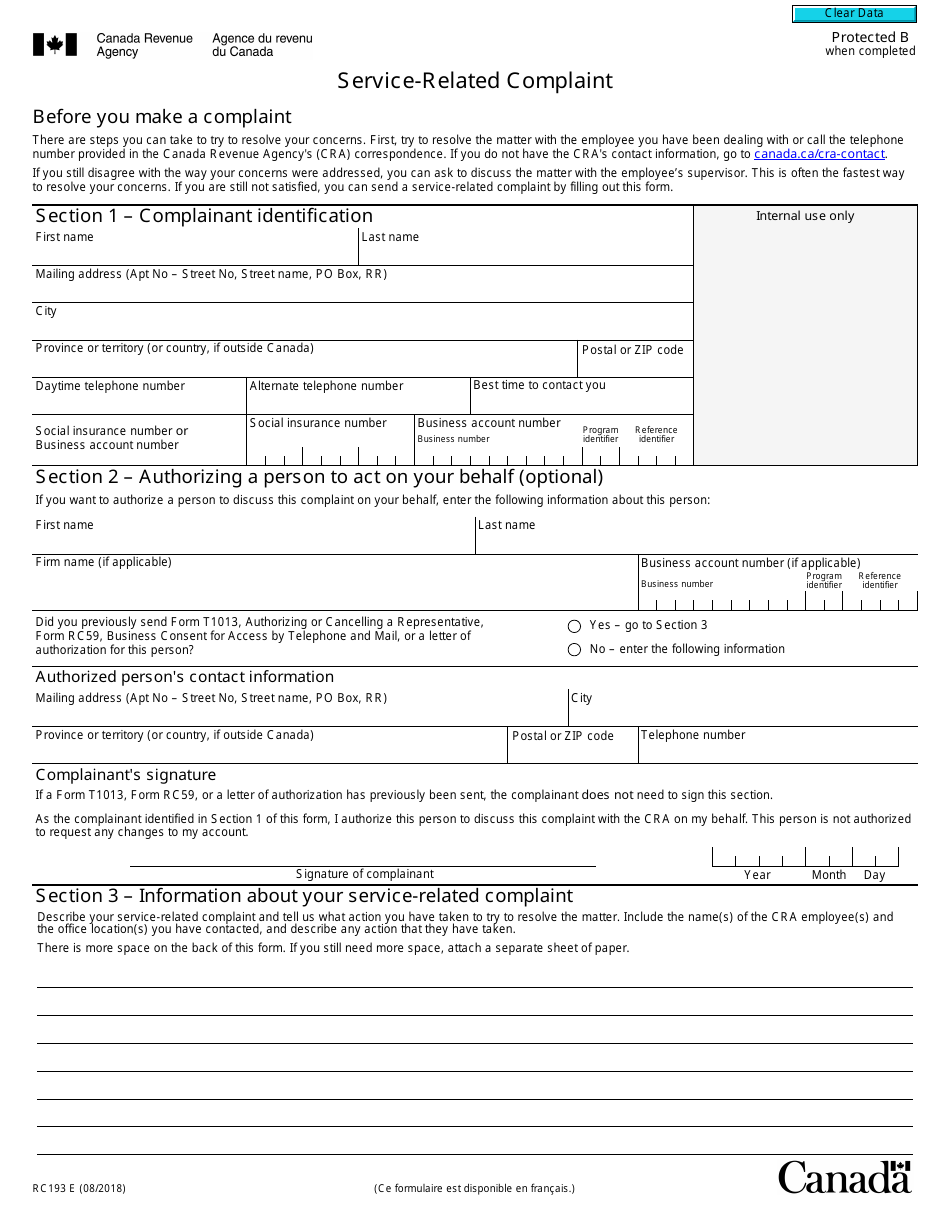

Form RC193 Service-Related Complaint - Canada

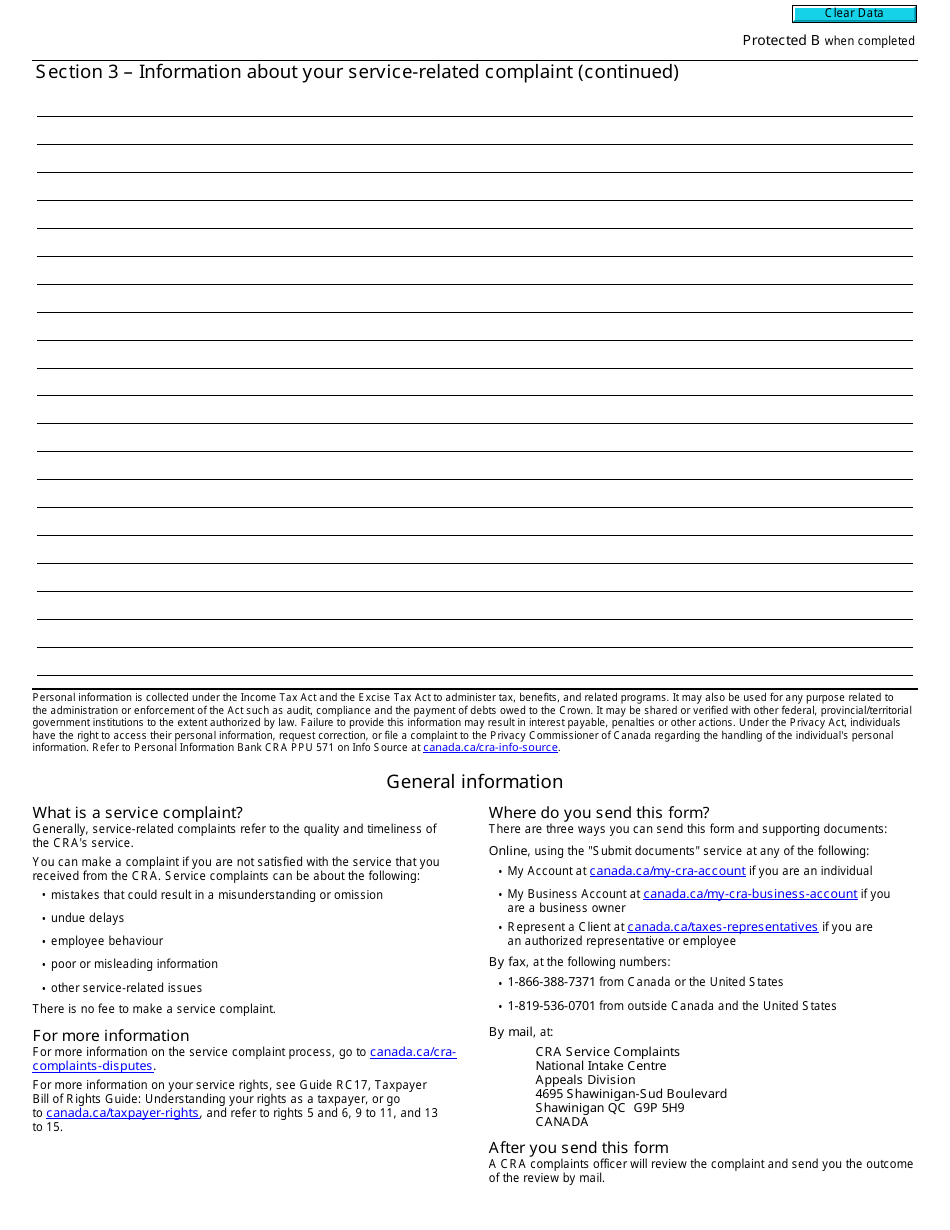

Form RC193 Service-Related Complaint is used by individuals in Canada to submit a complaint regarding the services they have received from the Canada Revenue Agency (CRA). This form is specifically designed to address any issues or concerns related to the quality, timeliness, or professionalism of the services provided by the CRA. By completing and submitting this form, individuals can provide detailed information about their complaint and request a resolution from the CRA.

In Canada, the Form RC193 Service-Related Complaint is typically filed by individuals who have concerns or complaints related to the services provided by the Canada Revenue Agency (CRA). It allows taxpayers to formally express their dissatisfaction and seek resolution for issues such as delays, poor communication, or other service-related matters. By completing and submitting this form to the relevant CRA office, individuals can initiate a process to address their complaints and work towards a solution.

FAQ

Q: What is the RC193 form in Canada?

A: The RC193 form is used in Canada to submit a service-related complaint to the Canada Revenue Agency (CRA).

Q: What kind of complaints can be filed using the RC193 form?

A: The RC193 form is intended for complaints related to the quality of service, conduct, or behaviour of CRA employees.

Q: Is there a deadline for submitting a service-related complaint using the RC193 form?

A: There is no strict deadline, but it is recommended to file your complaint as soon as possible after the incident in question.

Q: How should I fill out the RC193 form?

A: The form requires you to provide information about yourself, the CRA employee involved, and a detailed description of the incident. Follow the instructions on the form for guidance.

Q: Will I receive a response after submitting the RC193 form?

A: Yes, the CRA will acknowledge receipt of your complaint and may contact you for additional information or clarification if necessary. They will also inform you of the outcome of their investigation.

Q: What should I do if I'm not satisfied with the outcome of my complaint?

A: If you're not satisfied with the CRA's response, you can request a review from the CRA's Complaints Resolution and Redress Services.

Q: Is there any other way to resolve a service-related issue with the CRA?

A: If you prefer, you can contact the Taxpayers' Ombudsman's office, an independent organization that helps resolve service-related complaints about the CRA.