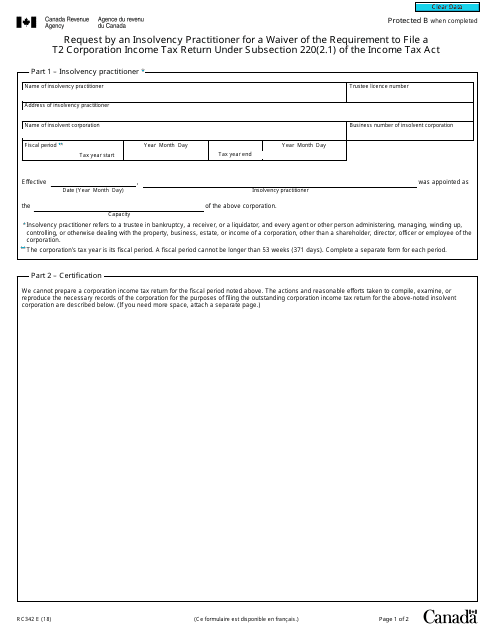

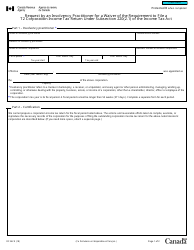

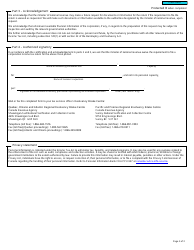

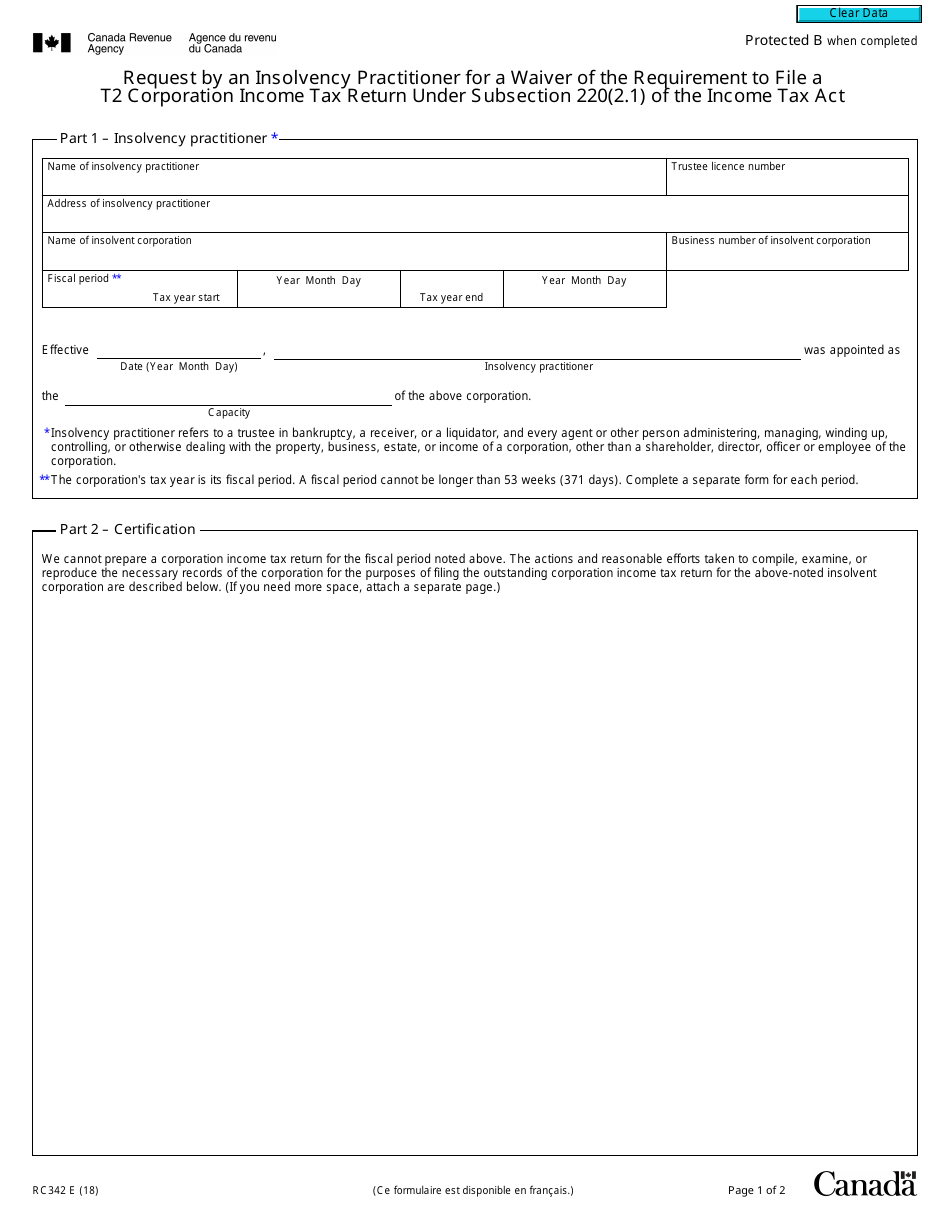

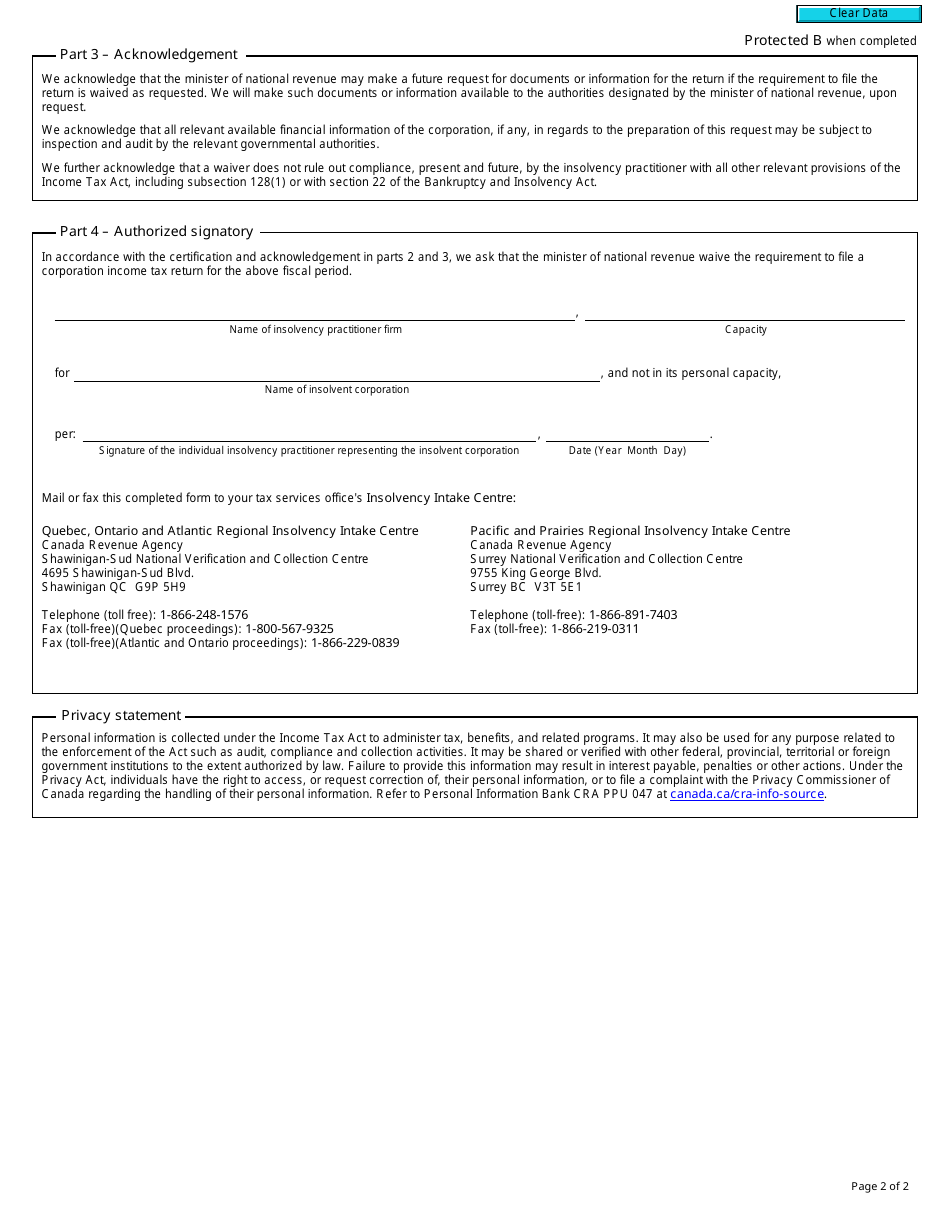

Form RC342 Request by an Insolvency Practitioner for a Waiver of the Requirement to File a T2 Corporation Income Tax Return Under Subsection 220(2.1) of the Income Tax Act - Canada

Form RC342 is used by insolvency practitioners in Canada to request a waiver for a corporation from filing a T2 Corporation Income Tax Return under Subsection 220(2.1) of the Income Tax Act. This waiver is requested when the corporation is going through insolvency proceedings.

FAQ

Q: What is Form RC342?

A: Form RC342 is a request by an Insolvency Practitioner for a waiver of the requirement to file a T2 Corporation Income Tax Return.

Q: Who can use Form RC342?

A: An Insolvency Practitioner can use Form RC342 to request a waiver of the requirement to file a T2 Corporation Income Tax Return.

Q: What is a T2 Corporation Income Tax Return?

A: A T2 Corporation Income Tax Return is a tax return filed by corporations in Canada to report their income, expenses, and taxes owing.

Q: What is the purpose of Form RC342?

A: The purpose of Form RC342 is to request a waiver from filing a T2 Corporation Income Tax Return for insolvent corporations.

Q: Under what section of the Income Tax Act is the waiver requested?

A: The waiver is requested under subsection 220(2.1) of the Income Tax Act.

Q: Who is an Insolvency Practitioner?

A: An Insolvency Practitioner is a professional who specializes in dealing with insolvent individuals or corporations, such as a licensed insolvency trustee or a bankruptcy trustee.