This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC364-CA

for the current year.

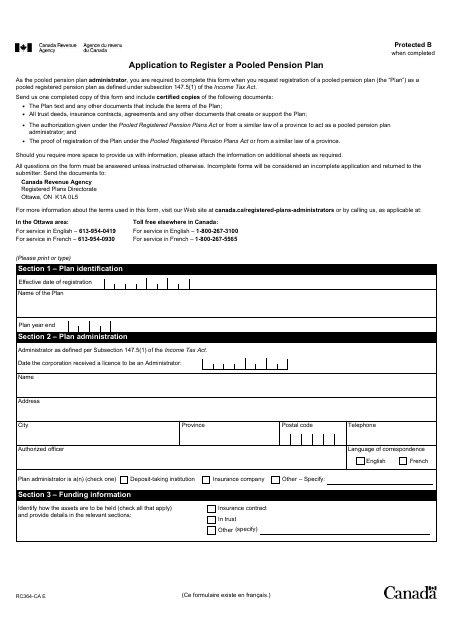

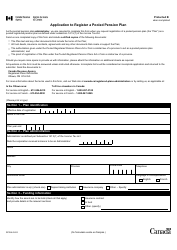

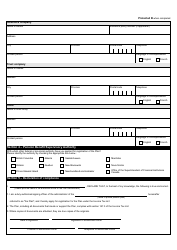

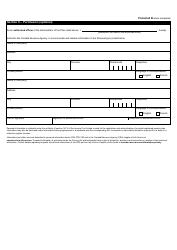

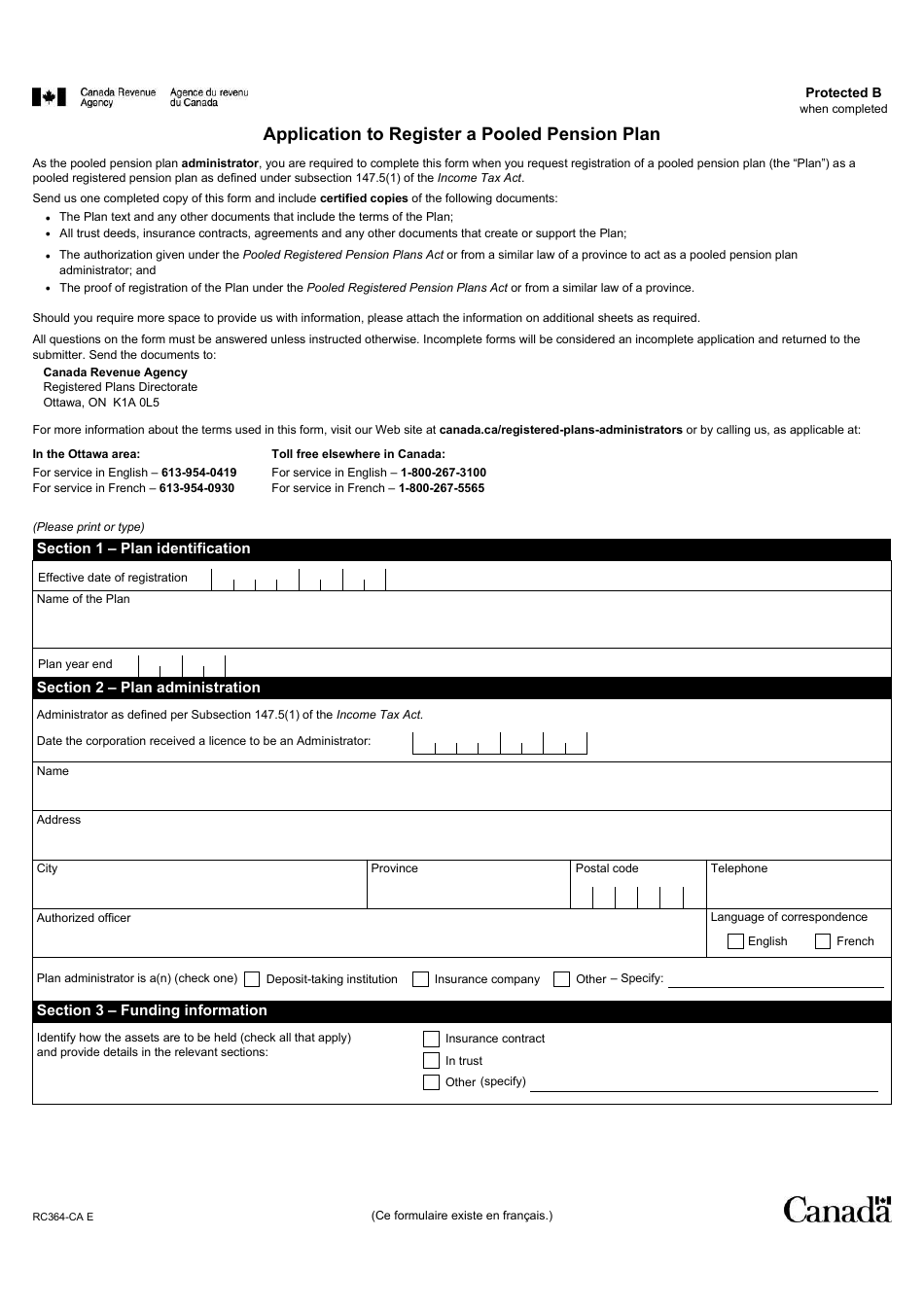

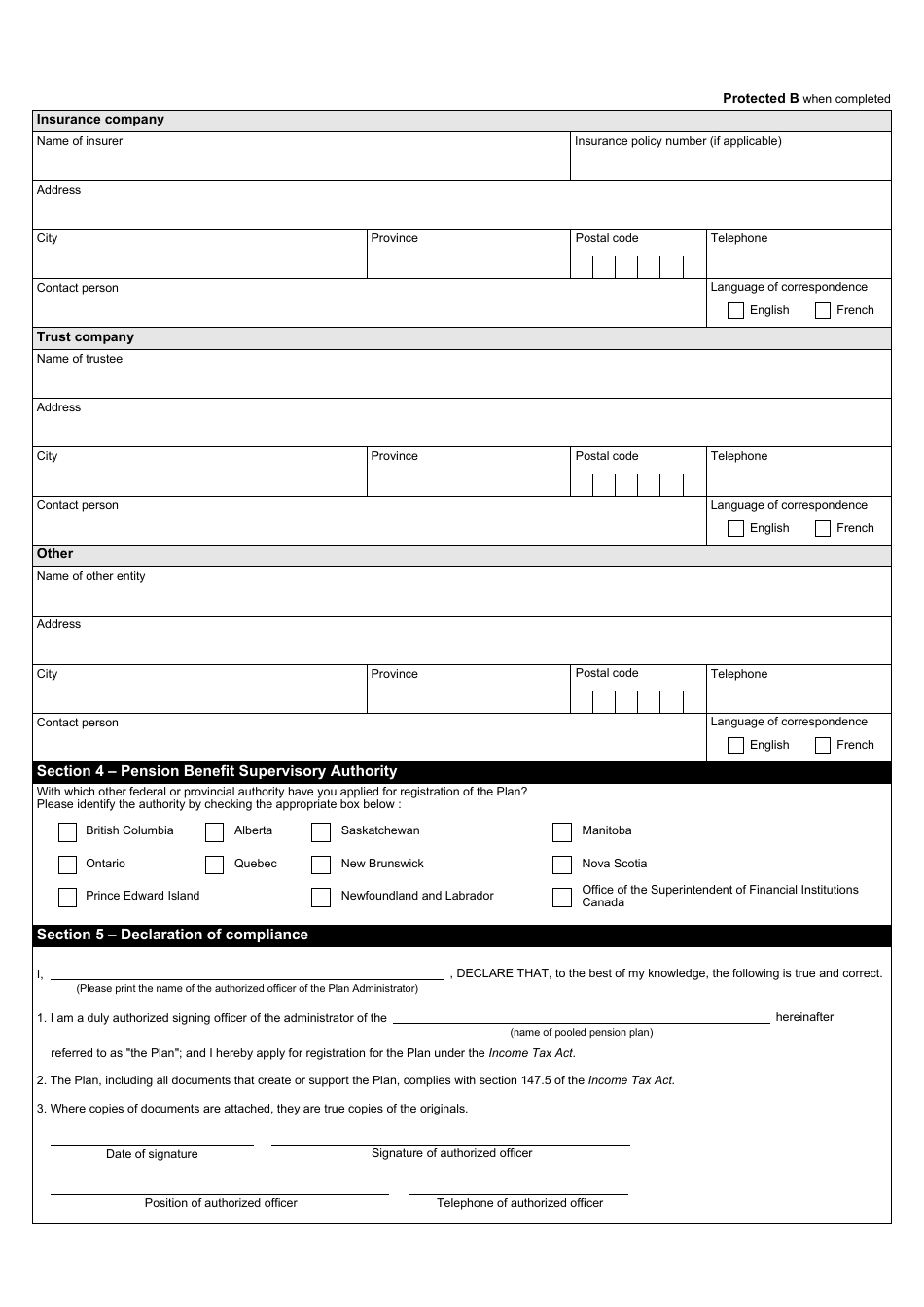

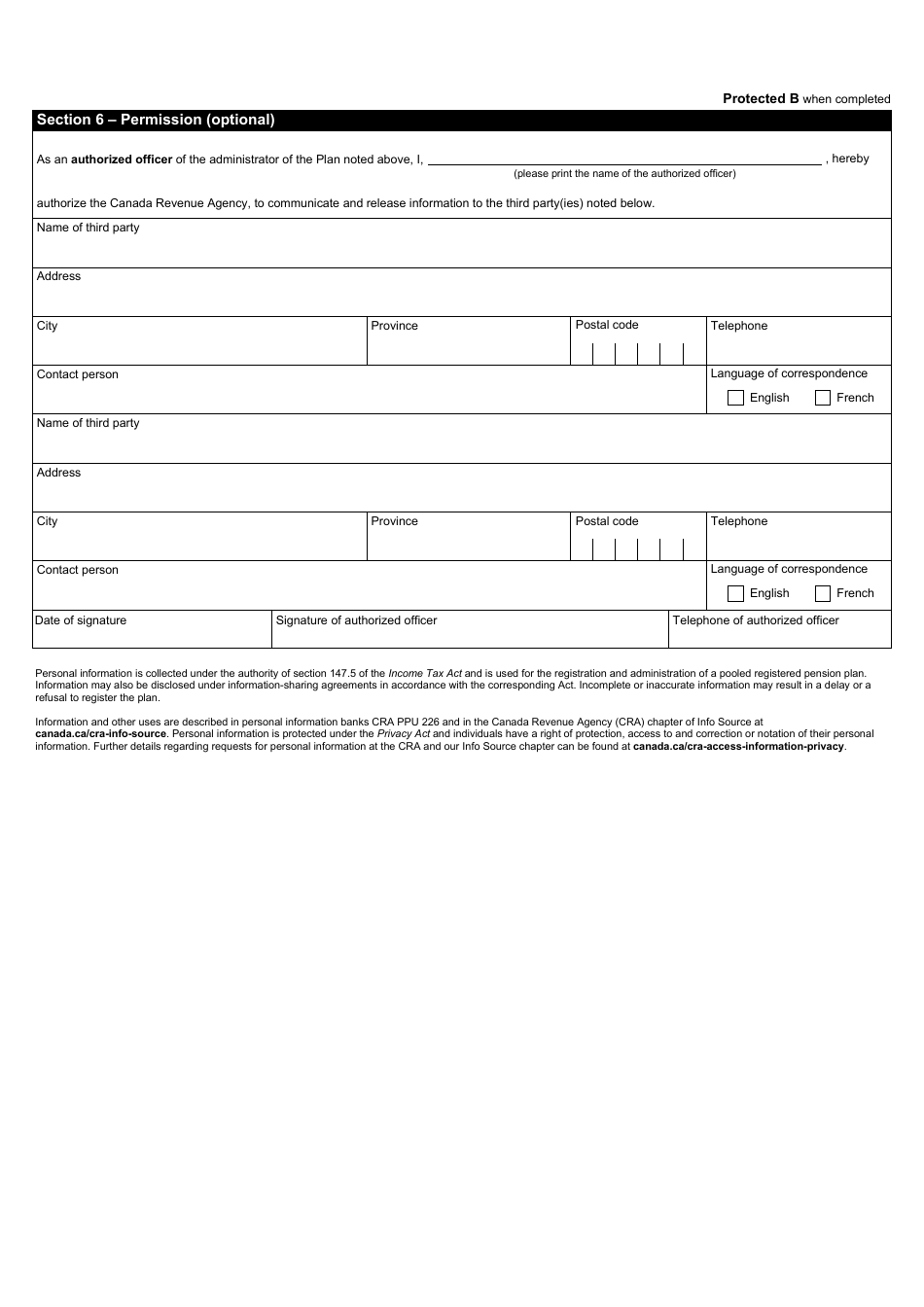

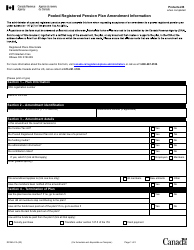

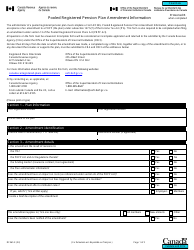

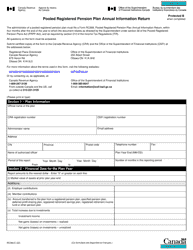

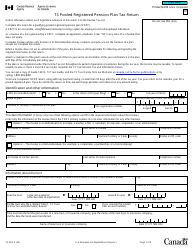

Form RC364-CA Application to Register a Pooled Pension Plan - Canada

Form RC364-CA Application to Register a Pooled Pension Plan in Canada is used to apply for registration of a pooled pension plan with the Canada Revenue Agency (CRA). This form is specifically for Canadian residents or businesses who want to establish a pooled pension plan for their employees.

The employer files the Form RC364-CA Application to Register a Pooled Pension Plan in Canada.

FAQ

Q: What is Form RC364-CA?

A: Form RC364-CA is an application form used to register a Pooled Pension Plan in Canada.

Q: Who needs to use Form RC364-CA?

A: Anyone who wants to register a Pooled Pension Plan in Canada needs to use Form RC364-CA.

Q: What is a Pooled Pension Plan?

A: A Pooled Pension Plan is a type of pension plan where contributions from multiple employers are pooled together and invested on behalf of plan members.

Q: What information is required on Form RC364-CA?

A: Form RC364-CA requires information such as the name and address of the plan administrator, details about the plan's design and investment provisions, and information about the plan's members.

Q: How long does it take to process Form RC364-CA?

A: The processing time for Form RC364-CA can vary. It is recommended to submit the form well in advance of the desired registration date to allow for processing and review by the Canada Revenue Agency (CRA).

Q: Are there any additional requirements for registering a Pooled Pension Plan?

A: Yes, in addition to completing Form RC364-CA, there may be other requirements, such as providing a copy of the plan document and obtaining any necessary approvals or consents.

Q: Can I get assistance with completing Form RC364-CA?

A: Yes, you can seek assistance with completing Form RC364-CA from a qualified professional, such as a tax advisor or pension consultant.